From How to steal $billions (September 2019), regarding the combined exploits of Jho Low and Goldman Sachs as chronicled in Billion Dollar Whale:

Despite connections to the Obama White House, things do begin to unravel for Mr. Low. I don’t want to spoil the suspense, though. The worldwide civil and criminal litigation is ongoing, but it seems safe to say that Goldman gets to keep all of its fees!

Turns out that I am wrong yet again… “Goldman Sachs Malaysia Arm Pleads Guilty in 1MDB Fraud” (NYT):

Goldman employees, the bank said, took part in a scheme to pay $1 billion in bribes to foreign officials. The bank, in turn, arranged the sale of bonds to raise $6.5 billion that was intended to benefit the people of Malaysia but was instead looted by the country’s leaders and their associates.

In the end, the scandal, which netted the bank a relatively paltry $600 million in fees, will cost Goldman and its current and former executives dearly. The bank itself will pay more than $5 billion in penalties to regulators around the world, more than it had to pay for peddling bonds backed by risky mortgages a decade ago. And it has moved to recoup or withhold more than $100 million in executive compensation, a rare move for a Wall Street bank.

(It is fascinating how the NYT characterizes a 10 percent fee for selling bonds (more typical is less than 1 percent, according to the book; the super high fees Goldman was able to get made it obvious that fraud was involved, said the author) as “relatively paltry”)

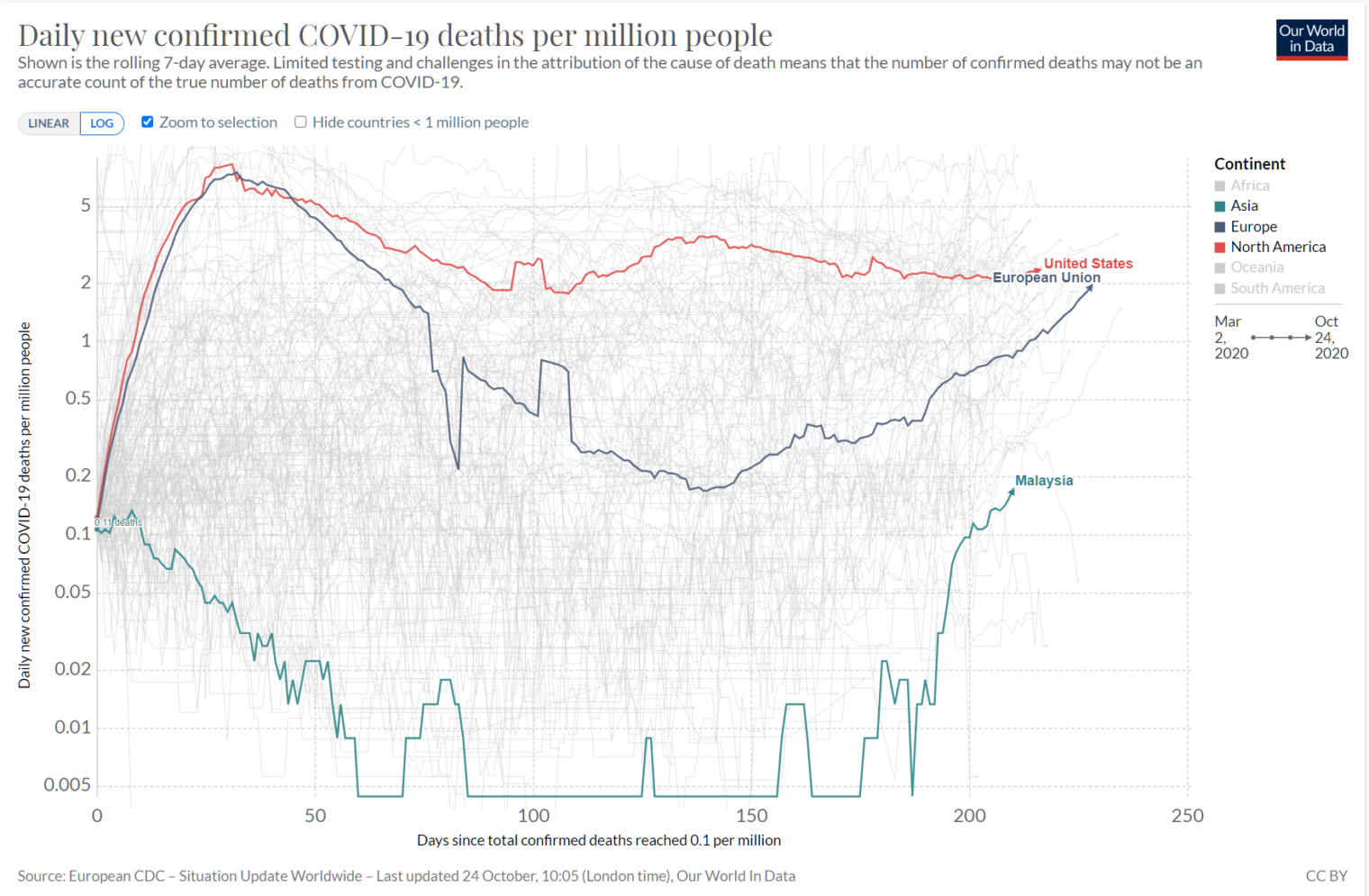

This is a good time to check in with Malaysia. Like Laos, Cambodia, and Vietnam, the country has enjoyed a low death rate from Covid-19:

“Amid coronavirus surge, Malaysia asks what went wrong as Muhyiddin and other politicians take brunt of criticism” (South China Morning Post, two weeks ago):

Three months after an initial strict lockdown ended, the country faces a sharp uptick in Covid-19 cases

Wikipedia has Malaysia down as 85-percent masked, as of August 9, compared to 90 percent in renewed-plague Spain, 83 in renewed-plague France, 75 percent in the always-plagued U.S., 65 percent in Germany, and 4 percent in Denmark.

Related:

- How to party with Hollywood Stars and Supermodels (party-goers (generally paid): Leonardo DiCaprio, Robert De Niro, Charlize Theron, Swizz Beatz, Alicia Keys, and Jamie Foxx; Miranda Kerr has sex with the chubby fraudster until the cash appears to be running out)

You and I both can take part in GS success by applying for Apple Card! It backed by GS.

I wonder why they didn’t go with HSBC – equally good and ethical choice.

Don’t feel bad. Almost everyone else was wrong, too.

“Bannon is one of the smartest people I know,” Scaramucci said, adding that Bannon has read “every book” at Barnes & Noble twice.”

“He also said Bannon understands the economic divide in the U.S. better than anyone.”

Department of Mind Reading:

“He has an almost clairvoyant understanding of the divide. And I think he also has a lot of common sense about his personality where he wants to come up with the right policies to narrow that divide.”

https://www.thestreet.com/investing/this-is-what-stephen-bannon-was-like-at-goldman-sachs-14063232

There was also this weird case about GS and aluminum prices

https://www.bloomberg.com/opinion/articles/2014-11-20/the-goldman-sachs-aluminum-conspiracy-was-pretty-silly

The article seems to be stating that the aluminum storage business was so complex (thanks GS?) that nobody actually knew what was really going on even GS, so they can’t be guilty of screwing everyone who depends on aluminum. I guess that’s possible. But that begs the question of what else are the parasites at GS screwing up in our economy, whether intentional or not ?

I am SHOCKED to see such behavior from the same people who were recently virtuous enough to refuse (to much acclaim) to underwrite any white male company IPO.

It’s a real shame. The exec’s will have to settle for 80 foot yachts this year, rather than the preferred 90 footers.