“President Biden not ruling out wealth tax and believes rich aren’t paying enough, White House says” (USA Todaym March 15):

Warren, who campaigned for president on a platform including a wealth tax, introduced an “ultra-millionaire tax” in her legislation. The tax would impose a 2% annual tax on the net worth of households and trusts between $50 million and $1 billion and another 1% surtax on any wealth above $1 billion.

In contrast to income taxes, which are applied to a person’s individual earnings or an entity’s profits, a wealth tax charges an amount from the value of given assets. Progressive economists have long argued for a wealth tax as a means of combating wealth inequality and other ills.

We already have a few wealth taxes, though. One is property tax, which is almost impossible to get out of. The second is capital gains tax, which actually functions as a wealth tax because it isn’t indexed to inflation. Any time someone sells a long-held asset, some of the original value will be taxed away due to the fact that even an asset whose value falls will usually appreciate in nominal terms. The third is estate (inheritance) tax. The super rich generally escape both capital gains and estate taxes by putting money into their pet foundations. Most of Bill Gates’s personal profits from Microsoft will never be taxed, for example, because he puts appreciated Microsoft stock into the Gates Foundation and from there the money can go straight to Africa without the U.S. Treasury getting a rake.

What if Warren Buffett and Bill Gates could still carry out their charitable goals, but had to sell appreciated assets and pay capital gains tax before donating the resulting cash? In California, for example, at least one third of the money would end up in the hands of state and federal government (the other two-thirds can then be sent to Africa!).

Readers: What do you think would raise more money for the U.S. government (now $2 trillion (about 10% of GDP) larger than before and therefore occupying as large a role in our economy as the most lavishly funded European governments (but without providing the free education, free health care, and other good stuff that the European governments provide)), Warren’s wealth tax or eliminating the ability of billionaires to stuff what would have been taxable $billions into foundations?

Once implemented, would President Harris keep the wealth tax at 2-3%? From The Last Castle:

In 1909, President Taft suggested a tax on income. In July 1909, the Sixteenth Amendment passed but four years elapsed before Wyoming became the thirty-sixth state to ratify it. On February 3, 1913, it became law. Its first full year in effect was 1914, the same year of George [Vanderbilt]’s unexpected death.

Later that year, the government levied a 1 percent tax on net personal income in excess of $3,000 annually, and a 6 percent surtax on income that exceeded $500,000.

Note that the $500,000 threshold is equivalent to roughly $13 million in today’s mini-dollars. I.e., if the rates had stayed where they were when proposed, anyone earning under $13 million/year today would pay at most 1 percent income tax and those earning less than $80,000/year would pay nothing.

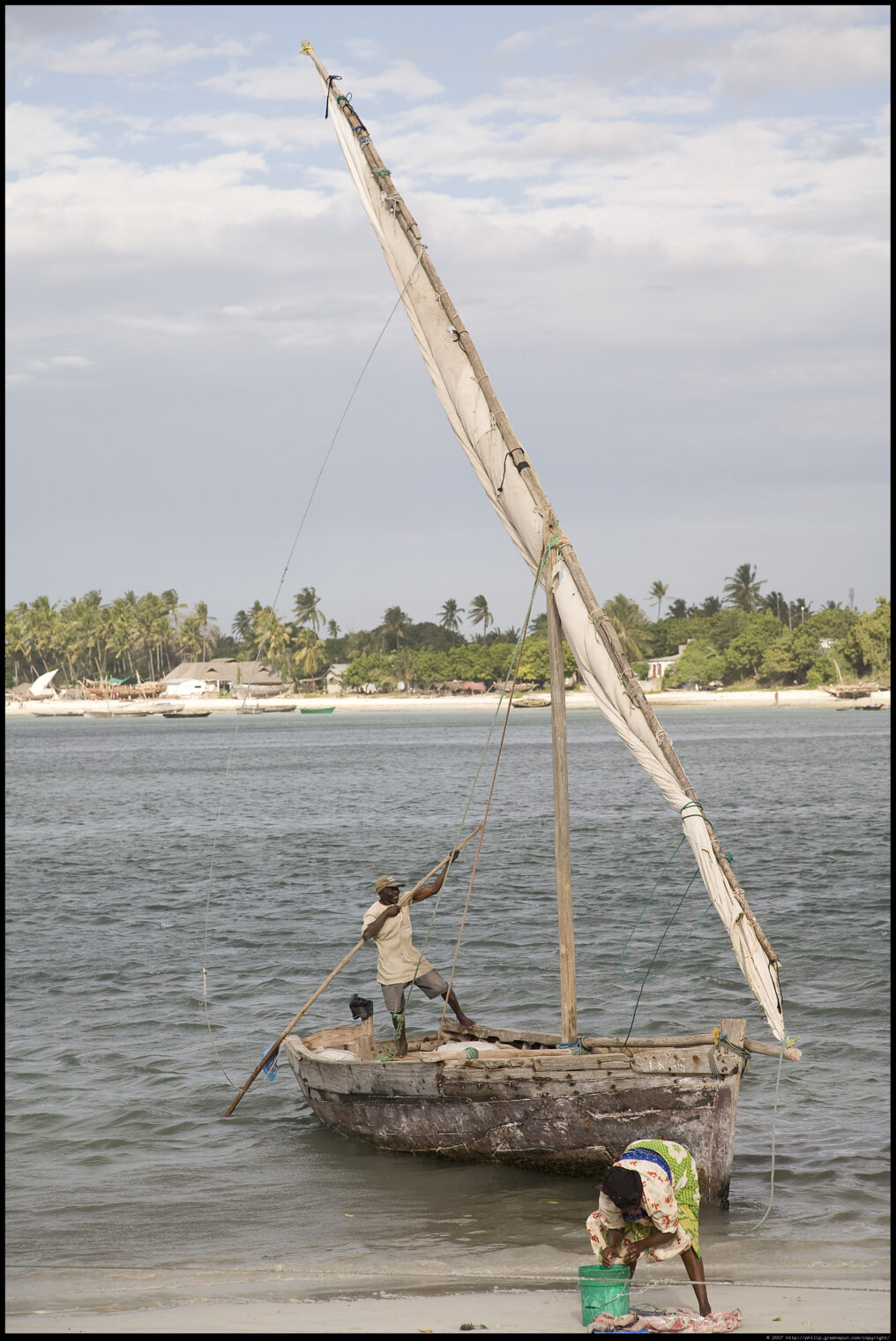

A fishing boat in Dar es Salaam (2008) that could use some paint, but I’m not sure that the Gates Foundation has delivered…

