Two weeks ago: Could our epic deficits drive inflation no matter how high the Fed raises rates?

John H. Cochrane, the superstar economist (and sailplane pilot! How does that work when you’re a professor at University of Chicago and the nearest ridge is 1,000 miles away?), answers the question in the Wall Street Journal… “The Federal Reserve Can’t Cure Inflation by Itself”:

By raising interest rates, the Fed pushes the economy toward recession. It hopes to push just enough to offset the stimulus’s fiscal boost. But monetary brakes and a floored fiscal gas pedal mistreat the economic engine.

The Phillips curve, by which the Fed believes slowing economic activity reduces inflation, is ephemeral. Some recessions and rate hikes even feature higher inflation, especially in countries with fiscal problems.

Higher interest rates will directly make deficits worse by adding to the interest costs on the debt. Reducing inflation was hard enough in 1980, when federal debt was under 25% of gross domestic product. Now it is over 100%. Each percentage point interest rates are higher means $250 billion more in inflation-inducing deficit.

Monetary policy alone can’t cure a sustained inflation. The government will also have to fix the underlying fiscal problem. Short-run deficit reduction, temporary measures or accounting gimmicks won’t work. Neither will a bout of growth-killing high-tax “austerity.” The U.S. has to persuade people that over the long haul of several decades it will return to its tradition of running small primary surpluses that gradually repay debts. That outcome requires economic growth, which raises long-run taxable income. Raising tax rates alone is like climbing a sand dune, as each rise hurts income growth. The U.S. also needs spending reform, especially on entitlements. And it needs to break the cycle that each crisis will be met by a river of printed or borrowed money, bailouts for big financial firms and stimulus checks for voters.

In other words, as long as Congress keeps borrowing and spending, at least according to Professor Cochrane, we can experience inflation even with high interest rates from the wizards behind the curtain at the Fed. Maybe there could be a house price crash due to the high interest rates (how many people can afford a $20,000 per month mortgage on a 4BR?), but that won’t bring down the headline inflation number since house prices were taking out of the government’s official stats. The rent prices that are in the CPI stat shouldn’t come down because mortgage rates are high. In fact, maybe the high mortgage rates will lead to higher rents since renting is an alternative to buying and paying a mortgage.

