After 16 years of rule by Angela Merkel and the Christian Democrats, the government in Germany is changing. I talked to some European bankers and a former hedge fund manager to find out what, if anything, investors should do about this.

The general consensus was that very little would change in Germany. As in the U.S., grand plans from a party can be derailed by an individual member of parliament who thinks that the grand plan will have a negative impact on his/her/zir/their own little corner of the country. For better or worse, this tends to make the German system stable.

Nobody said that Merkel would be missed. One banker pointed out that Merkel was likely voted out by the low-skill welfare-dependent migrants that she was instrumental in bringing to Germany (welfare in Germany is much less generous than in the U.S., but still leads to a better material lifestyle than trying to work for a living in a lot of countries). “They’re betting that the Social Democrats will increase the handouts,” he said. “The conservatives bring them in saying that they’ll work and they turn around and vote for liberals so that they don’t have to work.” (After five years in Germany, about 51 percent of migrants don’t work, which is considered an improvement and a success story by pro-migration Germans.)

Another banker said that Merkel was responsible for the UK leaving the EU. “The British could have just ignored the EU’s demands to accept migrants, as the Eastern European countries did, but they’re too bound up in being law-abiding,” he said. “The Eastern European countries just refuse and dare the EU to throw them out, but there isn’t really a mechanism for kicking a country out of the EU.”

The former hedge fund manager said that Merkel was an unprincipled follower of public opinion. While she initially told Germans that most would be infected with SARS-CoV-2 and therefore most resistance would be futile (e.g., masks and shutdowns would just slightly delay the inevitable), when people demanded lockdowns she locked them down.

How’s Europe doing? “Euro zone inflation hits highest level in 13 years as energy prices soar” (CNBC, October 1, 2021):

Headline inflation came in at 3.4% last month, according to preliminary data from Europe’s statistics office Eurostat. This was the highest level since September 2008 when inflation stood at 3.6%. It comes after German consumer prices rose by 4.1% in September — the highest level in almost 30 years.

The rise has been driven higher by surging energy prices, deepening concern among policymakers. The front-month gas price at the Dutch TTF hub, a European benchmark, has risen almost 400% since the start of the year.

What’s more, this record run in energy prices is not expected to end any time soon, with energy analysts warning market nervousness is likely to persist throughout winter.

France has become the latest country to step up measures to mitigate the costs for consumers. Prime Minister Jean Castex said Thursday the government would be blocking further natural gas price increases as well as rises in electricity tariffs. However, before these measures kick in, gas prices will rise by 12.6% for French consumers as of Friday.

I.e., France is copying Richard Nixon’s wage and price controls and hoping for a different result. (See also “Nixon Taught Us How Not to Fight Inflation” (WSJ): His price controls led to an exponential increase in demand, which caused a shock when they ended.)

I asked the hedge fund manager if the European inflation numbers were cooked like the U.S. numbers (e.g., food and energy costs are excluded from some measures, the cost of buying a house is excluded from all measures (the government comes up with a fictitious world in which people can rent their houses from themselves for a government-determined price)). “Completely fake of course,” he responded. “However, there is one reality of their own making. To ‘save the world’ (read: tax more) they recently yanked up taxes on natural gas and the such. Together with rising oil prices, this has created quite a bit of inflation as you can imagine.”

