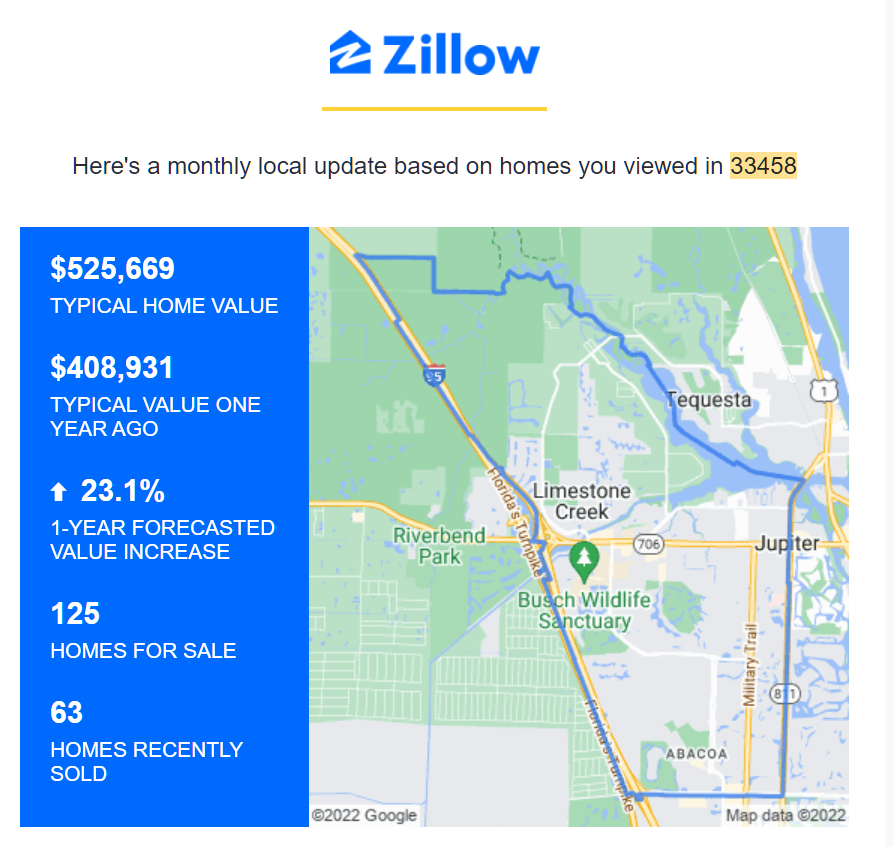

From February 2022, when we were dumb enough to sign a contract to buy a house:

The market will go up 23%.

In April, when we were dumb enough to close on a house:

The market has gone up a little and will go up 18.3 percent more.

In June, Zillow is busy celebrating Pride Month (from 2020: “They’re bold, bright and one-of-a-kind — they’re the homes we love, Pride-month style. We may not be celebrating together in person, but we’ll never stop celebrating what’s beautiful.”), but the company’s robot still has time to say that the forecast is 14.6 percent:

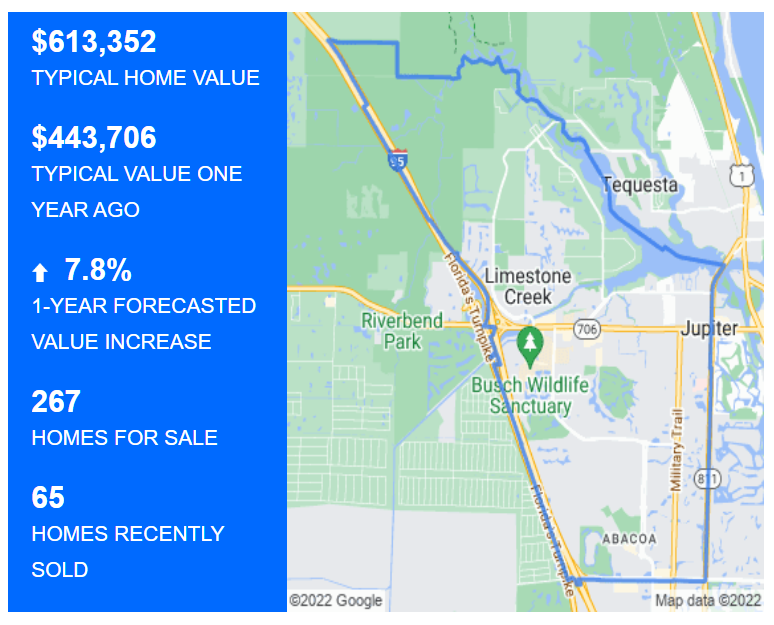

August 5, 2022, the “typical home value” is up by a staggering amount and the forecast is 7.8 percent more:

