“Bank of America Shares Finally Recover From 2008 Financial Crisis” (Wall Street Journal, December 12, 2025):

Bank of America notched a symbolic win Friday when its stock traded higher than $55.08, a level not seen for America’s second biggest bank since before the 2008 financial crisis.

Like other banks that were damaged during the crisis, Bank of America has struggled to get its stock price back to the highs seen when George W. Bush was still president. Citigroup shares also haven’t recovered to their past high of around $530 in 2007.

Bank of America’s previous closing high was $54.90 on Nov. 20, 2006.

Perhaps a cautionary tale for those who are buying into the AI bubble!

Nowhere in the article: any inflation adjustment. It thus becomes a good example of money illusion. The WSJ is supposed to be by and for people who are sophisticated about money. That a stock today trades higher in nominal dollars than it did in 2006 is meaningless given the reduction in value of the dollar. $54.90 in November 2006, adjusted for official CPI, is equivalent to $88.49 today. An investor who bought BofA stock in 2006, in other words, has lost nearly 40 percent of his/her/zir/their money.

(Adding insult to injury, if the stock keeps going up and the investor sells at only a 20 percent loss then the IRS will be there to collect 23.8 percent of an illusory “gain” (an increase in the nominal price) and a state such as California will collect an additional 13.3 percent (9 percent in Maskachusetts).)

Reporter biography: “Alexander Saeedy … is a graduate of Yale University, where he received a bachelor’s and master’s degree in History.”

