Update: Ordinary schmoes are going to bail out the billionaire customers of Silicon Valley Bank, but the bailout is being disguised as a “special assessment” on the peasants’ banks. (NYT) Technically this is “not from taxpayers”… it is a bailout only from those taxpayers who have bank accounts.

I’m inaugurating a new category for blog posts today: transferism. The working class has already paid for a portion of all of the luxurious electric cars being driven around Silicon Valley. Joe Biden’s loan forgiveness scheme forces the working class to pay for elite families’ kids’ college education. What if there is a bailout of Silicon Valley Bank today with some money from the Federal Reserve or the U.S. Treasury? A friend in the money business says that Silicon Valley Bank wouldn’t take personal accounts unless an individual had at least $7 million in liquid assets (i.e., excluding real estate and private company shares). So a federal bailout would be a transfer from the working class to some of the richest people in the world.

(This also happened during coronapanic. A friend owns an aircraft charter company and the government gave him a huge amount of money in 2020 to pay pilot salaries. “I turned around and gave almost all of the money to the [Gulfstream] owners,” he said, “because they’re the ones actually responsible for the cost of pilot salaries. They never would have fired the pilots because they were still using their planes personally and it would have been too hard to re-hire and re-train. We ended up having our most profitable charter year ever, though that was exceeded in 2021.” In other words, money that will one day be extracted from the working class via taxation was used to pay billionaire Gulfstream jet owners.)

What are readers predicting for the fate of Silicon Valley Bank? “Regulators Hold Auction for Silicon Valley Bank” (WSJ):

Regulators are auctioning Silicon Valley Bank as part of a broader effort to contain the fallout from its failure on Friday.

Treasury officials confirmed the auction to lawmakers and staff on a call Sunday afternoon, according to people familiar with the matter, saying bids were expected by 2 p.m. Eastern Time.

That was hours ago! If there had been a successful bid, wouldn’t we have heard? Pre-coronapanic, which we can use as a period of time when valuations were at least vaguely tethered to reality, Silicon Valley Bank was worth about $10 billion. If it takes $20 billion to make depositors whole, the current enterprise should be worth at most -$10 billion. But given that the enterprise is now associated with incompetence and a huge amount of money has been wired out, maybe -$17 billion is a more accurate number?

So, despite not knowing anything about banking or being confident in the $20 billion shortfall plug figure, my prediction is that SVB is sold to a large bank for -$17 billion (i.e., taxpayers give the acquirer $17 billion). The justification will be that if taxpayers didn’t “invest” this $17 billion, the panic would spread and your Main Street bank would be next.

From the library at the Charles Hotel in Harvard Square:

Related:

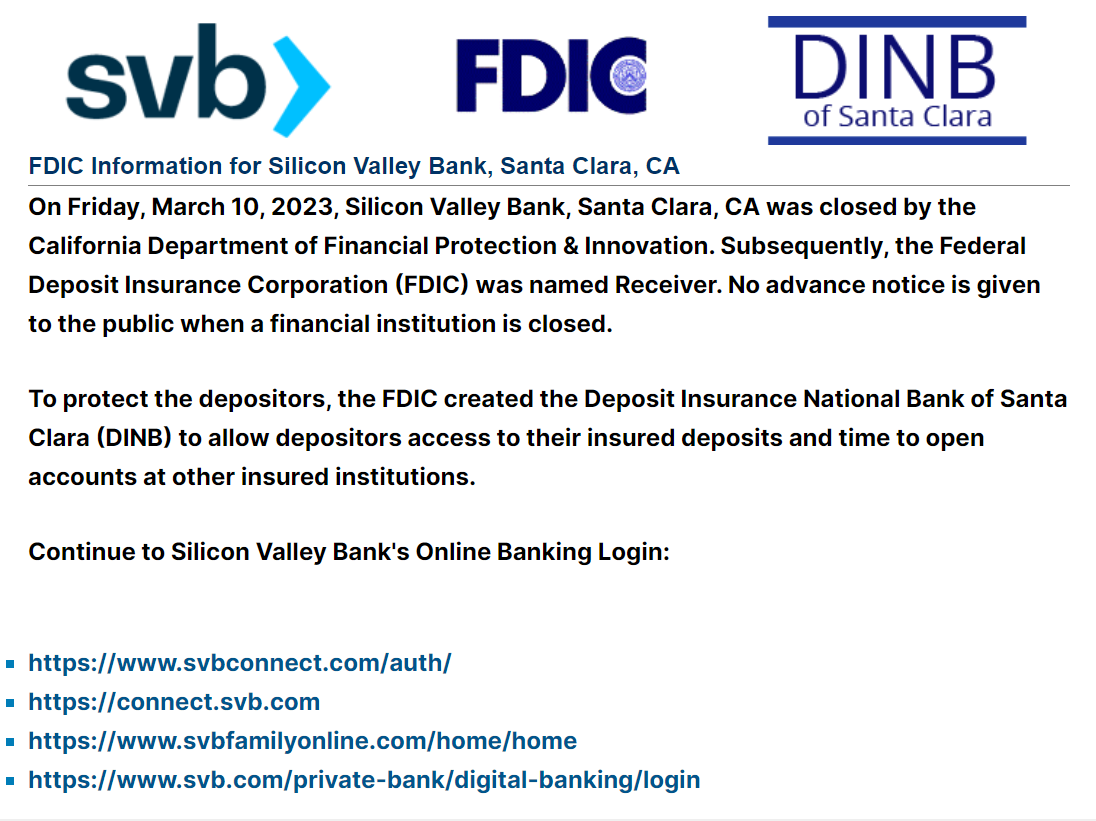

- “Diversity, Equity and Inclusion” (still works even though the home page has been replaced by the below)

Perhaps I’m poor middle-class schmuk, but why would someone, even with 7mil, would want to *personally* bank in SVB?

For my personal banking I want reasonable retail presence and reasonable personal-finance competence, neither of which SVB has.

Any analysis is going to be stale in a matter of minutes… but I imagine there are multiple road blocks preventing a sale:

1- TBTF banks are worried about the cost of becoming even bigger especially if the SVB asset isn’t worth the additional oversight.

2- SVB played fast and loose lending to startups, accepting warrants, etc. Many banks might worry about hidden liabilities.

3- SVB enjoyed loyalty from the venture community BECAUSE it played fast and loose with the rules. That loyalty might evaporate under a new responsible owner.

4- Regulators don’t want to sell to a smaller bank that might also fail as a result of buying SVB.

5- Virtually anyone would want government assistance and/or a significant deposit haircut. (I think your valuation is a touch pessimistic but I’d still expect 90 cents on the dollar for uninsured deposits barring a bailout.)

—

The hidden upside? If treasury bonds rally strongly due to the perception that the economy is slowing down, SVB could “magically” reattain solvency as this was a duration mismatch crisis, not a credit event. Unless of course the FDIC has already sold off the treasury/mbs books.

Annndddddd BAILOUT!

https://www.cnbc.com/2023/03/12/stock-market-futures-open-to-close-news.html

Good thing it happened to folks with $7mm minimum net worth, and not to schmucks in Eastern Ohio!

https://www.cnbc.com/2023/03/12/regulators-unveil-plan-to-stem-damage-from-svb-collapse.html

I’m confused. https://www.wsj.com/articles/federal-reserve-rolls-out-emergency-measures-to-prevent-banking-crisis-ba4d7f98 quotes an official statement: “Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

If the taxpayer won’t get hit by losses then who will? Are they saying that they’ve found a buyer who will accept the risk of losses? Are they saying that they’ve gone through the assets and figured out that there are no losses? (i.e., that everything can be sold this week for more than the obligation to depositors)

https://www.nytimes.com/2023/03/12/business/janet-yellen-silicon-valley-bank.html

The agencies said that “any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.”

So the losses won’t be borne by taxpayers… they’ll be borne by taxpayers who have bank accounts at banks other than SVB. Actually, since SVB won’t be around any more to pay this “special assessment” and then squeeze that out of customers via extra fees, lower interest, etc., it may turn out that being an SVB customer, and getting their too-good-to-be-true terms for years, actually worked out much better than being a boring Bank of America customer.

Phil, My initial read is same as yours.

Sounds like an FDIC special assessment… but they are pretending “no losses”… used the systemic risk exception to bail out the morally hazardous VC speculators.

I think that my prediction was off by $3 billion, but that’s not terrible compared to the $175 billion in deposits. I thought that the enterprise value of SVB was $3 billion and the losses were about $20 billion so the taxpayers would be soaked for $17 billion to get rid of it. Now it seems that taxpayers will be soaked, via this special bank assessment that will be hidden, for 100% of the losses (as I predicted) and the enterprise value was $0 ($3 billion less than I predicted).

