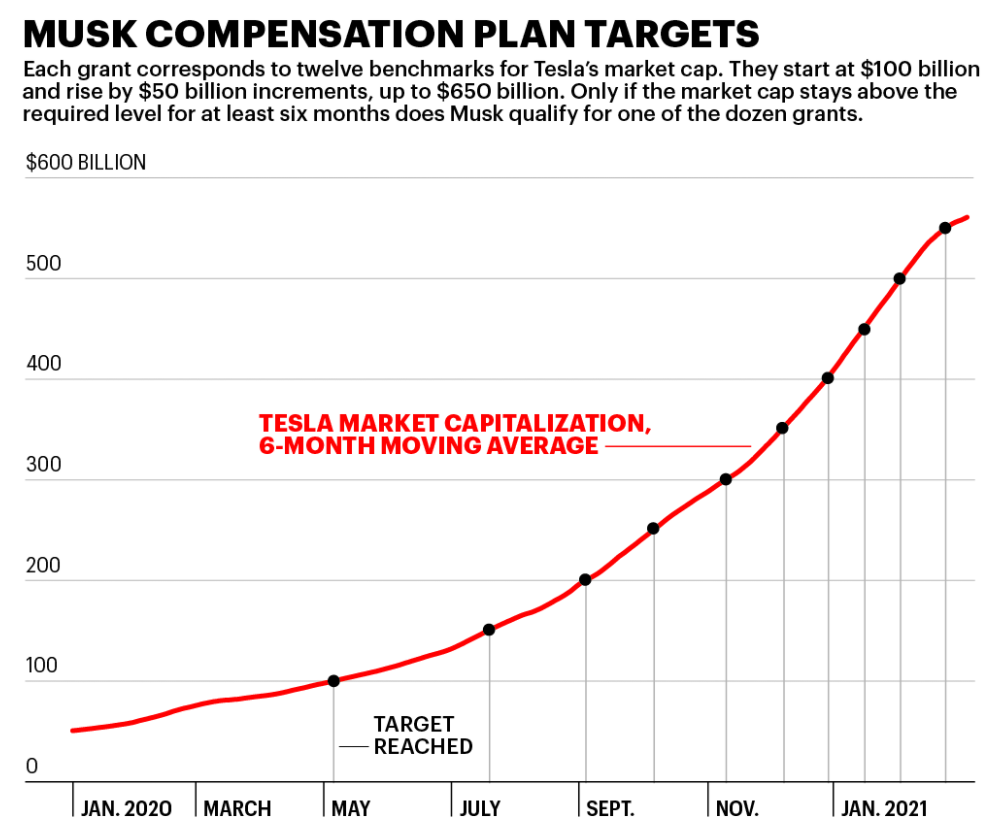

Elon Musk gets paid more if Tesla’s market capitalization, revenue, and profit (using the fraudulent EBITDA number) rise, but the goals seem to be stated in nominal dollars, not real (inflation-adjusted) dollars. From Fortune:

Plainly the biggest driver of Tesla market cap is the baffling inability of mainstream car manufacturers to deliver a competitive product (they can’t even give us dog mode, a handful of lines of software for which an 18-year-old spec exists!). But what if investors are expecting the dollar to lose half or more of its value over the coming years of rule by Democrats? They’re throwing money into stocks, including Tesla, just to avoid holding the same type of cash that the government is printing like crazy. The revenue targets are easier to meet now that used car prices are rising (up 45 percent over a one-year period says New York Times).

How many other top executives are going to get a huge tailwind from inflation if this kind of nominal-dollar compensation plan is the norm?

Related:

- Relative importance of getting a ride from Uber versus helping the Afghan refugees (Uber executives, despite earning tens of $millions per year, want customers and shareholders to pony up $2 million to help Afghan refugees rather than contributing any money themselves)

You know who else owns call options on Tesla?

https://finance.yahoo.com/news/nancy-pelosi-buys-tesla-calls-191017279.html

Perhaps the implicit leverage of the managerial class creates a political bias towards inflation?

Why is EBITDA fraudulent?

