… for those who renounce U.S. citizenship.

There has been a bit of an uproar regarding the Democrats’ plan to tax unrealized capital gains and Republicans are complaining that it is an unprecedented new area for the federal government. But this isn’t a new area, at least when it comes to Americans who decide that they’re never going to pay U.S. taxes again. The IRS web page regarding the expatriation tax:

IRC 877A imposes a mark-to-market regime, which generally means that all property of a covered expatriate is deemed sold for its fair market value on the day before the expatriation date. Any gain arising from the deemed sale is taken into account for the tax year of the deemed sale notwithstanding any other provisions of the Code. Any loss from the deemed sale is taken into account for the tax year of the deemed sale to the extent otherwise provided in the Code, except that the wash sale rules of IRC 1091 do not apply.

And a detail page:

Section 877A(a) generally imposes a mark-to-market regime on expatriates who are covered by section 877A, providing that all property of a covered expatriate is treated as sold on the day before the expatriation date for its fair market value.

For purposes of the mark-to-market regime, the covered expatriate is deemed to have sold any interest in property that he or she is considered to own under the rules of this paragraph other than property described in section 877A(c). For purposes of computing the tax liability under the mark-to-market regime, a covered expatriate is considered to own any interest in property that would be taxable as part of his or her gross estate for Federal estate tax purposes under Chapter 11 of Subtitle B of the Code as if he or she had died on the day before the expatriation date as a citizen or resident of the United States.

In computing the tax liability under the mark-to-market regime, a covered expatriate must use the fair market value of each interest in property as of the day before the expatriation date in accordance with the valuation principles applicable for purposes of the Federal estate tax, except as otherwise provided in this paragraph.

How often does this happen? “IRS steps up enforcement of the individual expatriation tax” (KPMG partner; June 2024):

The number of individuals who renounce their U.S. citizenship or terminate their green card status has increased significantly since the enactment of the current expatriation tax regime in 2008. Lists of these individuals published quarterly by the IRS in the Federal Register show that the number of individuals expatriating has increased from 312 in 2008 to 3,260 in 2023, with a peak of 6,705 in 2020.

My big question is how President Kamala Harris will collect long-term money from the targets of her extended (not exactly new, as noted above) unrealized capital gains tax. A person targeted by the tax has two choices:

- pay President Harris for unrealized capital gains in 2026 (let’s assume it takes a while for this to be implemented), 2027, 2028, and every subsequent year until death

- pay President Harris for unrealized capital gains at long-term rates in 2025 and then never pay income taxes to President Harris, the U.S. government, or any other government again (expatriation)

Why wouldn’t a rational target of the new tax choose Option 2? He/she/ze/they renounces U.S. citizenship, moves his/her/zir/their assets into an offshore Dutch trust (as U2 did) and moves to any country that doesn’t dig into offshore assets/income for computing income tax. Or establish a residence in Italy and pay a flat tax rate of €200,000 a year (recently bumped up from the €100,000/year rate established in 2017, which means it has kept roughly even after adjusting for inflation in the costs of things that rich people buy, but the bump doesn’t affect people who signed up for this prior to August 2024). Or simply move to a country that doesn’t impose any income tax (KMPG on relocation to Monaco). If the expat is nostalgic, he/she/ze/they can return to the US for 30-60 days per year, depending on the employment situation, without becoming subject to U.S. taxation.

There is a lot to like about living in the U.S. (especially here in Florida!), but is it worth paying 100X as much in taxes compared to living in some other part of the world? If there are friends you want to see buy them a first class ticket to Heathrow and push your way through the pro-Hamas rallies to a night of theater. Or, if you’re truly one of those who has taken more than he/she/ze/they needs, send the Gulfstream or Airbus Corporate Jet to pick up the friends.

Here’s a place in northern Italy that costs less than a tract house in Palm Beach County ($2.7 million for a modern house on 22 acres):

