How are folks feeling after today’s inflation report? The Wall Street Journal:

Core prices, a measure of underlying inflation that excludes volatile energy and food categories, increased 5.6% in March from a year earlier, accelerating slightly from 5.5% the prior month. Core inflation, which economists see as a better predictor of future inflation, has stayed stubbornly high in part because of inflationary pressures from shelter costs.

(The journalists don’t speculate on what might be causing shelter costs to rise. It couldn’t be a shift in the demand curve from 175 million post-1965 immigrants and their descendants (half of these folks are already in the U.S. housing market and the other half are forecast to arrive soon), could it?)

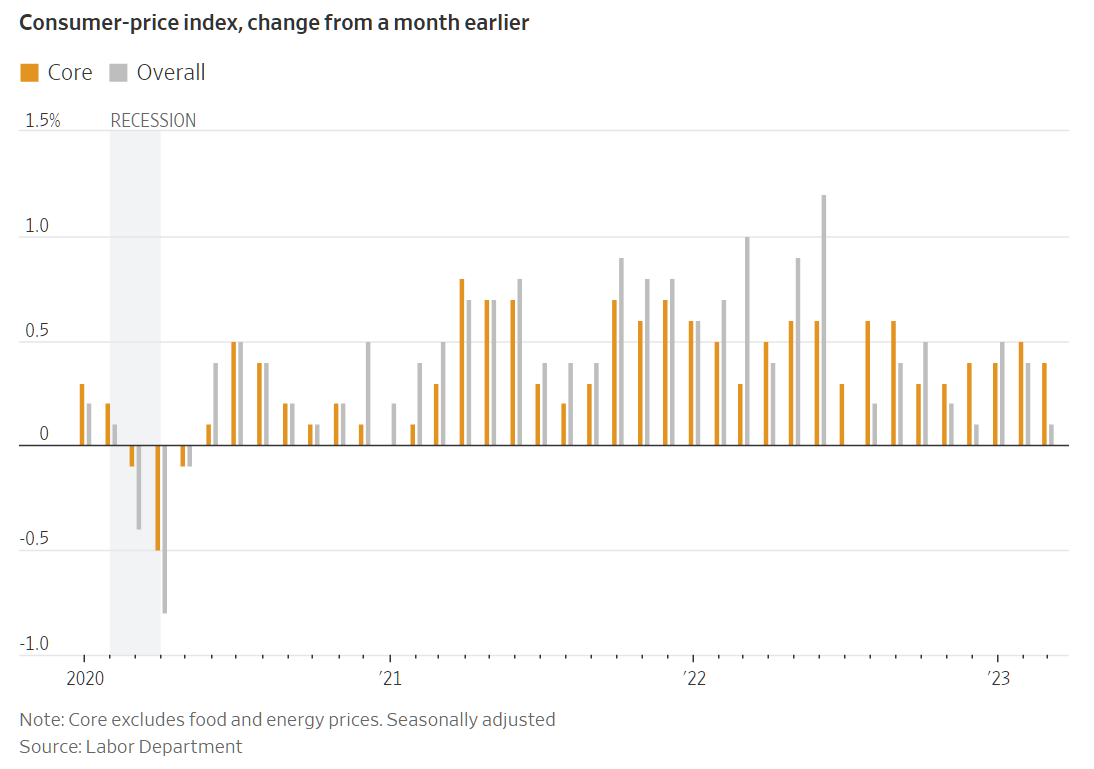

The month-to-month chart shows reasonably stable core price inflation of close to 0.5 percent per month.

We, via Congress and the Fed, can’t resist trying to cheat our way to economic prosperity. The deficit spending and quantitative easing aren’t going to stop, in other words, and therefore the steady erosion of the dollar’s purchasing power won’t stop. But maybe we can adapt in a small way….