Why not QE? They could just print and buy all the assets from SVB at whatever rate keeps the depositors whole. Technically that wouldn’t be taxpayer money.

Philip — A banking bailout is different than other bailouts because they can backfill a massive cash hole without losing any money.

From what I’ve seen, the balance sheet of SVB looked pretty good. The problem is that they have ~ $200B in assets and people tried to withdraw $42B in cash in one day. That can kill any bank.

This was a normal run on a bank, which is exactly the type of activity that can kill any bank, and which govt protects against.

The problem is lack of confidence, and the govt can solve that at minimal loss by providing that confidence. This is what the history of banking has taught us.

The Fed can effectively buy SVB’s assets, hold them to maturity, and likely get paid back without losing any money.

Remember the TARP bailout? The govt actually made a small profit on that.

This was the obvious and correct solution.

The government is going to make money on this non-bailout bailout and that’s why they need to hit all of the Bank of America peasants with a “special assessment” to cover the non-existent losses?

As I understand it, the “special assessment” only kicks in if there are losses. The NYTimes says:

“The agencies said that “any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.””

So you shouldn’t think that 100B of bailout generates 100B of bills for others. Very possible the loss will small or non-existent.

You “lose money” in real terms by opportunity costs, a basic economic concept. The bonds have been marked down because they have lost value — the pv of the income stream is less because of the rise in interest rates that discounts the value of the income stream — so if the government effectively buys the bonds at par, the difference between what the markets says they are worth and what the government is willing to pay, something no one else would do, the government is “losing money” and giving a windfall to those people with accounts in excess of 250K by repaying them at 100% — something they are not entitled to under the law. The government is effectively taking money from one group of Americans, those who will finance the repayment of creditors (depositors) and giving it to the creditors, who made a business decision, for reasons that at the moment are unclear, to deposit large amounts of money in excess of the 250k limit at this bank — rather than just buying short term treasuries. (There is no doubt a reason they did this and it is no doubt corrupt — but time will tell). The argument that effectively buying the bonds at par is in the best interests of the US because it will reduce the likelihood of further bank runs assumes that it will not further encourage the wealthy to ignore the 250K limit and thereby increase the cost of future bank runs. It also rewards the incompetent or corrupt decision of the various companies to hold unusually large amounts of cash at SVB.

jdc — The market value issue is real, but there is some nuance there.

A bank doesn’t mark all their assets to the market value, nor should they.

For example, suppose I have a $100 payment to make in 5 years, and I buy a 5-year treasury and plan to hold that bond to maturity.

The value of that bond will fluctuate as interest rates move, but it would feel wrong to say I’ve made or lost money along the way. In a more realistic sense, I’m holding something worth $100 against a upcoming liability of $100, so my assets cover my liabilities exactly for the entire 5 years.

In accounting terms, this is called “hold to maturity” treatment, and banks hold these assets at their purchase price on their books.

As far as we know now, SVB was following the rules and their books were in balance using accepted accounting treatment. This means there were a bunch of hold-to-maturity assets that would be marked down if they had to be sold, but they didn’t mark them down because they weren’t supposed to.

But now things get hairy because the Fed needs to take over these assets. I’d argue the ideal solution is to buy the portfolio _at the value held on their books_ as long as SVB was following the rules.

In this case, the Fed would be be paying market prices for their “available for sale” assets and paying par value for their “hold to maturity” assets.

Of course, this only makes sense for the Fed to do because the Fed’s job is to regulate the banks and provide stability. So it makes sense for them to say “If your bank follows the rules but falls due to a bank run, we’ll make you whole”.

And if the Fed buys the assets of a profitable bank at book value and holds those assets to maturity, as the bank intended, they should come out in good shape.

* Also, I wonder if the 250k limit achieves anything real. If you’re a startup with $5M in funding, is the system better off if you spread that money across 20 banks to get $5M in coverage?

David,

You do not address the two main points jdc raised.

The government created a huge moral hazard by bailing out wealthy business depositors such as Roku whose not very smart CFO decided to hold half a billion in cash in SVB. Even if the bank assets book value would translate into enough money to pay depositors, a wrong signal has already been sent: the insurance limit is limitless, you wealthy folks do not need to care about cash management, we’ll bail you out at the expense of other bank clients, essentially at the expense of the entire US population. During the last 3 years 11 banks failed. There have been no depositor bailouts until today.

