As we celebrate Tax Day (updated date for coronapanic) and you add up what you’re paying to the Feds and states, it might cheer you up to look back to this 2019 article from a former Senator and a former top executive at the U.S. Bureau of Labor Statistics, a Wall Street Journal article on income inequality:

Official measures of income inequality, the numbers being debated, are profoundly distorted by what the Census Bureau chooses to count as household income.

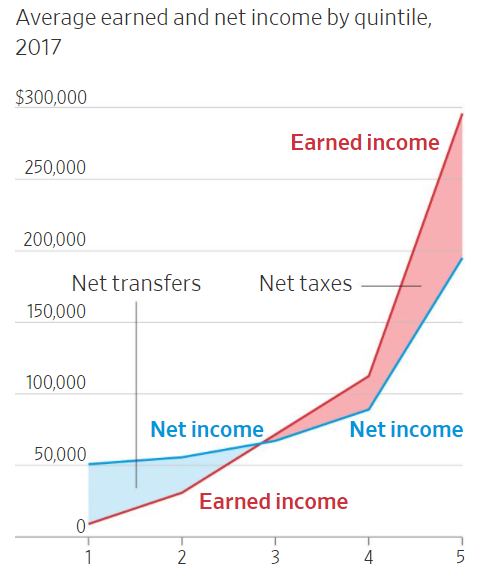

The published census data for 2017 portray the top quintile of households as having almost 17 times as much income as the bottom quintile. But this picture is false. The measure fails to account for the one-third of all household income paid in federal, state and local taxes. Since households in the top income quintile pay almost two-thirds of all taxes, ignoring the earned income lost to taxes substantially overstates inequality.

The Census Bureau also fails to count $1.9 trillion in annual public transfer payments to American households. The bureau ignores transfer payments from some 95 federal programs such as Medicare, Medicaid and food stamps, which make up more than 40% of federal spending, along with dozens of state and local programs. Government transfers provide 89% of all resources available to the bottom income quintile of households and more than half of the total resources available to the second quintile.

Today government redistributes sufficient resources to elevate the average household in the bottom quintile to a net income, after transfers and taxes, of $50,901—well within the range of American middle-class earnings. The average household in the second quintile is only slightly better off than the average bottom-quintile household. The average second-quintile household receives only 9.4% more, even though it earns more than six times as much income, it has more than twice the proportion of its prime working-age individuals employed, and they work twice as many hours a week on average. The average middle-income household is only 32% better off than the average bottom-quintile households despite earning more than 13 times as much, having 2.5 times as many of prime working-age individuals employed and working more than twice as many hours a week.

Condensed version of the above: Your spending power will be roughly the same if you don’t work at all (and therefore don’t have to file tax returns, extensions, estimated tax, etc.) than if you work full time, unless you are a high-skill worker who can command a wage that is well above the median. The article includes a chart from 2017, before all of the Coronawelfare was ladled on top:

Note the flat shape of the “Net income” (i.e., spending power) curve until one is in the top 20 percent. The old sourpusses who wrote the article conclude with a scolding tone:

America already redistributes enough income to compress the income difference between the top and bottom quintiles from 60 to 1 in earned income down to 3.8 to 1 in income received. If 3.8 to 1 is too large an income differential, those who favor more redistribution need to explain to the bottom 60% of income-earning households why they should keep working when they could get almost as much from riding in the wagon as they get now from pulling it.

But, as Cicero noted more than 2000 years ago, “The cash that comes from selling your labour is vulgar and unacceptable for a gentleman … for wages are effectively the bonds of slavery.” Maybe the fact that we’ve created the world’s largest group of humans who don’t work is a feature, not a bug?

(Separately, I don’t see how the above calculation can be done accurately. Many of our brothers, sisters, and binary resisters who receive free housing and/or reduced rent are in private-sector apartment buildings that have been ordered by local governments to provide free or reduced rent. The rent subsidy is reflected in higher rents paid by market-rate tenants, not in a local government’s budget.)

Related:

- A CATO article along the same lines, but with a lot more data

- As demonstrated by Hunter Biden’s plaintiff (in possession of Joe Biden’s cash-yielding grandchild), for an American, the most straightforward path to the highest spending power without working is “Child Support Litigation without a Marriage” (profitability varies tremendously by state, though)

Conversely, “jobs” that don’t pay above $60k (the break-even point on your graph) aren’t economically productive. The “business” owner providing these pseudo-jobs actually profits from govt transfers rather than customer purchases, ie: they are actually in the business of receiving indirect welfare.

