Coronapanic and landlords

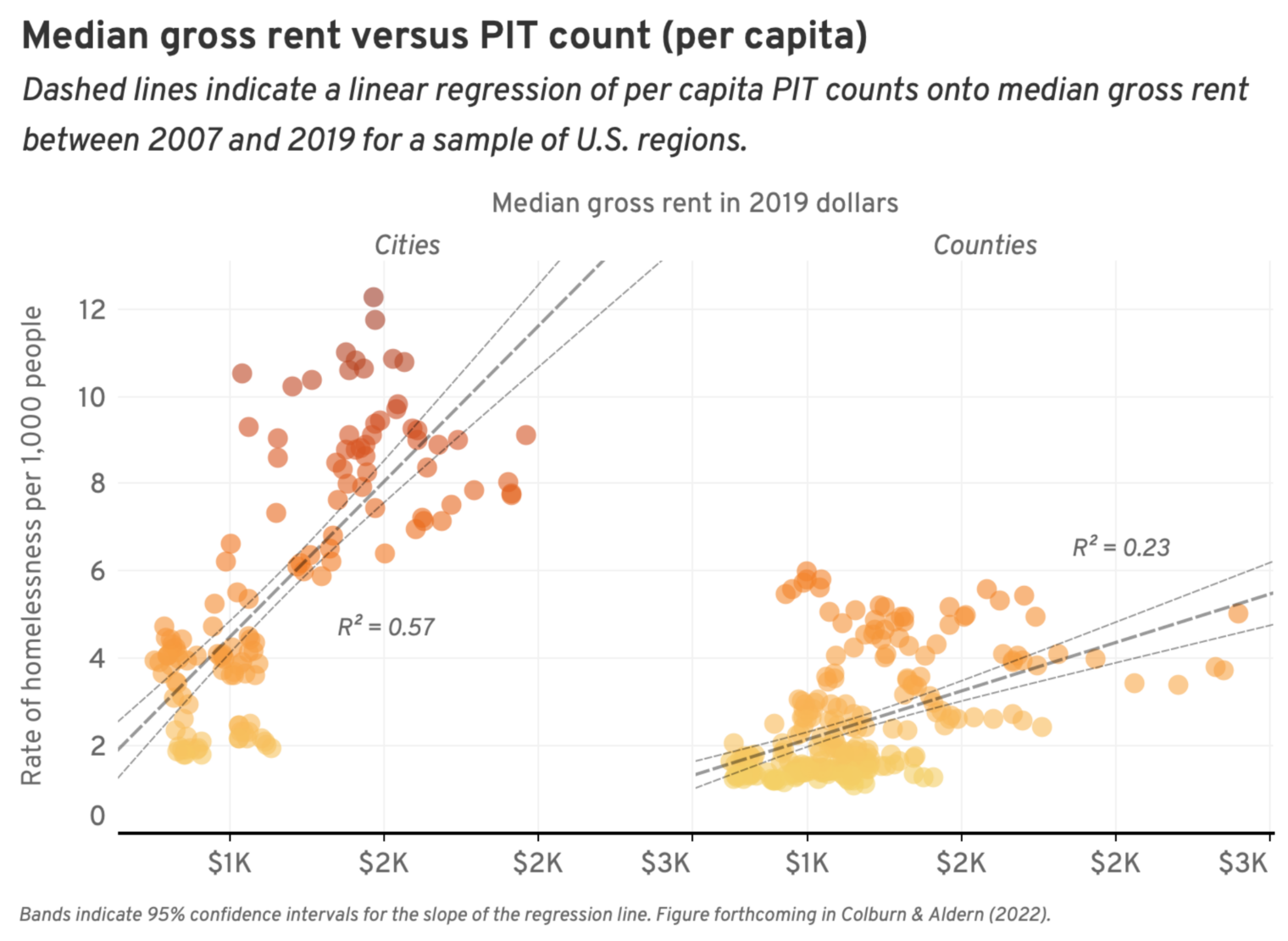

An aviation connection owns 250 apartments in the middle of the country. I asked him whether he’d lost a lot of money during coronapanic when nobody had to pay rent and he was barred by order of the CDC from evicting anyone. “No,” he said. “Nearly all of my tenants kept paying and, in fact, many of them applied for and received government assistance to pay their rent. I already had 20 percent Section 8 vouchers and ended up with about half of my income coming from the government.”