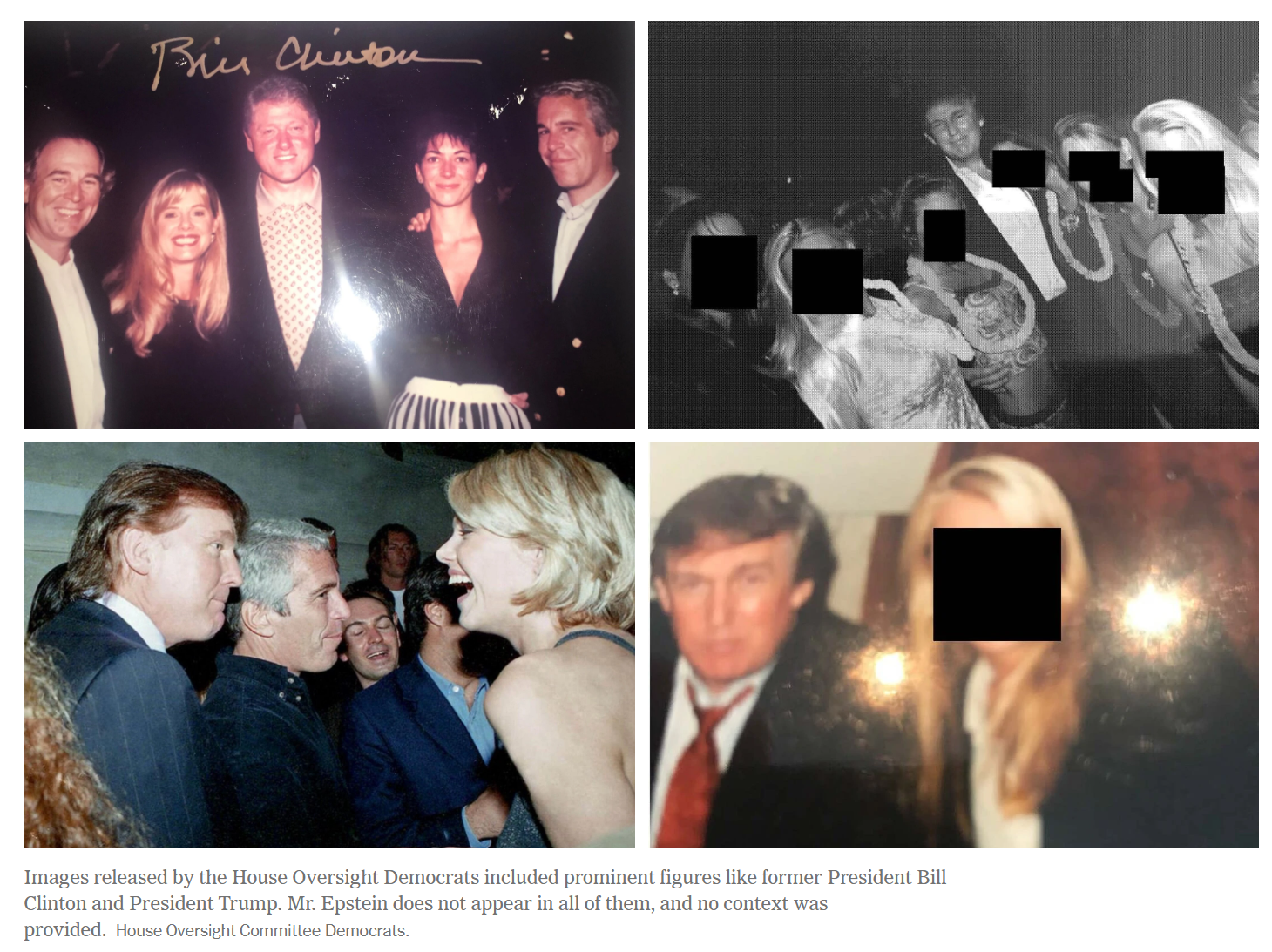

Also in journalism, the New York Times displays a sampling of what it says are photos from Emmanuel Goldstein’s laptop (“Democrats Release Photos Showing Epstein Ties to Powerful Men”: “The 92 photos, selected by Democrats on the Oversight Committee from a trove of 95,000 images in Mr. Epstein’s email account and on one of his laptops”):

Three-fourths of the sample images include Donald Trump so a reasonable reader would infer that 75 percent of the images released (or maybe 75 percent of the 95,000 total?) included Donald Trump. Buried lower in the article: “The series of photos does include three images of Mr. Trump”. In other words, the representative 4-image sample of the 92 images chosen by the NYT contains 3 out of 3 Trump-related images.

If the entire stonk market was negative for 20 years, the fed would have had to abandon inflation targeting or something would have to be terribly wrong with productivity to require such a high interest rate. Fortunately, our fearless 100% stonk leader Greenspun will take the hit 1st.

Phil, a little secret to share with you (please keep it on the down low?). You have covered this issue of inflation relative to the assets of wealthy folks like yourself a number of times, right? Do you feel Communist America somehow has any degree of pity for you because you owe taxes on your stock holdings even though they underperformed on an inflation-adjusted basis?Really…please? Comprende?

The WSJ business reporting is at best lackluster. Many business articles read as if they were written by a company PR person. Others are written by reporters who obviously don’t know understand the subject matter. Articles are often incoherent because they omit key facts indicating failure at both the reporting and editorial levels. You have to wonder who the WSJ’s audience is these days given that outside of the opinion section the reporting and perspectives are similar to the NYT’s (the WSJ was likely not young Alexander Saeedy’s first choice) & opinion today basically has a value of zero since lots of quality opinion is given away for free on blogs and YouTube. I am not even clear that the Journal charges anymore for its content. Try not paying and see what happens.

Agreed, the WSJ has become the new NYT. Woke pablum.

It does not give much info comparing Bank of America shares in 2006 and now. In between Bank of America took on liabilities from Merrill Lynch balance sheet and had had to lower its risk profile. Did it even have a large investment trading arm before acquiring collapsed Merrill Lynch?

Did the WSJ mention dividends? Chat GPT claims that Bank of America paid $16 in dividends since November 2006. Reinvesting the dividends would have resulted in 85% total return, i.e. $54.90 turning into $101.56.

You raise an interesting point about capital gains. I went to look if there was any literature about indexing the rate to exclude inflation.

In 2018 the Congressional Research Service studied the idea and (surprise) did not like it, in part because capital gains taxes (aka double taxation) are already privileged in other ways. https://www.congress.gov/crs-product/R45229

Cato Institute is obviously more enthusiastic, and also more mathematically literate, pointing out that without an inflation adjustment, capital gains taxes are potentially infinite (when taxing effective losses).

https://www.cato.org/blog/inflation-can-increase-capital-gains-tax-rate-infinity

What is the logic for punishing people for investing in their own country (even if you hold a world mutual fund, it’s about 65% US stocks) with income they already paid taxes on once?

I’ll also note there is an (pathetically low) annual limit on capital loss deductions. So you can be taxed to infinity on the gains but if you take a bath it can take a lifetime to recoup, if you ever do (also with no inflation adjustment)

How long did it take the executive compensation to recover?