With tax law and tax rate changes on the horizon, is it time to buy Berkshire Hathaway? Nobody is better connected to the current rulers than loyal Democrat Warren Buffett (he thinks tax rates are too low, but somehow hasn’t ever found that box on the 1040 return where one can make a voluntary contribution to the U.S. Treasury). The complexities of the current tax code have been awesome for Buffett/Berkshire (see “Warren Buffett’s Nifty Tax Loophole” (Barron’s 2015), allowing for near-infinite deferral of taxes due at the corporate level.

Is it a reasonable bet to assume that Buffett/Berkshire will come through whatever happens in Congress and at the White House with less damage than suffered by the average publicly traded company?

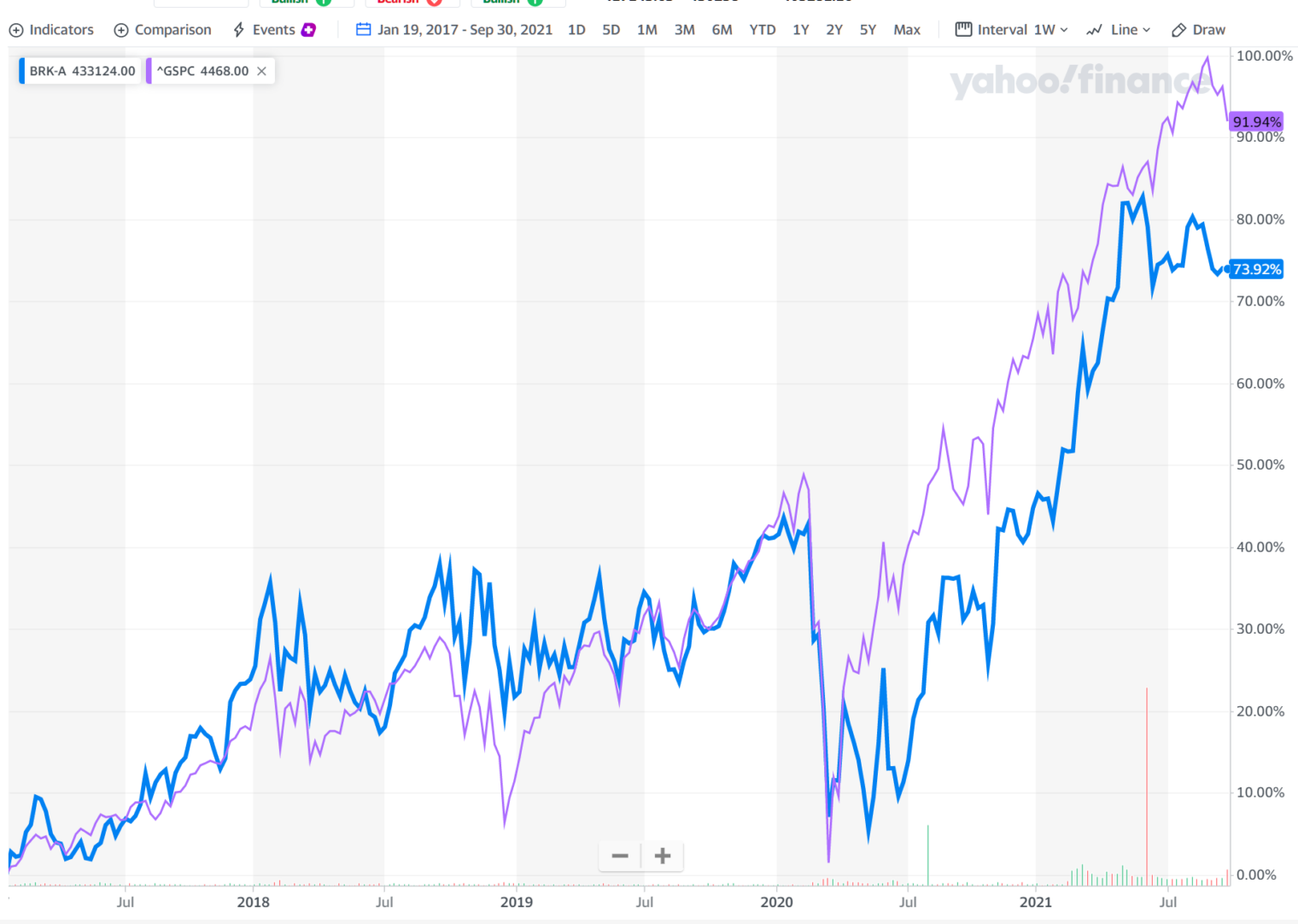

On January 19, 2017, I asked Berkshire Hathaway now that Warren’s friend won’t be in the White House? Under the hated Republican dictator, how did Buffet do? Significant underperformance relative to the S&P 500:

And maybe the situation for Buffet fans is actually worse than the chart suggests because the S&P 500 paid a divided every year during this period while Berkshire Hathaway did not.

How about our friend Toucan Sam?

