Today the Federal Reserve technocrats depressed investors by saying that interest rates won’t be lowered all that much in 2025 (unsaid: Congress won’t put down the deficit spending crack pipe and, thus, inflation is inevitable). Mary C. Daly, last seen addressing the diversity crisis at the San Francisco Fed and ensuring the stability and longevity of Silicon Valley Bank, voted with the rest of the governors to cut interest rates by 0.25%. The lone dissenter to the cut was from the Rust Belt: Beth M. Hammack, head of the Cleveland Fed (formerly at Goldman). Let’s follow Ms. Hammack going forward and see if she’s right about the inflation that the government and media assure us does not exist.

(A friend asked why the stock market was down today. She’s a physician and had interpreted the news from the Fed meeting as a prediction that the U.S. economy was going into a slump. My response: “Fed said it would have to keep interest rates high. Congress wont stop deficit spending. So the only way to tame inflation is high rates, which means stocks need high yields to compete w bonds. If a stock pays a fixed dividend it can only generate a higher yield by falling in price. Remember if you can buy a bond yielding 6% you need to buy a stock at a price where you’re sure you’ll get at least 8% return.” Curiously, the Wall Street Journal had a headline about the Dow Industrials (below) rather than the S&P 500.)

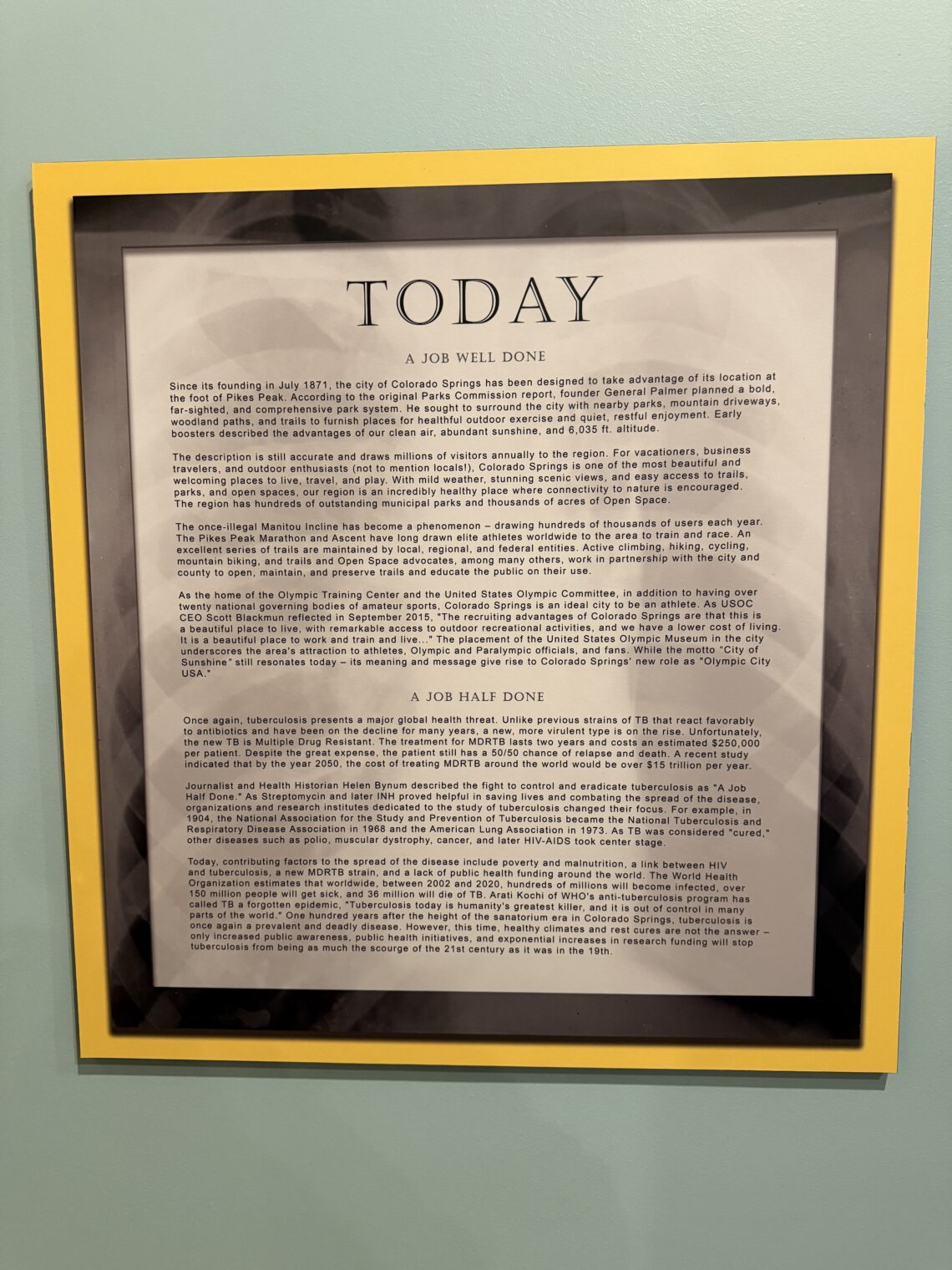

Speaking of non-existent inflation, I went to a museum today in Colorado Springs. It is inside a massive 1903 courthouse that is three stories high with a clock tower reaching skyward beyond. The volunteer at the front desk told me that it cost $420,000 to build.

It was replaced in the 1970s by a monster-sized concrete “judicial center” across the street:

What was inside the museum? An art exhibition in which paintings from any artist with a connection to the region were welcome… so long as the artist identified as “female”:

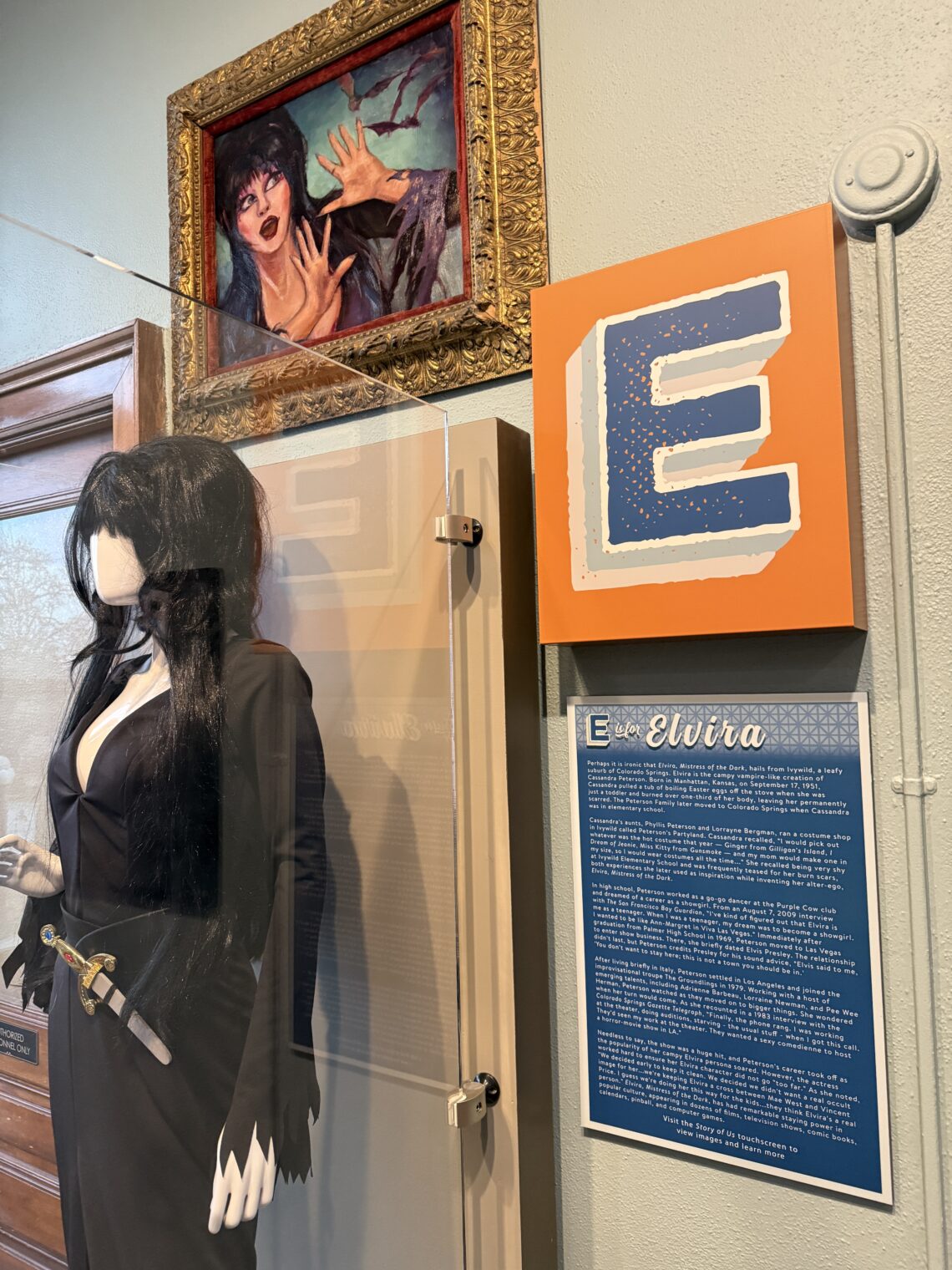

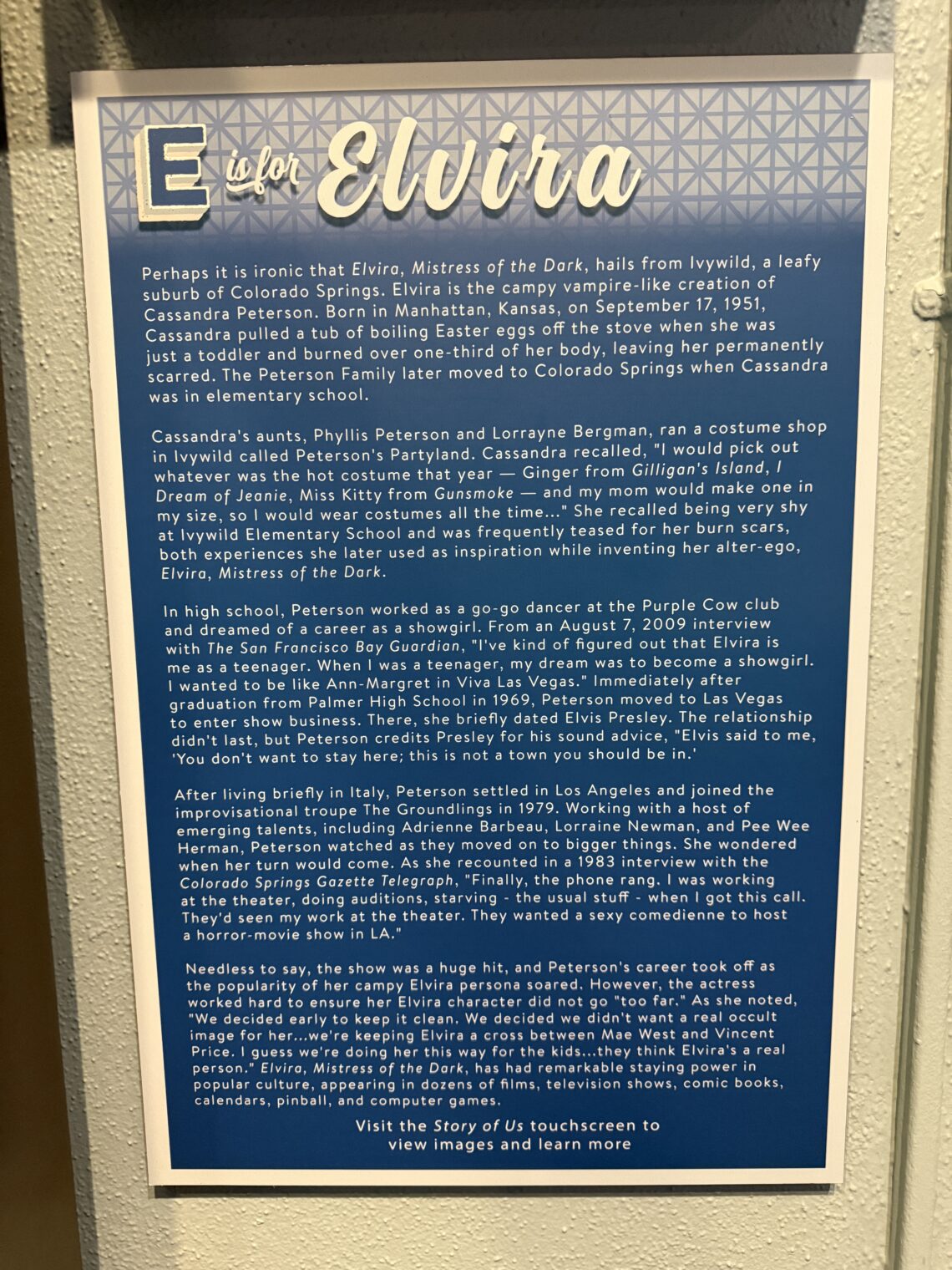

Some important history for fans of the Elvira’s House of Horrors pinball machine (#9-ranked on Pinside):