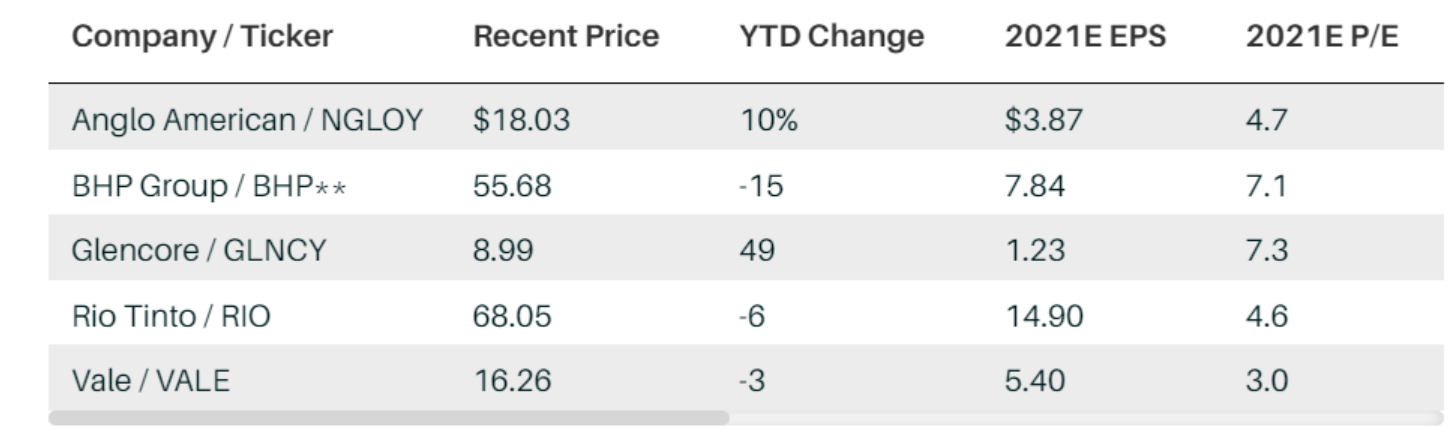

If the Europeans are inflating away the value of their currency just we are inflating away the value of ours, what is an investor to do? Move money to China, as BlackRock has recently started to do? That’s a bridge too far for a lot of non-Chinese investors. How about “Mining Stocks Offer a Cheap Play on Growth. Dig In.” (Barrons, September 17, 2021), in which we learn that iron and copper miners have P/E ratios of 5-7 (compare to over 30 for the S&P 500):

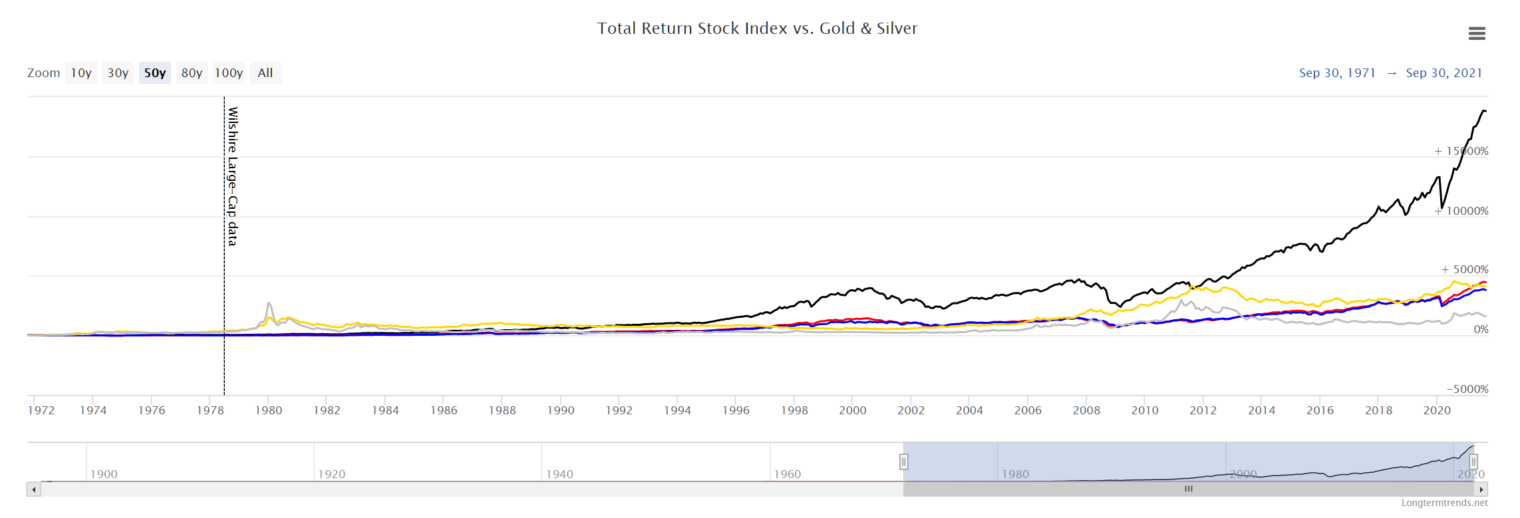

We have no idea where the euro and dollar will be after the politicians on both sides of the Atlantic are done with their manipulations of the respective economies. I’ve always hated gold as an investment because it isn’t productive. And, in fact, once you factor in dividends paid (“total return”), gold has underperformed U.S. stocks going back to the beginning of our galloping inflation (1971):

