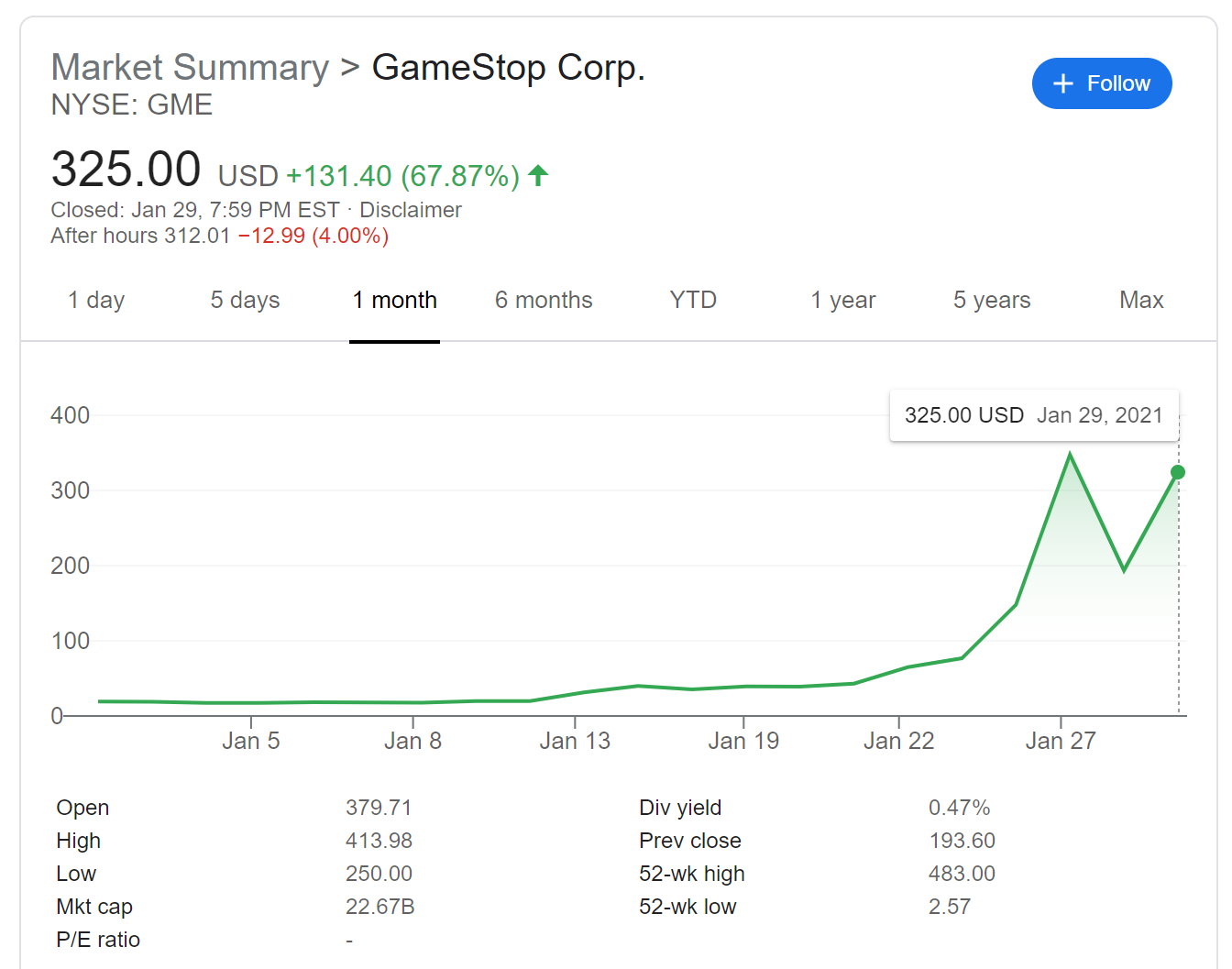

This has been a tough month for fans of the Efficient Market Hypothesis. GameStop (GME) started out the month at less than $20/share and is now “worth” over $300/share. The market cap for this bricks-and-mortar retailer is over $22 billion:

Why doesn’t it come back down now? Mall-based retail isn’t a lot better than it was a month ago. The Wall Street shorts who got squeezed have presumably had to close out their positions by now. Unless the company can use its current high share price to issue more shares and invest them in some super profitable business, don’t the shares have to come back down to $20?

Agree they should offer shares and invest in the business. But why does the investment have to be profitable? Why not use the free money from Robinhood to expand stores and undercut Amazon?

The biggest funds claim they are out, but the data suggest shorts are hanging in, or perhaps changing hands to new shorts. Tough to get short interest down if they believe it is still only worth $20.