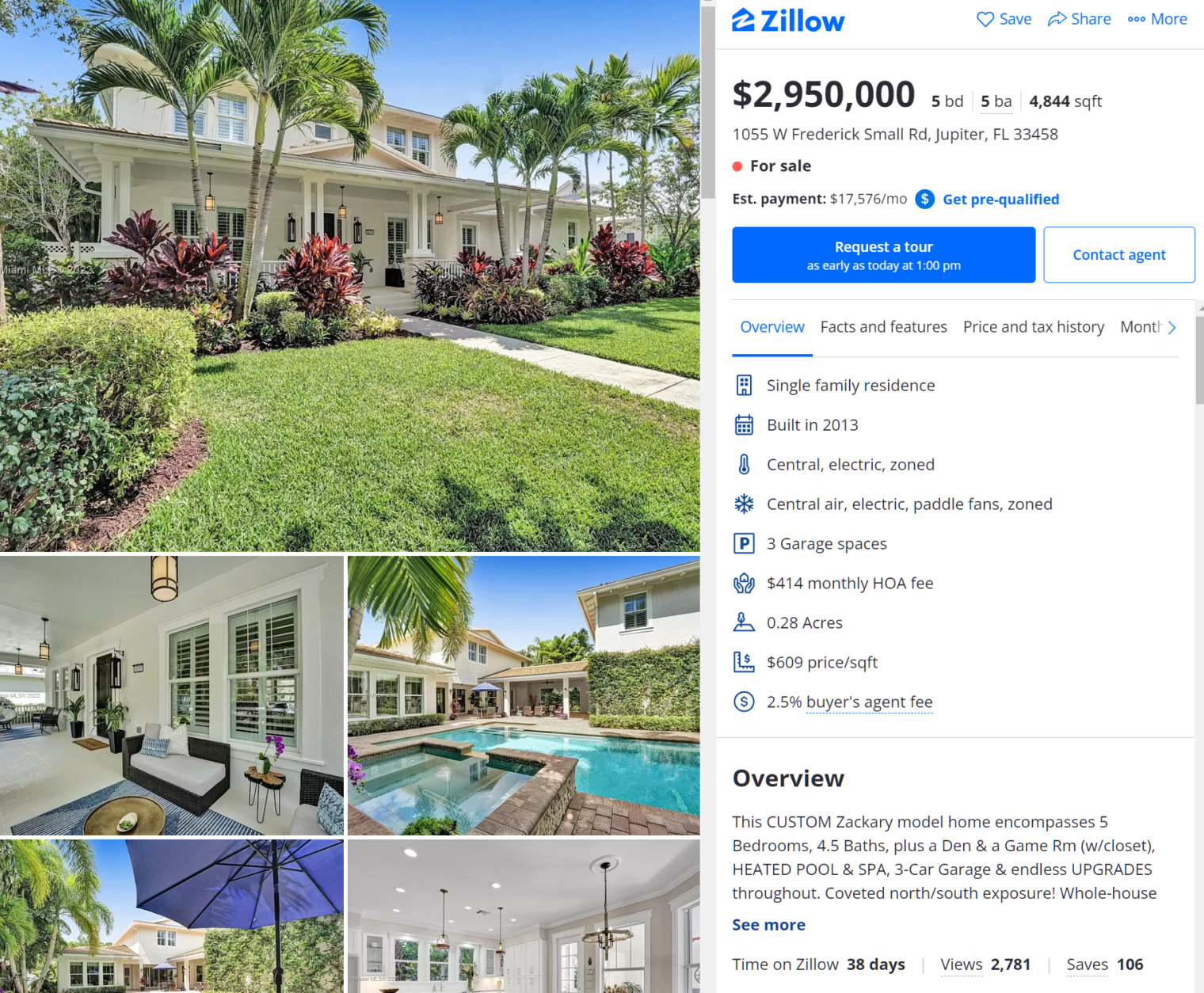

On the third hand, though our realtor says that the crash hasn’t happened yet here in South Florida, houses are sitting longer on the market. This could be because it is mid-summer and that is the traditional dead season for real estate. Here’s a fairly standard 5BR house on a busy street in Abacoa:

Note the 38 days on the market at the bottom. In January 2022, this place would have sold within two weeks. Zillow estimates the payment for living on this vast 1/4-acre estate and listening to cars zip by all day at $17,576 per month. For that to be one third of a buyer’s income, he/she/ze/they would have to earn $633,000 per year (i.e., be a dermatologist or plastic surgeon).

Related:

- Cochrane’s calculation of the complete tax rate for a successful Californian (he also has a job next to Stanford): How much is the property tax? In Calfornia, we pay 1% per year. That doesn’t seem bad, except that property values are very high. You can’t get a tear-down in Palo Alto for under $2 million. If you buy a house that costs 5 times your income — say someone earning $200,000 per year buying a $1 million house — then that is equivalent to 5 percentage points additional income tax. On top of 42% federal, 13.2% state, 9% sales, and other taxes, it’s part of my view that we’re past 70% top marginal rate now.

- “How did Paul Krugman get it so Wrong?” (2009): Most of all, Krugman likes fiscal stimulus. … In economics, stimulus spending ran aground on Robert Barro’s Ricardian equivalence theorem. This theorem says that debt-financed spending can’t have any more effect than spending financed by raising taxes. … If you believe the Keynesian argument for stimulus, you should think Bernie Madoff is a hero. He took money from people who were saving it, and gave it to people who most assuredly were going to spend it. Each dollar so transferred, in Krugman’s world, generates an additional dollar and a half of national income. The analogy is even closer. Madoff didn’t just take money from his savers, he essentially borrowed it from them, giving them phony accounts with promises of great profits to come. This looks a lot like government debt. If you believe the Keynesian argument for stimulus, you don’t care how the money is spent. All this puffery about “infrastructure,” monitoring, wise investment, jobs “created” and so on is pointless. Keynes thought the government should pay people to dig ditches and fill them up. [Good news for the PPP program is next] If you believe in Keynesian stimulus, you don’t even care if the government spending money is stolen. Actually, that would be better. Thieves have notoriously high propensities to consume.