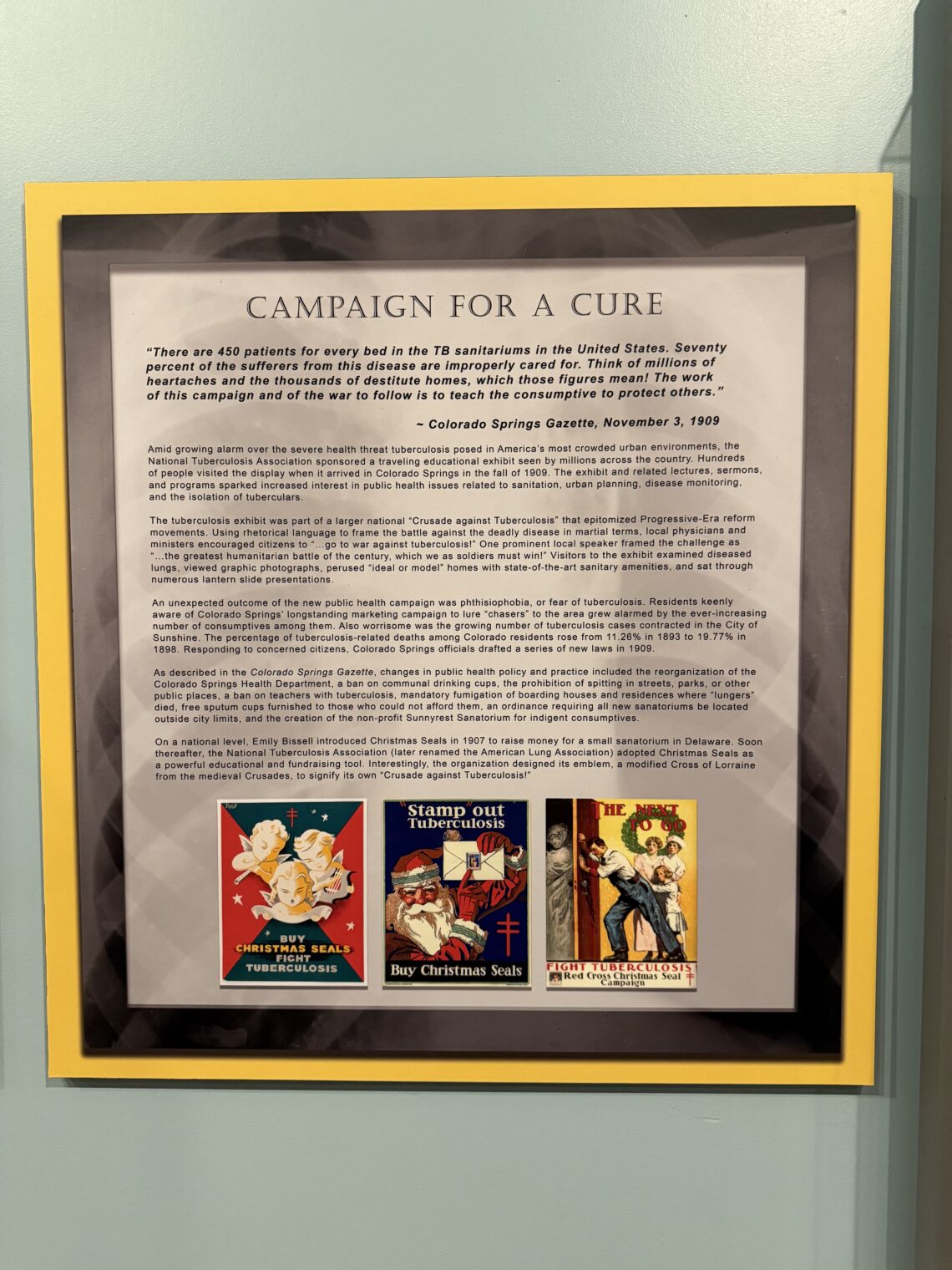

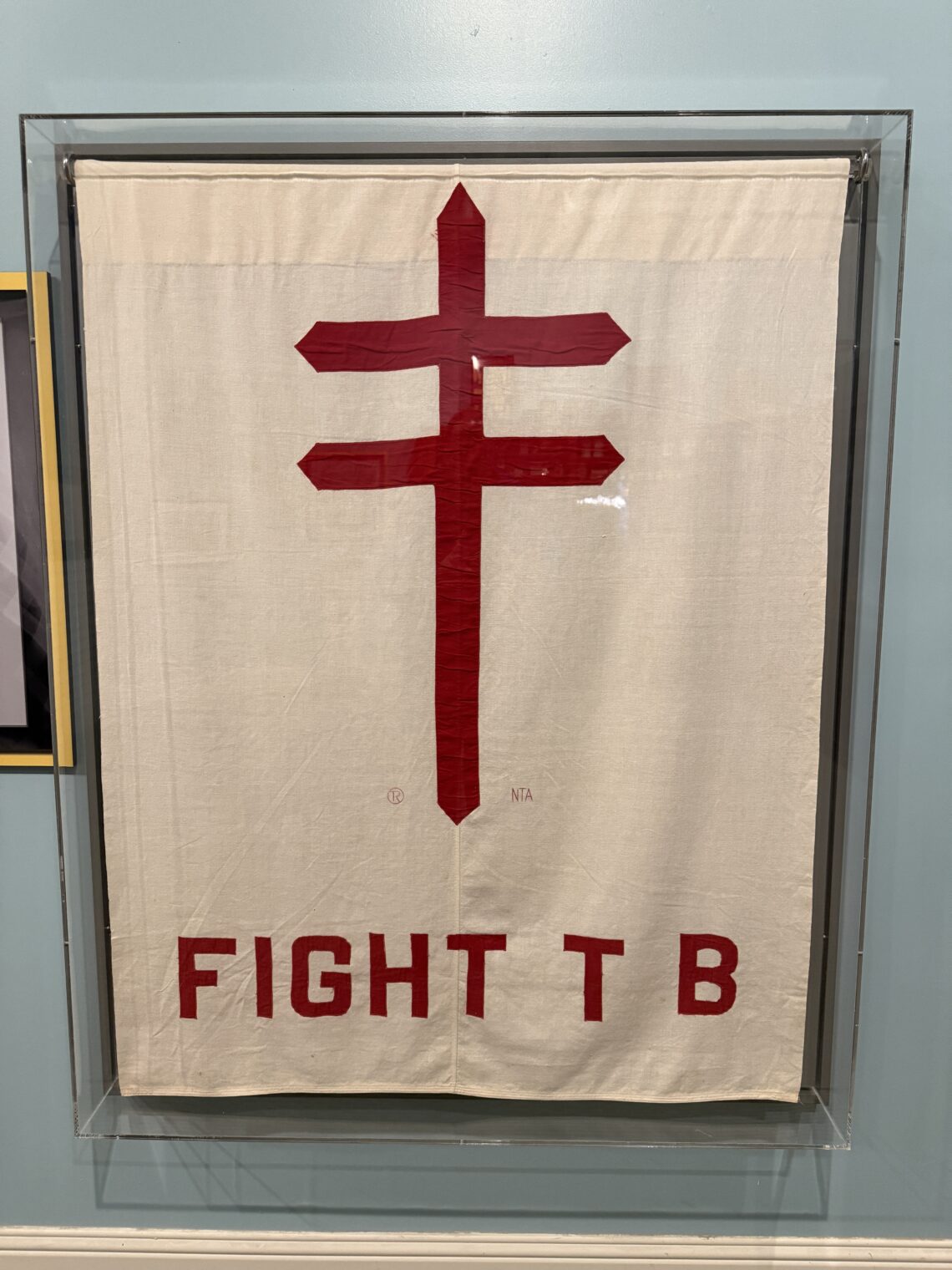

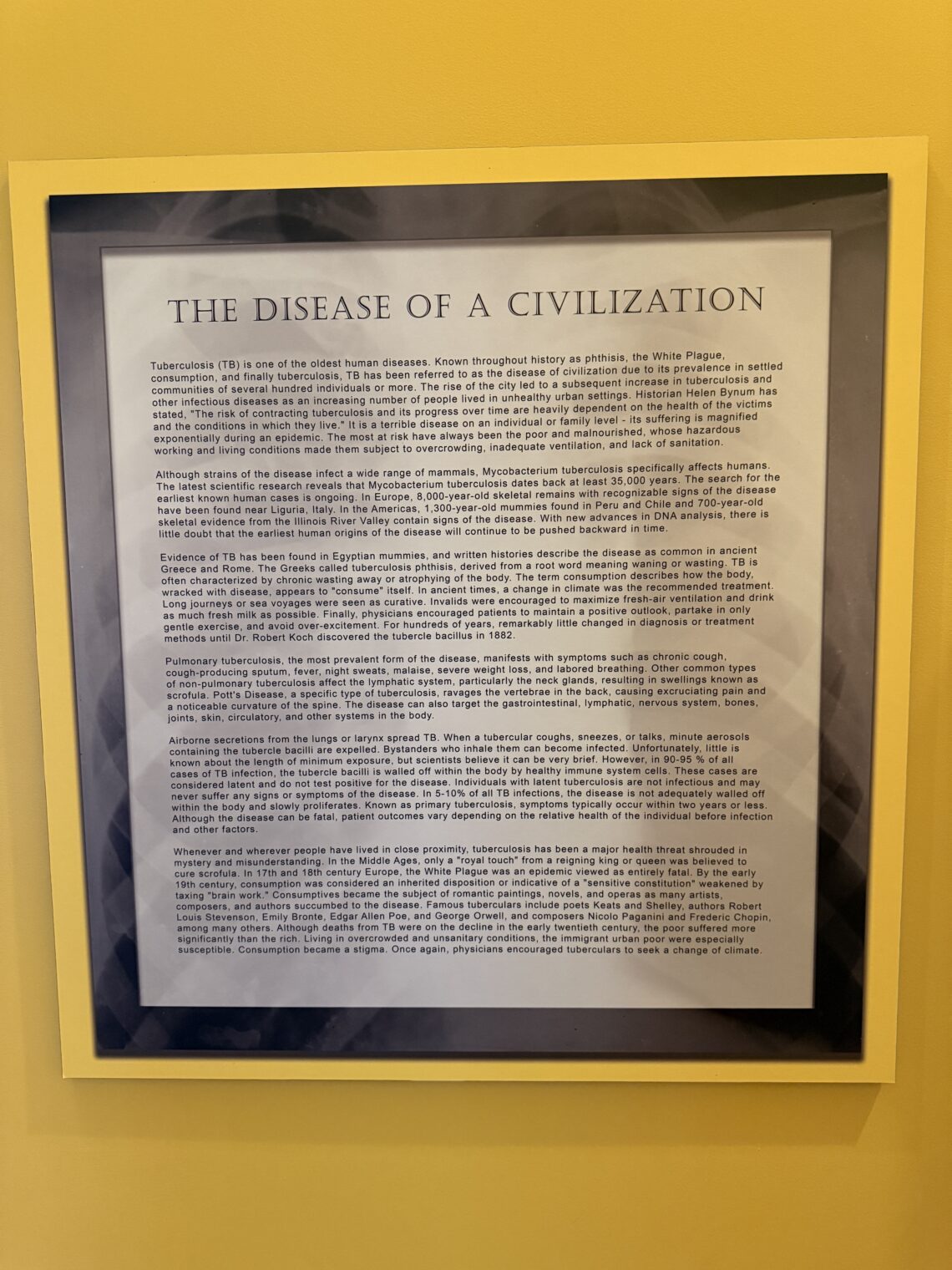

A reminder that SARS-CoV-2 was not the first pathogen to realize what fat targets humans living in cities presented…. (Colorado Springs was a cure destination for tuberculosis sufferers.)

The glorious history of test equipment… (HP had a division here making oscilloscopes, spun off and spun off and now “Keysight”)

It seems as though taxpayers got a good return on their $420,000 investment.

