I.O.U.

reviewed by Philip Greenspun; February 2010

Site Home : Book Reviews : One Review

|

I.O.U.reviewed by Philip Greenspun; February 2010

Site Home : Book Reviews : One Review |

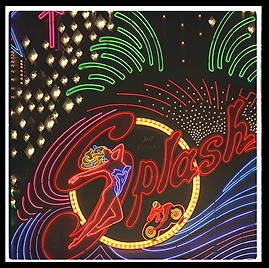

This is a review of

I.O.U.: Why Everyone Owes Everyone and No One Can Pay

by John Lanchester. Lanchester is a novelist who, while doing research

for a novel on the financial industry, decided to write a non-fiction

book in addition.

The book starts off with Lanchester bemoaning the U.S.'s growing income inequality and sweatshop working conditions. "Since 1970, the income of the highest-paid fifth of U.S. earners has grown 60 percent. Everyone else is paid 10 percent less. In the 1970s, Americans and Europeans worked about the same amount of hours per year; now Americans work almost twice as much." He cites a 2005 Harvard paper for the latter statistic. The Harvard paper says that Europeans worked "almost 50 per cent less", 18 hours per week instead of 25 hours per person of working age. Probably the ten pound heads at Harvard who wrote the paper have moved on to jobs on Wall Street, but even there I'm not sure how the math works out. Fifty percent of 25 would be 12.5, no? At least half of the difference seems to be that a larger percentage of working-age Americans had jobs back in 2005. Americans with jobs worked somewhat longer hours, but not up to 19th Century standards. If the goal is to be more like Europe, with a fraction of the population having great jobs in government or in unionized factories and the rest living on Welfare, we've made a lot of progress toward that goal during 2008 and 2009!

As far as growing income inequality goes, Lanchester fails to account for immigration. You wouldn't expect an immigrant who arrives here without a college education and without fluency in English to earn as much as a Daughter of the American Revolution. Given the crummy record of our public school system, the most expensively funded in the world, you wouldn't expect an immigrant's children to earn that much either. The U.S. population was 180 million in 1970. Today it is 310 million and most of that growth is accounted for by immigrants and children of immigrants. Had we simply restricted immigration to those with college degrees, English fluency, and several years of skilled work experience, the inequality and apparent unfairness would be substantially diminished.

[Sidenote on public schools: I teach at a helicopter flight school. If we were like the public schools we would say that it is perfectly acceptable that 50 percent of our graduates can't fly the helicopter. It was beyond our control because their family background wasn't very good. Their parents didn't teach them to control attitude or autorotate, so how could we be expected to? We have been very successful at teaching U.S. Army Blackhawk pilots to fly the Robinson R44, which proves that our instruction can be successful as long as the student arrives properly prepared. When we reach 52 years old, we'll retire on a $100,000 per year pension, guaranteed by the state and adjusted every year for inflation.]

This aspect of the book is irrelevant to Lanchester's main point, is poorly supported by data, and is weakly argued.

The author is on much firmer ground by page 35 where he explains leverage in plain English. He notes that Barclay's had equity amounting to only 1/61th of its "assets" (loans). In other words, if 1/61th of its customers had failed to pay back a loan, the bank's shareholders would have been wiped out. The median leverage was 35:1 in the U.S. and 45:1 in Europe. The vulnerability to which bank executives subjected shareholders was the source of big profits during boom years and huge transfers of shareholder wealth into executives' personal checking accounts via bonuses:

The banks were incredibly profitable not because they were doing anything better but simply because they were making bigger, riskier bets ... Between 1986 and 2006, the average annual return on banking shares rocketed from its historic norm of 2 percent to 16 percent. ... There was no skill, efficiency, intelligence, or judgment involved, just riskier bets. In Haldane's exact words, "Since 2000, rising leverage fully accounts for movements in UK banks' ROE [return on equity]--both the rise to around 24% in 2007 and the subsequent fall into negative territory in 2008."

In the classic MBA textbook

Principles of Corporate Finance

Brealey and Myers say that it is something of a mystery as to why

corporations take on debt. A shareholder who wanted higher risk and

potentially higher return could simply buy stock on margin. Indeed, a

local Boston money manager looked at the legendary private equity firm

KKR

and found that their return on investment was almost exactly the same

as if they'd bought an S&P 500 index fund using the same amount of

leverage that they used to buy the companies that they hand-picked. In

other words, their investors paid breathtaking fees for something that

they could easily have done themselves. Why do public companies do

this internally? Leverage increases reportable numbers, such as

profits, that may drive up stock prices or enable executives to claim

big bonuses. Why investors should have to pay 20 to 50 percent of

their returns to executives and fund managers simply because they took

on the task of applying for a loan is unclear.