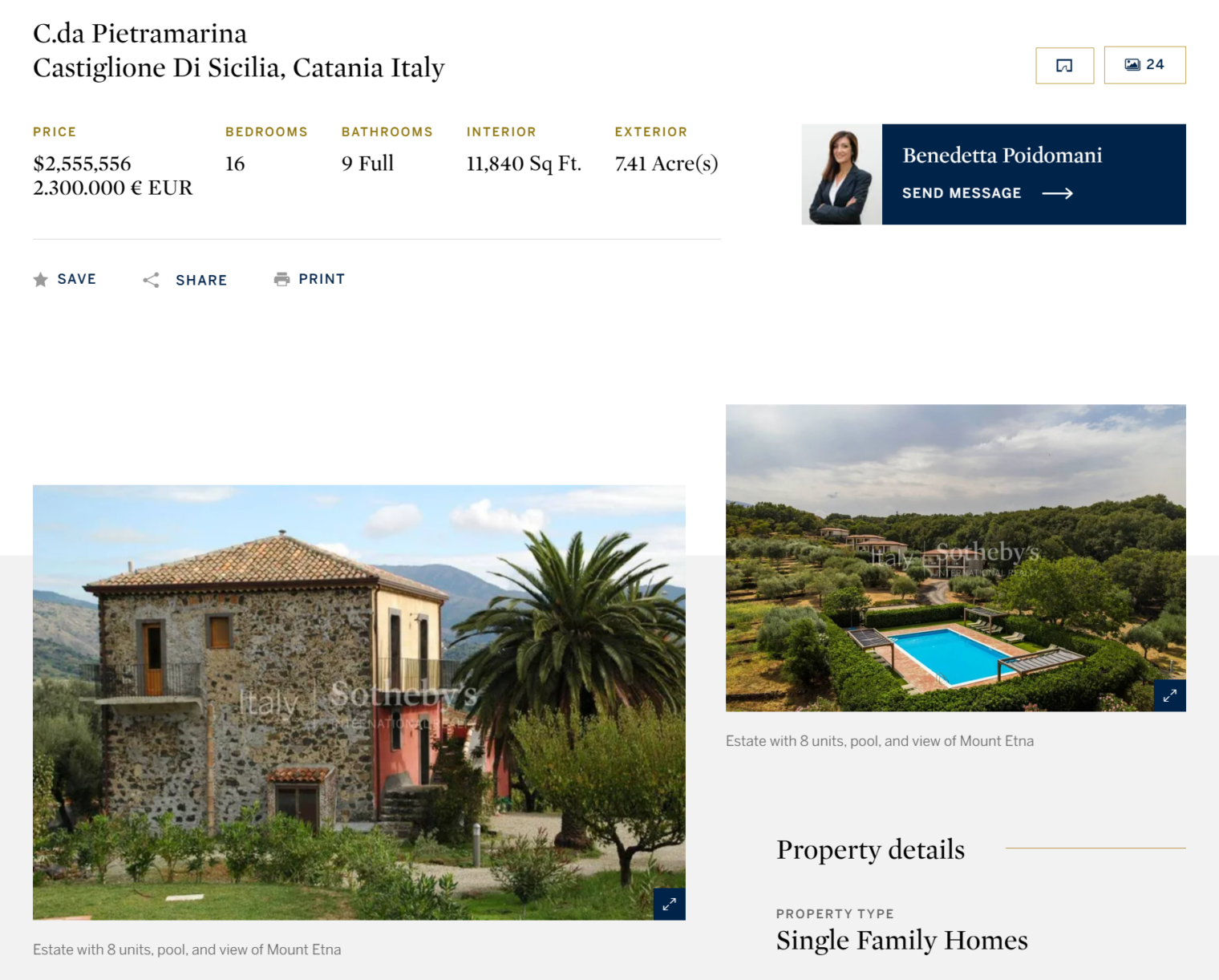

If you don’t mind a little maintenance, a castle in Sicily on 7 acres:

Given the tax savings, maybe there isn’t any need for maintenance. Just buy a new house every few years with a fraction of what would have been paid in unrealized capital gains tax and give the old house to a charity.

Separately, why didn’t the Democrats impose their new tax regime during the first two years of the Biden-Harris administration when they had control of both houses of Congress and the White House? How can Kamala Harris simultaneously say that she agrees with everything that Joe Biden did (or read from a teleprompter) and also that she will do completely different stuff starting January 2025?

Related:

- “Facebook co-founder renounces U.S. citizenship” (NBC, 2012)

- Wikipedia page on Eduardo Saverin: “a Brazilian billionaire entrepreneur and angel investor based in Singapore. … With an estimated net worth of US$26.3 billion as of early August 2024, he is the 69th richest person in the world, and the richest Brazilian. Saverin renounced his U.S. citizenship in September 2011, thereby avoiding an estimated US$700 million in capital gains taxes.”

- “$5 Trillion List of Tax Hikes Kamala Harris Just Endorsed” (Americans for Tax Reform (a.k.a. “Haters”, founded by Hater-in-Chief and Burning Man attendee Grover Norquist))

- (not very related, but interesting because of post-coronapanic tilting of the economic playing field in favor of the biggest companies) “Eighty-eight corporate leaders endorse Harris in new letter, including CEOs of Yelp, Box” (CNBC)

The lion kingdom has pondered the citizenship requirement to open a brokerage account & its implications on fleeing the global headquarters of liberal voting medeival christianity. The only way to win is to be an undocumented immigrant & never have to become an expatriate in the 1st place. Maybe Kamal will grant brokerage accounts to illegal immigrants.

I especially liked the Sicily castle; it even has built-in geothermal heating for those nippy nights: “Nestled on the slopes of Mount Etna…”