Readers: Please help me keep these bank failures straight. “First Republic Stock Plunges After Bank Rescue Plan, Dividend Suspension” (WSJ, today):

First Republic Bank shares fell more than 30% Friday after a multibillion-dollar rescue deal orchestrated by the biggest U.S. banks failed to convince investors that the troubled lender is on solid footing.

The move erased the gains that came Thursday, when a group of banks including JPMorgan Chase & Co., Citigroup Inc., Bank of America Corp. and Wells Fargo & Co. deposited $30 billion in First Republic in an effort to restore confidence in a banking system badly battered by a pair of bank failures.

“It’s not clear whether it’s viable as a stand-alone entity,” said Julian Wellesley, global banks analyst at Boston-based Loomis Sayles & Co. “So it’s likely, in my view, to be taken over.”

The sudden collapse recently of Silicon Valley Bank and Signature Bank—the second- and third-largest bank failures in U.S. history, respectively—have sparked concerns that anxious customers could drain deposits from other small and midsize banks.

What do SVB and First Republic have in common other than both being supervised/regulated by the San Francisco Fed? Was First Republic as devoted to diversity and inclusion as SVB?

As Congress and the D.C. Fed flooded the U.S. with money in 2020, what was First Republic thinking about? “First Republic Expands Commitment To Diversity, Equity and Inclusion” (August 31, 2020):

First Republic has engaged Management Leadership for Tomorrow (“MLT”), a national nonprofit that equips and emboldens high-achieving Black, Latinx and Native American individuals to secure high-trajectory jobs, while partnering with employers to provide access to a new generation of diverse leaders. The organization’s advisory services help institutions to better foster an environment of success for the underrepresented colleague experience.

“A diversity of backgrounds, opinions and perspectives has always been fundamental to our success,” said Jim Herbert, Founder, Chairman, and CEO of First Republic. “Management Leadership for Tomorrow has a proven track record of success in helping companies find and develop leaders from underrepresented communities.”

Individuals who self-identify as members of ethnic minority groups currently total 48% of First Republic’s workforce, with over 55 languages spoken at the company. Building upon First Republic’s long-standing culture of inclusion and diversity, MLT will provide strategic and tactical support to help further diversify the company’s workforce. In addition, the organization will collaborate with First Republic to enhance colleague and culture development programs that drive a sense of belonging and engagement.

If we count employees identifying as “women” as being in a victimhood class and we consider these 48% who were victims via “ethnic minority group” identification, the majority of the bank’s employees were victims and yet the goal was apparently to go bigger in the victimhood department. Here’s the person who was CEO for 37 years, through 2022:

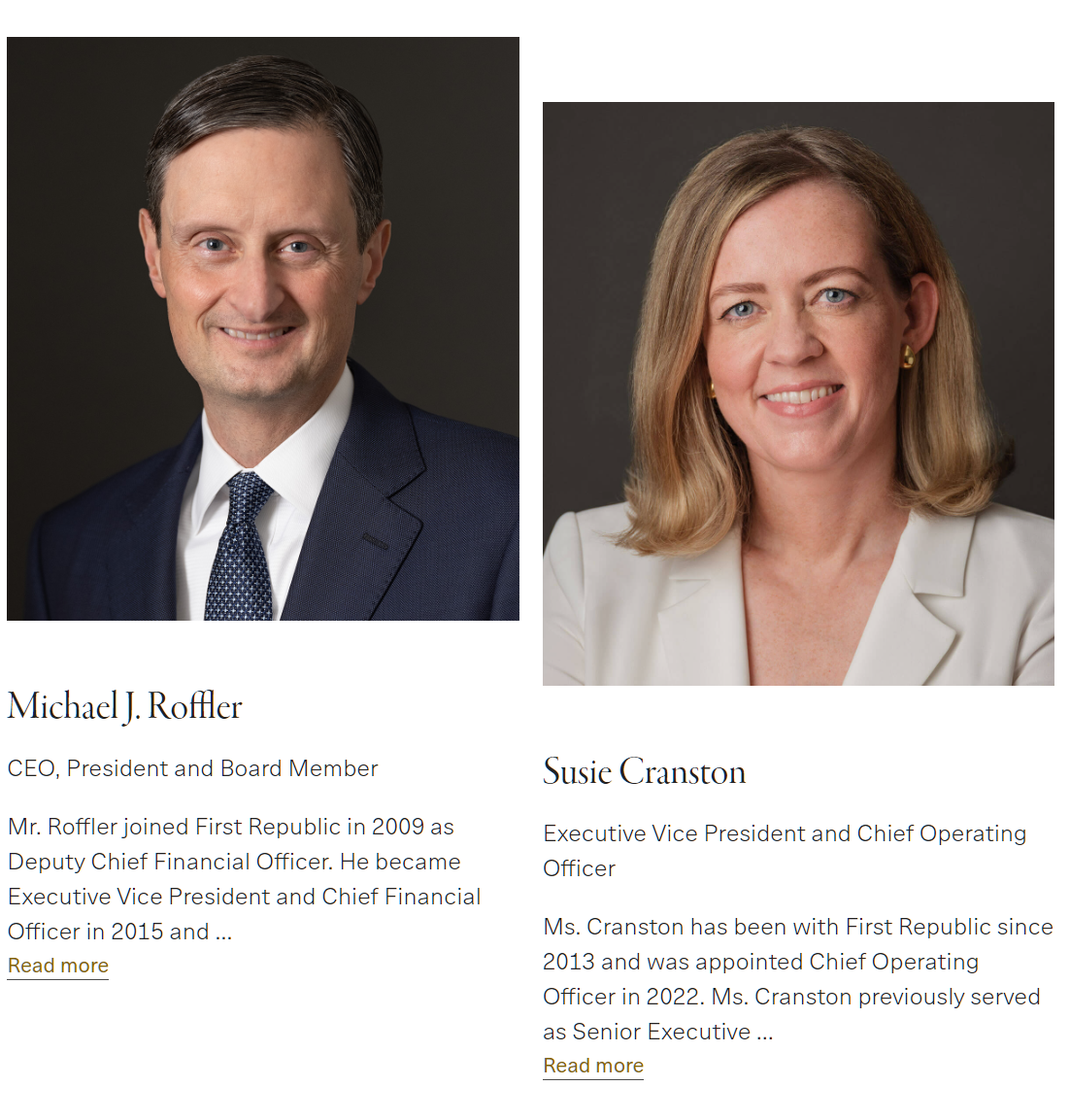

James Herbert was replaced, in the CEO/COO roles, by a diverse duo:

But what exactly did these diverse executives do to cause the meltdown? And why didn’t the San Francisco Fed notice anything amiss? Let’s check a 2018 New York Times article:

The Federal Reserve Bank of San Francisco has installed Mary C. Daly, a labor economist who currently serves as the head of research, as the institution’s new president beginning Oct. 1. … Ms. Daly, who is openly gay, will become the third woman among the 12 presidents of the Fed’s regional banks. As a senior executive at the San Francisco Fed, she has been a leading voice for addressing what she has described as a “diversity crisis” in the economics profession and at the Federal Reserve. At the San Francisco Fed, she pushed successfully to balance the hiring of male and female research assistants.

Dr. Daly attacked the diversity crisis at the San Francisco Fed, but ignored the insolvency crises brewing at SVB and First Republic? If diverse teams are smarter and more capable and the San Francisco Fed had more diversity than other regional Federal Reserve Banks, why are two of the biggest failures in the SF Fed’s territory?

Related:

- “Getting from Diversity to Inclusion in Economics”, Remarks at the Gender and Career Progression Conference (London, England) by Mary C. Daly, Executive Vice President and Director of Research, Federal Reserve Bank of San Francisco

My casual understanding is that FRC has the next highest uninsured deposit percentage after SVB.

The problems in SF are largely a function of too many high net worth depositors fleeing for the hills now that there are demonstrated bank runs.

FRC apparently also has low liquidity, i.e., not enough cash on hand to meet a run. I believe they are still solvent, unlike SVB which will leave a giant hole in the FDIC.

The policy of bailing out the depositors of the worst actor by far (SVB) and then lying about that “creating confidence” while retaining 250k insurance limits is one of the worst decisions of all time. Either you raise the deposit insurance limit, or you let the worst actor fail and come up with a different policy firewall.

Lying to the markets is the worst course of action, but par for the course from this administration.

Steve: If the taxpayers are now going to take all the downside risk of banking (deposits insured regardless of size), shouldn’t the taxpayers also get the upside profit? Why doesn’t the government simply nationalize all of the banks and let taxpayers have both sides at least?

Banks already pay deposit insurance to the FDIC for the 250k insured deposits. Why not surcharge the currently uninsured deposits as well, and let the banks pass that cost on to the high net worth individuals and commercial customers?