Lanchester explains that it was the high leverage that made mortgage-backed securities "toxic":

Gigantic holes appeared on the left-hand side of their balance sheets, where "Assets are listed". That suddenly and immediately meant they were at risk from having their liabilities exceed their assets--that is, being insolvent. ... the term "toxic assets" is misleading. ... The thing that's toxic about them is their prices. ... The problem is that the prices are, from the banks' point of view, too low. The buyers are are willing to acquire them at, say, twenty or thirty cents to the dollar... For the bank, that price is too low. It isn't too low in the sense that the bank wants a higher price; it's too low in the sense that, if it accepts the valuation, it will have a gigantic hole on the left-hand side of the balance sheet. Its assets aren't worth what they're supposed to be, and the bank is no longer solvent."

Lanchester does a good job of explaining how banks, via lending, increase the supply of money available to business. On page 39, he explains how this supply is drying up:

... the banks are being given two totally incompatible goals. One is to rebuild their balance sheets and recapitalize themselves so they're no longer at risk of going broke. The second is to keep lending money. They're being told to save and to keep spending at the same time. It's not possible, and in the circumstances it's no mystery why banks are hoarding every penny they can: they're doing it in order to "deleverage" and rebuild their capital as fast as possible. ... if they lose $100 million in equity [banks with leverage of 30:1] have to contract their assets and make $3 billion of lending go away just to stay at the same leverage ratio.

Lanchester starts off by comparing the simple old-school days of banking with the modern system in which mortgages are sold upstream to be packaged into tradeable securities:

... [old-style banking] is a guaranteed way of making steady money forever (and not incidentally of creating credit in the economy), as long as one all-important rule is followed: the bank has to be careful about to whom it lends money. ... The trouble with the model of packaging plus securitization was that it broke with the fundamental principle that the bank had to individually assess and monitor every loan. ... As for the risks, well, as Lawrence Summers said when he was deputy secretary of the Treasury, "the parties to these kinds of contract are largely sophisticated financial institutions that would appear to be eminently capable of protecting themselves from fraud and counterparty insolvencies." That turned out to be total rubbish.

On page 116, Lanchester explains how the work of David X. Li, a "math jock from rural China", was critical to pricing collateralized debt obligations (CDOs): "Li's new equation could model almost anything, especially the kinds of diverse risk from diverse sources which had previously been unmodelable."

On page 146, the author explains that not much has changed since the 200 A.D.: "How does the industry seek to master the risks? The commonsense version of what sophisticated investors do is diversification, a technique so old it's mentioned in the Talmud, where the strategy advocated is to have a third of your assets in trade, a third in cash, and a third in land."

How were the banks going to figure out if their exposure to CDOs and securitized sub-prime mortgages were going to bankrupt them? Using the Value at Risk (VAR) model. Unfortunately, "the probabilities in the VAR models were based on the bell curve. ... The problem with using the bell curve here is simply put: how do we know that the normative distribution applies to events in the financial markets? The way in which people move and jostle around a room might be plotted and mapped with statistical tools and shown to resemble something like a normative distribution ... But shout 'Fire!' and the movement of people will look very different--it will feature a stampede toward the exits." Lanchester quotes Nassim Taleb: "VAR is charlatanism because it tries to estimate something that is not scientifically possible to estimate, namely the risks of rare events."

According to Lanchester, one of the big new ideas was that one could model the risk of defaults on subprime mortgages by looking at the price of the credit default swaps on those mortgages. There was obviously a lot of wisdom in Wall Street and the market, so why not tap into it?

Using the Gaussian copula figure the quants came up with for the current market implosion--based on a 20 percent decline in house prices, feeding through the CDO industry--was that it was likely to happen only in a time frame many, many trillions of years longer than the history of the universe. You have to ask yourself how intelligent people could ever have come to persuade themselves of that. I'm only forty-seven, but this is the second time in my adult lifetime that property prices have fallen by more than 20 percent. ...

According to the models in use by the quants, the Black Monday crash of 1987 was a ten-sigma event. Translated into English, that meant that... had the market been open every day since the creation of the Universe, the odds would still have been against its falling that much in a single day. In fact, had the life of the Universe been repeated one billion times, such a crash would still have been theoretically "unlikely".

During the Collapse of 2008-?, however, even less likely things were happening: "the CFO of Goldman Sachs, David Viniar, said 'We were seeing things that were 25-standard-deviation moves, several days in a row.' ... Twenty sigma is ten times the number of all the particles in the known universe; 25 sigma is the same but with the decimal point moved 52 places to the right. That's the probability of a single 25-sigma event. Goldman were claiming to experience them several days in a row. ... It shouldn't be possible to be that wrong."

