Previous looks at estimating Covid death risk from insurance rates:

- COVID-19 is sure to kill you, but life insurance rates haven’t changed

- Thankful that life insurance rates are still down

From Canada:

Canadian life and health insurers paid $154 million last year in individual and group life insurance claims from deaths related to Covid-19, an industry group says.

The latest statistics published on Tuesday by the Canadian Life and Health Insurance Association (CLHIA) include details about benefit payouts related to the pandemic, as well as premium growth in life insurance and annuities.

An additional $150 million in disability claims was paid in 2020 above projections to support recovering workers.

Overall, the insurers paid $14.3 billion in life insurance benefits in 2020, $36.6 billion in health insurance benefits, and $46.2 billion in retirement benefits, the report said.

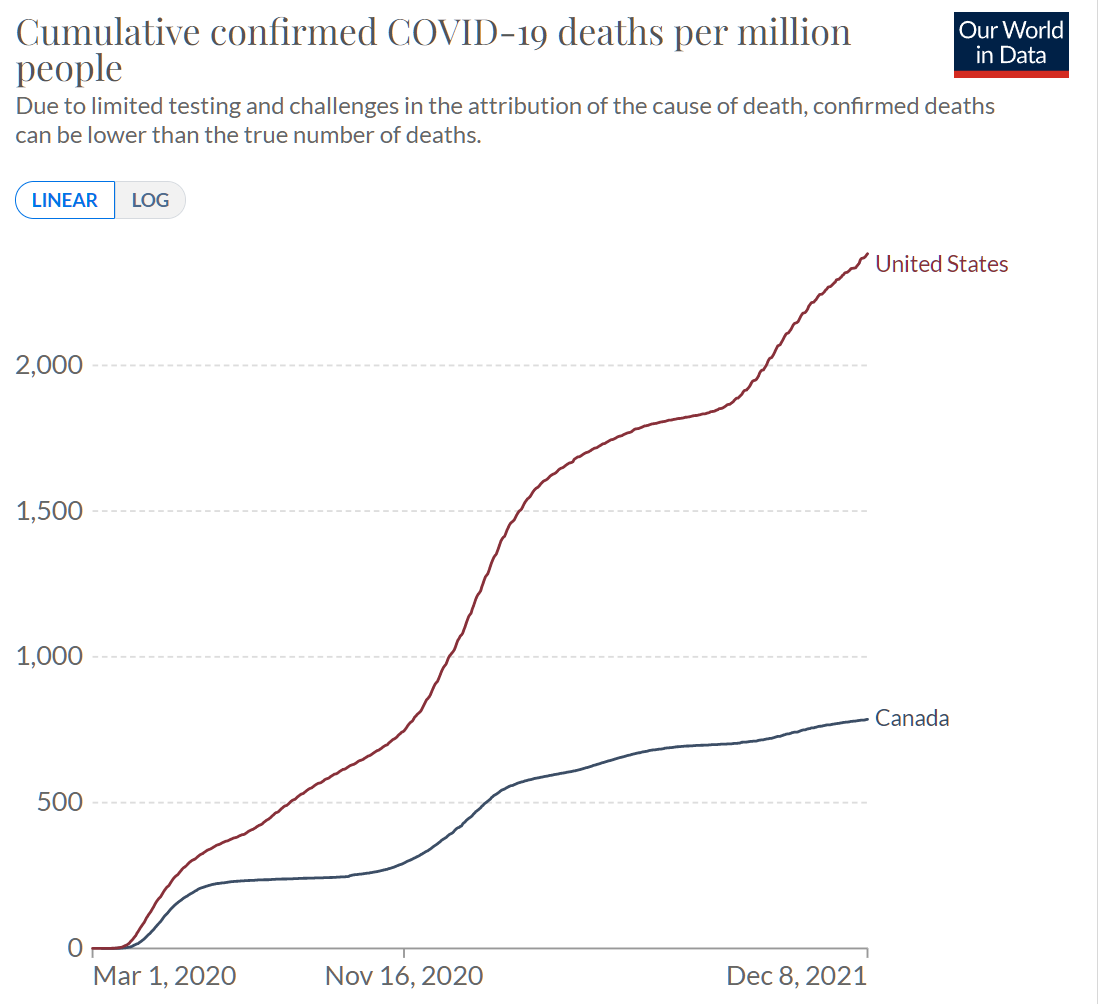

So the Covid-related death claims were 1 percent of the total in a county that had, in 2020, about 40 percent of the Covid-tagged death rate compared to the U.S.:

What about the overall increase in payouts in Canada? The same publication says that 2019 payments were $12.1 billion. That’s an 18 percent increase and, therefore, payouts went up by 17 percent for non-Covid reasons in 2020. Perhaps simply due to a big sales push 40 or 50 years ago?

