From page of the New York Times today:

Whom does inflation harm? It has to be bad for someone, right? Otherwise it wouldn’t be front page news. In fact, you would have to scroll down five times to reach “Migrant Truck Crash in Mexico: ‘They Were All Cadavers’”, a story about “a horrific crash that killed at least 54 migrants.” The NYT story that was much more important than 54 deaths:

The Consumer Price Index is rising sharply, a concern for Washington policymakers and a sign of the rising costs facing American households.

Inflation jumped to the highest level in nearly 40 years, fresh data released on Friday showed, as supply chain disruptions, rapid consumer demand and rising housing costs combined to fuel the strongest inflationary burst in a generation.

As housing and other day-to-day costs rise, workers may begin to ask for raises to help offset the financial blow. Employers are competing for laborers at a time when job openings far exceed the number of people actively looking for jobs, and wages are rising at a brisk pace. The Employment Cost Index, a measure the Fed watches closely, picked up notably in the three-month period that ended in September.

Increased pay has not been enough to fully offset inflation for most people: Wage gains are up sharply, especially for low earners, but are not rising quickly enough to keep up with the acceleration in prices.

The language gives the reader the impression that inflation is most detrimental to the American rabble. Let’s look at some of the language:

- American households

- laborers

- people actively looking for jobs

- low earners

On the other hand, if it is front page news in a newspaper controlled by elite Americans, shouldn’t we suspect that elites are being harmed? Throughout coronapanic, for example, the NYT advocated for public schools to be closed (#AbudanceOfCaution), thus depriving non-elite children of an education even as elite kids continued in their private schools or with home tutors.

Let’s consider someone on the bottom rung of the American income distribution. He/she/ze/they is entitled to free public housing, free health care via Medicaid, free food via SNAP/EBT, and a free smartphone (Obamaphone). If the market value of his/her/zir/their apartment in Cambridge, Maskachusetts, Manhattan, or San Francisco is $3,000 per month and rises to $30,000 per month, what difference does that make to someone who isn’t paying rent? Similarly, if someone on Medicaid had been getting hepatitis meds for $84,000 in pre-Biden money, what does he/she/ze/they care if the price goes up to $840,000?

What about a working-class wage slave who has borrowed up to his/her/zir/their eyeballs, like any true American? The house was bought with a mortgage and then a home equity loan siphoned out the gains due to inflation. The driveway contains three vehicles, all of them purchased with borrowed money. The wage slave was gulled into three years of college and never finished. He/she/ze/they is left with $45,000 in debt from that debacle. Maybe his/her/zir/their wages won’t quite keep pace with galloping inflation, but all of the debt is effectively wiped out.

