The peasants revolted in 2022 by updating the Massachusetts constitution so that a progressive income tax rate system could be introduced in the progressive state. The higher 9 percent rate initially applies only to those who earn at least $1 million per year so it is the “Millionaires Tax”. Here’s a recent Wall Street Journal article about some unreasonably rich douches seeking to unload their $16 million 13,550-square-foot house.

Here’s the quiet escape part, buried towards the end:

They recently purchased a home in Vero Beach, Fla., and they also have homes in New York City and Marion, Mass.

I’m going to guess that they end up spending at least 183 days per year in Vero Beach!

What kind of person lives in a 13,550-square-foot house spewing energy out of four walls and a roof in the midst of what Democrats tell us is a “climate crisis” and an “existential threat to humanity”? A big donor to progressive causes! The New York Post has an article about the owners Lawrence Rand and Tiina Smith showing up at a fundraiser for a “left-wing” group that is also funded by George Soros.

Related… a tweet from the union that represents America’s smartest and best-educated workers:

(the first time that anyone had to pay the new Maskachusetts tax was April 15, 2024, so I’m not sure why a higher-than-expected revenue in Year 1 of the new tax “proves wrong” those who said that the rich would move; packing up and moving might take a few years to organize; the one thing that I think the above AAUP post proves is that very few university professors expect to earn over $1 million in 2024 dollars)

A report from Boston University (April 2024) says the following:

