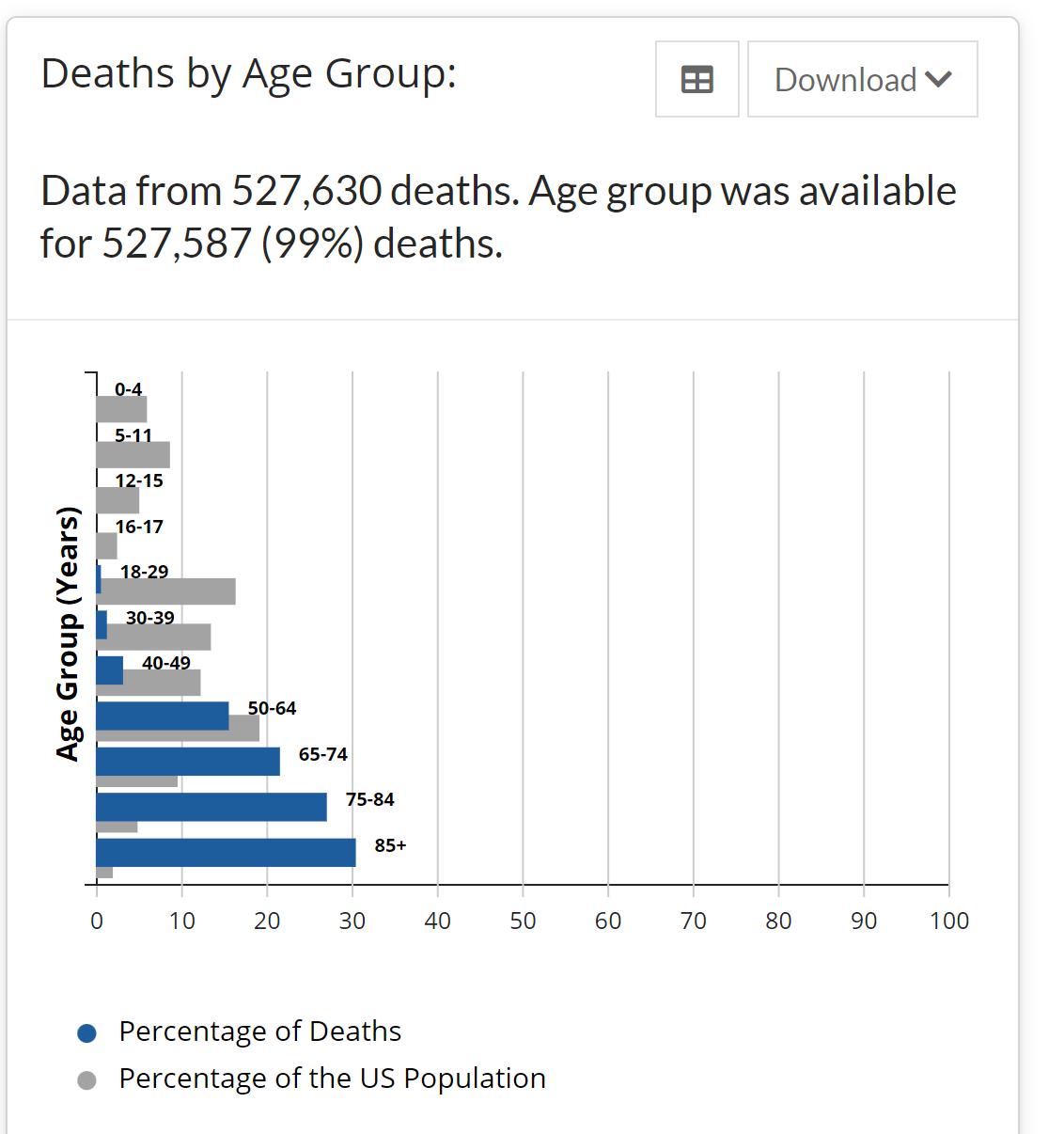

COVID-19 is the world’s greatest source of cognitive dissonance. We are informed by the CDC that roughly 640,000 Americans have died from COVID-19. The same agency tells us that deaths are concentrated among those who are old enough to be collecting Social Security:

Roughly 80 percent of the deaths are 65+.

We are informed by our brightest science-following minds in the media that COVID-19 has been killing people whose best years were ahead of them. Maybe the median age of a death in Maskachusetts was 82, but, absent coronavirus, those 82-year-olds being killed would have lived to 92 and, thus, collected an additional 10 more years of Social Security checks.

What happens to a financial enterprise when the obligation to send 10 years of month checks to hundreds of thousands of people goes away? “Social Security trust funds now projected to run out of money sooner than expected due to Covid, Treasury says” (CNBC, August 31, 2021):

The Social Security trust fund most Americans rely on for their retirement will run out of money in 12 years, one year sooner than expected, according to an annual government report.

The circumstances, which were exacerbated by the Covid pandemic, threaten to shrink retirement payments and increase health-care costs for Americans in old age sooner than expected.

