Happy Tax Day if you filed for an extension.

What’s different this year? Inflation means that ordinary schlubs can pay tax rates that were sold as applying only to the elite. The Obamacare “Net Investment Income Tax” of 3.8 percent on top of ordinary income and capital gains taxes, for example, wasn’t supposed to hit Joe Average. But what if Joe Average tried to escape the lockdowns and school closures in California by selling a house and moving to Texas? Adjusted for inflation in the real estate market, his house might not have gone up in value at all. In other words, his purchasing power from selling the house to buy a different house wouldn’t have changed (probably reduced, actually, in terms of how big a house in Austin can be purchased with the proceeds from selling a house in California). But almost surely he will have more than $250,000 in nominal gains. This is all an illusory inflation-driven “gain” and the tax code recognizes that to a small extent by excluding the first $250,000 of house price inflation. But on the rest of it, Joe will have to pay California capital gains tax, Federal capital gains tax, and an additional 3.8 percent for Obamacare. From the IRS:

The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes. The pre-existing statutory exclusion in section 121 exempts the first $250,000 ($500,000 in the case of a married couple) of gain recognized on the sale of a principal residence from gross income for regular income tax purposes and, thus, from the NIIT.

How about a wage slave? If he/she/ze/they was earning $170,000 in 2019 and got bumped to $210,000 in 2021, his/her/zir/their spending power is actually lower due to raging inflation. Yet now he/she/ze/they is subject to the 0.9 percent Obamacare “Additional Medicare Tax” due to having income over a fixed threshold of $200,000 (soon to be the price of a Diet Coke?).

From Delray Beach, Levy and Associates:

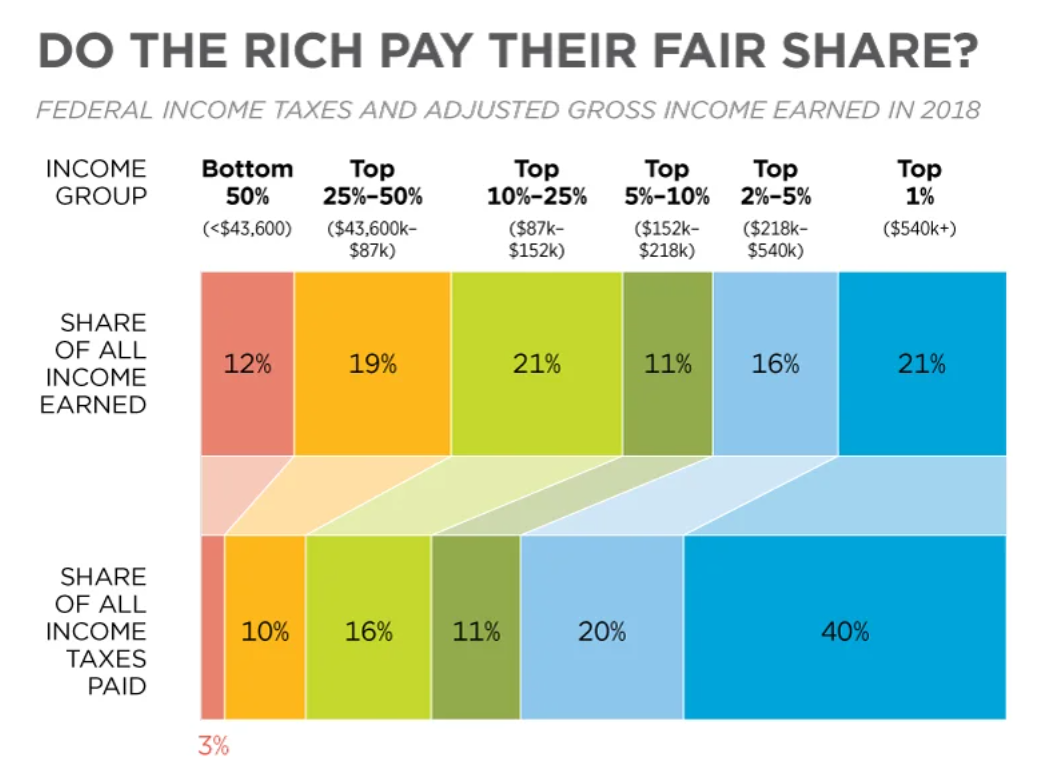

What kind of people are paying the bill for all of the great work done by Congress and Joe Biden? From the haters at Heritage Foundation:

In 2018, due to the cruel policies of the dictator Donald Trump, the rich Americans who earned 21 percent of all income paid only 40 percent of income taxes. Separately, keep in mind that the above chart relates to cash income. A person could be in the “Bottom 50%” with $0 in W-2 income and still have a spending power and lifestyle better than someone earning $50,000 per year (in the “25%-50%” column) due to means-tested public housing, health care, SNAP/EBT, smartphone, and broadband. See “The Work versus Welfare Trade‐Off: 2013” (CATO) for the states where being on welfare leads to a larger spending power than working at the median wage. Maskachusetts is #3 in Table 4, with welfare being worth 118% of median salary.

The lion kingdom has infinite capital gains from January & infinite capital losses from June, but can only claim $3000 in capital losses. The capital loss limit was last increased in 1978, when houses were $30,000. The mane reason given for not raising it during the last 50 years is fear that raising the limit would cause mass selling of stonks to claim more capital losses. What happened this year? The government dumped its stonk holdings to compensate for all the individuals who already hit their $3000 limit.

You have a similar issue with with other financial assets, so if stocks go up, admittedly not a problem during these Biden years, you are taxed on your nominal profit not the real, inflation adjusted, profit, and if you buy a supposedly inflation protected product, for example an I bond, you are eventually taxed on the inflation adjustment & for an I bond you buy today, which promises a real return of zero till the bond is redeemed, your inflation protection is reduced by your tax rate and your real profit by definition therefore has to be less than zero. As for the Heritage chart, I think one thing it shows is, no surprise here, taxes are lowest where the voters are situated.

Ricky: I didn’t know this. It is true of TIPS as well. What a scam. An investor who is 100% in “inflation-protected” bonds will lose about one third of his/her/zir/their investment to taxes over time (give Biden levels of I inflation).

How come no Nobel memorial price inc economics has been awarded for this yet? Or maybe it was.

Boohoo for the fabulously wealthy. Even idle-rich “Dr” Phil — throwing around a million here, a million there — is a mere pauper when compared to some guys.

Check out this graph, and this was made before Elon Musk’s fortune rose to $200B+.

https://mkorostoff.github.io/1-pixel-wealth/

(scroll right)

The companion site is also enlightening:

https://mkorostoff.github.io/incarceration-in-real-numbers/

You are right Mike.

All those filthy super rich SOBs like Musk, Bezos, Gate, Buffett, Page, Brin, Ellison, Ballmer, Ambani, Bloomberg, Zuckerberg, Walton, Shanshan, Zhao, Koch, Ortego, Dell, Yiming, Schwarz, Zeng, Scott, Kuehne, Huateng, Ferrero, Ka-shing, Schwarzman, Kee, Blavatnik, Mars, Wertheimer, Wertheimer, Rinehart, Nadar, Simons, Xiangjian, Mateschitz, Griffin, … … … should be shamed and hang in public.

Once we get all those filthy super rich SOBs out of the way, we will enjoy better self-driving and electric car, easier shopping on the internet, easy to use software for everyone, better managed companies, finding answers on the internet, managing data, improved software, cheaper full, better media, online social network, cheaper shopping, better medicine, online trading, improved manufacturing, improved clothing, cheaper computers, online video, … … … and then we will all go back to the stone age and live in caves like the Taliban.

George: In addition to suffering from envy, I think that Mike is suffering from ignorance regarding how the “fabulously wealthy” organize their tax cross-sections. The original post is about the successful peasant who gets a W-2 paycheck of $200,000 and then sells a house or earns a dividend from a stock that he/she/ze/they purchased. Yesterday at NBAA I learned that a Boeing 787 costs $250 million “green” and then another $120 million for Lufthansa Teknik to set it up with a comfortable interior (bedroom, shower, living room, conference room, etc.). If Elon Musk had bought one of these before Bidenflation, he could have borrowed at 1-2% against his appreciated stock and avoided taxes altogether (see https://www.wsj.com/articles/buy-borrow-die-how-rich-americans-live-off-their-paper-wealth-11625909583 from mid-2021 and https://www.propublica.org/article/billionaires-tax-avoidance-techniques-irs-files ).

Maybe Joe Biden has put a stop to this (by setting inflation at 8-15%, Biden has driven up nominal interest rates dramatically), but presumably the accountants and lawyers available to the “fabulously wealthy” will figure out alternatives.