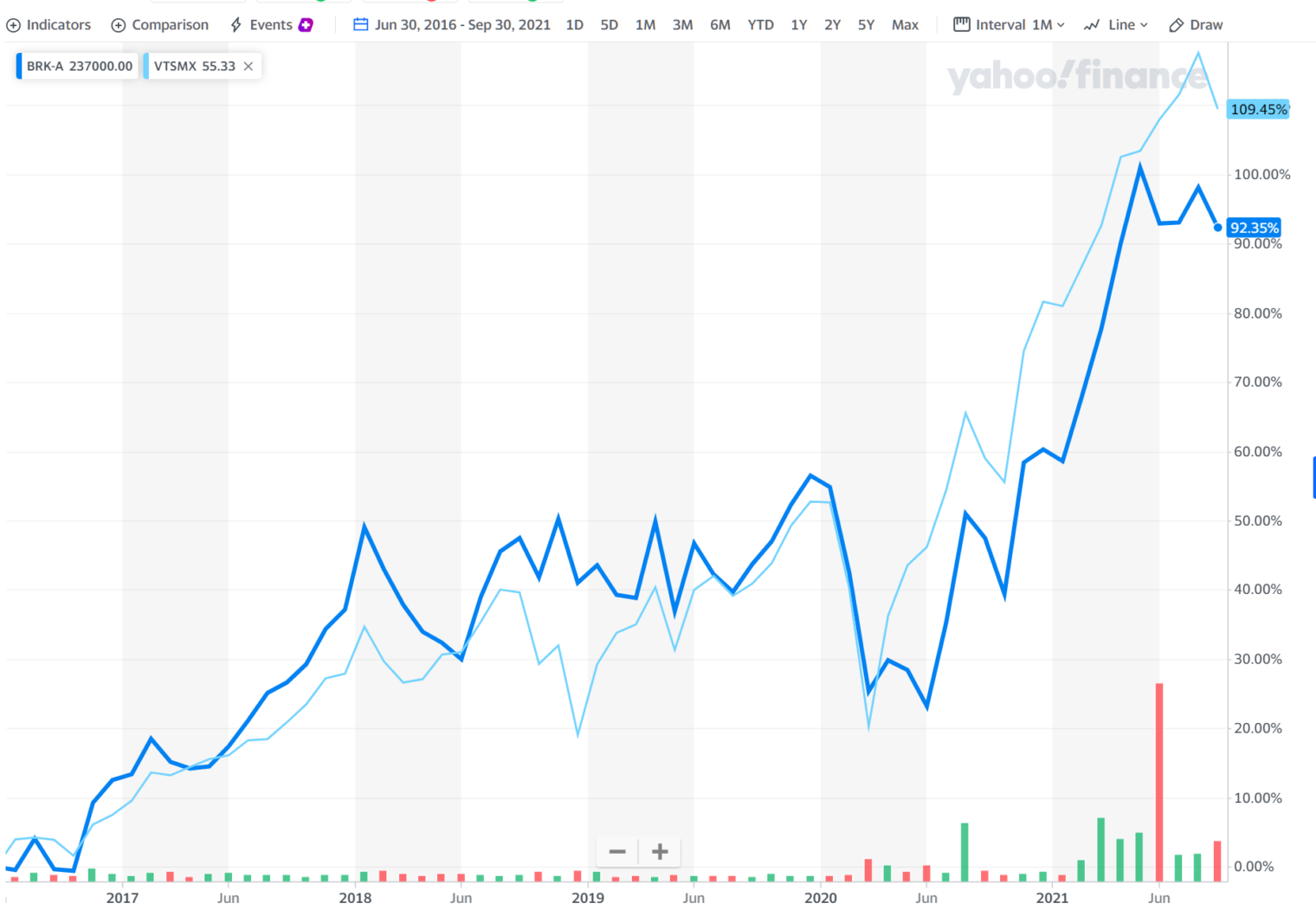

I sold my share because it is my belief that brk.a has a huge cult of personality with Buffet and he will be dead soon. It is hard to say what premium we are paying for Buffet but my guess is around 30%. It is a certainty he will be dead soon and it is a certainty that it will affect the share price so why risk it? I put the earnings from my brk.a sale into a vanguard fund called VTSMX

How did our favorite bird brain do? (He didn’t say exactly when in 2016 he sold, so I picked June 30)

Again, Toucan Sam did better than the chart suggests because the Vanguard fund pays a dividend.

This underperformance by Buffett calls into question Thomas Piketty’s work on inequality, which rests on the assumption that rich people can get better returns on their money than average people. Hardly anyone is richer than Warren Buffett (though sex-with-the-boss-then-divorce-lawsuit family court entrepreneurs MacKenzie Scott and Melinda Gates are pretty close). He didn’t get a better return than someone who put $10,000 into a 401k S&P 500 index fund.

Toucan Sam might have been wrong about Warren Buffett (now 91) being “dead soon”! Even the mighty coronavirus could not fell this tall oak of finance.

Looking at the S&P 500 charts, Covid-19 clearly has been great for the stock market!

Both parties and the Federal Reserve manipulate the market to go up at all times. I don’t think people like Warren Buffett are still needed.

Yes, a share of an S&P fund (IVV) being worth $433 is great (up from $300 before coronapanic)… as long as that isn’t also next year’s price of a Diet Coke. (Same issue with Joe Biden’s and Nancy Pelosi’s $3.5 trillion welfare spending bill plus $1 trillion infrastructure bill. By 2023, those could be what you have to pay to get a Tesla Y delivered in less than 6 months.)

I doubt there will be any Diet Coke available given this rate of inflation. Here’s a debe habere for the anticipated scenario:

“Basic staples like wheat, rice, oats, pasta, beans, sugar, and dehydrated or freeze-dried foods specifically packaged for long term storage are great options.”

https://theprovidentprepper.org/12-ways-to-prepare-to-survive-an-economic-collapse/

Note that neither Diet Coke nor BRK are amongst them.

Dead soon being a relative term! We don’t hear too much about old Charlie Munger anymore. Let’s remember to another post on the subject a year after Buffet finally dies. Vanguard was nice enough to roll my VTSMX shares into to VTSAX, which is an identical fund but has an expense ratio of .04%. I have been very happy now that I no longer buy individual stocks. I am a “MacCready Ring” style investor. When the markets are down I invest at a faster rate than when the markets are up. I have no “exit” plan and buy shares in VTSAX throughout the year. I will say in the last year the buying has slowed to a trickle. I anticipate investing more heavily when the market finally tanks, my guess is starting in November but who really knows!

I once worked for a Berkshire Hathaway company. It was one of the worst managed companies I’ve ever seen. That experience altered my perception of Berkshire Hathaway.

Buffett’s glory days ended a long time ago. The markets now a days are too efficient and BH got too large (in part because it never paid a dividend) so now more or less will mimic the market except that it is probably underrepresented in tech, which has been the place to be for about the last 20 years — which probably explains any underperformance over the last decade or two. Buffett’s record though was astoundingly good up until say the 21st century & notwithstanding his recent record is probably the greatest investor ever. And to his credit, and unlike anyone else i am aware of in the investment business, his wealth comes from his investments not from the fees he charges or salary he is paid — so his interests, including paying as little BH money to Uncle, are aligned with his shareholders. BH trades at about a 30% premium to book. Its premium to book has been drifting lower over many years as Buffett’s longevity shortens. It is probably not an expensive stock now given its high quality collection of businesses — though there is a lot of precedent for companies like BH to trade at a discount to book & it is highly unlikely that whoever controls BH post Buffett will have his skills and alignment of interests with shareholders.

You forgot to mention Buffett’s self-described occasional hobby of playing Bridge with Bill Gates. It’s astonishing to me that the two of them have never had found the occasion to remark on the existence of the 1040’s donation box, despite all of the combined engineering and finance mastermindmanship they bring to the table during their friendly card games.

What also amazes me about guys like Buffett (and to a slightly lesser extent Gates and other moguls I’ve listened to in the past like Ted Turner and Barry Diller) is that they all tend to lapse into a speaking style that is simultaneously as mundane and banal as any seven year old’s, but every bit as profound as we imagine Moses sounded. Ordinary people can say exactly the same words and add another 1,000 so – absolutely zero people listen – but Buffett will say something like: “The global economy this year is going to be more like an tough, overcooked steak with a lot of gristle than a fresh apple pie” and suddenly that’s picked up by every newspaper and talking head in the country and 300 million words are written to decipher what it means. Profound! I’ve often wondered how many tons of CO2 emissions and kilowatt-hours of electricity hang on every word they say.