The government violated the law by overriding the $250K insurance limit just so, claiming extraordinary circumstances for a bank that ranked just 16th, not TBTF even.

I am not sure which one of the two is worth or more corrupt.

Ivan — $500M is indeed a lot of cash, so I looked up the size of the business.

They had 3,600 employees, and their Q4 revenue was 867M, and their net revenue was -237M, which makes it sound like they’re spending about $1.1B every 90 days. So $500M is around 6 weeks of cash.

Nobody should be surprised that a business has at least 2 months or more of cash sitting around. They need to pay employees, rent, suppliers, etc.

What are they supposed to do if they need that cash but they’re only insured to 250k?

Do you think they did something wrong?

David, banks indeed mark their liquid assets to market. Banks can and usually do mark their investment assets to different models and mark to market is a must for liquid access for current value, anything else is fraud. Ever accounting major knows this.

Nobody is going to give banks their intended value when they sell, they going to sell at best bid price on the market.

perplexed — “Hold to Maturity” accounting is indeed a thing. It’s not some crazy idea I made up.

https://www.google.com/search?q=when+to+use+hold+to+marurity+accounting

This applies to liquid assets as well, as long as you intend to hold them.

I agree that when you’re forced to sell a bond that you intended to hold until maturity, the market value vs your book value can differ, and the company can get a rude surprise.

David:

When you say “For example, suppose I have a $100 payment to make in 5 years, and I buy a 5-year treasury and plan to hold that bond to maturity.”, what you are suggesting is that you’ve found a sucker to take all of the interest rate risk. *You* don’t care what interest rates are in the intervening time: you take the interest payment on the bond that you hold, whatever it is, and the person taking the $100 payment in 5 years takes the interest rate risk on the principal. If inflation is 8%/year, and in 5 years that $100 is worth $68 of today’s dollars, the sucker on the other side of your trade takes the purchasing power loss.

What you are contending is that the VC folks who bank(ed) at SVB are the suckers who will happily keep their money in the bank until the bank’s 10 year MBS portfolio matures, at which point these VC folks will get their (devalued) money back. It appears the VCs were not willing to be the suckers.

Demand deposit liabilities are different from fixed payments at future dates, as SVB management and the VC folks have known all along. The suckers in this story are the working class, as usual, as our host points out.

David,

“What are they supposed to do if they need that cash but they’re only insured to 250k?

Do you think they did something wrong?”

They should have used safe cash equivalents such as T-bills that settle on N+1, i.e. in one day the holdings are converted to cash as needed. Any introductory course on “Corporate Finance” has a chapter on cash management that teaches how to optimize your cash holdings to reduce exposure, protect against inflation as well as other risks such as bank runs. If Roku CFO was so ignorant that he did not know what T-bills are, or insured cash sweeps ,or a multitude of other instruments designed to manage cash holdings, he/she could have at least spread the $0.5B across several banks !

So, yes, *all* businesses/depositors at SVB including Roku did do something wrong: they mismanaged their cash holding either out of sloth or ignorance or arrogance or all three of those.

Now, the wealthy depositors are being bailed out by the entire population of the US who are clients of the surviving US banking system because the idiot-depositors neglected their fiduciary responsibilities.

But the questions is: “Were SVB tellers still wearing masks in 2023?” Inquiring minds want to know. Surely it would have the highest correlation to business success compared to any other variable. We can’t understand the business case without pictures of employee masks.

Mike: you raise a good point. The photos on the now-mostly-dead web site showed a rainbow of skin tones and hairstyles, but nobody was wearing a mask!

Thanks to everyone for the insights and analysis; I have nothing to add (but now I’m interested to see how it all finally unwinds) except:

Tonight we decided to order out for Italian and my father and I drove to pick it up. He went into the restaurant and after returning with all the food, he said: “I’m dying of thirst, be right back.”

He came back with a couple of drinks and said: “Here’s your usual. I don’t know how much longer this country has left, I really don’t [shaking his head.] It was $4.29 and so I gave the cashier $20.30, which was what I had in my pocket. She couldn’t figure it out, panic look, and first she gave me back $18 in cash for some reason. I said: “Sorry, this is wrong. I gave you the $20 plus thirty cents so instead of giving me back $15.71 you could give me $16 in cash and put the penny in the penny tray.” She said: “oooooohhhhhh” and took out a calculator and was finally satisfied it was $16.01.”