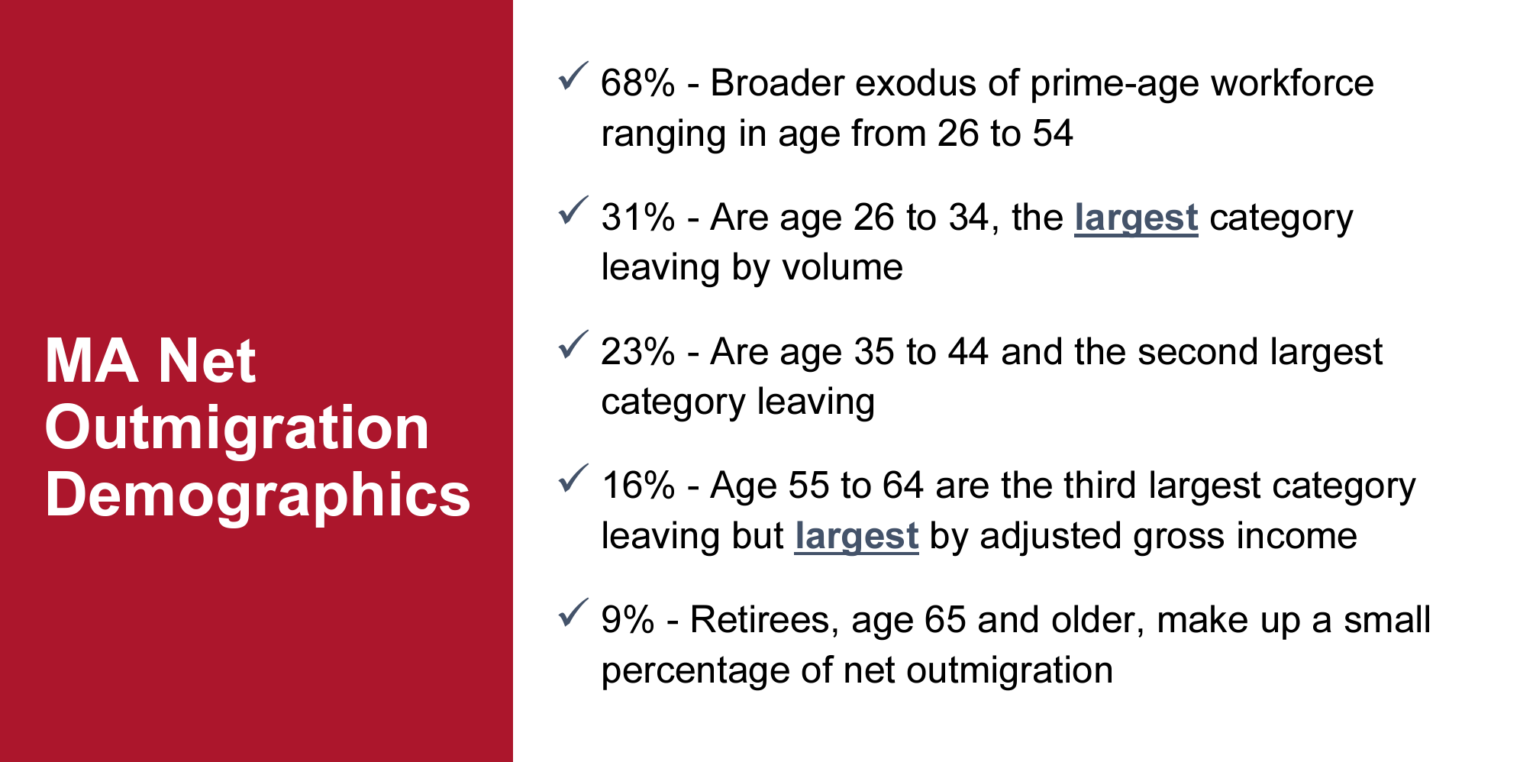

MA rate of outmigration is rising rapidly, impacting population, size and workforce composition

Growing exodus of prime age workforce and higher income earners

Higher income earners are leaving MA with over half earning 1.3 to over 2.6 time the state average

Over the last decade, the Top-5 destinations have remained consistent: Florida, New Hampshire, Maine, North Carolina and Texas

Southern states are gaining the lions share of adjusted gross income

Florida gained $1.77 billion (42% [of the adjusted gross income that fled])

The BU nerds didn’t point out that migrants living in public housing are likely going to call Maskachusetts home forever!

(The BU analysis purports to have a number for outmigration in 2023, but I don’t see how this could be reliable. My understanding is that IRS data is the gold standard and the latest IRS data covers 2022 (see this recent WSJ article, for example; “Florida gained about twice as much income in 2022 from other states as it did in 2019”).)

I propose that we check back in 2028 to see what has happened with high-income Massachusetts residents during 2023-2026 (using IRS data). My theory is that it takes 2-3 years for a rich person to move. A peasant can throw the contents of his/her/zir/their 1BR apartment into a U-Haul and drive to a 1BR apartment in another state within a few months of deciding to move. The rich person, on the other hand, may have a lot of connections to unwind and might need to wait for a suitable house to be built in the destination state.

Much of my immediate family left MA for FL starting w/ my grandparents in 1975, father 1980, brother 1985, myself 1990, mother 2000, aunt 2010, other brother 2020, as well as half a dozen childhood friends. The rest moved to NH.

One of the noticeable problems with MA/CT/NY escapees is that they carry and spread their mental diseases to places they escape to, on average, of course.

Witness, for example, the sorry state of Denver, in comparison to even a decade ago after Millennials from Northeast or CA descended upon it,

It’s not for nothing that FL locals call Palm Beach County Yankee County, and it’s not a compliment.

“Sire, the peasants are revolting!”

“Yes, they certainly are.”

“My theory is that it takes 2-3 years for a rich person to move.” says the rich person that made the move in half that time!

TS: 2-3 years would be an average! And the pressure of a higher tax rate isn’t as motivational as the pressure of a Scientific coronapanic response (lockdown, school closure, mask order, vaccine papers checks). If Massachusetts would behave with some logical consistency and go back into lockdown (SARS-CoV-2 is still with us, still killing Americans, and still mutating, so what was required by Science in 2020 should also be required in 2024), I’d cut my estimate!

Florida should introduce checklist for refugees from Mascachusets: if they contributed to lefty causes they are running from , Florida should match + 1% their Mascachusets tax rate for them. Similar for NY and CA.