One might think that an asset bubble that inflates and deflates doesn’t hurt that many people. After all, if you just stay in your house, what difference does it make if the value goes up to 3X and then comes back down to 1.2X?

Jeremy Grantham, the G in the asset management firm GMO, points out that people caught up in bubble fever adjust their consumption (i.e., spend like drug dealers). From his January 20 newsletter (a friend who has managed $billions sent it to me):

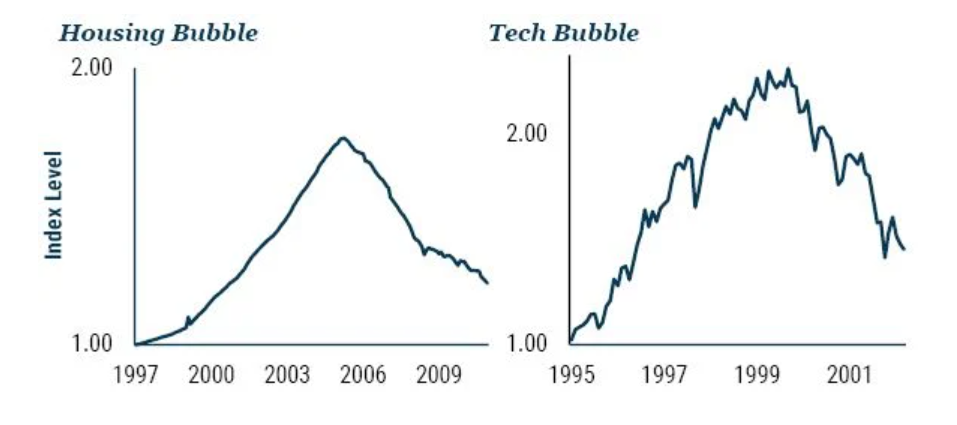

All 2-sigma equity bubbles in developed countries have broken back to trend. But before they did, a handful went on to become superbubbles of 3-sigma or greater: in the U.S. in 1929 and 2000 and in Japan in 1989. There were also superbubbles in housing in the U.S. in 2006 and Japan in 1989. All five of these superbubbles corrected all the way back to trend with much greater and longer pain than average.

Today in the U.S. we are in the fourth superbubble of the last hundred years.

One of the main reasons I deplore superbubbles – and resent the Fed and other financial authorities for allowing and facilitating them – is the underrecognized damage that bubbles cause as they deflate and mark down our wealth. As bubbles form, they give us a ludicrously overstated view of our real wealth, which encourages us to spend accordingly. Then, as bubbles break, they crush most of those dreams and accelerate the negative economic forces on the way down. To allow bubbles, let alone help them along, is simply bad economic policy.

What nobody seems to discuss is that higher-priced assets are simply worse than lower-priced ones. When farms or commercial forests, for example, double in price so that yields fall from 6% to 3% (as they actually have) you feel richer. But your wealth compounds much more slowly at bubble pricing, and your income also falls behind. Some deal! And if you’re young, waiting to buy your first house or your first portfolio, it is too expensive to get even started. You can only envy your parents and feel badly treated, which you have been.

If your house goes from being worth $800,000 to $1.6 million, as the houses in our Florida neighborhood have done within the past two years, Grantham predicts that you’ll sign up for that lavish vacation, buy the fancy new car, splurge on clothing and jewelry (see “Cartier’s Dazzling Festive Season Bodes Well for Luxury Stocks” (WSJ): “Overall, U.S. jewelry sales increased 32% year-over-year from Nov. 1 to Dec. 24”), pay $1.2 million for a piston-powered unpressurized airplane, etc. We see this with governments as well. States that are raking it in from temporarily turbocharged capital gains taxes build new spending programs that will need to be funded every year, even if capital gains tax revenues collapse due to asset values stagnating (but maybe inflation can help, since capital gains tax calculations don’t adjust for inflation and, therefore, even assets that actually lost value will result in taxes being owed on a nominal profit).

Where does Grantham, an elder statements of the equity markets, think we’ll end up?

The key here is that two things are true: 1) the higher you go, the lower the expected future return; you can gorge on your cake now or enjoy it piece by piece into the distant future, but you can’t do both; and 2) the higher you go, the longer and greater the pain you will have to endure to get back to trend – in the current case to a trend value of about 2500 on the S&P 500, adjusted for the passage of time, from whatever high point the market might reach (currently at nearly 4700).

In other words, the S&P crashes to 2,500 or, assuming sufficiently clever manipulation of all the control wheels by wizards in Washington, D.C., stays more or less where it currently is, adjusted for inflation, for a decade or so.