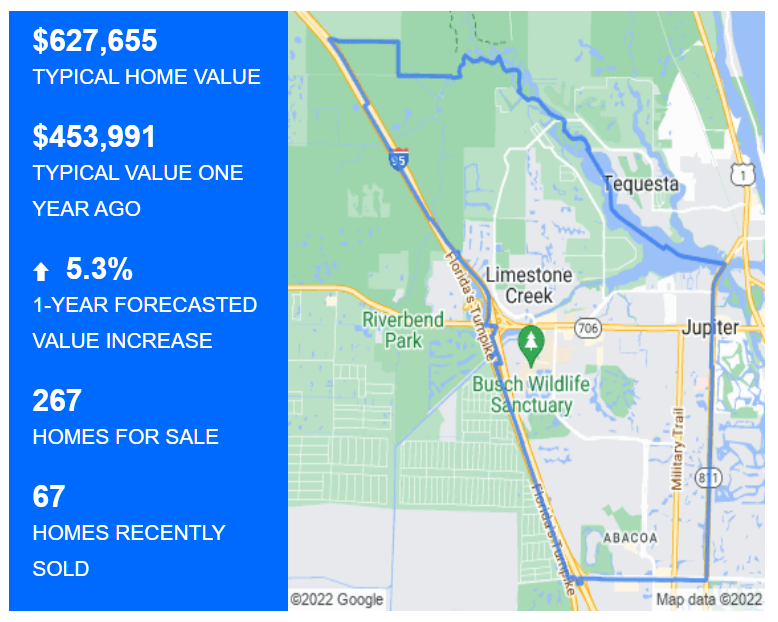

August 14, 2022, the “typical home value” is still up (yet houses have seemingly been slow to sell for a few months now and there have been many price cuts) and, with the Inflation Reduction Act nearly signed by the vigorous Vanquisher of Corn Pop, the inflation forecast is down to 5.3 percent:

These forecasts aren’t mutually inconsistent. If we take the starting “typical home value” and inflate it by the forecast 23.1 percent increase we get $647,098 for the expected typical home value in February 2023. If, indeed, the current value is already $627,655, the forecast 5.3 percent inflation rate (to August 2023) will make that happen.

Do we believes these precise forecasts? If so, should Joe Biden ask Zillow to come in and take over the Fed?

Separately, speaking of house price inflation, it occurs to me that the capital gains tax applied to homeowners does not make any sense. Suppose that Dana Dentist, a gender-neutral driller of teeth, purchased a 4BR house for $500,000 fifteen years ago. Dana falls in love with someone he/she/ze/they met at a Pride March in another city. Dana sells his/her/zir/their house for $1.5 million (in 2022 mini-dollars) and buys an identical size/quality house in the new sweetheart’s city, which just so happens to cost $1.5 million. Dana is no better off. He/she/ze/they has exactly the same size and quality of house. Yet the IRS now hits him/her/zir/them for capital gains and Obamacare investment income tax on $750,000 (the first $250,000 of gain on a primary residence is exempt). There may be state capital gains taxes to pay as well if Dana did not live in Texas, Florida, or a similar state.

Note that this wouldn’t happen to a commercial property owner. If he/she/ze/they sold House 1, which had been rented out, and bought House 2 in order to rent it out, the sale/purchase would be done in a 1031 exchange and there would be no tax on the fictitious capital gain until, perhaps, House 2 was sold and not replaced.

What’s the downside of the Feds and states taxing fictitious capital gains? By making moving more expensive, the policy discourages people from moving for better career opportunities and, thus, reduces the overall growth rate of the U.S. economy (not as much as our family law system does, but at least to some extent).

While I cannot speak to any of your tax questions, Zillow is way high on prices. Maybe they just want to get people to sell? RedFin is much closer to market value, although maybe still a bit on the high side (though hard to tell here in New England!). [also: my realtor recently wrote me that they are no longer impressed with Zillow (maybe they never were?) and wanted me to post a review elsewhere] BTW, my college roommate, Allan, developed the home price index known as Case-Shiller, which is more accurate (especially when localized). This was back when banks were unable to value their mortgage portfolios because the house prices had fallen (and many bank loans were of the non-performing variety). https://www.investopedia.com/articles/mortgages-real-estate/10/understanding-case-shiller-index.asp

Case-Shiller is awesome! See my live blog of Shiller’s lecture in http://philip.greenspun.com/teaching/universities-and-economic-growth

On the other hand, Case-Shiller still shows prices going up in Miami (the closest big city to us). https://fred.stlouisfed.org/series/MIXRNSA and this doesn’t agree with my lived experience. Houses seem to be sitting on the market longer. I know that I’m the dumbest person in the world and I bought in Feb 2022 so that has to have been the peak, etc.

Capital gains taxes that are not at the very least indexed to inflation have never made any sense.

Didn’t know that like kind exchanges only applied to investment properties while home owers only get an exemption on $250,000 in capital gains or $1 in 1980 doll hairs. That explains why so many houses are empty rental properties & people rent from themselves.

Capital gains taxes in the presence of inflation are a backdoor wealth tax. Wealth tax is a dream of politicians of many persuasions but us unconstitutional, so I’m sure they were thrilled to discover this “one simple trick.”

> Case-Shiller is awesome

@philg: maybe Case is awesome, but Shiller? Not so much. On YouTube I watched Shiller lecture Yale students on how they would soon learn to use an amazing technology to model and predict financial markets. He seemed awed but bewildered trying to explain this advanced technology. After a few minutes it dawned on he: was talking about spreadsheets, but was getting all the technical details wrong. Then he tried to explain the history of how it was invented, but he got events+names+dates wrong, confusing VisiCalc with Lotus 123 and Excel. I wondered: how did he ever win a Nobel, and how much of his other work is sloppy too?

You should be putting your house into an LLP! To avoid any capital gains tax just rent the house to yourself for a year. Then rent the house from yourself that you buy. A real estate lawyer can probably set this transaction up for you for less than 10k.

It makes sense when seen as a way to tax the working class who dare try move up the rungs (dentists are workers, just high earning). The goal is twofold: to feed the government machine and to gatekeep the old money class, who are the only true winners in our economic system.