There is a good point from old Dilbert cartoon: “successful people are not looking for the company”. I would not listen to public speeches of any moguls.

@LSI: Very appropriate. And kind of the opposite thing happened about nine months ago to a slightly lesser luminary, Lawrence Summers, when he was interviewed one morning on National Public Radio and likened the Democrats’ stimulus spending plans to “overfilling a bathtub by leaving the faucet on” and he was just totally IGNORED by the host, who immediately changed the subject back to how crucial it was that they spend even MORE than was being discussed.

I honestly had some empathy for Larry Summers that morning. Here’s this doofus chick from Kalamazoo College on NPR giving him the “talk to the hand” like he was back at Harvard in January, 2006 all over again. The Party Made Him, the Party Can Take Him Away! Lol.

@LSI: And by the way, I’ll tell you from an organizational psych. point of view: a lot of what is going on right now between the so-called “moderate” Democrats and the so-called “liberal” Democrats is a huge personality and culture clash. These “liberals” (as they are called) have *absolutely ZERO* respect or tolerance for anyone who disagrees with their left-wing agenda, including the moderates from their own party. They do NOT CARE how many years these people have been in service, they have ZERO regard for any niceties of seniority or decorum or civility, and they intend to hold a knife to the throats of anyone who disagrees with them. I’ve seen this before.

I think that market has priced in “dead soon” staff. Berkshire Hathaway has younger managers. I would not buy it until inflation has subdued. It can be good hedging strategy against risk though but fairly expensive. Markets are not rational during inflation and money supply expansion.

LSI: The last big inflation run in the U.S. lasted from 1966 to 1982 (and, actually, the run never truly ended by the low-inflation standards of pre-1966; see https://www.macrotrends.net/countries/USA/united-states/inflation-rate-cpi ). So you can’t leave money sitting in cash “until inflation has subdued.” That could be 16 years from now and your money could have been inflated away to pocket change (maybe to $0 if the coin shortage continues?).

If you wouldn’t buy Berkshire Hathaway today, in hopes that Uncle Joe and the Democrats will tame inflation with their #Science-informed policies, what would you buy?

It depends. If you are interested in managing your own portfolio you can buy individual stocks and trade them. If not you can invest in no-load mutual funds and ETF, such as semiconductors ETF. I think regional ETF is to risky as now CPP fainting financial crisis to lower costs of labor and lure back wealthy rich bastards who are now looking to do detailed-oriented work elsewhere.

I would bet on irrationality and money supply expansion and buy hot technology stacks and hedge them with financial stocks. You can mix – buy fiscal technological start-ups. Hedge clowns as Nike. Buy food, beverage and staples stocks as they benefit from cash giveaways, especially big brand names that are under priced. Short over priced woke brands, it works.

You can also invest at preferred rate into any of private wealth management teams that you believe into. But cheaper one are either trailing markets or if low risk provide too low return. But they are good at maintaining sector and regional mix

Meant to write CCP, Chinese Communist Party, not CPP

BRK supposedly resists volatility, so it’s lower during the peaks & higher during the crashes. It also pays a dividend if you get BRK.B.

Warren is a good salesman, which should probably push up its valuation. Warren’s stocks & index funds are basically the same. They’re both managed even though 1 is marketed as an index.

The lion kingdom suspects we’re in another phase of institutions buying in for the long term while retail traders are selling the news about impending interest rate hikes & government default which are never going to happen.

“…Warren Buffett (he thinks tax rates are too low, but somehow hasn’t ever found that box on the 1040 return where one can make a voluntary contribution to the U.S. Treasury).”

I’ve heard this statement numerous times, numerous ways, and it just grows more intellectually disingenuous with time. The analogous counter to this, for all the folks who think taxes are too high, would be to simply stop using government services. If we all did this, individually, the government would surely shrink, and taxes would follow. Don’t drive on any public roads, use no public services, take your money out of all US FDIC insured banks and regulated markets, eschew mail, city water and sewer, the internet, and so on. See how silly that sounds?

I do find it curious that a high percentage of the smartest and most successful, Buffet and Gates, have this view, though. They’ve been there, they’ve done what most others have not, and they’re not buying into the republican fantasy. It’s only the aspirational and far less successful that seem to buy into the trickle down nonsense. Why is that?

“See how silly that sounds?”

What sounds silly to me is that someone came up with the idea that spending money we don’t have without a way to pay it back is a good idea, and that lots of seeming smart people agree with it. Even sillier is that noone seriously discusses debt issues and “monetary theory” during political debates while running for office.

Senorpablo: It seems that your favorite examples of public services aren’t funded by the Congressional borrow-fest (followed by higher tax rates or a massive hidden tax via inflation). They’re funded by user fees that would fall if the Deplorable stopped using the services.

https://www.fdic.gov/about/what-we-do/index.html says “The FDIC receives no Congressional appropriations – it is funded by premiums that banks and savings associations pay for deposit insurance coverage.”

The “public roads” are funded by gasoline taxes (maybe this is why rich people in Silicon Valley love migrants so much; a migrant driving a 15-year-old Camry or Accord pays gas tax to fund the roads used by a Tesla Plaid owner).

Mail is supposedly funded by stamp purchases. City water and sewer are funded by fees to homeowners and landlords (as an increasing percentage of Americans live in means-tested public housing, I guess you could say that these are now funded by Congressional borrowing, but the typical public housing resident doesn’t say that taxes are too high).

The Internet is paid for (at 2-3X European rates!) by users. Maybe you’re talking about some seed funding that the military spent on ARPAnet back in the 1960s and 1970s? That is not comparable to the currently proposed handouts because the military was buying something for itself to use. They weren’t just giving money away as Uncle Joe proposes to do. In any case, if the U.S. military had never wanted a wide-area computer network for itself and no American had ever worked in this area, we would have almost exactly the same Internet today, based on work done in the UK and France (see https://en.wikipedia.org/wiki/Packet_switching#History ).

