Happy New Year to everyone! Let’s consider a New Year’s resolution to look at our investments…

“Wave Goodbye To the Stock Market’s Historic Run, Goldman Sachs Says” (Investopedia):

Analysts at Goldman Sachs on Monday forecast the S&P 500’s average annual return over the last decade of 13% will shrink to just 3% in the next 10 years.

Goldman analysts forecast the S&P 500 will return an average of just 3% a year in the next decade, a far cry from the 13% average annual return of the last 10 years. That would rank in the bottom decile of comparable periods in the last century. It also puts the odds that stocks fail to outpace inflation at about 33%.

So why the pessimism? One of the primary causes for Goldman’s concern is the market’s extreme concentration, which by their measure is near its highest level in 100 years. Concentration of this magnitude, the analysts say, makes the performance of the S&P 500 overly reliant on the earnings growth of the index’s largest constituents.

The 10 largest stocks in the S&P 500 currently account for about 36% of the index, far higher than at any other time in the last 40 years. These stocks have swelled in size in large part because of their exceptional earnings growth over the last two years. The Magnificent Seven—Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOG; GOOGL), Amazon (AMZN), Meta Platforms (META), and Tesla (TSLA)—more than doubled their earnings on a year-over-year basis in the first quarter of 2024.

2History shows, however, that it’s extremely difficult to sustain earnings growth at that clip. Just 11% of S&P 500 companies since 1980 have maintained double-digit sales growth for 10+ years, according to a Goldman analysis. A microscopic share (0.1%) has sustained 50%+ margins for a decade.

What’s the alternative if you don’t have a direct phone connection to God to tell you what individual stocks to buy?

However, growth is expected to pick up for the “Other 493,” which are forecast to post double-digit earnings growth over the next five quarters, significantly narrowing the gap between those companies and the Mag Seven.

The market’s extreme concentration and the difficulty of sustaining earnings growth are two key reasons Goldman expects the equal-weight S&P 500 index to outperform the more widely tracked capitalization-weight, or aggregate, version over the next decade.

Historically, the equal-weight index tends to outperform the aggregate index, but the last 10 years have been a different story. The aggregate index has outperformed the equal-weight by 3 percentage points a year since 2014.

Goldman expects the pendulum to swing back in favor of the equal-weight index, which their model suggests will outperform by 8 percentage points annually through 2034, its most dramatic outperformance since at least 1980. The size of the outperformance may seem extreme, the analysts note. “However, the equity market has also rarely been as concentrated as it is now.”

The current record outperformance for the equal-weight index is 7%, which it achieved in the decades ending in 1983 and 2010. These two 10-year stretches, Goldman points out, each began when the market was at peak concentration, as it may be today.

How would it work to put together an equal-weight portfolio? Just find a zero-commission broker and buy $1000 of each of 500 stocks (total value: enough to buy a meal at Five Guys a few years from now). It would require a lot more trading for rebalance, though, than the market-weight S&P 500 because the market-weight index adjusts automatically when one component stock rises or falls. The trading could lead to tax inefficiency that would wipe out the theoretical superiority of equal weight.

One could also let someone else do the trading, and somehow this Invesco ETF (RSP) seems to have figured out how to eliminate what you’d expect to be capital gains from all of the trading.