@Steve: But why “invest in the business?” Looking at the other stocks in the frenzy we’ve got Bed Bath and Beyond, AMC Movie Theaters, Blackberry – and all based on what? How does anyone propose to “undercut Amazon?” Somehow I don’t think Jeff Bezos is worried.

This has all been very exciting to watch, and I’m sure for the participants it has been lifechanging and life-defining, but I don’t see where GameStop goes from here as a company. There must be some incredibly profitable pandemic-proof business for them to try, but I can’t imagine what it is.

Aside from all the drama and the romance, I can’t see what they’ve done except to artificially boost the stock prices of marginal companies to unwarranted levels for the purposes of “revenge” against their Hedge Fund Overlords, but where does it go after the throbbing climax?

@Alex

>… I can’t see what they’ve done except to artificially boost the stock prices of marginal companies to unwarranted levels for the purposes of “revenge” against their Hedge Fund Overlords, but where does it go after the throbbing climax?

Is that what you said when the shorts artificially depressed the stock price of marginal companies?

In fact, the more you really look at this whole thing, it seems like an awful lot of leftists are pulsing and throbbing with joy that they’ve been able to make billions and screw the hedge funds while upending the stock market. I don’t see how either of these things are very good in the long term. Maybe I just don’t understand enough about the intrinsic value of GameStop. Maybe the name itself is kinda Cyberpunk/Cory Doctorow.

Introduction:

The complete moron’s guide to GameStop’s stock roller coaster

How does this epic rally end? And can it be repeated?

https://arstechnica.com/gaming/2021/01/the-complete-morons-guide-to-gamestops-stock-roller-coaster/

To delve into more technical aspects read:

GameStop’s Gargantuan Gamma Squeeze

It’s not just a short squeeze that’s driving the video game retailer’s epic volatility.

https://www.fool.com/investing/2021/01/26/gamestops-gargantuan-gamma-squeeze/

I’m a long time member of the WallStreetBets subreddit mentioned in the articles. Naturally I have “invested” in GME. What will happen next? I have no clue.

Basically a Ponzi scheme disguised as a short squeeze. Or maybe the other way around. No matter. Those who sell at a high price make a big profit, the suckers who buy get left holding stock that subsequently drops like a stone.

I’m also a longtime lurker on wsb and I’ve watched this play out. I find that subreddit a great source of laughs because the investments posted there are downright balls-to-the-wall risky. I found out about GME there a few weeks ago but no way was I going to invest in that though. I made my millions the hard and honest way by slaving away at a FAANG for decades (ha).

@anon I’m with you as WSB lurker. Have certainly learned some stuff. Was tempted by GME @ 18-22, but seemed to risky so am on the sideline. Fascinating…

Stock prices are merely what buyers and sellers agree they should be. The only connection between company performance and stock price is in the minds of the buyers and sellers. Sometimes buyers and sellers value things way out of whack from what they “should” be valued at. I’m dumb, so it took me a long time to realize what is probably obvious to others. Am I wrong?

Well Silver Lake, one of AMC’s creditors held convertible debt yet had shorted them, and exercised the option to convert $600M to avoid the margin call, that may allow them to survive:

https://deadline.com/2021/01/amc-entertainment-silver-lake-swaps-debt-for-equity-as-cinema-chains-stock-surged-1234682417/

Is it possible that TSLA stock is affected by similar phenomenon, shorts having to keep paying more and more to cover their positions and driving the stock price?

TSLA is a darling company who’s stock is boosted by aspiration and hype. Not based in reality, but kept aloft by sheer good will.

One reliable rule about bubbles is that they always last longer than anyone would reasonably expect, often to the point of bankrupting those who try to profit from short trades. To succeed at shorting you need deep pockets and nerves of steel.

Conversely post-bubble crashes last longer than they logically ought to, with securities remaining underprices (based on actual prospects) for long periods. This presumably reflects human psychology. The giddy investors who drove the bubble are scared away from the market entirely and don’t return until a new bubble starts to inflate.

It’s possible that GameStop is worth more than $20/share, but the shorts were causing people to mis-estimate the real value of the company. (Management often says shorts have that effect, right up until the shorts prove them wrong, but hey, stopped clock.) In that case you might GameStop to come back to a more reasonable two-digit number, but a little higher. Or the shorts were right, and GameStop will end up in the single digits. There’s no reasonable explanation I can find for the current valuation. You’d have to attribute an astounding level of goodwill, and nobody I know who has shopped at their stores thinks that’s reasonable.

GameStop should take a page from Bitcoin. They should come out and say they are going to limit their shares to those currently in existence and will mint no more. Management owns a lot of shares and that would be good for them. Issuing shares would hurt shareholders because would provide more supply for shorts to be able to cover.

Since the float is smaller than the number of people short, as long as there is more but demand than sell demand the price will keep going up.

GameStop. The Store of Value.