In Alan Greenspan's autobiography (my review), he says that interest rates were not within his control. Formerly poor countries, in which citizens are accustomed to saving heavily, have become rich. That created a huge surplus of capital in search of investment, which depressed interest rates. Had the Fed set interest rates high, banks and others could have gone over to China and oil-rich countries and borrowed dollars at lower rates. So the asset bubble wasn't his fault. On page 176, Lanchester says "History will, I believe, judge this view to be mainly incorrect and say that the blame for the asset bubble was about 90 percent to do with central bankers ignoring the dangers of low interest rates." Lanchester notes that the U.K. and EU had asset bubbles without any real help from the Chinese, but they had central bank policies similar to those of the U.S. Fed.

Lanchester notes the nearly 100 separate state and federal agencies in the U.S. charged with regulating banks. He relates a chestnut about Italy making people "understand what an anarchy would in practice look like: it wouldn't be a society with no laws but one with thousands of laws to which nobody pays any attention."

Like Nomi Prins in It Takes a Pillage, Lanchester cites the massive increase in leverage permitted by the Bush Administration SEC in 2004. Lanchester gives us some extra detail, however. The extra leverage was supposed to be accompanied by extra supervision and investigation by the SEC, but the SEC never used their new powers: "the banks got the rule change they needed to take gigantic risks, and in return, the SEC got the power it needed to supervise them and didn't use it." Lanchester quotes Harry Markopolos, the accountant who tried for 10 years to get the SEC to shut down Madoff's Ponzi scheme, practically giving them the entire case pre-prepared: "My experiences with other SEC officials proved to be a systemic disappointment and led me to conclude that the SEC securities lawyers, if only through their investigative ineptitude and financial illiteracy, colluded to maintain large frauds such as the one to which Madoff later confessed."

Would things have been better if regulatory power had been more concentrated? Lanchester notes that the U.K. has just two regulators and their financial sector imploded more or less in the same way as the U.S. banks. How is that possible? Lanchester says mostly because the banks cheated and evaded: "the pervasive use of derivatives to increase rather than hedge risk, the overwhelming preference for over-the-counter derivatives, the use of off-balance-sheet vehicles--all of these things were critical contributors to the disaster, and all of them had, not just as some marginal benefit but as their central purpose, the determination to get around the banking rules."

How is it possible that Moody's and Standard and Poors failed to alert investors to the risks of securities backed by mortgages given to people who had no income, no job, and no assets (the Ninja loans)? Lanchester explains that it was mostly a consequence of well-meaning government action:

Once upon a time, these investors had access to the agencies' ratings by way of a subscription service, but by the mid-1970s the SEC changed its view of how the business should work, having apparently decided that the ratings were too important to be a restricted, subscription-based service and instead were something that the broader community had a right to know. The ratings still had to be paid for, of course, so the SEC decreed that from then on the company issuing the bond should pay the ratings agency for its assessment, which would then be a matter of public knowledge. This immediately created a conflict of interest. ... The end result was that almost 90 percent of mortgage-backed CDOs were assessed as AAA grade. Very little corporate debt is rated AAA... [the same rating as U.S. Treasuries] so we arrived in the bizarre position in which poor people struggling to pay back their mortgages had miraculously produced the world's most secure financial instruments. This was a fortunate conclusion to reach for both the banks, which made money issuing the CDOs, and the ratings agencies, which made money assessing them.

The subprime boom was good for the ratings agencies, who were paid by volume: "Between 2002 and 2006, Moody's revenue doubled, and its share price tripled."

Until the Collapse of 2008-?, it was easy to assume that the American way of doing things was best. We were rich and growing. Everyone else was second-rate. France and Germany, however, did not suffer anything like the American economic dislocation during 2009 and Lanchester explains why.

German banks ... will lend only a maximum of 60 percent of a property's value. ... In France... the critical figure is not the value of your property but the size of your income. Banks have to lend only the money that you can reasonably afford to pay back out of your monthly pay packet. In practice, that figure has been assessed as being a third of your income. ... if the bank stretches the rules and you get into trouble paying the money back, the bank can be sued for reckless lending. ... In Britain, going into the credit crunch, the typical household owed more than 160 percent of its average income. ... In France the equivalent figure was 60 percent.

How come Canada, intimately tied to the U.S. and sharing a continent, was barely touched by the Collapse of 2008-?? Lanchester explains that "Canada didn't join the party. Its banks had higher capital requirements than elsewhere. ... Other features of the Canadian banking system included lower levels of securitization... a law insisting that if anyone was borrowing more than 80 percent of the value of a home, he or she had to take out insurance on the debt; and no tax relief on mortgage interest."

How badly did the Canadian economy do with these kind of fetters on its financial services industry? "Since 2004, Canadians' average incomes have grown at 11 percent a year, compared with 5 percent in the U.S. A country doesn't have to have a frenetically overactive financial sector in order to have a thriving economy."