Newsom is fighting fire with fire and prints more money:

https://www.nationalreview.com/corner/californias-inflation-relief-an-election-year-handout/

In true propaganda language, the measure that exacerbates inflation is called “inflation relief”.

States can’t print money.

“Politicians are pulling these funds out of the state’s $97.5 billion surplus.”

Geez California is doing so terribly because of their high tax rate, they’ll never be able to compete with red states!

Anon, CA surplus is from 2021 capital gain distribution taxes, not going to happen in 2022.

I’ve lost track of all the federal coronapanic money-shower plans. Is any of the $97 billion federal (i.e., printed) money? All of the states are swimming in cash, according to https://reason.com/2022/04/18/states-are-flush-with-cash/

The $2400 per-capita surplus sounds good (comparable to an annual Alaska Permanent Fund payment), but would it be real if California accounted for government employee pensions in a reasonably sensible way?

https://californiapolicycenter.org/california-state-and-local-liabilities-total-1-6-trillion/ says that the official estimated for unfunded pension liabilities in June 2020 was $300 billion, but if you use a discount rate that accountants suggest it could be $900 billion.

The other one-time event for California was the government forcing citizens to do everything online. I guess you could argue that there is continuing revenue from people using Zoom, etc. even if the shutdown orders have expired.

https://www.pandemicoversight.gov/data-interactive-tools/interactive-dashboards/coronavirus-relief-fund

The above link says California received $16 billion out of the $150 billion Coronavirus Relief Fund, mostly in 2020.

It’s a rather academic exercise trying to calculate exact amounts received, as total spending of $5+ trillion was intended to “replace costs”. For example, the PPP was intended to replace unemployment insurance… Of course this was a huge benefit to state governments! It was money getting paid to employees that was coming out of neither business expense, nor unemployment insurance. And stimmy checks went into trading meme stonks, which inflated capital gains tax revenue.

https://lao.ca.gov/LAOEconTax/Article/Detail/735

California’s tax revenue grew 30% in fiscal 20-21 and an additional 20% in fiscal 21-22. (56% above pre-pandemic tax revenue). This is an addition to the direct state aid, and the expenses avoided (like PPP replacing unemployment insurance).

“Politicians are pulling these funds out of the state’s $97.5 billion surplus.”

If they were serious about “inflation relief”, they’d build small apartments from that money (and more) until there is a healthy rental market.

Of course, the interest groups do not want that to happen.

Also, like philg, I wonder how much of that windfall originated from federal money printing. Silicon Valley is inundated with cash, some people always get funding even for the most ridiculous startups (or diversity programs).

“The U.S. has to persuade people that over the long haul of several decades it will return to its tradition of running small primary surpluses that gradually repay debts.

This will be even less political popular than over-turning Roe v Wade with the tattood and pink hair ladies.

“Zillow estimates the payment for living on this vast 1/4-acre estate and listening to cars zip by all day at $17,576 per month.

Cars zipping by doesn’t sound too bad. Trucks and Harleys and even Honda Civics with their catalytic converters and mufflers removed entirely would be more effective at home price deflation.

“Inflation is always and everywhere a monetary phenomenon” – M Friedman

The issue with fiscal profligacy is not that it causes inflation directly, it is that it crowds out private sector spending. That in turn makes an economic crisis more likely when the central bank attempts to contain inflation with standard monetary tools.

Imagine what interest rates would have been, had the Covidian spending not been monetized by the central bank. That’s what we are beginning to see in the mortgage markets now that we are entering QT (quantitative tightening).

As for California, they can’t print money. But they have benefitted tremendously from fiscal assistance from the federal government, which in turn was monetized by the central bank. The states are yet another area where fiscal health will deteriorate with extreme rapidity as capital gains tax receipts go ‘poof!’ and interest rates normalize with QT.

Searching revealed various estimates of median salary for dermatologists in the U.S., but a quick glance didn’t find any above $400,000:

$362,600 here: https://www.salary.com/tools/salary-calculator/dermatologist

The numbers did vary by location, Miami, Florida was $353,000, though presumably that could be higher in affluent neighborhoods.