“If a stock pays a fixed dividend it can only generate a higher yield by falling in price.” I believe that is not correct, a stock can increase in price or pay more dividends if the company profit increases. Higher borrowing costs result in lower levels of economic activity (depressing profits) and higher financing costs for companies (that also depress profits). So, yes, stock prices are affected by increases in interests rates, just not in the way you described.

Bonds do have to adjust their prices to changes in interest rates (bonds are not subject to “profits” in any other way than the issuer ability to pay).

By “fixed dividend” I meant that the dividend wouldn’t change and, by implication, company profit wouldn’t change. Yet the stock price could still fall because investors demanded a higher return. My friend was worried that the fall in stock price was driven by investor expectations of lower profits/dividends in a recession.

“Courthouse” -> “Judicial Center”

Reminds me of George Carlin’s observation on “soft language”:

https://youtu.be.com/hSp8IyaKCs0

I will note, as Mr. Carlin didn’t, that the transition from “Operational Exhaustion” to “”Post-Traumatic Stress Disorder” does not merely add a hyphen, but it serves to _locate the problem in the individual_. The external cause (“shell,” “battle,” “operational…”) has been completely removed and replaced with the confusing gauze of “post-traumatic stress,” but now the individual has A DISORDER: there is SOMETHING WRONG WITH THE PERSON.