(black is the total return; silver is bumping along on the bottom; the S&P (without considering dividends), the Dow Jones, and gold are clustered in the middle)

Could mining iron and copper be considered a hybrid of gold’s inflation hedge and the return to be expected from investing in a productive activity? People will still need steel even if there is a lot of inflation in one or more currencies. On the third hand, aside from the low P/E ratio, why are raw materials miners better investments than upstream manufacturers? And if the P/E is 5 or 7, is that because a company is heavily indebted and can go bust (rather than simply slim down) in the event that demand is reduced?

Related:

- “Nobody Really Knows How the Economy Works. A Fed Paper Is the Latest Sign.” (nytimes, October 1). My summary of this plus the rest of the nytimes: Since even the smartest and most expert experts have no idea how the economy works, it makes sense to have the government move in and manage a much larger portion of it.

- Gina Rinehart, one of the world’s richest women (though not nearly as rich as some American divorce plaintiffs), who turned a nearly-bankrupt mining company into a huge success (and she’s a fan of Donald Trump’s economic policies)

This was the most boring election I have ever witnessed. None of the structural problems of the country are even discussed. Whist “bold” reforms maybe happen rarely, e.g. the Hartz reforms, Wahlkampf used to be quite fun in the past. E.G. the liberal, in the european FDP, once put up this ridicoulous goal getting 18% of the votes by eg. putting this number on their shoesoles etc…

https://www.youtube.com/watch?v=pmbVWn7JvXY

It is all gone. Nobody can openly discuss the devastating cost of the EU, migration (probabaly 600k per person like in the Netherlands, but we dont know it) https://www.unz.com/jthompson/costly-immigration/ and the energy policy. Supposedly the elctorate worries so much about climate change, that 40% of youth dont want to have kids anymore. https://www.zeit.de/green/2021-10/klimaangst-familienplanung-kinderwunsch-klimawandel-psychologie-emma-lawrance-interview and climate policy was one of the most “discussed” topics prior to election.

But they dont worry that a country that cannot get a vaccine booking site running with 1 year preparation during a pandemic might fail at the way less complicated task of totally eliminating fossil fuels in around 10-20years, with a shrinking high IQ population share, massive social spending, declining worldwide competiveness, a planned 1 trillion “reconstruction fund” at EU level that of course is a net negative for Germany…

> This was the most boring election I have ever witnessed. None of the structural problems of the country are even discussed.

I concluded the same thing in advance after listening to the BBC World Service cover the penultimate (?) debate, which was all about foreign policy and had virtually nothing to offer the voters in Germany when it came to domestic policy. One of the correspondents said that something like 50% of the German electorate had no idea which candidate they supported. The “debate” (as covered by the BBC WS) seemed like a sound-bite fest with very little substance. Mostly noise, very little signal. The astounding thing is that nobody said: “There’s something wrong with this, isn’t there? Arguably the most important economy in Europe and the election is a toss-up with people who have no idea what they’re doing.” There was no outrage.

I surmised that the country would drift leftward even farther, which in nominal terms it did, and thanks to @Philg for filling in some of the blanks.

I conclude from this election that “elections” in “democratic” societies in Europe are virtually meaningless affairs wherein the elites have figured out how to almost completely isolate themselves from scrutiny, accountability, and most importantly the prospect of losing their jobs. They can just switch from one party to another, update their websites a little, and carry on.