By contrast, if Bill Gates and Warren Buffet, instead of merely complaining that taxes were too low and the Democrats didn’t have enough to spend, had given $200 billion to the U.S. Treasury, that would have funded a few years of public housing, Medicaid, SNAP/EBT, and Obamaphone for Afghan migrants (let’s assume that there will be 1 million total from this recent batch, once the chain migration is partially complete). Instead the money has gone to Africa (Gates Foundation) without ever being subject to capital gains tax and/or to a family court plaintiff and her team of lawyers (see https://www.wsj.com/articles/melinda-gates-was-meeting-with-divorce-lawyers-since-2019-to-end-marriage-with-bill-gates-11620579924 ; in between those meetings with litigators tasked with maximizing family court profits, Ms. Gates was counseling the rabble on the secrets of a happy marriage: https://people.com/human-interest/bill-gates-wife-melinda-secret-happy-marriage-25-years/ ).

Sam – We don’t disagree on that. It’s worth noting that it was Reagan kicked off the era of massive deficit spending. Republicans love to tell us how lowering taxes always results in more revenue. It’s a wonder we don’t yet have negative tax rates!

Philg – Based on your previous postings, I assumed you weren’t partial to some taxes and not others. Rather, I figured you were an across the board, all taxes are too high, all government is inefficient and bloated leaning fellow. I thought of one more: don’t hire anyone who received a public education.

Senorpablo keeps selling hot air while we with “near-negative tax rates” are working 5 months out of 12 o pay uncle sam, more if you count all local, state, sales and gasoline taxes.

@Senorpablo: Yeah, I remember Reagan’s worst budget deficit – $175 billion. And then it was $300 billion under Bush I. Of course the Polifact Pontificators note that Clinton “got it to zero” with the help of the dotcoms, because Al Gore Invented the Internet.

And Reagan said it was the biggest disappointment of his Presidency. The President doesn’t spend the money, Congress does, and comparing Reagan (or Bush, or any other President’s before Trump’s) budget deficits with what we’re talking about now, which is essentially UNLIMITED deficits according to several Democrat congresspeople, is deeply disingenuous. Congress can’t get drunk, pass out and change its underwear the next morning now without spending $175 billion dollars. That kind of money is barely a rounding error to Democrats now.

I remember reading Tom Toles’ cartoons about how America was being sawed into pieces by the Japanese and hauled off by tugboats with racist portrayals of Orientals and German Biermeisters saying things like “Arigato!” “Dank!” because of Reagan’s deficits.

Where is Tom Toles now on the 3.5 Trillion dollars the Democrats are currently shooting for?

SenorP: I am in favor of some taxes! I like the way aviation fuel and airline tickets are taxed to fund airports. People who don’t fly don’t have to pay! I have advocated here for years for a congestion tax that would declutter our roads and also give the government revenue. Corporate tax is one of the worst taxes in my view because companies can move offshore. Estonia gets by just fine with a 0% corporate income tax. Ireland does fine with 11%. We aren’t smarter than the Europeans and they all gave up on high corporate tax rates.

Alex – please spare us the tired excuses about republicans and spending. Congress does the spending, sure… Why then, when the republican’s held control of all three branches, didn’t they decrease the deficit? The president proposes the budget. It must be complete happenstance that, in recent history, the budget deficit has increased for republican presidents, and decreased under democrats. Decades of data back this up. You’re buying into what most conservatives buy into: talk. Republicans talk an awful lot about things like reducing spending, but they can never manage to actually get around to doing it. Talk’s cheap. Just like canceling Obama care. 70+ practice votes just for show when they were shooting blanks, but when the gun was loaded, they came up empty.

Philg – Congestion tax so that wealthy folks can get more of an advantage over the commoners? I’m guessing you’re not for a normalized, percentage of income style congestion tax? Ireland and Estonia? Were they doing fine before American companies sprang up there for no other reason than to buy a slice of tax haven? Sure, companies can move off shore. And then who will they hire? That’s a race to the bottom. We lower the corporate tax, and then all these other countries follow suit–they’ll always make it more attractive than what we can. Same with other countries lowering their labor and environmental protections. But again, what are Apple and Google going to do with billions of dollars to spend in Estonia? The Supreme court tells us that corporations are people in terms of political contributions, why should they not be taxed as such?

Senorpablo, that’s not exactly true about Republicans in congress, balanced budget that you attribute to Bill C. was actually pushed by than Majority Leader in US House of Representatives Newt Gingrich as part of his Contract with America political program. Clinton fell in line. Even though balanced budget was an accounting gimmick, it was the smallest real budget deficit since “Read my lips” G. W. Bush who manged both tax hikes and as a result deficit hikes. Reagan had to deal with US voter dichotomy, himself prone to dichotomies: his congress was Democratic despite his personal popularity; Democrats mostly spent their efforts on investigating Reagan.

I agree that recent Republican crier Speaker and cheese salesman Speaker lost US for good but there is a small chance of correcting the course. Biden is soft and changes positions under pressure and if faced with principal Republican Speakers in 2022 he could fold and cut budgets. We are now in the spending territory that large budget cuts can be implemented that will not be felt by anyone but cronies of politicians.

Agree on “congestion” tax – they are called public roads for the reason they should be accessible for public. Reach people can always build their own, or fly around.

LSI: there are plenty of public things that require a fee to use, e.g., public tennis courts down here in Palm Beach Gardens (spectacular clay with a country club-grade clubhouse), public airports, as noted above, that require indirect fees (fuel and ticket taxes) and direct ones (landing and parking fees), parking meters for cars, city-owned parking lots for cars, etc. If there is no fee or the fee is too low (parking meters), the result is congestion that makes the item of infrastructure more or less useless.

Senorpablo: It wouldn’t make sense to charge different people on the same road at the same time different congestion fees because you’re trying to charge them for the impact that they have on other people (clogging the road and lowering traffic speed). That’s Econ 101! If a person showing up on the road is going to do $10 of damage to all of the other drivers, you want to charge them $10.01 for maximum efficiency. People moving around may contribute to overall economic activity, so you don’t want to discourage people from moving by charging them way more than the actual cost (including the externality of causing congestion). Right now we have turned ourselves into India (roads jammed all the time) by charging people way less than the actual cost (people pay $0 for imposing a huge externality on others).

Separately, “corporations are people”? I know that is a popular way to summarize the holding in https://en.wikipedia.org/wiki/Citizens_United_v._FEC , but it was actually a First Amendment case. A film had been produced. A company wanted to advertise and then broadcast the film. The holding was that they had a First Amendment right to broadcast their film (and advertise its broadcast), despite the fact that the film was critical of a candidate (Hillary Clinton) in an upcoming election (2008 primaries).

LSI – more elaborate and detailed excuses. I particularly like your take that Newt was the mastermind, and Bill fell in line. Haven’t heard that one before. And, you can diminish Clinton’s balanced budget and reduce it to accounting tricks all you like. But, the republicans have never even come close–and they’re the fiscal responsibility champions! Bush II drove up the deficit, Obama reduced it. Trump raised it again. The happenstance never ends. Those who believe republicans are fiscally conservative are being conned. Stop buying into the words and look at the data.