Page 217: "Britain has half of the total European credit card debt. ... We are all about to feel significantly poorer. That's because we're about to get the bill. ... the recovery everyone is longing for is the point when we will get the bill. It's when we recover that we will start to pay back the cost of what happened. Governments can't begin to fix the holes in their own balance sheets--holes which get rapidly worse as tax revenues collapse and spending vooms upward--until the economy is growing again."

Lanchester explains that the government budget problem is compounded by the fact that "the average British household owes 160 percent of its annual income." He predicts that British government payrolls will shrink by at least the 600,000 workers that the government has added in the "last few years" (a government that shrinks in size is almost unprecedented in modern history and Lanchester does not cite any examples).

Nomi Prins in It Takes a Pillage estimates the cost of the U.S. bailout at somewhere in the $13 trillion range. Lanchester quotes U.S. government officials as estimating the cost in the $4.6-7.76 trillion range: "That number is bigger than the Marshall Plan, the Louisiana Purchase, the Apollo moon landings, the 1980s savings and loan crisis, the Korean War, the New Deal, the invasion of Iraq, the Vietnam War, and the total cost of NASA's space flights, all added together--repeat, added together (and yes, the old figures are adjusted upward for inflation)."

Lanchester says that the U.K. cost is proportionally just about as bad and predicts "a bitterly divided polity, one in which the interests of everybody on the state's payroll (both those on benefits and those on state-derived employment) are in direct conflict with those of everybody else. [We're already seeing some of that here in the U.S., with taxpayers wondering why federal government workers earn, on average, twice as much as private sector workers (reference).

Lanchester offers the following explanation for why the insolvent banks of Wall Street and the City of London were not nationalized:

Because it would be so embarrassing. ... The Anglo-Saxon economies have had decades of boom mixed with what now seem, in retrospect, smallish periods of downturn. During that they/we have shamelessly lectured the rest of the world on how they should be running their economies. We've gloated at the French fear of debt, laughed at the Germans' nineteenth-century emphasis on manufacturing, told the Japanese that they can't expect to get over their "lost decade" until they kill their zombie banks, and so on. It's embarrassing to be in a worse condition than all of them.

Lanchester points out that we're truly in uncharted territory now.

The huge bailouts of major financial institutions means that the Anglo-Saxon model of capitalism has failed. The level of state intervention in the U.S. and U.K. at this moment is at a level comparable to that of wartime. We have, in effect, had to declare war to get us out of the hole created by our economic system. We have been left with these grotesque hybrids, privately owned banks which are able to generate boggling profits because their risks are underwritten by the taxpayer. ... There is no model or precedent for this, and no way to argue that it's all right really, because under such-and-such a model of capitalism...there is no such model. It just isn't supposed to work like this, and there is no road map for what's happened. ... So: a huge, unregulated boom in which almost all the upside went directly into private hands, followed by a gigantic bust in which the losses were socialized. That is literally nobody's idea of how the world is supposed to work."

I.O.U.: Why Everyone Owes Everyone and No One Can Pay packs the most critical information concerning the Collapse of 2008-? into 232 pages.

I.O.U.

contains only a handful of tables and no graphs, photos, or

other illustrations. As such it would be fine for reading on a Kindle

or similar electronic reader.

Philip Greenspun has taken undergraduate and graduate courses in economics at the Massachusetts Insitute of Technology and has a basic 1970s and 1980s knowledge of investing, on display in his investing and investing for early retirees articles. Greenspun admits that his knowledge and faith in common stocks has likely become obsolete in a world of executives looting from shareholders and Wall Street looting from the taxpayer.

"...Europeans worked 'almost 50 per cent less', 18 hours per week instead of 25 hours per person of working age. ... I'm not sure how the math works out. Fifty percent of 25 would be 12.5, no?"The original writer probably wrote, "American worked 50% more than Europeans, 25 hr instead of 18hr;" an inattentive editor then switched it around carelessly.

-- Don Davis, February 19, 2010

Don: I linked to the original paper cited by Lanchester (you can read it for yourself). There are three authors from Harvard. The paper does not appear to have been professionally typeset and from that I would conclude that it was not professionally edited. So the arithmetic or writing error (depending on how you look at it) cannot be blamed on anyone other than these three geniuses from the world's greatest university. Moreover, the paper is published on the authors' own Web site and has been sitting there for five years. At any time during the preceding five years they could have noticed the error and corrected it (if they believed that it was an error).

-- Philip Greenspun, February 21, 2010

"Traders, Guns & Money" by Satyajit Das (2008) is also a good book about the financial mess we are in. It focuses on derivatives and banking, however, not on the economy as a whole. Explains securitization and leverage in humorous, simple english. The book might be complementary to the I.O.U. book. For FT and other fiancial news sites, the author writes online columns. Check them out.

-- Knut Behrends, February 21, 2010