What would be the cost if the US government canceled Medicare, Medicaid, food stamps and let nature take its course? Would crime go up or would everybody have to work or die?

Maybe its time for a social experiment, pick your favorite deplorable state and cancel all the communist social programs and see what happens. If the results are economically good, then cancel all the communist social programs across the country. We all know that society is lazy if they are given free handouts. In addition cancel all the corporate subsidies, no corporate communist programs either. Corporations can be just as lazy as individuals if they are given free handouts.

Back in the old CSSR, my babushka used to say, “The government pretends to pay and you pretend to work”.

I would think that this would lead to social unrest. Would you be willing to get carjacked on a routine basis go cut back on the welfare state?

It’s not possible because of the many Federal government programs, to do this test. However it is certainly an interesting thought experiment!

Pavel: I don’t think it is fair to call the U.S. welfare state “communist”. In the USSR, for example, every able-bodied working age person had to work. A Soviet who had sex with a dermatologist wouldn’t be ensured a lifetime of leisure via child support. A Soviet who married the manager of an enterprise and divorced him/her/zir/them wouldn’t be able to harvest alimony for decades. Similarly, the Soviets did not have a concept analogous to our welfare system, except for the physically disabled perhaps. The hallmark of being in the U.S. means-tested cocoon is that there is no need to work (though, of course, it is possible to do some off-the-books work for cash without upsetting the apple cart of free housing, health insurance, food, and smartphone) and that this 100% leisure lifestyle can be kept up for multiple generations so long as dependent children continue to be produced. The American system of transferism is not a variant of communism, at least not if we consider the USSR to have been been an example of communism.

philg: Thank you of reminding about the requirement to work, I seemed to have forgotten that part of my mandatory Canadian University Marx/Lenin course.

In the USSR and CSSR, you could quit your job, but you only had a couple of months to find a new job before you would be declared a parasite on society and sent to the gulag.

Canceling Medicare, Medicaid, food stamps without removing the minimum wage would not work. In order for this experiment to work, would require removing the minimum wage, this should increase the amount of opportunities for any able-bodied working age person to work. With minimum wage removed would also solve the automation taking away jobs problem, the robots would always be more expensive. With the agricultural capacity of the US to feed every individual to 500 lbs weight, the food prices should also go down to a level that anybody working should be able to afford food. Food scarcity is not a problem in the US. Housing prices should also go down, because the inflationary pressure of all the government programs would be removed. The main reason that this will never get implemented is that it would result in a large number of parasite government workers no longer being required.

A note to readers. Paver is a foreigner who has admitted to stealing our election. When will this menace from the north stop?

As far as I can tell, for most people, it not actually possible to quit one’s job and immediately begin receiving $50K/year in benefits. Just to start with, publicly subsidized housing is a lottery and the odds of winning said lottery are very low. From there, many benefits are based on being a single parent and/or over the age of retirement. The benefits readily available to a healthy, working age individual, with no dependent children are pretty limited.

Daniel: That’s not what “Dr” Phil has told us hundreds of times over the last many years. In his view from the ivory tower anyone who quits their job is automatically entitled to, and receives, free housing (always near Harvard Yard even!), food, medical care, internet, Obama-phone, etc. How can California possibly have such a homelessness problem when they all could be living a life of free-loading luxury?

Daniel: I think anyone with a dependent child eventually can get onto the means-tested gravy train here in Massachusetts. You’re correct that a single 30-year-old who lacks the biological equipment for producing a child is likely unable to access these benefits and must continue as a drone worker.

https://www.mass.gov/guides/a-guide-to-obtaining-housing-assistance

is a good starting point.

There are plenty of programs that we no longer call “welfare” for which a childless person could immediately qualify, however. Medicaid, for example (“MassHealth”). Food stamps (SNAP/EBT). Obamaphone. Housing is the tough one as you point out. Fortunately, our wise leaders are going to fix the housing shortage by admitting millions of migrants every year!

(Another way to accelerate eligibility for means-tested (“free”) housing is disability. In addition to getting into public housing sooner, disability means a monthly check. See https://apps.npr.org/unfit-for-work/ for how Americans have figured this out.)