Did Doug Emhoff hit a woman with Hunter Biden’s laptop?

I don’t know if we’ll be without power and Internet due to Hurricane Milton so I’m scheduling this non-hurricane-related post in advance in order to deliver on my “posting every day” promise/threat.

A Deplorable posted “Kamala Harris’s husband Doug Emhoff ‘forcefully slapped ex-girlfriend for flirting with another man’ in booze-fueled assault after date to star-studded gala” (Daily Mail) on Facebook with the comment “Another post election day story for the Times.” In fact, a Google search restricted to “site:nytimes.com” shows that the Newspaper of Record (TM) hasn’t seen fit to cover the story of this Democratic National Convention featured speaker slapping anyone.

In a separate discussion about this story, a Big Law partner (closeted Republican) wrote that all members of the Party of Independent Thought would transition from “Kamala is so brat because look at Doug” to “Doug has nothing to do with this election; he’s not running for anything”. Just a few hours later, his prophecy was confirmed when a Minneapolis Democrat in a discussion about the above story posted “Who is this guy? Is he running for something?”

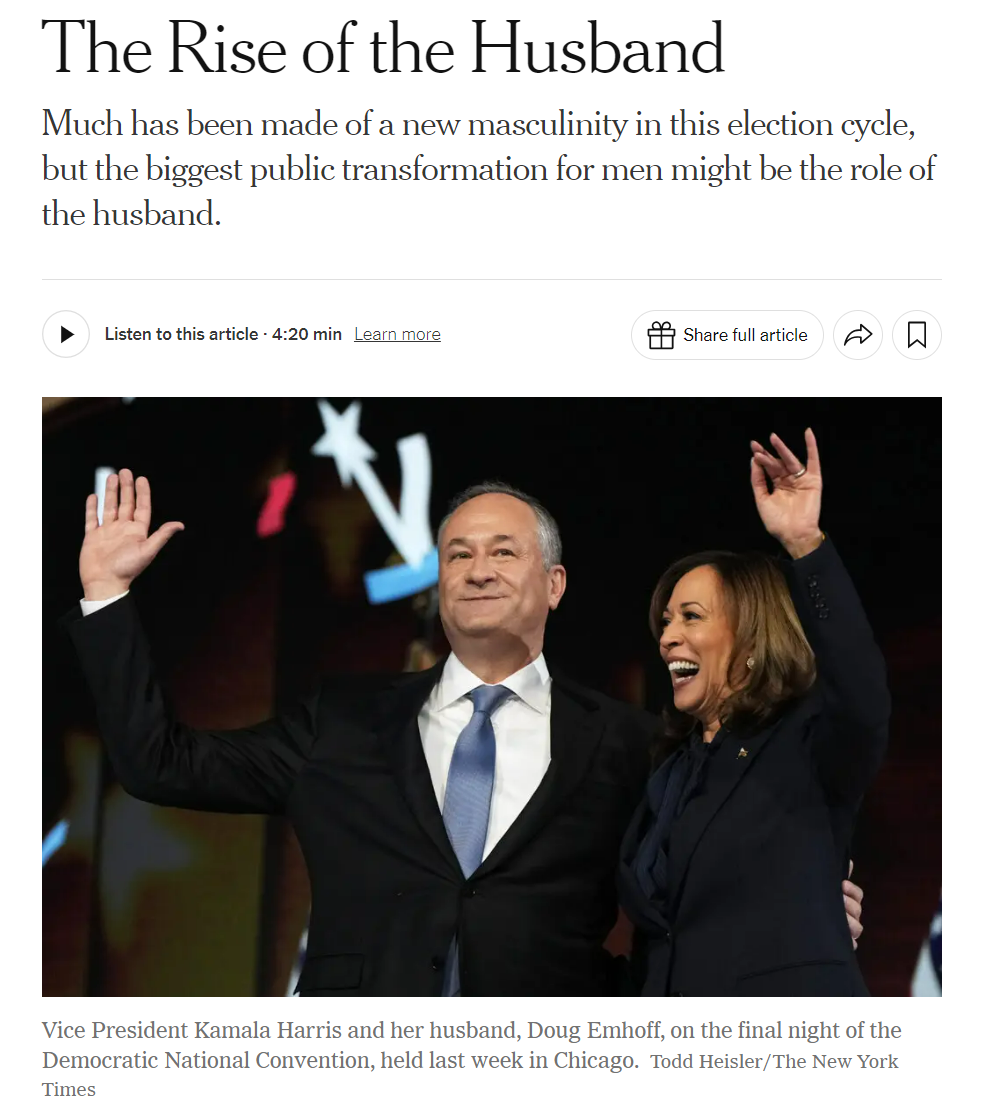

New York Times, about 1.5 months ago:

Speaking of husbands, “Kamala Harris and the Influence of an Estranged Father Just Two Miles Away” (NYT):

Friends of both say the estrangement, set in motion by her parents’ split when Ms. Harris was a child, may have as much to do with traits father and daughter share as it does their decades of differences. … It upset Ms. Harris that her father did not attend Shyamala Harris’s funeral in 2009. … Dr. Harris’s spectral presence in Ms. Harris’s life began when he and her mother separated in 1969, when Ms. Harris was 5. The couple divorced in 1972 after he lost a bitter custody battle that brought his closeness to Ms. Harris and her younger sister “to an abrupt halt,” Dr. Harris wrote in a 2018 essay. The sealed divorce settlement, he said, was “based on the false assumption by the State of California that fathers cannot handle parenting.”

Note that the New York Times covers a lawsuit with a plaintiff and a defendant as a mutual activity (“her parents’ split”). Reading between the lines, it looked like Kamala’s mom sued Kamala’s dad and won the winner-take-all fight that the California Family Court set up. And then Kamala was upset that her dad didn’t want to go to his plaintiff’s funeral. (We know a guy in Maskachusetts whose plaintiff died of cancer after winning the house, the kids, the cash, most of his income going forward, etc. On hearing the news, he was ready to throw a huge party to celebrate her death and the return of his kids not shed crocodile tears at the successful litigant’s funeral.

