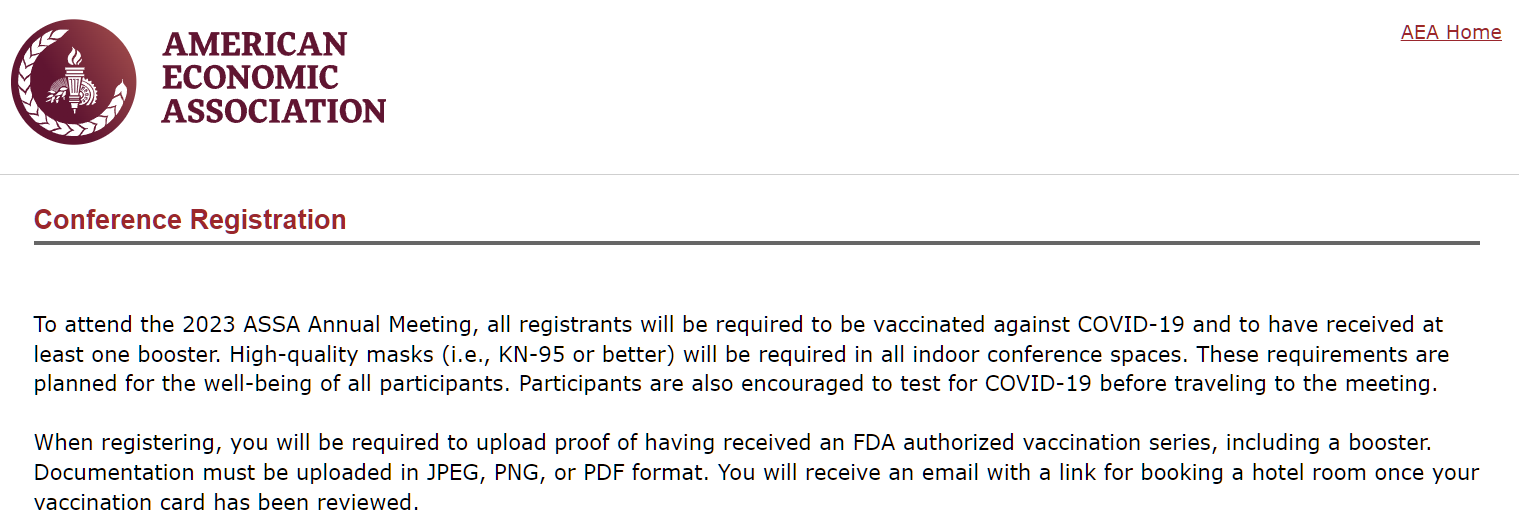

The American Economic Association’s rules for an upcoming gathering of approximately 13,000 people:

(from https://conf.aeaweb.org/)

They’re concerned enough about COVID-19 that they want everyone to wear an N95 mask (not professionally fitted, though, and hence potentially useless against an aerosol foe) and they want to check papers regarding a vaccine that Science (v2020) said prevented infection and transmission. But they’re not concerned enough to refrain from arranging a mass indoor gathering and, instead, meeting via Zoom?

As when I gawk at those who are headed to vacation destinations on jammed airliners in cloth and surgical masks, I remain fascinated by this intermediate level of COVID concern!

Related:

- “Monkeypox Outbreak a Boner Killer for NYC Gay Sex Parties” (Daily Beast, 9/7/2022): “We have been aggressive in educating our clients through social media and in-house,” said a representative for The Cock, located in NYC’s East Village. “We continue to require COVID vax proof and are frequently posting monkeypox info and vax availability on Twitter, Facebook and Insta.”

- the Danish Health Authority’s COVID-19 vaccination page: nobody under 50 can get the shots, absent special circumstances, so it would be tough for young Danish economists to attend Karen’s Economics Convention

OT: WaPo, 09/17/22 – The U.S. safety net was built for cold winters. Hot summers threaten it.

“More than 40 years ago, Congress established a critical safety net, the Low-Income Energy Assistance Program, to help people financially survive frigid winters and the costs of run heat. But sweltering summers are now creating a huge new financial burden for Americans whose air conditioners run up energy bills for longer periods of time…Thanks to pandemic-related funds, the Biden administration was able to more than double the $3.8 billion dollar federal energy assistance program…

About 20 million Americans are behind on their utility bills, according to the National Energy Assistance Directors’ Association, which represents state officials administering energy assistance programs. They owe an average of $800, double the amount before the pandemic.