Senorpablo, you did not follow US Congress during Clinton 2nd term or you forgot. Hard to believe that you could forget Gingrich’s Contract of America – it was huge in all media and newspapers.

Somehow you got exposed to a conspiracy theory that the executive power, ie POTUS ie President of The United States is accepting annual budgets. Sorry to disappoint you but under US Constitution US Congress delegated power of the purse and can fund or de-fund President requests. Overwhelming majority of funding requests are coming from US Representatives and US Senators themselves, i.e. from their lobbyists.

Sorry to disappoint you again, US National debt doubled under Obama https://www.statista.com/statistics/187867/public-debt-of-the-united-states-since-1990 Trump was faced with hardest crisis in post-WWII US history, partially self- made, and even though debt did not rose as dramatically as it is rising now, during supposed recovery. And debt grew under Clinton too, but much slower. You can see on the graph as during first 4 years of Clinton with Democrats in congress debt rose about 20%, huge number by that time and inline with last years of G. H. Bush increases; when Gingrich became the House Speaker growth slowed down and went nearly flat during the impeachment, but not quite.

Philg: Public off the street parking fees are there to raise “revenue” for localities and usually public parking places are always taken, I suppose you do not suggest that in absence of fees more then one cars would park at one spot? Particularly in NYC and out boroughs all parking spaces are taken, whether they are paid or free. I suppose there may be a usage fee to maintain the road but it should not be non-affordable for let’s say top 80% of all earners, otherwise we would live in new feudalism

LSI: https://en.wikipedia.org/wiki/The_High_Cost_of_Free_Parking is a whole book about what happens when parking meters aren’t priced properly! Some excerpts at https://www.vox.com/2014/6/27/5849280/why-free-parking-is-bad-for-everyone

Via the miracle of low-skill immigration, which you celebrate :-), the U.S. is headed toward Chinese levels of population density. At the same time we don’t have a Chinese ability to build infrastructure. So we should expect a lot of things to become yet scarcer (e.g., housing and space on the roads, since we have no way to build public transit without bankrupting ourselves). If people had to pay the true cost of driving, including fees for causing pollution and fees for causing congestion, they would live differently. Some would carpool(!!). Some would move into a city apartment and walk to work. Some would take remote jobs. In my former town of Lincoln, Maskachusetts, they set it up so that each individual household would drive a private vehicle (typically a pavement-melting SUV with a “stop climate change” bumper sticker on the back) to the “transfer station” (formerly “dump”). If people had to pay to use the roads during times of congestion they either wouldn’t drive to the dump until after the morning rush hour or they would vote to set up town garbage pickup so that a truck would go from house to house, thus cutting the road usage for this function by 800X (stat from https://scdhec.gov/environment/land-and-waste-landfills/how-landfills-work ).

Suppose that folks in Los Angeles in the 1950s had been required to pay for the pollution that their cars emitted. Do you think that LA would have suffered decades of smog pollution if people had to pay a smog tax on a per-vehicle per-mile basis (adjusted for the pollution output of the vehicle)? I think we would have gotten clean cars at least 10 years earlier than we did and folks in LA also would have developed their real estate differently, thus reducing the need for so much driving.

Philg, I somewhat share your concerns for the future but do not see point a lot of woulda coudla shoudla. You are looking for some Pay Per View utopia that would save us all akin “intellectual” (university humanities professors) idea of Communism. Your hypothetical place is some other place then real historic USA and I am not convinces that such place could be a viable country of its own.

America used to build fast. Hope USA will be able to innovate again. If not then societies come and go.

Almost nobody lives near their workplaces because real estate is expensive or if subsidized hard to get due to constraints that you are describing. People do account for true costs of living in the city by moving away and subsidize their employers by spending more of their lives commuting for their jobs. Applying your logic employers should pay salaries that allow local living. But many of them would be forced out of business or move out of coastal cities, especially those positioned on small narrow islands. That is some other country, a neverland.

LSI – I understand roughly how the budget and congress work. Also familiar with Newt, who was kind of the pioneer of the polarized and contrarian politics the republicans have perfected today. However, the president sets the agenda, proposes the budget, and has the bully pulpit. Again, you need to look at the outcomes and ignore the rhetoric. If what you suggest made any sense, wouldn’t there be some data to back it up, for example, when republicans controlled all three branches of government? What intricate excuses do you have to explain away those 4 and 2 year periods of time under Bush and Trump? Six full budget terms.

Philg – the fee structure you describe, when you say the intent is to “…because you’re trying to charge them for the impact that they have on other people…” makes no sense. Really what you want, and are describing, is the desire to deter the commoners from impacting the wealthy “producers,” is it not? Because, if you charge people the same amount, you’re only deterring the commoners with lower incomes. People making into the several six into seven figures and beyond could care less what the meager cost is, they’ll pay it without giving it a second thought, because their time is more valuable. It’s zero deterrent to them. Jus like parking tickets are not. These are public lands and infrastructure we’re talking about. And essentially what you’re advocating for, is an inverse progressive access to these things, whereby low income folks have less ownership. What’s next, kick the poor folks off the beaches and national parks, because wouldn’t those places too be much nicer for the rich folks without all the riff-raff clogging them up? What you’re describing is a society in which the wealthily will just continue to accrue massive advantages, in this case time and conveniences for public services in addition to the massive private convivences they already enjoy, at the expense of everyone else. It’s already a massive problem based on present income inequality outcomes. At some point, why would people even bother going to work–when they see generations of their parents working to tread water. What you describe only erodes further the illusion of the “equal playing field” that’s part of the American dream.

Philg, LSI – It seems some crazy socialists have also determined that normalized fines are a better, more just way to hold people accountable for their actions:

https://en.wikipedia.org/wiki/Day-fine

Senorpablo: Pricing an externality isn’t a “fine”. You’re not trying to punish people for doing something illegal. You’re trying to give them the correct signals by charging them the actual cost. If you charge $1 million/mile to a successful divorce plaintiff, e.g., Mackenzie Scott (formerly Bezos), she won’t take the trip to the luxury boutique that, in an efficient market, she would take.

https://www.investopedia.com/terms/e/externality.asp explains the Econ 101 perspective on this. See also https://en.wikipedia.org/wiki/Pigovian_tax

If you really want to hit rich people with pricing that is way above the Econ 101 market-clearing marginal cost price outcome (see https://www.imf.org/external/pubs/ft/fandd/basics/suppdem.htm for an explanation of how supply and demand curves intersect), you don’t have to limit your idea to externalities. You can just charge Melinda Gates $1 billion/year for clean water. She would die without being able to drink water and therefore her demand for water will not fall much despite the higher price. Rich people buy food, so charge them a 1000% sales tax on food.