Whatever is being hyped in Barrons one should do the opposite since by the time something appears in Barrons the smart money wants to move on and that is why someone decided to tip a Barrons reporter — so they can unload their inventory on what the Brits refer to as the “punters.” Mining stocks always sell at low PEs at the peak and high PEs at the trough since their earnings are very cyclical — my guess is that in real terms over periods of time commodity investment accomplishes nothing (for the investor as opposed to the promoter). The last time mining stocks were hyped was around 2010 when the talk was we were entering into a “supercycle” that would last at least 50 years with an endless appetite for natural resources from China and India. That ended badly for anyone who bought into that pitch.

Merkel’s accomplishment to make the CDU drop from 41.5% in 2013 to 24.1% in 2021 cannot be overstated. Previously, the historic low was 33.8% in 2009.

I don’t think the migrants are responsible for most of that drop. Many CDU voters went to the Deplorables (AfD) after 2015, who are against immigration and have made many motions in favor of Israel in the parliament (as opposed to the left, which must be anti-Israel in Europe). They are also against the public television racket, where everyone has to pay substantial yearly fees even if he/she/ze/they does not own a TV. So public broadcasters think they are Nazis, and the mainstream media follows.

(I voted FDP, which is pro business and was once (under Genscher) a respectable party. Partly a pragmatic choice since no one wants to form a coalition with the Deplorables, partly I don’t like some of the people in the Deplorables.)

I agree that nothing will change in Germany. Either FDP or CDU are in the upcoming coalition, they’ll block anything that would harm their masters (unfortunately, if their masters want more migrants to drive down wages, they’ll get that, too).

“It comes after German consumer prices rose by 4.1% in September — the highest level in almost 30 years.”

Back then one could get 8% interest in a risk free savings account in Germany. These days quantitative easing (or whatever the current euphemism is) will give you almost negative interest rates.

Anonymous: That’s a good point. It was also true during most of the Jimmy Carter years here in the U.S. Inflation was high, but it was possible to find money market funds and other simple investments that would preserve one’s capital. The big losers were people who had bought savings bonds, who weren’t nimble enough to move money from savings accounts into money markets, etc. But the average person could protect him/her/zir/theirself. Capital preservation today requires skill, luck, and cunning! (or maybe just Bitcoin, according to the crypto enthusiasts?)

With rare exceptions, former hedge fund managers are poor investment advisers.

Anon2: Well, he did quit when his strategy stopped working (too many other people crowded into the trades that he’d been doing). But maybe that is a sign of integrity! He stopped taking fees when he could no longer deliver great results.

philg: temporary strategies are quite common in investment, especially algorithmic investing utilizing machine learning. Every outfit has quants whose tasks are to come up with new setups; all successful trading strategies get copied. I have heard of situations when traders made enough money and quit but had never seen them; I recall when traders whined that $50,000,000 or so compensation is just too little (and it was when looking at dough made by mostly business and shareholder value destroying CEO). If someone created a hedge fund for one trick it is not very ethical.

I don’t really believe amateurs have a reasonable chance of success, when competing with professionals, when it comes to investing.

It’s like an amateur tennis player expecting to compete with a professional tennis player.

If one really could do better, it would be a good idea to quit your job and do this professionally, as an investor who can consistently beat the market can earn almost unlimited income and fame.

Realistically, Vanguard’s S&P 500 index funds are the best for almost everyone, in terms of investing for the long term.

G C: Of course, I agree with you in general. But an investment in the S&P 500 represents a choice. The U.S. is about 15 percent of the world economy and the S&P is heavily weighted toward the U.S. (some companies, e.g., Apple, get the majority of their sales outside the U.S.). So even an amateur investor who has decided on index funds still has to make some choices, e.g., small cap versus large cap (S&P), U.S. versus Developed Markets versus Emerging Markets. Putting it all in the S&P and walking away is equivalent to saying “I think the a particular 15 percent of the world is going to outperform the remaining 85 percent for the next 50 years”.

Smaller investor can out-perform large investors in many cases, of course not in large trades that required discount financing. Hedge funds now need to manage volatility and risk exposure, something small investors are not required to do. I do not think it is smart to invest into regions right now, it is a form of risky betting since much of it s covered by one totalitarian government or the other, or by hard regulatory regimes. It s better invest in sector products, this should cover regional risk spread as well as sectors spread over regions already.