“It’s definitely the case that cooling costs are not only increasing because of energy prices but also because cooling is more necessary as a result of climate change,” said Diana Hernández, an associate professor of sociomedical sciences at Columbia University’s Mailman School of Public Health…

During the pandemic, New York City distributed 74,000 air conditioners to low-income seniors isolating in their apartments. Later, when Columbia University’s Hernández surveyed recipients, she found that some were reluctant to use them on the hottest days because of the expense…”

DP: At least in Cambridge, Maskachusetts, public housing generally includes utilities, so the total cost of housing (rent+utilities) can never be unaffordable, even for someone who chooses to refrain from work.

lots of low income assistance with utility bills, similar to eligibility for SNAP, Medicaid, federal student lunch program (although lunches were free-to-all during much of the pandemic). An example from my state, where electric utility is owned by Exelon: https://www.delmarva.com/MyAccount/CustomerSupport/Pages/DE/BillPaymentAssistance.aspx

And Philip’s point is valid that most public housing includes water, electric, gas, and usually internet & basic cable TV. Which begs the question as to why Biden in April 2022 announced “free” internet to those who qualify, by negotiating $30/mo with major carriers (Comcast, Verizon, Cox, et al). I am wondering how many are pocketing $360 annually while using the internet in their low-income apartment???

I hope everyone makes it out alive.

I keep trying to find this T-shirt for sale online but I guess the distribution is selective.

https://i.ibb.co/YWxBNMv/AMABOUT-MONKEY-VAX.jpg

Consistent with economists — lean politically liberal, but lean conservative in their personal habits & preferences. There are exceptions, of course, like conservatives N. Greg Mankiw & Thomas Sowell. But let’s just say I’ve known enough economists over the years to know that they are not heavy drinkers, hard partyers, compulsive gamblers (they understand statistics enough to know the odds). I attended the AEA meetings in NOLA and in Washington, DC. Economists are slow workers when it comes to attempting to ask out the females in their midst. However, in recent years, more & more females have been getting PhDs, so their chances are better. The late Barbara Bergmann, who wrote “The Economic Emergence of Women” (for which I was a research assistant) promoted her AEA-sponsored organization, “Committee on the Status of Women in the Economics Profession.”

“Biden in April 2022 announced “free” internet to those who qualify, by negotiating $30/mo with major carriers”

Based on his 2022, Federal Income Tax return, my 80-year old father (net worth $1 million) qualified for the $30/mo. Affordable Connectivity Program.

Doesn’t surprise me. The brilliant Biden administration minds designing all these “free” programs aren’t directly affected by their staggering costs. Similar to $1T about to be dispensed to federal student loan borrowers, who on average are wealthier than the average American. Lots of seniors with relatively high net worth, but who have limited earned income, are gonna qualify, for $30/month which covers entire cost of high speed internet. Mostly means that Comcast, Verizon et al will jack up the rates on the rest of us even more, to compensate for the paltry $30/mo they’re now collecting from folks like your dad, who previously paid rack rates like the rest of us.

@Suzanne: “Similar to $1T about to be dispensed to federal student loan borrowers, who on average are wealthier than the average American.”

Biden is going to pay off the $9000 balance on my student loan (my net worth is $2 million).

“Lots of seniors with relatively high net worth, but who have limited earned income…”

Same well-off retirees are getting free or nearly free obamacare!

A friend who lived in a house that was worth, at the time, more than $2 million (now: 4 million Bidies?), got MassHealth (Medicaid) for his family at $3/month. He filled out the online form truthfully and that’s what popped out as the amount owed. The form simply didn’t ask about investment income, of which he had plenty! Saved him at least $25,000 per year compared to Blue Cross and he and his wife found that there was a wider choice of physicians available for themselves and their two children.

Massachusetts ought to borrow Ivy League college financial forms (more detailed than the FAFSA which is also required by the Ivy League). Definitely looks at investment income. Therefore penalizes parents like that Minnesota father who reduced his consumption for decades in order to put his daughter through college debt-free (Elizabeth Warren snarkily replied when asked whether he’ll get a refund, “Of course not!”). Do better, Massachusetts, in evaluating eligibility for Medicaid. Medicaid & Medicare will be bankrupt soon enough, if they aren’t already.

Maskachusetts taxpayers are now #MarkedSafe from paying for my friend’s health insurance. His wife got tired of all of the social justice signs on the front doors around their (rich) neighborhood and they moved out of state. (They moved before coronapanic.)