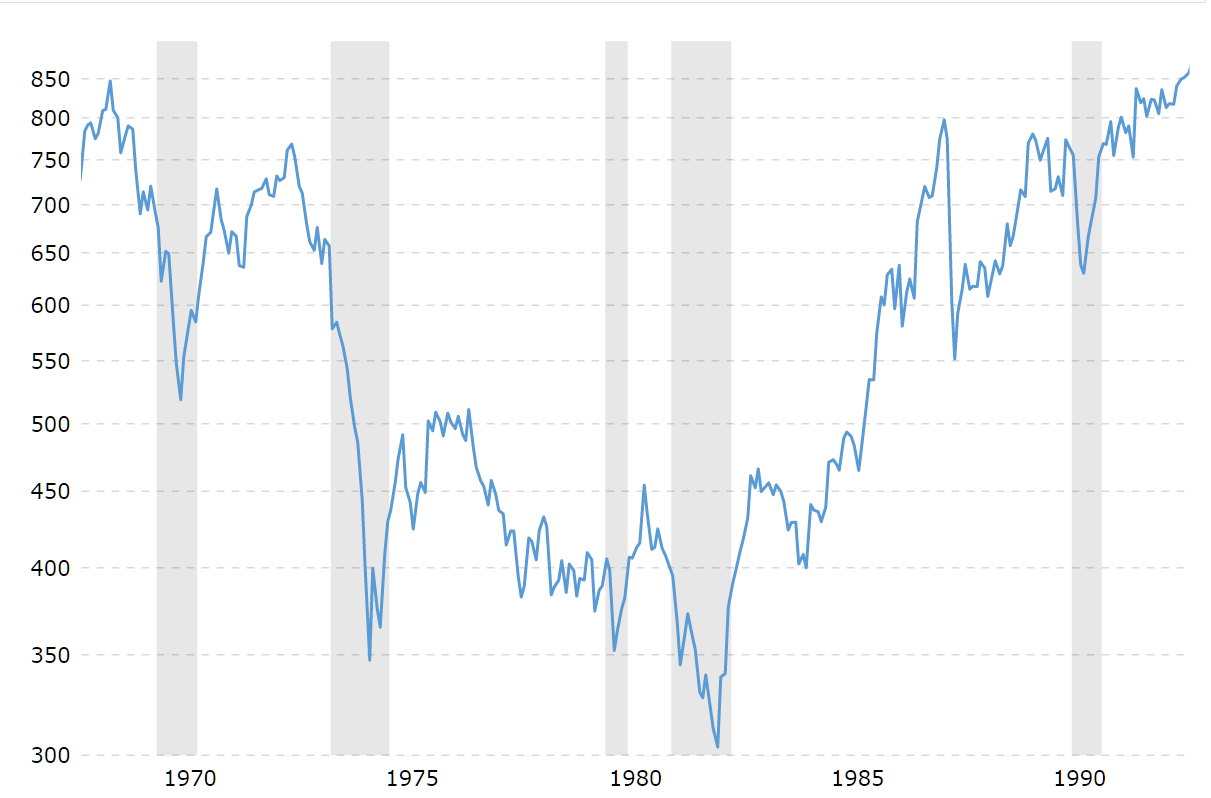

What if we get to the above-median end of the American income and wealth spectrum? By definition, someone with “wealth” is a saver, at least on net. Savings, especially if kept in bonds, are attacked by inflation. Stocks generally fell during America’s previous experiment with rampant inflation (printing money to finance Lyndon Johnson’s new comprehensive welfare state and also the Vietnam War that JFK and Johnson embroiled us in). Here’s a chart of the S&P in constant dollars (source; the gray regions are recessions). It doesn’t recover its 1972 value until 1987:

How about the government itself? Inflation makes it easy for the government to pay bondholders ($29 trillion in federal debt isn’t so bad if a Diet Coke costs $29 billion). Inflation enhances capital gains tax receipts, since the U.S. taxes capital gains without adjusting the basis price for inflation. An asset bought 50 years earlier, even if it went down slightly in real value, will be taxed at 33 percent (federal plus state in California) on essentially the entire value when sold. As evidenced by their low quit rate, government workers are paid much higher salaries than they would earn for comparable work in the private sector. Inflation, especially when combined with a fraudulent CPI formula, allows the government to quietly cut employees’ wages.

The effects are certainly going to be uneven, but it is fair to say that generally the powerful inflation that our leaders are brewing is a force for redressing the inequality that the same leaders decry?

(Separately, let me remind readers that all of my ideas are stupid. Back in January 2021, I cautioned a friend who had borrowed money to buy a factory new $3 million Cirrus Jet. I lived for so long in New England that I developed a Yankee idea that you shouldn’t borrow for a personal airplane. In nominal dollars, the jet is now worth far more than he paid, of course, so essentially he is being paid by the lender (and bondholders behind the lender?) to fly around in his jet.)

Related:

I don’t think your ideas are stupid. Counterintuitive and out-of-the-box sometimes, sure, but definitely not stupid. Later today I can supply a direct example of price increases that affect primarily middle and lower-middle class Americans. I’m working on a menu update for a local restaurant in a nearby town. Almost every price has gone up since the last printing one year ago, and the most egregious so far is: Potato Skins – were $6.99 and now are $9.25, an increase of more than 32% in one year. This is a local “town center” type restaurant, basically a pizzeria with extras, booths, tables, free wi-fi, delivery, etc. that caters to local workers, town residents and walk-in/sit-down customers. There is no drive-thru.

Here’s the demographic. This *barely* a middle-class town in MA, with a large cohort of poor people:

“The median income for a household in the city was $33,913, and the median income for a family was $41,863. Males had a median income of $36,008 versus $25,685 for females. The per capita income for the city was $18,514. About 13.0% of families and 15.4% of the population were below the poverty line, including 25.8% of those under age 18 and 10.2% of those age 65 or over.”

When I’m finished I’ll compare the increases across the whole menu. The owner tells me that he needs this ASAP because 1) he’s taking a beating as he sources high-quality ingredients like Boar’s Head meats even though he’s a modestly-priced restaurant in a pretty poor town and 2) despite the digitization of everything, a lot of his customers still prefer the printed menus and his staff find themselves spending 2x as much time on the phone correcting the prices for slightly irate call-in customers reading obsolete menus. The viability of the restaurant has historically been a factor of the high-quality food he makes for good prices, so this menu is going to come as something of a shock, at least for his potato-skin customers.

I don’t know the demographic breakdown of his customers on a fine-grained enough level to judge how many people are SNAP/EBT/SSI recipients. I’m sure there are a significant number of them, but my impression is that most of his customers are people with jobs of some kind.

$2.25 extra for the potato skins could also buy about 0.63 gallons of gasoline, which is enough to get to the restaurant using most cars from anywhere in the town. So I expect his delivery drivers to be working harder as more people opt to have their food delivered. He does not mention a delivery charge on the menu – IIRC he offers it free and the drivers rely on their tips.