After having skimmed this post earlier today, I said: “Well, don’t worry. She just moved out here from Newton, where she used to work for Silicon Valley Bank.” [Yes they have several branches in MA, incl. Newton.]

[HAHAHUHUHAHAUHUAAHAH laughter – I made Dad laugh!!]

JP Morgan knew the dangers in November. They refused to comment to the NYPost. Jim Cramer was still pushing SVP Financial’s (the parent company) stock on Feb. 8.

https://nypost.com/2023/03/12/jpmorgan-analysts-warned-about-silicon-valley-banks-16b-in-unrealized-losses-in-november/

As usual, the Silicon Valley exec behavior is shameless. First, a couple of super rich VCs start the bank run (probably acting on inside info) and sink SVB.

Then, their social circles on Twitter threaten more bank runs if there isn’t any bailout.

After getting their bailout, some VCs, who have personally canceled and shamed employees for social justice causes in the past, are pleading for empathy and understanding for the bailout, because otherwise employees would be affected.

It would be hilarious if some of them were shorting SVB the entire time or are now buying cheap SVB assets.

It will hit the mainstream bank and every other bank if they don’t contain it by forcing a sale. It might do that even if they do bail it out. We’re at a high risk of debt deflation right now. I’d prefer to let it rip, but that isn’t going to happen.

Why is it going to hit bank mainstream? Multi-millionaires and billionaires started hating themselves and get rid of their ill-gotten gains? They are going to store cash in the attic? In this case armed security business will boom, invest there! Besides being enabled by accounting fraud, I would suggest investigators of SVB disaster to look at who may benefit from this? Move by Chinese Communist Party in financial war with USA? Socialist takeover over US financial system?

Dow Jones U.S. Banks Index down 6%, Bitcoin up 8%, Coinbase up 6%.

Solid stuff, they saved the tech bros.

Maybe my prediction that Biden nominates Sam Bankman-Fried as U.S. Treasury Secretary will come true sooner than expected!

Update from a friend who used to manage part of a mutual fund at Fidelity…. Barney Frank, of Dodd-Frank fame, was on the board of one of the recently seized banks. https://investor.signatureny.com/governance/board-of-directors/default.aspx

(Some at-home business experience for Mr. Frank: https://www.businessinsider.com/the-one-thing-no-one-is-mentioning-in-their-barney-frank-tributes-the-prostitutes-2011-11 )

The FDIC limit is painfully behind inflation & should be at least $250 million in today’s money. They’re just disguising an increase in the FDIC limit as a bailout.

WSJ, 03/10/23

https://www.wsj.com/livecoverage/stock-market-news-today-03-10-2023/card/silicon-valley-bank-ceo-sold-3-6-million-in-shares-days-before-fatal-loss-disclosed-6re8L8VDWjk956bOLaDD

“A trust owned by Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million worth of shares in his bank last week, days before the bank disclosed a $1.8 billion loss that triggered a fatal run on the bank, according to company filings.

On Feb. 27, the trust sold $3.6 million worth of shares while acquiring options worth $1.3 million. “

Forbes.com, 03/11/23

https://www.forbes.com/sites/jackkelly/2023/03/11/some-silicon-valley-bank-workers-will-be-offered-a-premium-to-their-salary-to-help-the-fdic-start-sorting-things-out/?sh=46b7d396764b

“Despite the onslaught of bad news for the lender, there is a glimmer of hope for its workers. Employees of SVB have been offered 45 days of employment at 1.5 times their salary, which will be paid by the Federal Deposit Insurance Corporation amidst its bank takeover, according to a companywide email on Friday from the FDIC.}

Salary.com

https://www1.salary.com/Greg-Becker-Salary-Bonus-Stock-Options-for-SVB-FINANCIAL-GROUP.html

“As President & Chief Executive Officer at SVB FINANCIAL GROUP, Greg Becker made $9,922,132 in total compensation. Of this total $1,040,385 was received as a salary, $3,000,000 was received as a bonus, $1,622,657 was received in stock options, $4,238,529 was awarded as stock and $20,561 came from other types of compensation. This information is according to proxy statements filed for the 2021 fiscal year.”