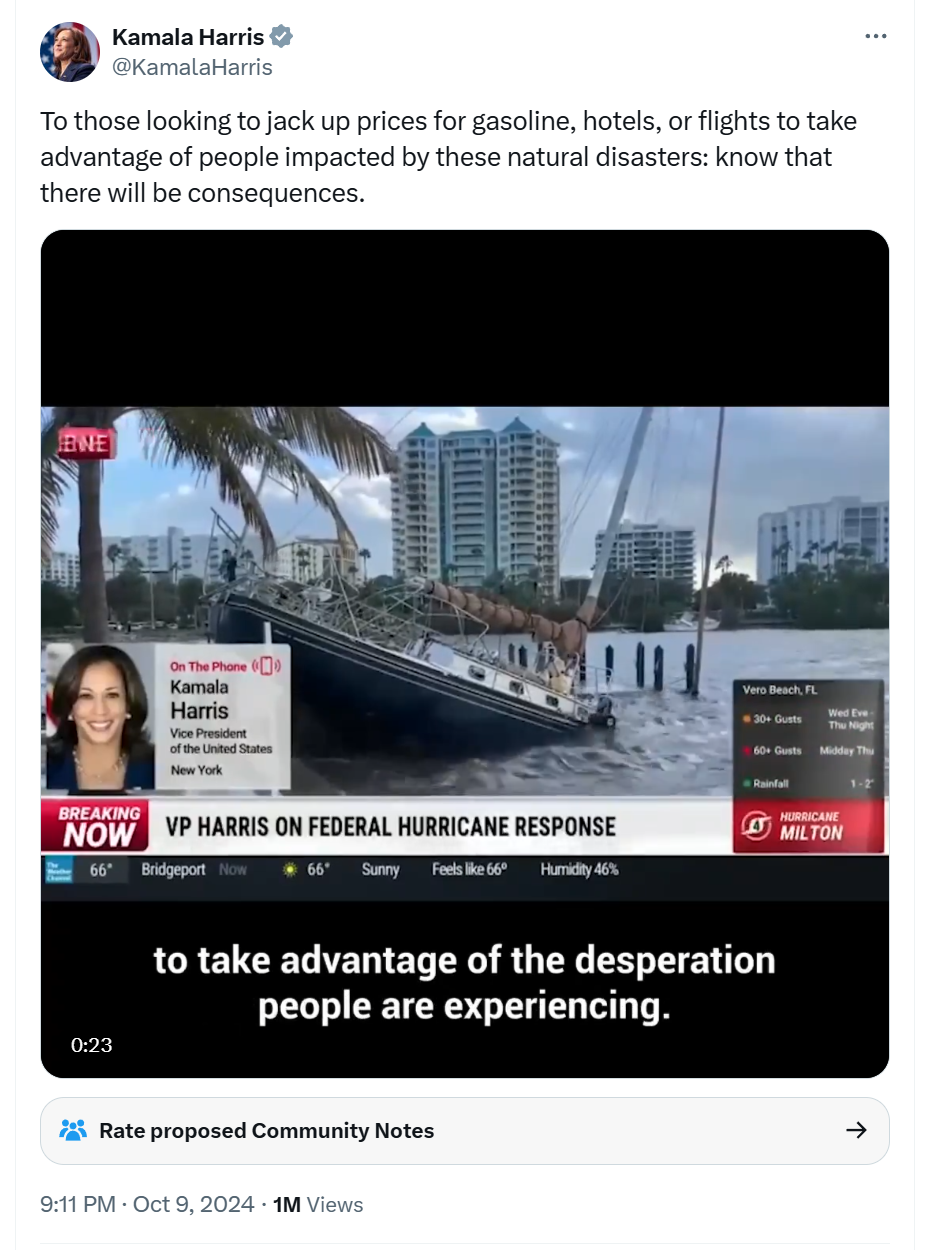

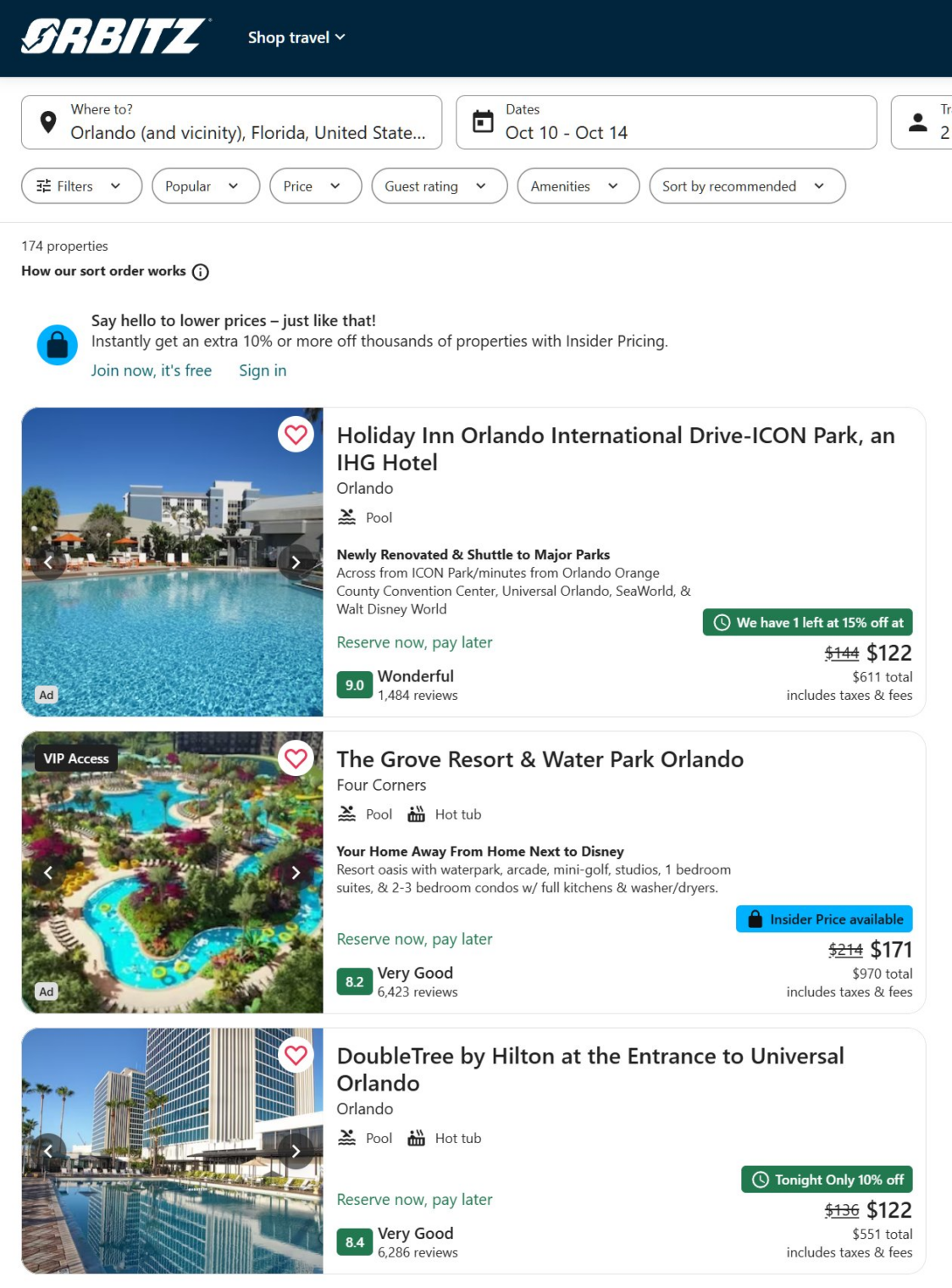

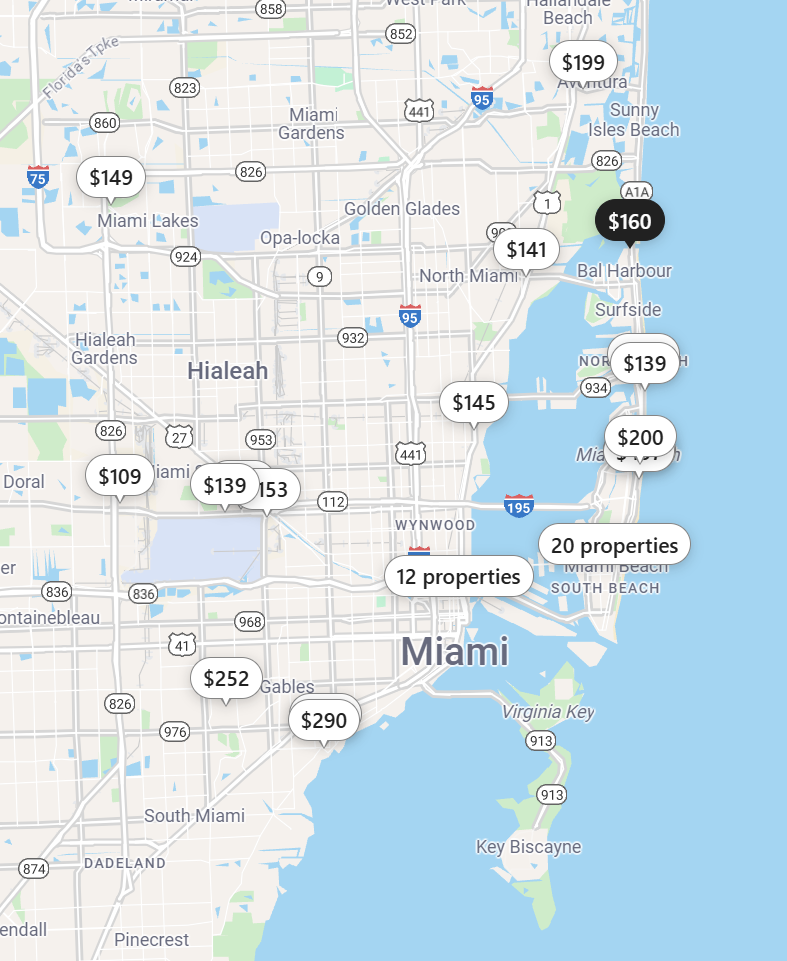

Addendum: We never did lose power thanks to the heroic engineering efforts of Florida Power and Light as well as the grid-hardening initiative approved by Ron DeSantis in 2019 over the objections of Democrats (see Tough questions from reporters for Ron DeSantis). In other hurricane news, combat veteran Tim Walz tells Floridians to evacuate at 6:32 pm, roughly two hours before landfall. This is apparently not the kind of “misinformation” that Democrats seek to outlaw and suppress, though it contradicts government advice to “shelter in place” once winds exceed 45-50 mph. The “mandatory” evacuation orders on the Florida west coast generally required evacuation by 9:00 am on Wednesday and officials told people who hadn’t evacuated to “shelter in place” after the winds picked up. From the war hero now fighting misinformation:

From the National Weather Service, 4.5 hours earlier (“It’s time to shelter-in-place”):

From Sarasota County, where Hurricane Milton hit:

An hour before Tim Walz suggested evacuation, the county was saying “shelter in place”:

The above tweets, combined, are good examples of the motivation for Why not a simple web site or phone app to determine whether one must evacuate?

Related:

- “NY Times still can’t admit Hunter Biden’s laptop is real! What’s it going to take?” (New York Post, June 12, 2024)