Your horror at the hypothetical prospect of only rich people being able to use a scarce public resource should already be activated because the hypothetical is real:

https://www.posquare.com/rates-hours/

$40 to park in a city-owned garage! How many worthy poor people can afford $40 to park for three hours? But for Hunter Biden’s plaintiff (see https://www.dailymail.co.uk/news/article-9203029/Hunter-Bidens-baby-mama-engaged-amateur-MMA-fighter-raising-baby-own.html ), this is not enough to motivate her to take her $2.5 million baby on the COVID-infested MBTA. And for a divorce plaintiff who obtained a multi-billion-dollar payday, $40 is not even perceivable.

If you’re like my Deplorable immigrant friend who says “I don’t see color,” you could say “I don’t see movement” and therefore, there is no difference between space for a parked car (the city-owned parking lot whose fee structure you don’t object to) and space for a moving (sort of) car (the city-owned streets where space is equally scarce, but for which there hasn’t traditionally been a price charged). The Econ 101 graduate says the car takes up public space whether it is parked or moving and therefore the public space won’t be used efficiently unless a price is attached to it.

(If economists have been advocating for pricing externalities for 100 years, you might reasonably ask why governments don’t do it more consistently. Instead of taxing cars for the pollution that they emit, thus discouraging people from driving filthy 25-year-old cars 15,000 miles/year, we mandate that brand new cars be clean as they leave the factory. It has thus taken the U.S. 20 extra years to clean up the air compared to it we’d put the tax in circa 1970 like all the economists suggested. (Recently we have had people speak positively about a carbon emissions tax as the right approach to reducing C02 output.)

I think part of the reason is that Americans are not competent with information systems. Writing a regulation to bake a transponder into every car and then figuring out how to track and bill cars is something the government in Singapore can easily do (and they have done it! A primitive system in 1975 and an electronic one starting in 1998), but it is realistically beyond the capabilities of the U.S. But the other reason is political. People like you will complain that poor people can’t afford to retire their 25-year-old smoke-emitting cars and can’t afford to pay for road use that has traditionally been free. The Econ 101 graduate would say that you help the poor person by giving him/her/zir/them cash, not by letting him/her/zir/them use a scarce resource for free. If the poor person gets an extra $5,000/year, for example, he/she/ze/they can elect to spend it on paying the road use prices or he/she/ze/they can decide to alter his/her/zir/their schedule to avoid rush hour travel and spend most of the $5,000/year on goods and services that have more value to him/her/zir/them. But politicians are elected by voters and what voters seem to want is a traffic jam of 25-year-old cars spewing out filth! You’re living proof!)

https://ops.fhwa.dot.gov/publications/fhwahop08047/02summ.htm gives some history of the Singapore system. They talk about the “equity impacts”. One thing that you hadn’t considered is that jammed up streets also make life unpleasant for people riding public transit buses. When traffic is moving at 2-4 mph, the bus is also moving at 2-4 mph.

From the DOT article:

Benefit-cost analysis by World Bank economists in 1978 suggested that the ALS pricing produced net benefits. The estimated rate of return on investment taking into account only the benefits of time savings was 15 percent. Realized savings in operating costs, fuel and accidents would increase the realized rate of return, as would exclusion of the large capital costs of unsuccessful park and ride lots.

Other economic assessments of the ALS program from 1975 through 1988 suggested that pricing not only reduced congestion dramatically, but also kept the RZ mostly free of congestion over the entire period even as the income, employment and business activities were growing dramatically. Thus, the ALS pricing has allowed Singapore to defer or cancel major investments for roads. The savings have been estimated to be on the order of S$1.50 billion (more than US$1.0 billion at current exchange rates).

In the public transportation sector, bus operators increased their revenues due to the significant increase in patronage. According to many analysts, increased ridership and faster speeds have almost certainly resulted in increased productivity of operations.)

Senorpablo, when budgets went nearly balanced (not surplussed as advertised by Clinton people), Bill had anything but a bully pulpit, Monica Levinsky did. Gingrich ran or reducing expenditures, not Clinton. If you have been following as you say you should known well known pattern for reducing government expenditures – energized Republican US Congress coupled with politically handicapped Democratic POTUS. This corresponds to flatter points on the chart 2 years under Trump – combination of Trump and Democratic House of Representatives coupled with partly real/ partly overreaction crisis. G. W. Bush ran on “Compassionate Conservatism” but even his highest debt increases correspond to Democrats taking over the Congress, despite his trillion dollar Iraq country building programme that Democrats did not own but participated in. I would say that risk of this repeating are small as no interventionist Republican can be currently pass party nomination.

On congestion pricing I do not think that finding optimal accessible paying solutions is socialism. Florida is good with managing roads and traffic, you do not suggest that Florida is a socialist state? I do not think that philg gave enough thought to this isue that affects him only marginally . Congestion is because working stiffs are going to/ from work working for not-retired multimillionaires or to/from attractions because they all forced to take tome off at the same days of week. Too bad it interferes with sight-seeing activities of the rich but it is a bit grotesque to suggest to make driving to/from work and for rationed from outside time off to make driving at the same avenues more pleasant for thousands or tents of thousand leisured people.

Philg, if “but it is realistically beyond the capabilities of the U.S. But the other reason is political. People like you will complain that poor people can’t afford to retire their 25-year-old smoke-emitting cars and can’t afford to pay for road use that has traditionally been free. ” was directed to me, lowly SLI, I will wear it as a badge of honor. Maybe this is the reason God put me here. You advocate another version of command and control economy because “this time it is different” Yeah. Marginal poor people do not create bottleneck traffic, under 10 years old Hondas, Toyotas, Chevrolets, Fords , BMWs and Mercedes by working middle class do and mostly at hubs selected by government and rich people and their economists, where middle class forced to commute. And yes , taking someone’s 25 old car without consent is stealing even if compensated. And it does not solve congestion problem.

Singapore is a city with large population and smart technocratic dictator. I grew up in a larger city where I could commute to farthest point in around an hour and without using personal vehicle, this is not unique to Singapore. Singapore population is declining. I do not know why you keep bringing Singapore up discussing all of the United States.

In the world positive perception of the USA is defined more by Detroit or American automobile industry of old.

Charging companies or consumers for an externality is not a “command and control economy”. It is actually a lot less command and control than the stuff that we have done!