PhilH: Correct me if I’m wrong, but I think EBITDA would show a profit for an enterprise that is guaranteed to produce losses. Suppose a company borrows at 5 percent in order to buy a $100 factory that can be leased out to an operator for $2 million/year. EBITDA says this company has $2 million/year in “earnings”. In fact, it has $3 million/year in losses (since the interest expense on the loan is $5 million). Enron used a lot of metrics like this to reward managers and they, in fact, entered into transactions like the hypothetical. https://en.wikipedia.org/wiki/Rebecca_Mark-Jusbasche got the company into electricity generating and water projects that were never forecast to earn more than they cost to finance. She was paid enormous bonuses based on the formula designed by the Harvard Business School and McKinsey geniuses, but Enron investors were doomed from day 1 of her projects.

He may be referring to the practice of excluding stock based compensation when calculating non-GAAP EBITDA. If you’re a tech company with many expensive engineers and executives, the profit margins look a lot better if you can ignore a large portion of your employee’s compensation.

I think there were changes in the GAAP rules around stock compensation in 2005.

Sorry, philg, looks like you already answered.

EBITDA was never designed to show how profitable a company is but as a useful metric for bankers to see how much cash is available to cover interest expense. EBITDA/Interest or EBITDA/Total Financing Costs are very useful tools. It is correct to say it is not a substitute for net income.

I don’t understand your argument, Phil. The plan was entered into well before the current inflation and the Forbes article and the graph you reprint seems to show that his options vest based on market cap, i.e., what the market thinks the company is worth, not on EBITDA. EBITDA is a metric for measuring corporate performance and like all accounting metrics, including GAAP earnings, has pluses and minuses.

Jack: That’s my point exactly! The plan was created in a low-inflation environment, not contemplating that at least some of the hoped-for growth in valuation could happen merely due to inflation and not due to to any positive actions by Tesla management, including Mr. Musk.

Philip, isn’t this point about inflation effect on stock market prices should be true for most relatively well managed large public traded company? Are you saying that hyped stock inflates faster then non-hyped stock? I agree , this effect is a part of being hyped and true even when economic inflation is under control.

LSI: Yes, the magic of inflation should help nearly all big company executives meet their performance targets (expressed in nominal dollar terms). I singled out Elon Musk because his bonuses are the biggest (but I think the structure is conventional).

I think that TESLA price reflects Democrat party fixing the market, as Steve reference above indicates. If all cars are not to be outlawed, why would Tesla worth order of magnitude of Honda capitalization and several times of world market share leader Toyota with their popular economy cars including plug-in hybrids? I think Steve points to both high profile insider trading and tyrannical plans.

I am a fan of Mask but Tesla is exceptionally good at making rarity cars (based on their negligible market penetration in extremely busy and compact and thus favoring electric vehicles NY/NJ/CT tri-state area centered on Manhattan) that save on dealerships costs more expansive then cars that are sold through Honda and Toyota dealerships that also feed millions of employees and vendors .

more expansive = more expensive

You are looking at Tesla as if it is a car manufacturing company only but as you know they are not. Investors are driving Tesla’s stocks up betting on its many “pet” projects (which I consider most as POC (proof-of-concept)) and SpaceX.

George A, SpaceX is a private company right now with estimate value in 40 – 80 billion dollars range based on raised capital. What Tesla side projects are you talking about?

My understanding that Tesla buys actual battery making technology from vendors . Its price premium over Toyota would be understood if Tesla could monopolize battery technology or develop and patent compact robust nuclear fusion energy production technology or something similar in scope.

All the lion kingdom classmates shot into multimillionaire territory last week as their Idaho houses crossed over $800,000 & their Calif* houses shot over $2 million, all paid off in the last 20 years. Weird not knowing anyone still worth under 7 figures. It used to be that inflation was bad for everyone because interest rates always eventually spiked. Now, it’s all about being on the winning side. It may be that the government has reached the limit of its printing capacity & the next recession will find it truly facing deflation.

when government money printing capacity is affected by supply chain problems, he-he?