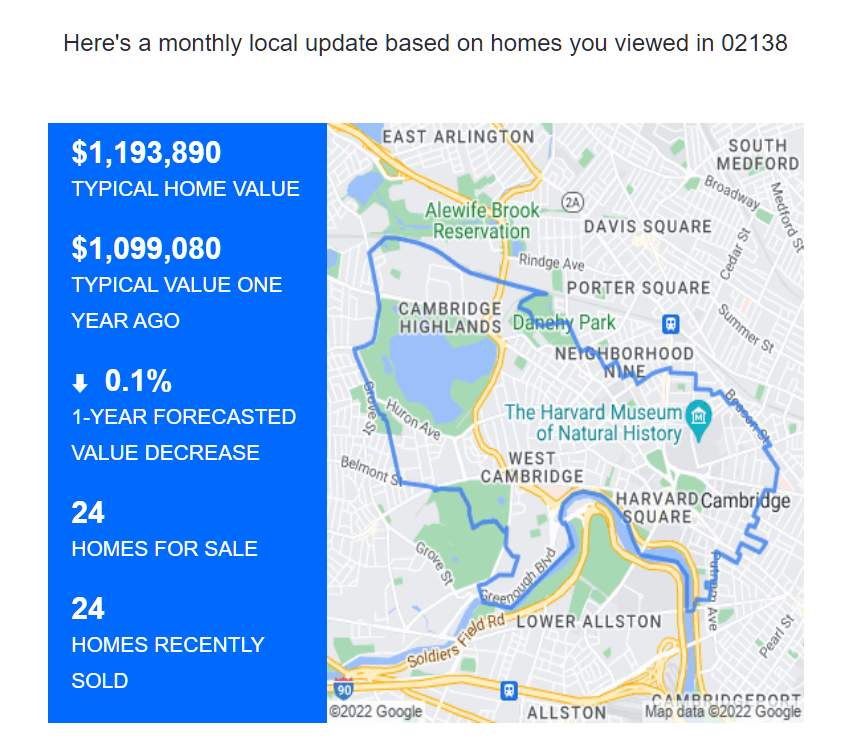

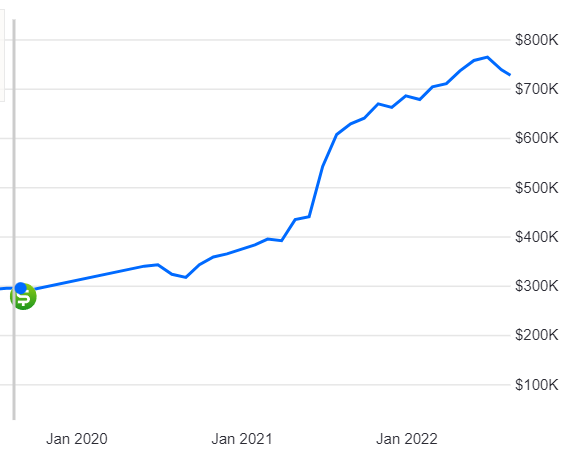

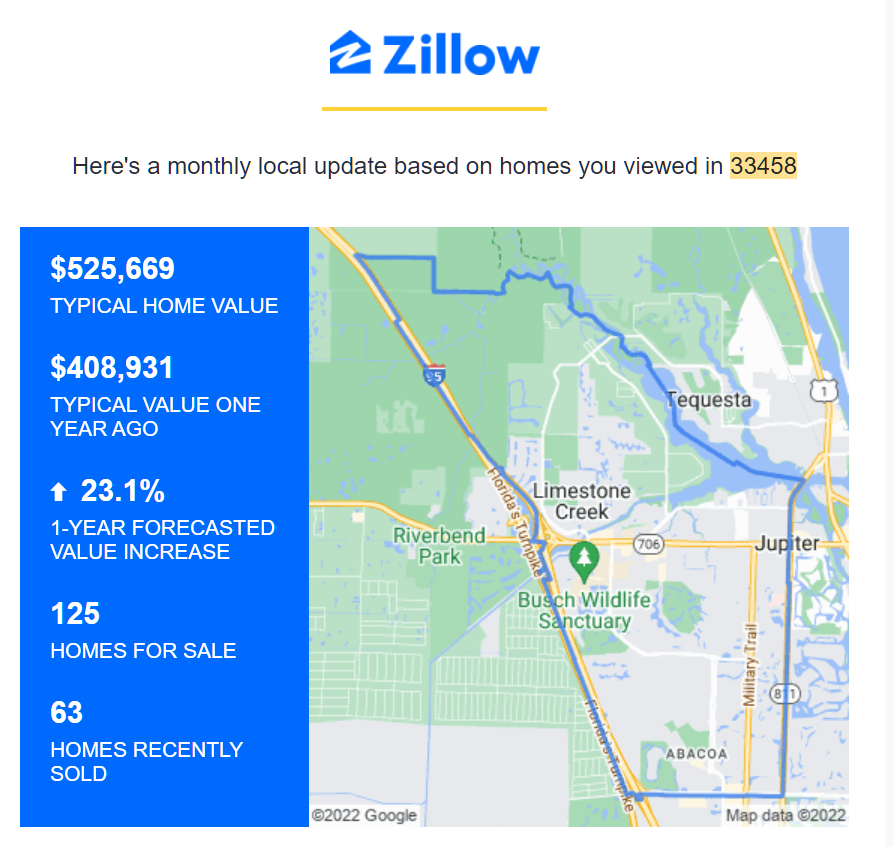

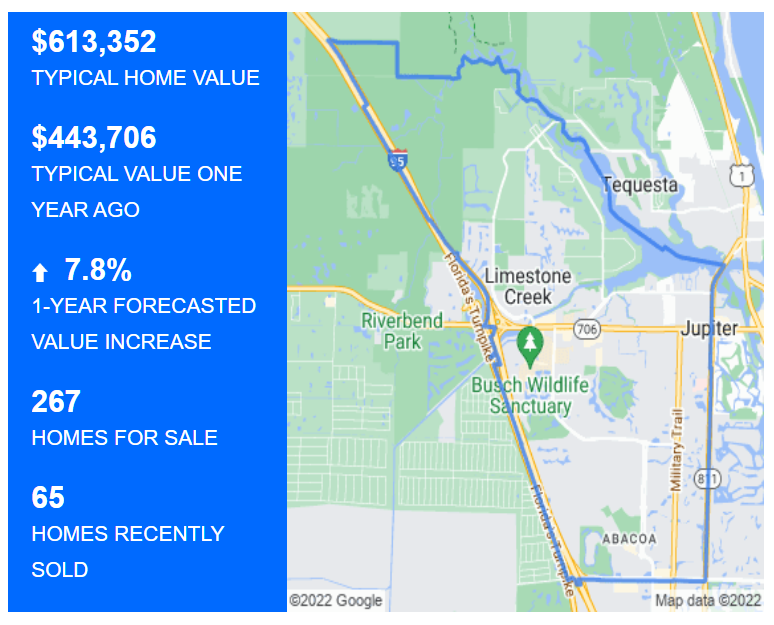

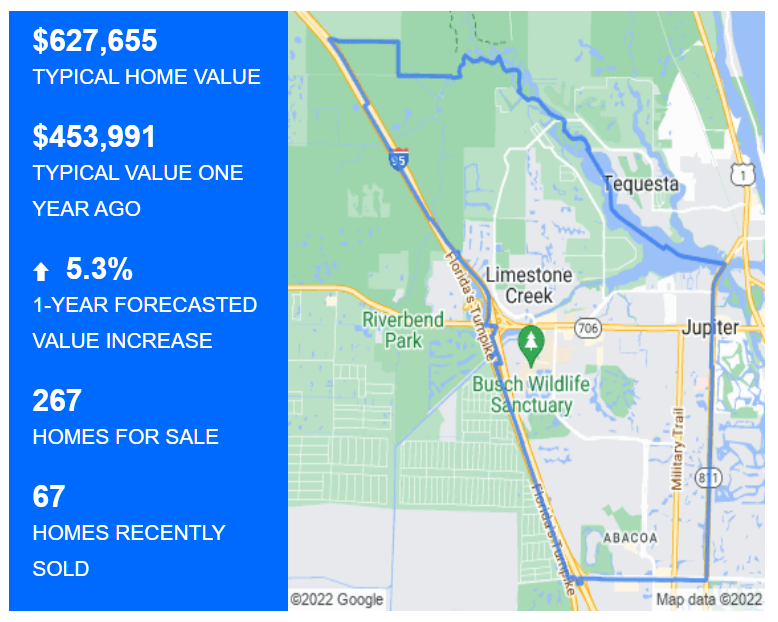

He took the opportunity to refinance his properties at a 2 percent rate and also substantially raised the rents that he was charging (i.e., his costs fell and his revenue soared). He estimates that his property doubled in nominal value between 2019 and today. He raised rents by 50 percent.

Who else got rich? “The local car dealer [in his small town] bought a Phenom 300 and a Bell 407” (that’s $15 million worth of aircraft; the Phenom 300 is made by Embraer in Brazil)

What else has been working for him? Open borders. “I love having Latinos as tenants,” he said (sorry about the hateful failure to use proper English (“Latinx”), but it is a direct quote), “but sad to say that the English-speaking tenants get upset if there are too many Latinos in their complex. They complain about Mexican music being played and noise. I don’t want to be racist and exclude people on the basis of being Hispanic because it makes other tenants upset.” Has the rising cost of labor eroded his increased profit margin from the 50 percent rent boost? “No,” he replied. “White people have pretty much stopped working, but there are plenty of hard-working Latinos. I wish that I spoke Spanish because then I could do a better job explaining what I need.”

Full post, including comments