Instead of environmental regulation, for example, where you make it illegal to produce a car that emits more than X amount of pollution (with no reward for putting out less than X), you allow freedom for both drivers and manufacturers. A car company that for whatever reason would find it very expensive to reduce emissions below X need not spend those $$. A consumer who needs an unusual vehicle can therefore find it in the marketplace. A car company such as Honda that has superior engineering resources can produce a vehicle that is much better than what the threshold would have been and advertise the vehicle as costing less/year to operate because it doesn’t pollute as much.

Pricing externalities shouldn’t be controversial. If you don’t put a price on externalities then you get situations like a paper mill dumping unlimited amounts of pollution into a river (since it is farms and cities downstream that will bear the cost of the pollution, not the paper mill).

Philg, charging companies and consumers is a form of command and control because in real economic companies and individuals due the charging. And traffick pricing is happening in heavily trafficked areas already without extra government regulation. My observation is that price of parking near work in such areas consists of price of parking in Park of Ride locations + price of state monopolist train ride or market – driven bus and van commute + price of extra time commute in heavy traffic congestion + extra fuel, and all consumers consider extra commute the smallest component of total.

You suggest extra-market mechanism of pricing which is characteristic of all command and control economies. Such mis-pricing is the major reason for decline of all command and control economies. Individual vehicle ownership provides a glue that has kept America economically mobile and viable. Decline in private vehicle ownership correlates decline with economic mobility.

LSI: By definition, an externality is something that an economic actor won’t have to pay in a “real economy”. Just dump the pollution into the river. In the case of traffic congestion, once the average vehicle speed comes down to 2 mph, because nobody was charged for the congestion externality, everyone will agree that it is time for the government to step in. A wise bureaucrat can determine what trips are essential and issue “green passes” for those trips. So if you don’t accept that one useful role for the government is pricing and charging for externalities then, especially in a society that will be growing via immigration, you quickly get to the point that scarce resources become useless and the government is tapped to ration those resources via some mechanism other than price (we don’t want Deplorables to move around and post on Parler, so maybe only those who are registered Democrats can travel Monday-Friday, 7 am to 7 pm).

@Senorpablo,

This isn’t about who spends more, it is about *how* and *where* the money is spent.

A lot of the $ spent by the Democrats are all about welfare programs. such programs interfere with the normal flow of the economy and discourages the poor from seeking to move up in life because those programs don’t come with strict restrictions or limits to get the poor out of the hole that they are in. Such endless spending programs don’t contribute back to the economy to keep the engine going, they drain down the economy impacting everyone except the very very rich, the 1%’er, which is why they are getting richer and richer.

One simple example of many: Democrats want to wipe out rent for the poor and want to continue offering COVID money. This is fine if this was a short term program or with balanced restrictions, but if you keep doing it, you will disrupted the economy big time for a long time. The recent unemployment number speak to this: we have high unemployment high job openings with help-wanted signs are all over the place despite the fact that minimum hourly pay is at $15 and more even for jobs with no skills!!

Another example, not money related: “New Oregon law suspending graduation testing requirement sparks debate” [1]. I understand that this is temporary, for the next 3 years. But how is that a good thing for the poor?

The $3.5T spending that the Democrats are pushing, has a lot of social programs spending that will keep the poor poorer – the spending is not being invested for long term benefit — it is giving money away somehow created out of thin air. As an example, if today I win the lottery, and I spend it all in 1 year, then yes, I’m be rich and happy for 1 year, but if I invest it and spend it over a span of my life, then I’m rich and happy for life. I see this over and over with the poor buying lotter ticket every day and when they win, be it $10 or $100,000, that money is gone in no time: easy-come, easy-go.

Democrats want to win you over using policies that are centered around “emotions”, Republican use “logic”.

[1] https://ktvz.com/news/oregon-northwest/2021/08/13/new-oregon-law-suspending-graduation-testing-requirement-sparks-debate/

Philg, navigable US waterways have been property of US government for the long time and if some companies in the past heavily polluted it with what constitutes poison and bribed political class to keep it this way it is not an indication that we need to transition to micromanagement of daily lives based on perception of bored uninvolved do-gooders. I support universal individual state environmental laws that protect public health – they level playing field for everyone and not directly poisoning environment is an extension of commandment not to murder and corresponding civil laws. Your suggested micromanagement, whether jokingly or seriously, of daily lives of people is an opposite of that, it is not possible in law-abiding civil society.

I do not support CO2 laws – CO2 is not a poison and current shifting models can not be used as a base for generic laws. Science also says that CO2 levels were much higher in the past and biodiversity back then was much more extreme and included giant reptiles . Why modern politicians want to discriminate against tyrannosauruses? We need to work to restore population of tyrannosauruses. How they are worse then wolves?

Philg – we have congestion taxes here in CA in the form of variable priced toll lanes and roads. The public gave up resources so that a minority of rich folks can enjoy a nicer commuting experience. Those lanes and roads are underutilized for much of the time outside of commute time periods. Rich people like to enjoy all the advantages and luxuries they can get. Already, the legal and tax system is highly advantaged to those who can afford lawyers and accountants. In fact, the vast majority of our laws are not applicable or available to perhaps the majority of Americans. The cost to bring or defend litigation is simply out of reach. Justice is blind, but only if you can afford a few hundred grand for a good lawyer. Only slam dunk personal injury cases and the like are within reach, and even then, the lawyers take a huge cut on contingency. Do divorce lawyers also work on contingency? Your congestion tax is just a way for rich people to buy more convenience and luxury that isn’t currently available to them at any cost. And that drives them crazy. What you propose would be such a radical change to the economy, who knows what the impacts would be? One thing is for certain, it would increase the quality of life for the wealthy, at the expense of everyone else. What’s wrong with the free market solution as-is? Don’t like the congestion, move. That’s the typical conservative solution to everything.

George – I think it’s pretty rich that you conclude that welfare programs are the cause of increasing income inequality. That really defies common sense, but is apropos to conservative thinking–blame the deadbeat parasites for everything bad. Also, you speak to welfare, as many republicans do, as if it’s a science and the outcomes are economically deterministic. It reminds me of the war on drugs–which conservatives and republicans were certain drugs would ruin society. Here we are, with many countries and every our own states decimalizing drugs to various degrees, and the sky hasn’t fallen. Likewise, there are plenty of socialist leaning countries whose welfare and even criminal justice polices would make US conservatives absolutely certain of our imminent demise. And yet those countries thrive and surpass us by many metrics.

SenorP: In the U.S., a divorce plaintiff who was smart enough to have sex with a high-income defendant shouldn’t need funding or a lawyer working on contingent fee. One of the first things that a judge will do is order the defendant to pay the plaintiff’s legal fees (depends to some extent on the state; see http://www.realworlddivorce.com/ ).