(Maybe “spend like drug dealers” above isn’t the best expression for today? How about “spend like crypto early-adopters”?)

Related:

- Grantham warned us of a bubble in January 2021 (and if you’d followed his advice by going short or moving to inflation-savaged cash you’d be pretty miffed right now!): “We at GMO got entirely out of Japan in 1987, when it was over 40% of the EAFE benchmark and selling at over 40x earnings, against a previous all-time high of 25x. It seemed prudent to exit at the time, but for three years we underperformed painfully as the Japanese market went to 65x earnings on its way to becoming over 60% of the benchmark! But we also stayed completely out for three years after the top and ultimately made good money on the round trip. Similarly, in late 1997, as the S&P 500 passed its previous 1929 peak of 21x earnings, we rapidly sold down our discretionary U.S. equity positions then watched in horror as the market went to 35x on rising earnings. We lost half our Asset Allocation book of business but in the ensuing decline we much more than made up our losses.” The Jan 2021 piece includes the figure below.

But as an individual, retail investor what should we do with our cash instead? If we leave it in cash it get’s destroyed by inflation, if we invest in equity or real-estate we are buying bubble inflated assets.

So, what is a small scale retail investor to do in these times?

I have the same question. I’m considering laddering some original issue corporate notes offered through Fidelity (2.0% to 3.5%) and hoping CD rates come up a little in March.

^ and I guess be ready to buy more equity mutual funds if and when the market declines by, say, 10% or more.

https://www.treasurydirect.gov/indiv/products/prod_ibonds_glance.htm

7.1% on I bonds right now. $10K annual limit

hedge your bets and go long S&P 500 and the (10x inverse) Toilet Paper ETF. Disclaimer, for entertainment purposes only. Trailing P/E ratios do appear to be inflated but there is also this ~ John Maynard Keynes said: “Markets can stay irrational longer than you can stay solvent.”

When the going gets tough, people who need money tend to sell their stonks & people who don’t need money tend to buy. The going gets tough when stonks are down.

Today’s crash was because of Russia’s invasion of Ukraine & is not part of the longer term decline from monetary policy. Bide is a joke compared to Putin, but in the long term, Ukraine falling to Russia won’t impact any more than pride.

Yes, war with Russia worries is great buying opportunity – they will be either over and stocks will rebound or world as we know will be over and nobody will care about stocks at that point.

Given famous Asimov’s saying that “violence is the last refuge of the incompetent” and given that neither Putin nor Biden, judging by state of their respective economic achievements that are best defined by word ‘failures’, are particularly competent, second scenario likelihood is increasing.

Is there an invasion? I’m mainly seeing Biden and Johnson making strong statements to distract from their domestic problems. Another “little rocket man” episode that will be followed by great diplomatic success and rising approval ratings.

And well connected people will buy the bottom just before the Fed pumps up the stocks again.

If Russia wanted to invade Ukraine, Ukraine would last maybe two days (maybe even less… if Crimea is of any guidance, a large chunk of Ukrainian military will immediately defect to Russia). NATO will do nothing (the Iskanders and other standoff weapons systems already deployed on Western borders will keep it this way).

The real issue for Russia is what to do with the impoverished Ukraine after the conquest. It does not have resources to waste on reconstruction and welfare and certainly doesn’t need tens to hundreds thousands of Banderite neo-Nazis and millions of propagandized civilians. The only feasible option is to keep NATO out by the least invasive means and wait for the on-going civil war to run its course, and only then pick the pieces. Meanwhile, millions of Ukrainian refugees are already integrating in Russian society, and Russia gives passports to eastern Ukrainians pretty much for asking.

As for motivation, Russia certainly doesn’t need more territory – it has lots of sparsely populated land already. Same goes for natural resources. Ukraine used to be Soviet industrial base, now its industries are either obsolete or destroyed (a lot of it was in Donbas). The only useful strategic asset (Black Sea naval base in Crimea) has already been annexed. Basically, Ukraine is little more than a buffer zone now. It’s a common mistake to think of Ukraine as a single nation – it has at least four distinct groups from former Polish (Galitsia and Volyn) to plain Russians (Donbas), trying hard to gain the upper hand, so the most likely outcome will be partitioning of Ukraine, and possibly absorption of its parts by Poland and Russia, with remaining central part becoming a landlocked and inconsequential statelet.

