I hope that all white readers who are members of the laptop class and/or government employees are enjoying their paid holiday for Juneteenth. For readers (like me!) who suffer from reduced income as a consequence of reduced working hours, let’s have a look to see whether we can afford to take it easy…

We are informed that inflation is poking along at about 5 percent per year (so you’ll lose half of your wealth over 14 years if you don’t invest carefully). That shouldn’t be enough to derail an insurance company’s profitability, even with regulators limiting price increases to once per year. What are the insurance companies themselves seeing? From the Insurance Information Institute:

“You have to look at year-over-three-years replacement costs, and they’re high,” [Triple-I CEO Sean] Kevelighan said. “Personal homeowners replacement costs are up 55 percent. We’ve got personal auto replacement costs up 45 percent.

The three-year inflation rate, as perceived by insurers paying claims, is around 50 percent. Maybe the problem is behind us thanks to the muscular efforts of Joe Biden to whip inflation? “State Farm Halts Home-Insurance Sales in California” (Wall Street Journal, May 26):

State Farm is stopping the sale of new home-insurance policies in California effective Saturday, because of wildfire risk and rapid inflation in construction costs.

State Farm is the nation’s biggest car and home insurer by premium volume. It said it “made this decision due to historic increases in construction costs outpacing inflation, rapidly growing catastrophe exposure, and a challenging reinsurance market.” It posted the statement on its website and referred questions to trade groups.

I think that we can ignore the wildfire risk as the primary business reason here. The wildfires of 2023 aren’t dramatically riskier than the wildfires of 2022. Maybe State Farm is just being greedy so that they can enrich their fatcat shareholders? They’re not truly losing money on new policies, but are trying to pressure California regulators into giving them yet more profits:

State Farm is a mutual company, meaning it is owned by its policyholders, and it has deep pockets. It ended 2022 with net worth of $131.2 billion.

Why does it matter if construction costs are outpacing inflation, as State Farm says? Our grow-the-population-to-450-million-via-immigration plan will result in skyrocketing rents and miserable living conditions for most Americans unless new housing can be built at some price that is affordable to low-skill migrants (who earn below-median wages).

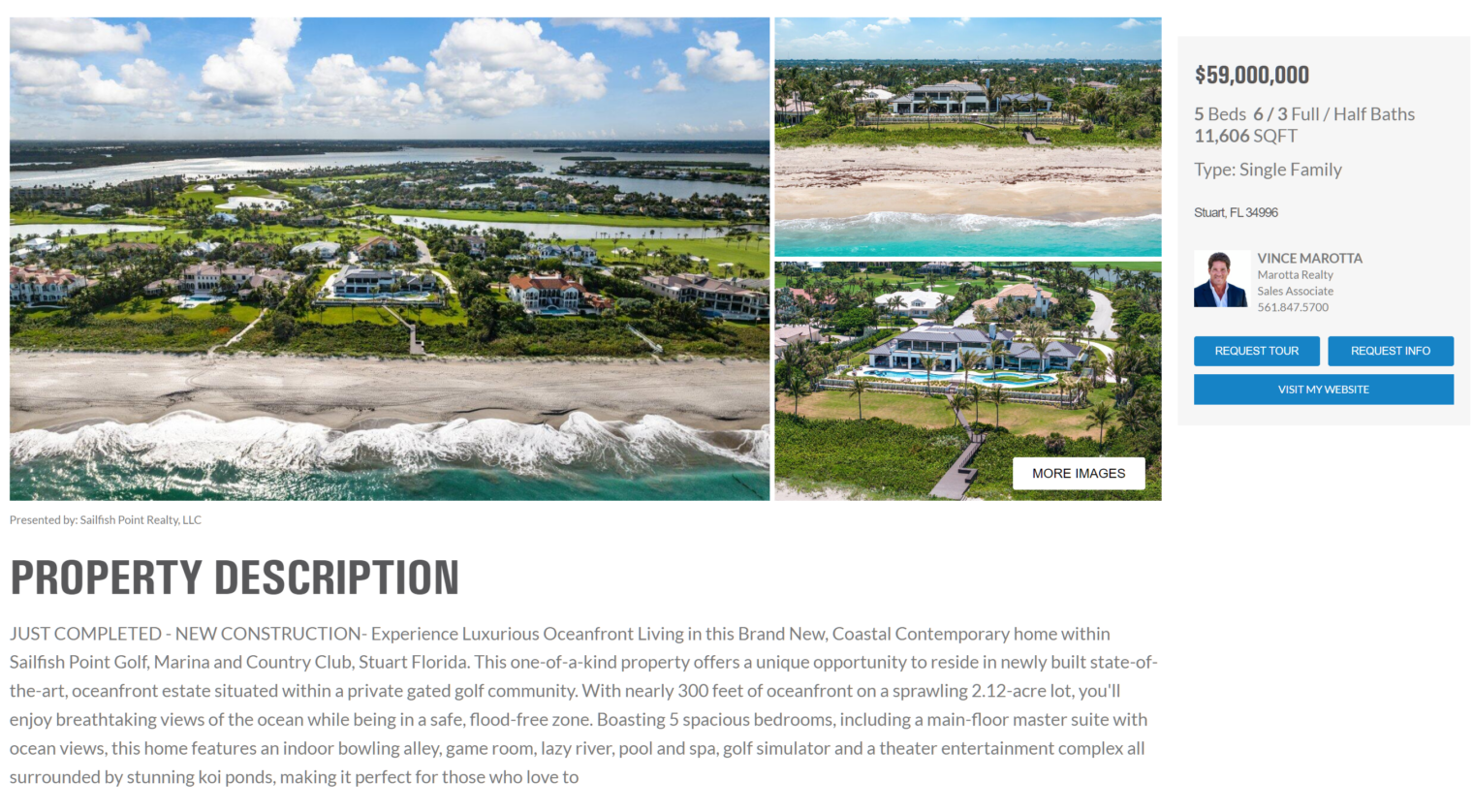

Let’s have a look at a newly built house just north of us in Martin County, Florida, far away from the high prices of Miami and Palm Beach. It’s only about $5,000 per square foot and comes with 2 acres of land:

Related:

- City rebuilding costs from the Halifax explosion (in which we look at the numbers for a Boston housing development where a two-income couple working full-time at the median wage couldn’t afford the bare construction cost of an apartment, much less the land or any profit for the builder)

- from last year… Juneteenth: a day off for white members of the laptop class and government workers (photos from San Diego)

Inflation is the average of everything going up 50% & everything going down 50%. Just keep driving down the cost of transistors so construction can go up.

If you want a good example of this, look no further than Naples, FL.

Not a very nice place by destination beach standards: mediocre restaurants, limited cultural venues, ugly architecture, and a short season. Yet beach houses now list for $80-100M when less than two decades ago they were selling for 95% less.

The town is regularly decimated by Nature, and indeed they have not yet repaired many of the streets, streetlights, and sidewalks directly adjacent to these $100M beach homes since they last washed away a few years ago.

What does floor insurance cost for a $100M beach house in Naples? The replacement cost on these McMansions is likely north of $20M in 2023 dollars.

Note: their insurance is likely subsidized by your tax dollars via the NFIP, but that caps out at $250,000 per dwelling.