I’m not sure the numbers from that site are accurate.

I make about almost 200,000 more than the top 90% listed income listed for my profession.

If a derm isn’t making at least $600,000 after 10 years of practicing, he/she/ze/they is doing it wrong! Three words: laser; hair; removal. As Sam (a physician, based on previous posts) hints, it is tough to get accurate data on what the real-world salaries are for doctors in the U.S. (half as many doctors per capita compared to Sweden). https://weatherbyhealthcare.com/blog/annual-physician-salary-report seems like it might be getting closer to the right numbers. A primary care doc is purportedly earning an average of $250k and a plastic surgeon is up at $576k (enough to buy that basic house in our neighborhood!). But these still seem too low. The specialist academic doctors that I knew in Boston sometimes got offered over $1 million/year. The specialists who ran their own successful practices were making enough to buy aircraft (sometimes jets!).

Scroll to the end of the link and you’ll see that the states where doctors earn the most are not the highest cost of living places. TN has no income tax and docs there are at the top of the nationwide stats. Florida ranks high, but not off the charts like Kentucky, TN, and Alabama. That’s what’s great about medicine. I know some computer nerds who make $300-400k/year working in Silicon Valley, but their standard of living is mediocre (small house, long commute, etc.). They could live like royalty in Kentucky on $400k/year, but a computer nerd in Kentucky doesn’t make $400k/year…

Figure the end game is everyone who left Calif* ending up having to go back to Calif* as most employers return to office commutes. The CPI city average reported no inflation for 20 years because everyone lived in 1 city.

lion: A friend’s son works at YouTube. They ask him to come in one day per week. When he does go in all that happens is he connects to Zoom meetings from his desk at the office. He is living a 2-hour drive away from the office right now (would be 1.25 hours, but Bay Area traffic adds 45 minutes each way). He could live on the Nevada side of Tahoe, I think, and still meet his overlords’ demands.

The drive from Tahoe is about 4 hours with no traffic. It would be 2 hours door to door with a cirrus sr-20. Maybe you could teach him to fly!

TS: https://philip.greenspun.com/blog/2017/10/05/facebook-uses-a-malibu-flying-engineering-manager-to-promote-careers-in-engineering/ covered a commute by plane to Silicon Valley.

the problem with living far outside of Silicon Valley and commuting in is there can be proles and deplorables for neighbors, who breeds pit bulls and have a Rebel flag bumper sticker on their pickup truck, that doesn’t have any mufflers and burns a lot of oil , generating a plume of smog everywhere it goes.

In Northern Nevada many people put an “I did that” sticker on the gas pumps. I sent some to our fine host but he has yet to put any stickers on gas pumps. Perhaps he should give the stickers to his friend’s son!

TS: It was a very kind gift! But political expression via signs and stickers in this corner of FL is not part of the culture!

At $2.9M that’s a deal compared to what you get in Texas these days. Glad I didn’t decide to become a doctor but instead poured over 68000 assembly books all day.

Back to the issue at hand-

The last time the fed needed to raise rates significantly to battle inflation, the national debt was roughly 1/4 of its current size (when compared to GDP).

Raising rates to the level needed to combat 8+% inflation will mean a lot more money will need to get printed in order to pay the interest on our massive debt. When “money printer goes brrrrrrrr”, that will feed more inflation.

So, are we in the midst of a nasty, negative feedback loop?

P.S Audio-visual aid:

According to this https://datalab.usaspending.gov/americas-finance-guide/debt/analysis/ domestic entities own 75% of the debt. So at the end of the day, it is still taxpayers who fund the government, whether they owe 1 trillion or 10. The government is just spending a lot, on your behalf.

A lot of this insanity in the real estate market MUST have been driven by things at the margins (stock appreciation, crypto, windfalls from pandemic measures) and super low interest. Now that those things are gone, wait for housing to look like a cartoon coyote running off a cliff. Maybe it will be obscured by hyperinflation. Maybe Florida has room for a lot of cryto-bros, but how many surgeons can it support?