The whole issue of whether the taxpayer is paying is somewhat semantic. Yes, in the sense that taxpayers have bank accounts. No in the sense that insurance pays. The moral hazard is in spreading the failure costs of reckless banks over the diversified and conservative banks.

SVB reportedly offered well below market loan rates to tech executives, in exchange for their business: https://www.nytimes.com/2023/03/17/technology/svb-tech-start-ups.html

But the FDIC insurance isn’t sufficient, I don’t think, to cover all of the shortfalls among these recent bank failures (at least if we assume the FDCI needs to keep some of its reserves for the next batch of failures!). That’s why the government is talking about “assessments” against banks still standing, not just collecting the regularly premium.

The Deposit Insurance Fund had a balance of $126 billion as of December 1, 2022.

https://www.fdic.gov/news/press-releases/2022/pr22082.html

However, this was below the statutory minimum of 1.35% of insured deposits. COVID-QE created so many bank deposits that the FDIC needed to create a “restoration plan” to reattain the minimum.

The denominator (insured deposits) might explain the political reluctance to expand deposit insurance. But it also means this rainy day fund can’t be used in a counter-cyclical fashion hence the need for a special assessment instead.

The FDIC’s inability to sell SVB or SBNY probably also stems from a reluctance to book what is likely a $15 billion loss (12% of the fund).

They should have haircut depositors at SVB (93% uninsured) instead of wiping out 12% of the insurance fund and extended insurance for the better banks. However the short-term political incentives pointed them in a very different direction.

The question was raised recently why CFOs were so stupid to keep all that cash in the banks. What if there was some typical Silicon Valley scheme, say:

“Startups get cheap and easy loans. They have to keep 30% of the loans in cash in our banks and use that for the initial payments.”

I’m not a banker, so this is an unsophisticated scheme, but during free money times something like this could work. Somehow it could be marketed as effective altruism!

If JPMorgan tried to bail out First Republic but not SVB (where all the startups were), we might learn something in that direction.

This isn’t a wild conspiracy theory. Bundling products at a discount is common in banking, e.g., getting free checking/ATMs/safe boxes in exchange for maintaining a $25,000 average balance.

I think SVB was giving discounted startup loans and discounted executive mortgages in exchange for deposit consolidation and, importantly, stock warrants.

We already know deposit consolidation was one of the conditions because there were comments about “covenant violations” during the bank run. As a VC Ponzi Bank, I suspect SVB collected stock warrants (similar to options) on startups in exchange cheap or unrisked startup loans. The prospect of even a single big win meant they could justify discounted “relationship” lending. But with the bubble deflation, the warrants would be largely worthless while the below-market loans in a rising rate environment would leave SVB with a uniquely bad balance sheet.

I’m just an outsider piecing together press snippets; no inside knowledge here. The mosaic points toward SVB having a deeply negative net worth, while FRC is still clinging to solvency but facing a severe liquidity crisis.

How is First Republic Bank different from Silicon Valley Bank? This bird brain is a client of First Republic Bank but not Silicon Valley Bank. Tuesday was spent transferring money out of various accounts if the amount exceeded 250,000. Maybe a waste of time!

In the regulatory business you get what you regulate for. If the primary focus of bank regulators is safety and soundness, banks will be more safe and more sound (even if less that perfectly safe and perfectly sound). If the primary focus of regulators is diversity and reduction of disparate outcomes, then that’s what you’ll get.

If regulators are less concerned with the quality of business decisions than who is making those decisions and less concerned with the quality loans and other investments than who received the loans or investments, outcomes are predictably what we see today and saw in 2008.

In the wake of 2008, regulators decided that private credit was risky, but lending to the government (treasuries and agencies) was “safe and sound”.

So no surprise, the best way to reach for yield was to add duration in treasuries and agencies, and the banks that did that are now blowing up. Turns out lending to the government wasn’t risk-free after all.

I don’t really understand fractional reserve banking, no matter how many times I try. I give the bank as a deposit, the bank takes the money and invests it, and then takes the proceeds from the investment for itself.

If I come back the next day, and ask for the money I deposited, and the money is in an illiquid investment, the bank says “sorry, no can do” and locks the doors on me.

Just to add insult to injury, sometimes the bank invests in stupid things that lose money.

I realize they do keep some cash on hand—in single digit percentages, that is, and call them “reserves.” So, as long as a certain percentage of people don’t demand to withdraw their money at one time, the bank doesn’t fail.

The whole thing is just very hard to understand. Isn’t this whole process just inherently unstable?

I suspect if I tried this as an individual I would be jailed immediately. Seems like it would be illegal.