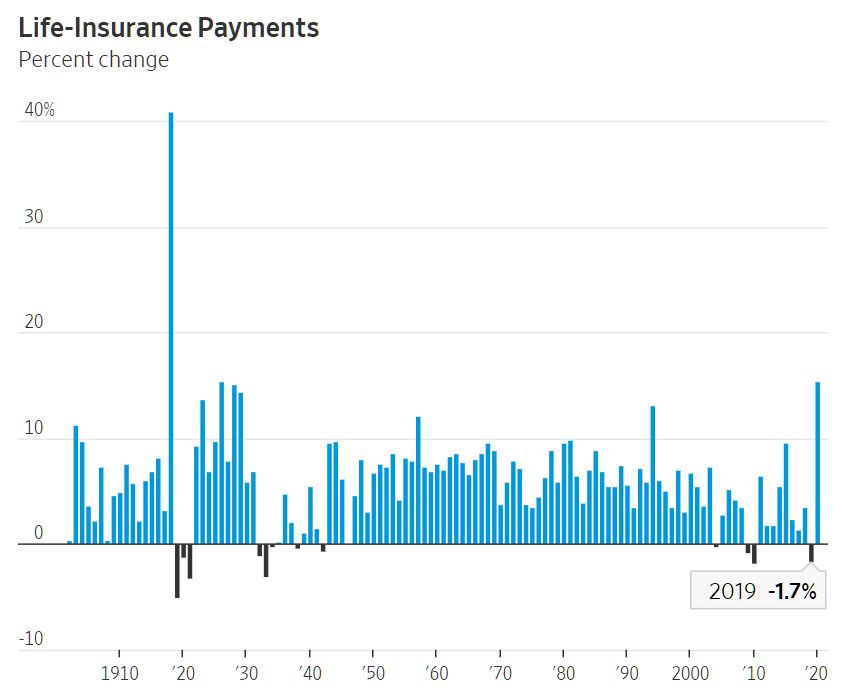

Today’s Wall Street Journal includes “Covid Spurs Biggest Rise in Life-Insurance Payouts in a Century”:

Death-benefit payments rose 15.4% in 2020 to $90.43 billion, mostly due to the pandemic, according to the American Council of Life Insurers. In 1918, payments surged 41%.

If we dig a little deeper, the article shows us year-to-year percentage changes. What happened in previous “surge years”? In 2015, payouts were up by 9.5%. In 1994, they were up by 13.1%. What was the great wave of death that swept the U.S. in 1994?

It looks as though 2019 was an unusually great year for life insurance companies (except those that sell a lot of annuities!). Payouts went down 1.7% despite population growth.

If we believe the Canadian data, adjusted for America’s higher Covid-tagged death rate, only about 2.5% percent of the 15.4% bump can be due to Covid. That would leave us with about 13% as the non-Covid increase, similar to the 1994 surge, and less than the 17% non-Covid increase that was experienced by Canadian life insurers.

Related:

The markets agree, the Dow Jones Life Insurance Index is at the highest point in 5 years:

https://markets.ft.com/data/indices/tearsheet/summary?s=DJUSIL:DJI

It underperforms the S&P though.

I’m sure you’ve seen the MedPage take on the WSJ article, with the headline:

“Death Payouts Soar Amid COVID”

“The COVID-19 pandemic led to the largest increase in insurance payouts in more than a century, falling short of the increase seen during the 1918 flu pandemic. (Wall Street Journal)”

https://www.medpagetoday.com/infectiousdisease/covid19/96094

The combined effect for busy, harried, headline-only readers is the unmistakable impression that life insurance companies are on the brink because so many people died as a result of the Plague.

I think this is a good reason for the life insurance industry to ask for some extra MMT spending in the next appropriation! When both MedPage and the WSJ can write articles showing how bad COVID has been for them, they need a bailout!

And they should get a bailout! Because the President of the United States and all the people who were talking and said they knew anything this time last year were telling us that if only this country could rid itself of its true Orange Plague, the vaccines would vanquish the virus and we would all be back to normal by this time. How can any industry that insures soon-to-be-dead people cope with that kind of totally wrong information coming from the government?

I wonder what are the demographics for folks who hold life insurance?

https://www.policygenius.com/life-insurance/life-insurance-statistics/ has some stats (54% of American adults have life insurance; those of us who identify as “women” get a 33% discount)

Black Americans, whose lives matter, are more likely to own life insurance than white Americans: https://www.limra.com/siteassets/newsroom/fact-tank/fact-sheets/facts-of-life-2021-format-vfinal.pdf (also, a positive COVID-19 test motivates people to buy, buy, buy!)