One of the features of the latest spending bill from Democrats in Congress and Joe Biden is the hiring of 87,000 IRS agents (or 30,000 new agents, depending on whom you believe). I’m wondering if this tips the scales a bit in favor of not working. If you’re in public housing, on Medicaid, shopping via SNAP/EBT, talking on an Obamaphone, and playing Xbox via the new taxpayer-funded broadband benefit, you won’t have to deal with the IRS in any way, regardless of how many agents are hired.

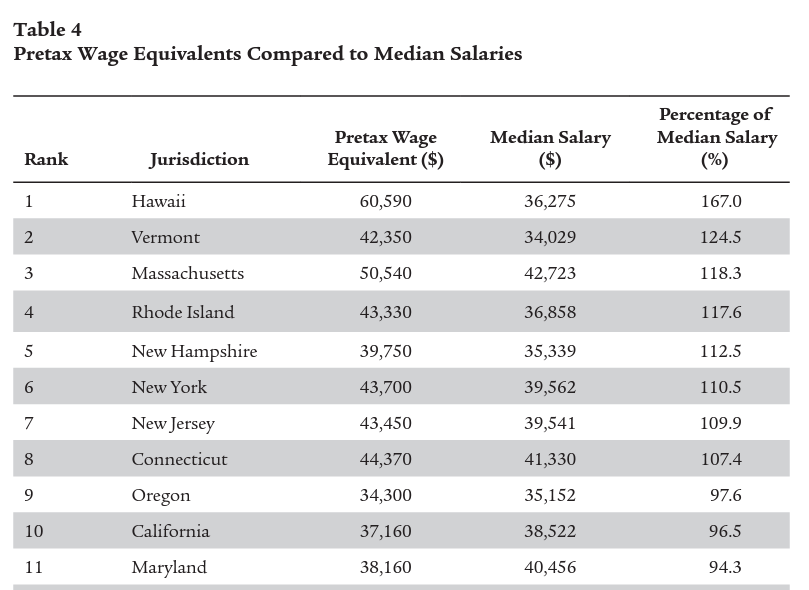

Back in 2013, before all of the coronapanic-related enhancements, the welfare system yielded more spending power than working at the median wage (i.e., being a chump) in at least some states. Table 4 from CATO:

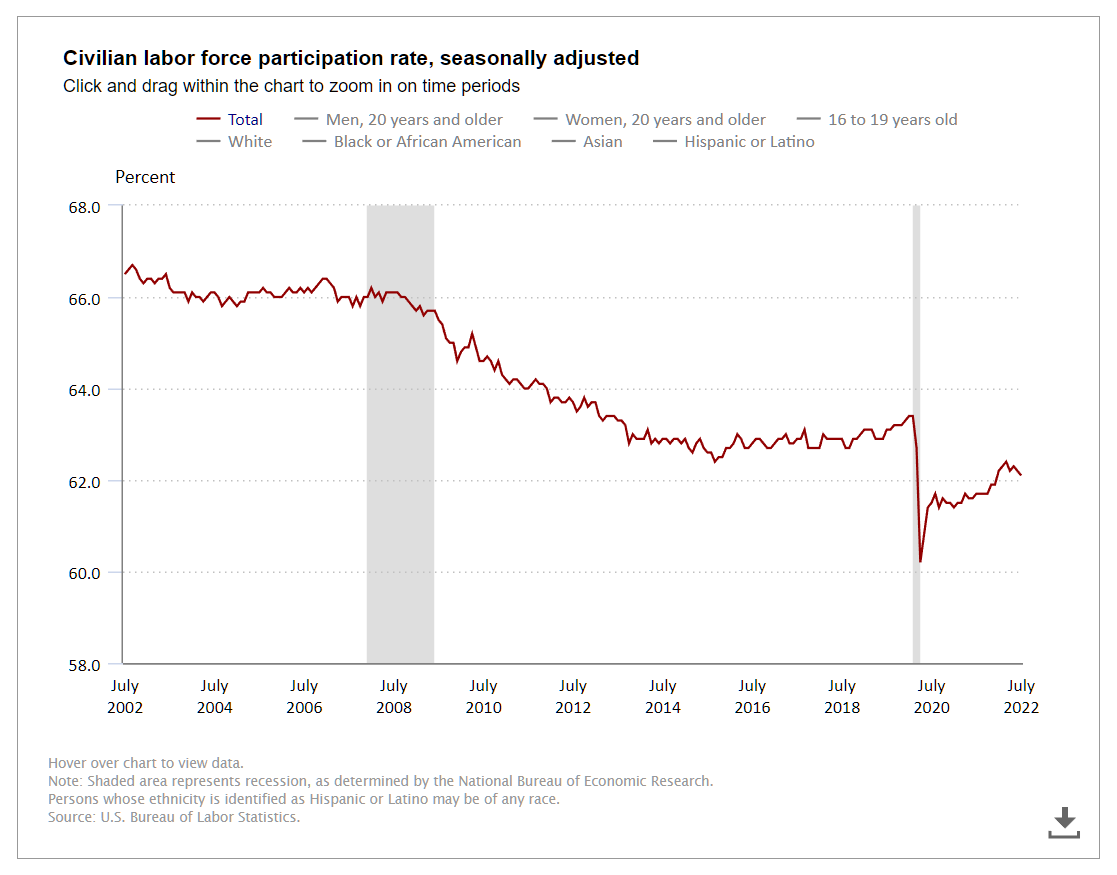

Obviously, the typical American will still be unlikely to get audited in any given year, but the greater risk of an audit, with all of the expense that is entailed even when no errors are found, could be reasonably expected to have at least a small effect on labor force participation, no? Especially for the declining percentage of Americans who are willing to incur the risk of starting their own business (See Inc. and “The decline of American entrepreneurship — in five charts” (Washington Post, 2015)). Speaking of labor force participation rate, let’s check the chart:

> the greater risk of an audit, with all of the expense that is entailed even when no errors are found, could be reasonably expected to have at least a small effect of labor force participation, no?

LOL, no. This was quite the non sequitur on your part.

I fixed it. Thanks! (“of” to “on”)