Related:

- “MacKenzie Scott Announces $4.2 Billion More in Charitable Giving” (New York Times): “In her short career as one of the world’s leading philanthropists, MacKenzie Scott has made a mark through the enormous scale of her giving and also through its speed, donating nearly $6 billion of her fortune this year alone.” (Also a good example of how much more lucrative it is to have sex with the boss than to continue working as an admin assistant.) Washington State has no income tax, but this would have yielded 23.8 percent (20 percent capital gains; 3.8 percent Obamacare tax) = $1.428 billion for the federal government.

- “Biden has promised not to raise taxes on people earning less than $400,000. Here’s what he might push for instead” (CNBC): She clarified on Wednesday that the $400,000 threshold applies to families, not individuals. Consequently, individuals who make $200,000 could be affected if they are married to someone who earns that same amount, for example.

For starters companies should get zero deductions for charitable donations, which are usually a way for managers to embezzle their shareholders’ money to build up their own social capital. Secondly, universities with outsize endowments like Yale or Harvard should also lose their charitable status, they are clearly hedge funds with a sideline in education as a tax dodge.

There is probably more to be gained by stopping externalities that foist costs onto taxpayers than by generating revenue. Stopping things like fossil-fuel subsidies, whether direct (oil exploration credits) or indirect (the costs of our outsize military presence in the Middle East).

But most of all since half of all health care spending is by the Federal government, and the US health care system is more than twice as expensive per capita than those of Europe, Japan or Singapore, thus about 10% of GDP wasted to fund the doctors’, hospitals’ and pharma cartels, there is no way the US budget deficit can be brought under control without wholesale reform of health care.

@Fazal, our health care spending is off the chart because it is managed by the same organization, our government, that doesn’t know how to keep a balanced checkbook. This over spending, under delivering issue existing across all things our government runs at all levels. Start with our local police station and move on to public schools, postal office, military, and the list goes on and on.

Do nothing, the current system is perfect. We’ll just keep funneling all the gains in productivity and efficiency to the top 1% of our population, the “job creators,” while the rest of society stagnates. “Job creators” are responsible for everything good and should get all the credit and reward.

@Senorpablo, I keep hearing about the 1%, how they are greedy, don’t pay enough taxes, so on and so forth. But there is another 1% that we hardly hear about from the media or the public: elective politician in office. While they don’t own wealth in terms of $$, we treat them like the “Job creators”, productivity boosters and running our government efficiently. Their track records is anything but a disaster but yet we trust them with our lives, praise them and reelect them while we shame those other 1%. And if that’s not enough, they have the powers to control our lives from birth to death.

George — are you suggesting then, that we should allow the 1%’ers to run our government too? Since they’re the only people in society capable of success and efficiency? Condense all the money and power–just imagine how wonderful that would be for the 99%!

@Senorpablo, no, I’m saying that just like the media and the public call out the 1%’ers for their do$$ars, they also need to call out the 1%’ers in politics that run our lives with their self-serving pol$c$es by taking money from the 1%’ers with do$$ars. Get ride of the life long politician and the 1%’ers with do$$ars cannot buy their way. Only then you can eliminate this 1/99% debate.

George — and who’s standing in the way of campaign finance limits? The party who’s primary mission is to benefit the 1% at the expense of everyone else. The same party who provided $2T in tax cuts for people who needed it least. The con is so thorough they do it in broad daylight now. And, the same folks who fought in the courts for years to allow corporations unlimited political donations. See a trend? So, while everyone is arguing over what the perfect solution is, the problem of massive, accelerating wealth disparity continues to grow unimpeded. Just as planned; more manipulation and distraction by the 1%–using unaffected pawns to do their bidding.

Dangers of government financing politics and preventing private citizens to contribute to candidates of their choice is much greater then private capital financing politics. I agree that corporate PAC participation in politics makes no sense but this is because somehow corporations interfere into employees private political activities, they have to control them due to government control of corporations.

For a moment I thought you confused Melinda Gates and Mackenzie Scott. But it turns out both were subordinates to their future husbands!

Jeff and Mackenzie both graduated from Princeton (the source of my confusion), but there was a 6 year age difference. Bezos was a 28 year old VP at D.E. Shaw, when he first met 22 year old Mackenzie Scott in the interview room. They were married within a year!

Interestingly, Mackenzie Scott re-married,less than two years after her divorce. This time, she picked a science teacher at her children’s private school, instead of her interviewer and boss.

https://abcnews.go.com/US/wireStory/mackenzie-scott-marries-seattle-teacher-bezos-divorce-76313877

Those tax – deductible multi – billion foundations make no sense. Is government saying that their spending is not for a good cause or that only paycheck to paycheck average Joes and Janes should fund it?

It is long overdue to limit tax – deduction amount in those foundations to let’s say $10 million (no tax free private jets) and make the limit inflation-adjustable.

Direct asset taxation is clearly unconstitutional. And yes, it is a slippery slope, looking at how income taxation started in 1913.