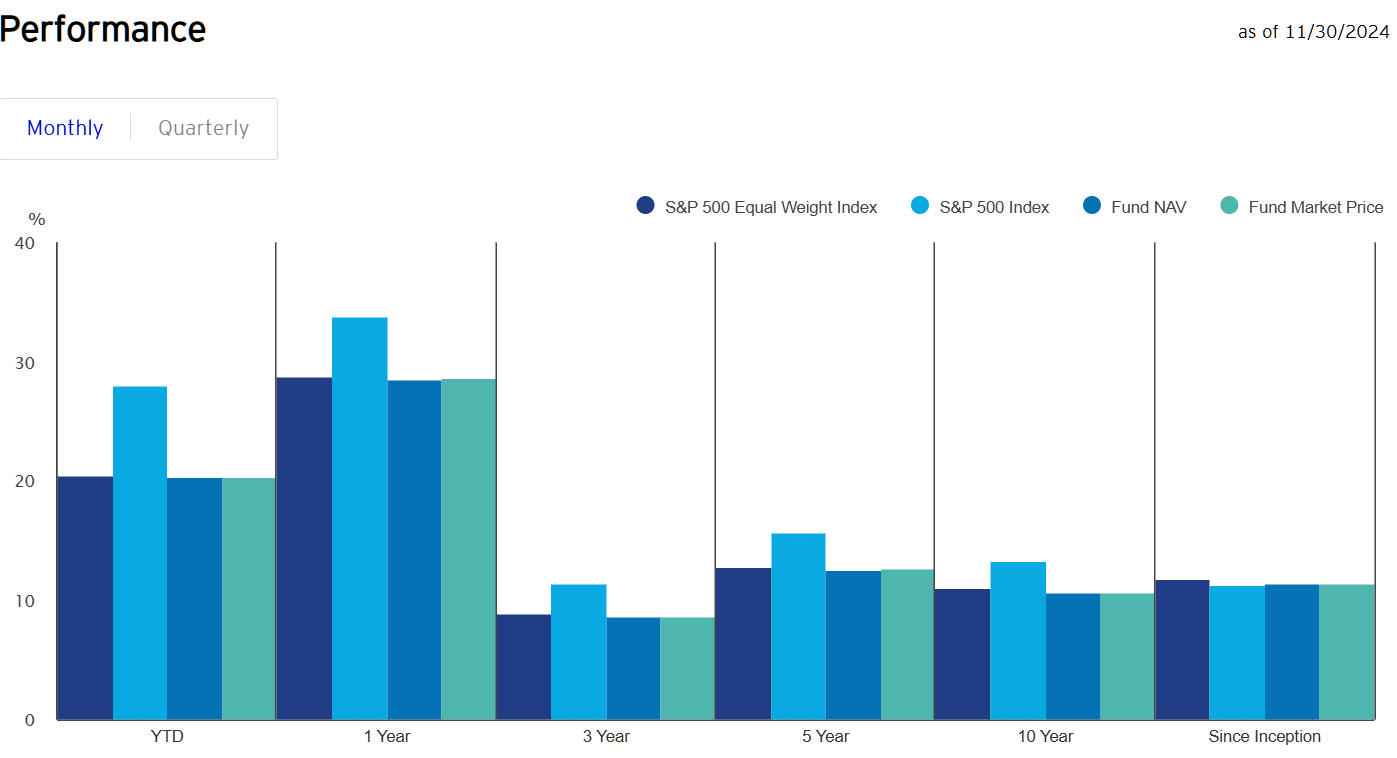

Past medium-term performance doesn’t seem to be great for equal weight:

Perhaps from letting the Mag 7 stocks run wild, the straight S&P (light/bright blue bar) seems to have outperformed, but if we go back 21 years to the fund’s inception (2003), the equal weight index has done a little better than the S&P 500 index (on the third hand, the ETF’s relatively high expense ratio of 0.2% will wipe out quite a bit of that small superiority).

Do we feel confident enough in the market power and dominance of the biggest companies in the S&P 500 that we think they can keep growing?

What about other indices? The NASDAQ-100 is now partly Bitcoin because they brought in MicroStrategy, a Bitcoin account selling at a bit premium to the value of the underlying Bitcoins (WSJ). And there is a lot of overlap by market cap with the S&P 500 (e.g., Apple, NVIDIA, Microsoft, Amazon, Alphabet). Maybe a simpler way to avoid the concentration risk in the S&P 500 would be to buy a midcap or smallcap fund.

And how about a little humility/honesty as an early New Year’s resolution? “He Lost 35% Ignoring 2024’s Biggest Trades: ‘I Am Not Good at What I Am Doing’” (WSJ):

In early December, Richard Toh, the chief executive and investment officer for the Singapore-based hedge-fund firm Kenrich Partners, sent a four-page letter to investors.

“I have come to the realization that I am not good at what I am doing but I guess some of you may have sensed that already,” he wrote. “I am sorry I have let you down.”

“I pretty much missed all the major themes in the last two years,” Toh wrote. “I was hopelessly out of sync with the market, buying when I should be selling and selling when I should be buying. We got whipsawed several times this year even as we got some facts correct.”