@perplexed: “Putin nor Biden, judging by state of their respective economic achievements that are best defined by word ‘failures’”

I won’t comment about Biden (I’m not sure this demented empty suit actually decides anything), but if you look at the actual figures and state of the society, Putin can objectively be considered one of the greatest statesmen in history.

He picked up a failed country with ruined industrial base, disintegrating oil and gas industries, and impoverished rapidly declining population. During his reign Russian per-capita PPP GDP grew 3x. The population decline is arrested, and country now has robust middle class. The government debt is mere 18% of GDP (compared to US govt debt of 130%), and Russia is probably the closest to self-sufficiency of all countries – it has enormous energy and mining sectors, surplus of agricultural production, competitive high-tech (certainly capable of building technological equivalents of Google or Facebook, but not yet at parity where semiconductor manufacturing is concerned), and is busy building up the industrial base. The foreign trade balance shows large surplus. The Moslem terrorism is effectively suppressed and the civil society is returning to its traditional cultural roots grounded in Orthodox Christianity. Putin also saw to rebuilding Russian military, which is capable now of effectively repelling attacks by any adversary and has state-of-the art weaponry. The society is mostly united and reasonably optimistic about the future, certainly nothing like the deeply divided America. The political power of billionaire oligarchs was curtailed and now they mostly keep to doing business. (Not that there are no problems… widespread corruption is one, and so is decay in education. Poor health habits and alcoholism are persistent, too, – though Putin notably doesn’t drink and is in a very good shape for his age, and so is widely considered a masculine role model.) His current approval rating is at 67% (at the top, before debacle in Ukraine, it was nearly 90%). Hardly a failure.

>>> The Moslem terrorism is effectively suppressed and the civil society is returning to its >>>traditional cultural roots grounded in Orthodox Christianity.

Do you think the planting of Kadyrov to Chechen had a role to play here?

averros: Many intelligent people are pro-Putin, but economic success alone is not sufficient. There are still Garry Kasparov and others.

averros: By what I can gather it seems that Putin was positive influence in the beginning but failed to deliver on his promises on making Russia rich enough and went to war(s). Three times of the bottom is still not very far from the bottom. Gazprom capitalization: https://companiesmarketcap.com/gazprom/marketcap/ Less then $100 Billion with record fuel prices, down from its maximum capitalization of $350 + billions around 2009.

National debt alone is not a good indicator of economic health: North Kora, 0% national debt https://www.macrotrends.net/countries/PRK/korea-dem-peoples-rep/debt-to-gdp-ratio.

As you said Ukraine is not Crimea alone and it has hundreds of thousands of militants to server in Ukrainian military that has about same weapons as Russia plus some western weapons. They are sure to make any large conflict extremely difficult with many casualties.

I wish peace to both Russia and Ukraine and for friendship among their people and with others.

Seems outlandish that some guy in Boston has a better idea of what things are worth than the millions of people transacting every day. People with triple digit IQs like him because he gussies up his fortune telling with words like “3-sigma.” He never provides his data so whether he is right or wrong about the three sigma thing like who knows? And you can’t check his performance since there is no record of it. His track record of outlandish market calls goes back for decades — his big call that made his reputation was in 1974 when he bucked the tide and came out in favor of equities. But some people like prognosticators — gives them a feeling that someone out there knows what is going on. And the more definite the better.

exactly, price to earnings ratio is affected by number of market participants and number of available tradable assets and all the links that exists between entities that generated the assets. Which dramatically increased in 1929 in different proportions and I am not aware at anyone trying to quantify it for public consumption. When a guy with triple-digit IQ bring it up it is likely for profit reasons, host of this blog excluded, by not being from Boston any longer.

I highlighted this because of his explanation of how a bubble is worse for ordinary upper middle class folks than a steady trend, not because I think he has a crystal ball into the future of the market.

steady trend would be too easy. That might work for those that can front run the 401k index fund proles or contrive some other clever scheme. Ideally we would buy into fear (e.g. PE < 15) but that is easier said than done.

On the other hand, economists still tell us that inflation is necessary to incentivize people to spend their money, rather than save it. According to economists, spending (and borrowing) is good for the economy, while saving is bad. But how can anyone save enough for a down payment on a house whose value is rising far faster than anyone can save a portion of their income? Maybe economists assume 100% of people work in the finance or real estate sectors where incomes keep pace with inflation?

It’s OK. It makes people worse off, but they can eat glorified dog food. Considering what some wealthy people now spend to feed their pets, it’s not even good enough to be dog food, but we’re moving into the Replacement Age.

https://www.beefcentral.com/news/fake-meat-as-highly-processed-as-dog-food-can-you-pick-the-difference/