There are also venture capital structures for family court entrepreneurs in the U.S. See http://newchaptercapital.com/ for how a plaintiff can get funding and “no repayments are required on the funding until the settlement of your case.” Here’s an article for how it can work for plaintiffs targeting high-income defendants in the U.K.: https://www.ft.com/content/e59a97c9-fc53-4552-8f73-52d91641eb01

But in general, I think you’re correct about the U.S. legal system. If a plaintiff who doesn’t work sues a middle-income defendant in family court, the lawyers will take 100 percent of the family’s assets long before the case is resolved. We tend to hear about the cases where the legal system works spectacularly well for an individual plaintiff (see https://electrek.co/2021/10/05/tesla-ordered-to-pay-ex-worker-137-million-in-racial-abuse-lawsuit-releases-blog-about-verdict/ ), but the average person can’t afford to access the legal system for ordinary problems.

Toll lanes with variable pricing will warm an Econ 101 graduate’s heart, of course, but the U.S. is much more deeply gridlocked than just on the highways! You’re living proof that Americans don’t want a society organized the way that economists say is efficient. And I guess you have a point about moving. Florida and Texas are able to build infrastructure. So people who want to find a usable road system can move to Florida and Texas! People who want to share a road system built for 61 million vehicles (1960) with 300 million vehicles (current registered number plus a few more for the Afghan migrants, the chain Afghan migrants, the Haitians that Biden did not deport, the chain Haitian migrants, and the 1+ million migrants who show up every year who aren’t Afghans or Haitians, etc.) can stay in Boston, the Bay Area, Los Angeles, etc. (not NYC, though: https://nyc.streetsblog.org/2020/11/19/congestion-pricing-can-still-happen-in-2021-but-there-are-a-lot-of-ifs-including-president-biden/ )

Do keep in mind that your opposition to congestion pricing means that you’re an advocate for increased CO2 emissions and also smog-producing emissions. Cars sitting in traffic jams spew out plenty of filth without performing any transportation function. See “The potential of road pricing schemes to reduce carbon emissions” https://www.sciencedirect.com/science/article/abs/pii/S0967070X16304061 for a prediction of how your way of thinking will ensure a toasty warm planet. Also https://www.sierraclub.org/sierra/can-congestion-pricing-help-americans-break-their-cars (Congestion pricing reduces greenhouse gas emissions in two ways: Yes, people don’t drive as much, but emissions also dip because people don’t waste as much gas sitting in traffic. “Congestion pricing’s unique contribution to carbon reduction [comes] from the fact that the amount of carbon emissions you get on your trip is affected by the speed at which the vehicle moves. . . . At very low speeds and very high speeds, you get far more carbon per mile,” Michael Manville, associate professor of urban planning at UCLA, said.)

@Senorpablo,

When a welfare program has no guidelines for a way out of the program and poverty, purring more $$ into the program isn’t the answer. We have been in this cycle since 1900’s: create more welfare programs and/or pure more money into existing programs. Biden’s $3.5T economic program has a good deal of the same.

You use decimalizing drugs (I have to assume you mean cannabis) as an example that the “sky hasn’t fallen”. That’s true for the non-poor neighborhood, but for the poor this now gives them easy access to get high to forgot about their misery and thus sink further into poverty. Furthermore, if cannabis isn’t a problem, why all those new cannabis shops are located in poor neighborhoods? And why have laws to limit the quantity of how much cannabis someone can buy?

Philg – That’s pretty nuts about contingency and VC funded divorce cases. It never ceases to amaze me the ways people will endeavor to make a buck. Need your money now? Call J.G. Wentworth! Reverse mortgages, have a life insurance policy? Call Coventry direct!

Economic efficiency isn’t always ideal for society. As an example, I’ve watched the master planned city of Irvine, CA (Safest City in America) develop over many decades and it’s been absolutely fascinating. The level of forethought put into the many decades plan by the Irvine Company is absolutely remarkable. It began in the 70’s, but my experience begins in the 90’s. Wide roads everywhere. Actually, they were unusually wide, but this was foreshadowing. Minimal traffic and no congestion ever. Multi story houses on large lots some condo’s and even apartment complexes–something for everyone. New schools, man made lakes, plenty of parks and extensive landscaping throughout, including tall trees whish are not common is SoCal typically. Large empty lots even on the busiest commercial streets. Open spaces. Even some orange groves and strawberry fields. Something resembling the density of a prototypical American town, it felt like paradise. Fast forward a decade and the once open, green hills are filling up with homes. Strawberry fields too. Traffic lights where there were none. Business begin filling up the empty lots. Roads become more congested. It’s still paradise compared to some adjacent cities, but people who’ve been here all along notice the change. A decade later, some of the massive warehouse sized commercial buildings in the industrial part of town transition to more dense retail or apartments. The remaining empty spaces in town begin to be filled with 10-20 story high rise buildings, other areas get massive apartment condo monoliths that occupy entire city blocks rising 5 stories tall. More traffic, more congestion. Now the streets that were nice and wide seem barely adequate and there are no more open spaces or ridgelines anywhere. If it had been built this way from the start, no one would have moved here when it was just a desolate and remote suburb of LA. They masterfully boiled the frog. They started with something idyllic and garnered a good reputation, which they slowly capitalized on over time, with more dense, more profitable properties, to the detriment of everyone who bought in previous. Not that home prices haven’t increased for everyone over time, but if you were in it for the open roads and spaces, etc, things have changed. All that to say I don’t think it could have been anymore economically efficiently carried out, in terms of Irvine Co. profits. But, that doesn’t mean it’s the best for folks who are actually living here.

As far as CO2 emissions during congestion, many new cars stop the engine while stopped, reducing emissions to zero. Not perfect, and there is some hysteresis, but it’s better than it used to be.

George – For drug legalization, I was referring to cannabis here in the US, but also to places like Portugal, I believe it was, where they have tried decriminalizing everything. Maybe folks that get high are less stressed out and that’s more productive for them. Certainly seems it may end up being less destructive than alcohol. Time will tell. I’ve know a few folks who seemed to actually benefit from it in the workplace. The nordic countries do some things which are even confoundingly progressive to me, especially regarding criminal justice. Sometimes things are just absolutely counterintuitive.

I sold most of my stocks and rolled everything into VTI…the ETF version VTSAX…2 years ago. It has done better than expected. I did keep a few of the biggie stocks…Amazon, Google, etc. Costco, and of all things, Crox (those ugly plastic shoes) have grown as well.

I think Berkshire Hathaway is an OK buy. But, to each his own.

I’d say that wasn’t a bird brained move!