So… our minds are supposed to simultaneously hold the following truths:

- COVID-19 kills mostly people old enough to be entitled to Social Security.

- The average old person killed by COVID-19 was healthy enough to live for at least another 5-10 years.

- Social Security will become insolvent as a result of not having to send checks to those killed by COVID-19.

Unless I am missing something obvious, the human mind is a wonderfully supple device!

Related:

- Sweden will have a lower death rate in 2020 than it had in 2010 (COVID-19 in Sweden, portrayed as a society-ending disaster by our media (including journalists in states such as MA and NY with much higher COVID-19 death rates than Sweden), apparently killed quite a few people who were on track to die in the near term from some other cause)

- COVID-19 is sure to kill you, but life insurance rates haven’t changed (COVID-19 in the U.S. has apparently killed hardly anyone who was healthy enough to pass a life insurance physical exam)

Health insurance companies in Europe are using the exact same sleight of hand and have raised their premiums substantially, all while:

1) People under 70 rarely get sick at all.

2) People put off doctor visits to avoid the plague.

3) Two pharmacies in my neighborhood have closed due to lack of visitors.

4) If it is true that the plague is killing all 70+ people, isn’t a one time 3 week ICU “treatment” cheaper than various medical bills until 95+?

If you had read the whole article and not just the headline your question would be answered

Unfortunately the article is so precious that it does not allow adblockers.

Also, apart from article accessibility issues, the insurance I was talking about is private. It isn’t financed in a pyramid scheme manner (young pay for the old).

Politicos stole SS finds, and now blame COVID-1984 for the shortfall.

Nothing to see here, move along, hamsters.

My understanding is that Social Security depends on investment returns to fund itself, and presumably the economic downturn caused by the “mitigation” measures for the Covid-19 pandemic caused the economic forecast to slow, negatively effecting investment returns more than early than anticipated deaths of Social Security recipients saved money. Presumably this suggests that the excess deaths were likely to have occurred without Covid-19 a relatively short time later. However, the formulas used to compute the death knell for the Social Security Trust may not take into account the difference between an economic downturn based on fundamentals, a cyclic business cycle/Kondratiev wave (a heterodox concept only taught at MIT Sloan, not MIT econ), or an artificially induced pandemic recession. Absent extreme Bidenist policies, I suspect the economy will recover rapidly to pre-pandemic levels, which is probably not anticipated by their economic models, so it might actually be that the modest savings from slightly accelerated deaths may actually extend the life of Social Security modestly.

Can’t believe that “Kondratiev “wave”” was taught at MIT Sloan. It usually was on pages of Soviet newspaper for young communists next to Big Foot at Pamir mountains sightings articles with wise statements such as “each century has youth and adult years”. It was most frequently mentioned during Soviet economic collapse that preceded disintegration.

The choice was between blaming covid-19, systemic racism, and climate change. It made more sense to blame covid-19.

SS is funded by young working people, not by payments previously made by the elderly during their working years.

Retirees didn’t see their jobs closed off by government mandates; the young people who pay into SS did, though.

Younger workers also don’t pay SS out of the enhanced unemployment they received for staying home instead of working.

So, yes, Covid-19 probably contributed to a decrease in SS revenues.

Although the article doesn’t dwell on it, hidden down in the middle it suggests that the shrinking labor force is what’s causing it, not old people dying. The labor participation rate has been lower during the pandemic.

Arthur Laffer pointed out years ago that the government should encourage smoking, in order to keep Social Security solvent. While smokers die earlier, there is scant evidence that smokers use more Medicare resources. Combined with the high taxes on cigarettes that smokers pay, smokers subsidize non-smokers.

It may be that mortality rates among the retired have not risen enough to make a big difference in Social Security payouts, even with COVID, but reduced payments into the system have.

This is just another drummed-up manufactured “news” to raise limit on which social security tax is based, which has been steadily rising.

” 2021 Social Security Tax Limit

Maximum earnings subject to Social Security taxes increased by $5,100

Each year, the federal government sets a limit on the amount of earnings subject to Social Security tax. In 2021, the Social Security tax limit is $142,800, up from $137,700 in 2020. This is the largest increase in a decade and could mean a higher tax bill for some high earners. …”

https://www.investopedia.com/2021-social-security-tax-limit-5116834

Without even reading the article I can confidently guess that the reason is reduced income (presumably from economic lockdown fallout landing on payroll taxes) that more than offsets the reduced outlays you highlight, Phil.

What I can’t understand is why you didn’t grab this low-hanging fruit for a post showing just how bad the lockdown was – it would still be very on-brand for you. Instead you gave us this willfully ignorant garbage.

Your confidence is rather misplaced.

According to the SSA, payroll taxes brought $805B and $856B in 2019 and 20102 respectively, so no dramatic reduction despite the lockdowns.

https://www.ssa.gov/oact/TRSUM/2020/index.html

https://www.ssa.gov/oact/trsum/

“Given the unprecedented level of uncertainty, the Trustees currently assume that the pandemic will have no net effect on the individual long-range ultimate assumptions.”