“I learned from that episode that sometimes the best investments are precisely the ones you cannot explain and probably made no sense. It also told me I am getting too old,” he wrote.

(There are so many people to whom I could legitimately write “I am not good at what I am doing” that I don’t know where to start…)

Separately, soon we will need to say goodbye here in Jupiter to our mayor’s personal Christmas light display (no keffiyeh as part of the crèche, as the Pope had):

Happy New Year’s Eve, everyone!

Gee, just a month ago, investopedia was declaring a new area of stonk booms & telling everyone to get in. Wonder what they’ll say next time stonks go up a percent. The lion kingdom went to Widmer World, a light show in a $2 mil house with only $2600 in property tax in CA.

Let’s see how Goldman did for this year:

“ Goldman Sachs Research forecasts the S&P 500 index will end 2024 at 4700, representing a 12-month price gain of 5% and a total return of 6% including dividends.” https://www.goldmansachs.com/insights/goldman-sachs-research/2024-us-equity-outlook-all-you-had-to-do-was-stay

Actual return barring a big crash in the next few hours: 23.16% (at 5878) https://www.marketwatch.com/investing/index/spx

Of course that’s one year, how did their projection of the last decade do?

“ Goldman projects market returns over the next 10 years will be 5 percent annualized and recommends investors focus on dividend growth stocks” https://www.cnbc.com/2015/05/18/goldman-sachs-markets-going-nowhere-for-a-year.html

Actual 10 year cagr on sp500: 11% https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

I’ll stick with index funds! In the meantime, leftover egg nog. Happy holidays!

All Muppets are stunned

Midcap tends to benefit from the pops when its members “graduate” to the S&P 500 index.

Also, you can buy large cap value stocks (however defined) and short a little S&P 500 against them. Just make sure you are earning at least 4% on the short rebate. Safer than an equal weight and much safer than shorting individual stocks.

How do I make money on the coming H5N1 epidemic? There’s the obvious ones like buy Moderna, whoever makes Tamiflu, etc. And going short airlines when it’s imminent that society will be immobilized. Anything else?

Mitch, your idea to short the airlines if your H5N1 thesis plays out is clearly a good one. If you wanted to diversify your shorts a bit more, a couple of others with big downside would be: restaurants (particularly those that own most of their units, like Darden, rather than those that are largely franchised, where the owners of the units would take the largest financial hit) and retailers (sticking with those that have more limited online sales, obviously, and staying away from those that might actually benefit from the situation of people staying at home, such as home depot). The common element of the airlines, restaurants and retailers is large fixed costs, so when revenues go down the earnings downside is very large, and hence the stock downside is also very large.

When earnings of top stocks in index fall then index will be rebalanced and new stocks will become top holdings. That’s why they are index funds.

Good point!

My New Year’s resolution is 3840 x 2160.

I thought I could avoid the risk of Fidelity’s cap-weighted S&P 500 index (FXAIX, 0.015% expense ratio) by investing in Fidelity’s zero-cost Total US Market Index (FZROX, 0.0% expense ratio), but looking closer at each fund’s composition, I see that they’re nearly identical and heavily comprised of the Mag 7.

“Goldman analysts forecast the S&P 500 will return an average of just 3% a year in the next decade”

Guess I’ll stick with my laddered, auto-rolled, Fidelity-brokered CDs extending out ten years, paying a weighted average return of 4.5%. Zero risk. Zero cost.

Deplorable, guessing you’ve already considered this, but just in case not. If you are looking to continue owning equities, but just excluding the the Mag 7, consider a small-cap or mid-cap index ETF/fund. Obviously not the same as owning the S&P 500 ex-Mag 7, because holdings would be *very* different (unlike total market index). Not making the case for these outperforming, just wanted to point out another alternative to cash-like returns.

@Anon: Yes, good point.

Another view is that globalism and technological advances have resulted in a winner-take-all economy. Apple, Microsoft, Google, and Amazon will just crush competitors, and continue to grow.

I have had good luck with VTSAX. https://investor.vanguard.com/investment-products/mutual-funds/profile/vtsax#overview

I have been investing in VFIAX starting 2009 with 13% average return. I am thinking of moving to NUKZ and VMNFX in 2025.