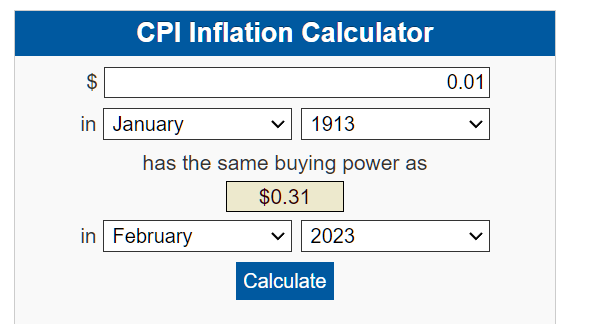

As the price of a crummy apartment trends toward $2000/month, can we let go of the pennies that litter our floors and clog our vacuum cleaners? The BLS CPI calculator goes back only to 1913, but it shows that the economy functioned just fine back then with the smallest coin being worth more than today’s quarter:

Given that most transactions are via credit card anyway and that we expect continued Bidenflation, why not declare that the smallest coin going forward will be the quarter? While we’re at it, we can decree that all quarters must be from the American Women Quarters Program, e.g.,

The next step up from quarters would be a $1 coin with a picture of (cloth-masked) Dr. Fauci on one side and Pfizer CEO Albert Bourla holding a positive COVID-19 test result.

Today’s $5 bill is worth less than a quarter was in 1913 so we’d get rid of it in favor of a $5 coin showing the legitimate government’s victory over the January 6 insurrection (Jacob Angeli, the QAnon shaman; obverse) and Joe Biden’s victory over Corn Pop (reverse).

Paper money would start with the $10 bill, which is worth a little more than the 1913 quarter.

Any better ideas for streamlining the use of cash?

Inflation anecdote: Chewy shipped Mindy the Crippler’s food recently. It was $2.97 per pound in September 2019. The same brand/variety food is $5.13/lb. today. That’s 73 percent inflation over a 42-month period…. roughly 17 percent compounded annual inflation. We are informed by the BLS that the price should have gone up to $3.48/lb. I.e., the government says that inflation is 17 percent and Chewy says it is 73 percent.

The socialist people’s republic of Canadastan got rid of pennies and $1+$2 bills, and daily life didn’t change much.

Donald Trump’s only really appealing pitch was to drastically slow down immigration and the powers that be pretended like it was 1. unspeakably cruel 2. never happened. I wonder why. (Immigration seems to be good for landlords; is the country being run for the benefit of boomer landlords?)

Just offset the $1000 apartments where no-one lives with the $3000 apartments where the jobs are & you get a $1700 average. Problem solved & away we go to 90,000 on your dow meter with zero interest.

Gold has appreciated from $20 to $2000 per ounce, if you want an accurate measure of inflation since 1913.

But they will still get rid of the $100 before they get rid of the $0.01; digital surveillance state incoming!

Chewy had to start making money. Losing money at gross margin level only lasts for so long.

As long as places are required to deal with cash there will be a need for pennies. I hadn’t tried to find it again, but someone tweeted in the last few days about recent studies confirming that there are major differences in purchases when you go for instance from $4.99 to $5, the left digit effect I think its called. So many companies want to price things at $X.99 which requires in theory the existence of a penny to give change. I hadn’t looked into the issue, but I’m not aware offhand of any ant-penny lobby that has as much incentive to push the issue as those who profit from its existence would have to keep it. Obviously the same requirement to deal in cash requires lower denomination bills as well, and enough people use cash its unlikely to go away soon. Some elderly politicians are probably still more comfortable taking payoffs in untraceable cash than in untraceable cryptocurrency (especially those that realize Bitcoin is traceable so that isn’t an option or would require washing through some other cypto)

Precise sales tax calculation will generate penny change requirements, in theory, even when a purchase is for a round $1 or $5 or whatever. But would it be illegal for retailers to round change to the nearest coin available? There are places in California with sales tax rates of 9.75%, for example. There is no way to give exact change from a $1 transaction if the state and local governments are getting their 9.75 cents.

oops, early AM here when posted, was still waking up and didn’t bother to address the sales tax issue or the partial-cent rounding comparison which is obvious. I suppose rounding, however they allow it could work for the penny issue, but the issue of smaller bills wouldn’t be solved that way, and is also subject to the left digit issue where $9.90 or $9 is better than $10.

You might think Mindy is getting the good stuff but it’s all bone ash and entrails.

At that price, why not give her potted meat or something where the rat poop tolerances are better?

Regarding inflation, I think we can learn from other countries. Research “official” inflation versus real inflation in the banana republics. There is always a large gap. Guess which direction?

When I lived in New Zealand back in 2007-8, they had no pennies or nickels. Everything was rounded to the nearest dime when paying cash. It seemed to work fine, and the NZD was pretty close in value to the USD.