In fact, I should ask him specifically about that before I send my proofs! Thanks for the help!

One other data point before I do the whole menu: Their price for a garden salad went from $4.75 to $6.99, an increase of more than 47% in one year. So it is more expensive for people to eat healthier meals in this relatively poor town. That has a lot to do with why we see so much obesity, and this is a negative feedback loop on many levels.

“If the market value of his/her/zir/their apartment in Cambridge, Maskachusetts, Manhattan, or San Francisco is $3,000 per month and rises to $30,000 per month, what difference does that make to someone who isn’t paying rent?” I am not very experienced in this issue but done some coding for local help services. I do not believe that government automatically pays all rent to a land-lord who invested in assisted living. Maybe in Maskachusetts (not sure) but not everywhere. Government pays pre-set amount which is controlled by rules and renters’ financial status re-certifications, sometimes scheduled sometimes surprising. So significant raise in rent will put pressure on landlords and on elected officials if they decide to raise the amount of subsidy . Most people still work and pay for their mortgage and rent and large raise in subsidy will be unpopular. Price of assisted real-estate is depressed and is at level of 1980th, last time I looked into it over year and a half out of interest and looking for broad investment opportunities.

LSI: In Cambridge and Manhattan, the public housing units are owned by the respective cities or they belong to recently constructed apartment buildings that have been required to give 10 or 12 percent of the units for allocation by the local housing ministry. So the units have a hypothetical market value based on location, size, and condition, but the $3,000 per month (or maybe $10,000 in Manhattan) never gets paid by anyone.

The internet says nothing about how the legions of gootube pilots pay for their airplanes. There are no personal airplanes. They’re all bought through corporate entities. Figured they were all heavily financed, but if airplanes follow houses, no-one will accept credit if prices are rising too fast for anyone to wait for a loan to be approved.

Inflation has always crushed the poorest. A better printing meter is at https://fred.stlouisfed.org/series/WALCL Don’t forget inflation is not caused by printing money. It’s caused by a supply chain disruption which is caused by printing money.

5 year bank cd and related treasuries bonds yield around 1% or less so the debt market doesn’t appear to be concerned about long term inflation unless they are mainly purchased by the American rabble.

Paul: That’s proof that the elites, who are the holders of these bonds, are being harmed. If they are getting 1% interest, they are losing 5.8% of their wealth every year in the current situation (6.8% inflation). If measured against the ability to buy stocks or buy a house, the bondholders are losing closer to 20% per year.

Those who loose 20% of their purchase parity annually on their investment are also downward mobile American rabble.

For some reason the government and foreign countries hold most of the government debt:

https://www.thebalance.com/who-owns-the-u-s-national-debt-3306124

Mutual funds are the only expanding slice, but they could be owned by middle class, too. Perhaps the MMT perpetuum mobile can explain circular government holdings.

> On the other hand, if it is front page news in a newspaper controlled by elite Americans, shouldn’t we suspect that elites are being harmed?

Why? The game that the elites have been playing in the last decade (or forever?) is pretending to care about the lower classes and distracting everyone with LGBTQIA+ and BIPOC issues.

If “laborers” are getting too expensive, clearly we need more cheap immigrants!

I have a basic question because the term has become so overused that I don’t even know what it means anymore. At first, “supply chain disruptions” were for things like semiconductors. OK, I get that, there are only a few big chip fab companies in the world, #2 is in Taiwan, and I know that a fab costs billion$ to build.

Now, though, “supply chain disruptions” has morphed into this Giant Black Hole that people point to when they don’t have any good answers.

What “supplies” are being “disrupted” and how is this occurring?

I know that recently – very recently in fact, just the past two weeks – there’s been a tremendous run and shortage of #9 and #10 regular and window mailing envelopes. One day I could call a supplier and have 100,000 of each dropped off and a few days later, everyone was panicking and there aren’t any to be found.

So how does this “falling off a cliff” phenomenon occur? We’re informed that the ports are open and goods are flowing. I have a couple of Teamster friends on Facebook and they spend a lot of their time pimping the Teamsters, informing everyone that all is well and there has never been so much cargo being unloaded at ports on the East Coast.

So where is the hard-headed intelligent analysis of these “supply chain problems” that have become the dartboard for everyone’s problems? Why is it affecting everything from converted paper products to the highest of high tech? And do any geniuses out there want to venture to guess when it will end? Is it related to the pandemic – and in what way? You can’t find enough stevedores? People dropping dead at paper converting machines?

I’ve seen nothing good on the subject. We just have this black hole of suck and almost zero explanation about how it popped out of the aether and sucked the life out of us.

As you said, capital gains are taxed without adjusting the basis price for inflation, so inflation is essentially a tax on capital. So sayeth Warren Buffett. Therefore I would say that capital-holders are hit disproportionately.