As part of our move to the Florida Free State, I had Everpresent scan a photo album that my mom made in 1966 (she didn’t use acid-free paper so there was no practical way to preserve it other than scanning).

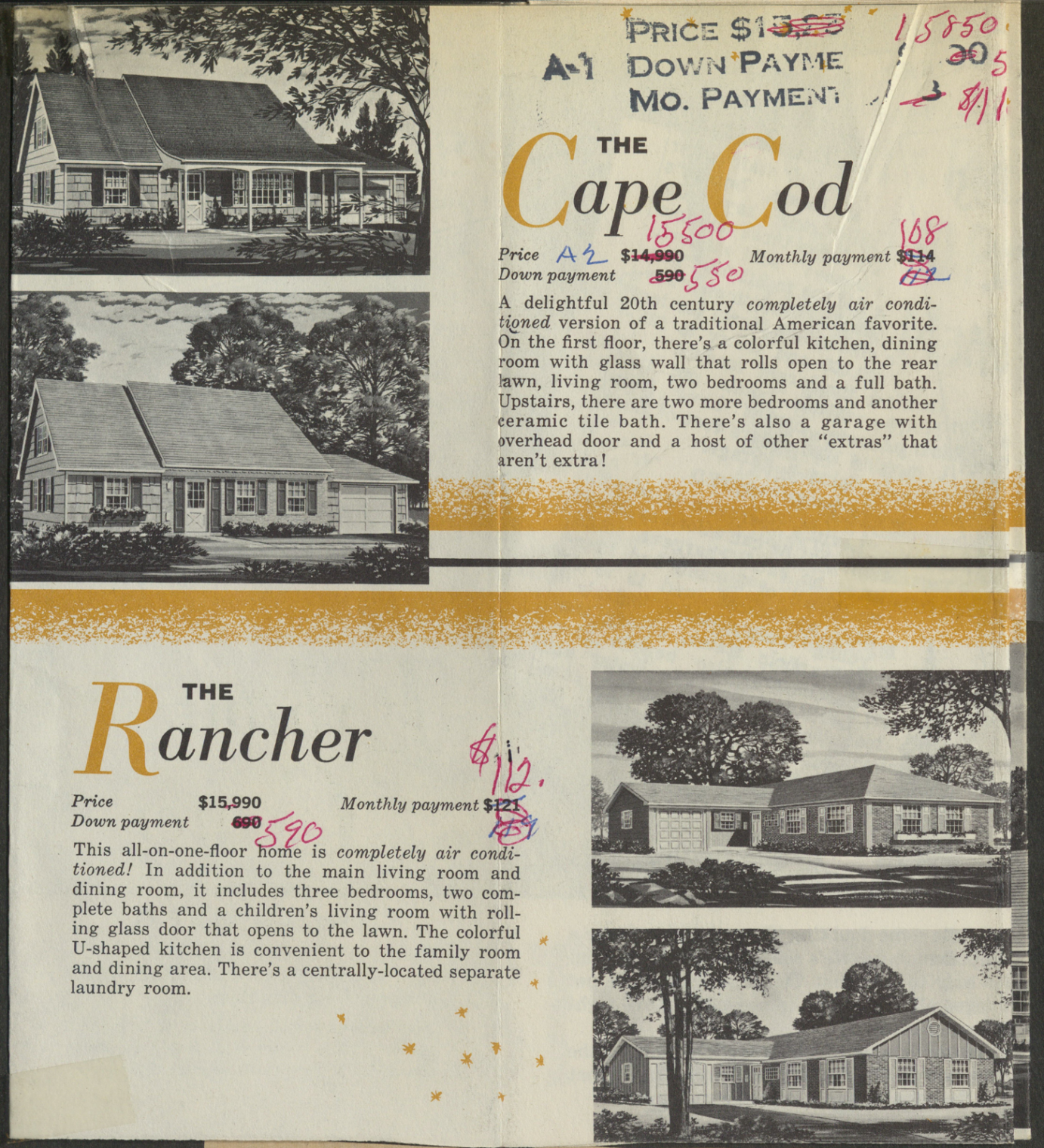

Here’s the air-conditioned brand-new house that my parents purchased in Bowie, Maryland (my father was working as an economist for Census Bureau): $15,990 with $590 down and $112/month ongoing. (Deal was arranged in 1961, but the house was completed and they moved in 1962. It might have been the Cape Cod, actually, which was slightly cheaper.)

Zillow says that the median price of a single family home today in Bowie is about $500,000.

How does that compare to official inflation? $15,990 in June 1962 is worth about $145,000 today says the BLS. So a house is more than 3X as expensive in real dollars, despite the fact that the above (air-conditioned!) house was brand new. (Would $15,990 in today’s Bidie Bucks even pay for a central air-conditioning system (installed)?)

Related:

- “Accelerating Inflation Spreads Through the Economy” (WSJ, 10/13)

What median income was back than? How much did government economists make?

Looks like a GS11 was making $9,000/year back then. So the house cost less than two years of salary. https://fraser.stlouisfed.org/files/docs/publications/bls/bls_1444_1965.pdf

Mortgage payment would have been 1/7th of monthly pretax income.

When I bought my house I took paid including mortgage a little less then 2 times of my income back then. Interest rates were not optimal but initially I paid about 1/8th of my pre-tax income in monthly mortgage which shows that mortgage rates were higher back in 1961. I did not buy houses that I looked at in my first area of choice because they were 2 to 3 times of my than income. Although my income since has gone up (not much but significant amount comparing to my income back than) and after refinancing I am paying significantly smaller portion of my pre-tax income in taxes and houses at the place that I skipped appreciated more then my current house I am not sorry that I did not buy my first choice back then. Property taxes there are through the roof and would significantly exceed my mortgage by now and the place is now under dictatorial blue state mandates that started several years back per-coronavirus and there is infighting in local township every time properties are re-evaluated for taxes.

Wow, a house for (less than) a whole house A/C or even car payment (well, now)! In 2009, I put a Carrier A/C + heat pump + backup gas furnace with all new ductwork in my last house for about $17K (it was a lot of work, including adding the basement as a zone [which had been all-electric baseboard before that] as well as fighting with the town building inspector about “stretch building code” compliance). In 2018, at this house (smaller), $18K paid for a top of the line 5-head Heat Pump system (share a 48K BTU compressor). Another $18K for a top of the line 6KW solar (18) panel array to offset some of the cost of moving off oil/steam (still present for cold weather backup). Might pay for itself within 6 years (might have been 5, but Summer sunshine was lacking for much more of July than typical).

It looks like this document captured start of consumer price inflation. Printed price crossed over and higher price is written over in red link.

We have systematically destroyed the concept of upward mobility in this country. Now we are in the process of systematically destroying the rest of it.

The BLS says its only worth $145k because the CPI (ie: “inflation”) calculations exclude housing + food + energy (who needs those, right?). Those prices are excluded because they are “too volatile”. That allows politicians and the Fed to tell us what a great job they are doing in limiting inflation, while reality says otherwise.

This is exactly right. Government inflation numbers are fairy tales. I believe this is well documented in South America, why should the US be any different?

Even without the intentional understatement by official government sources, my personal inflation rate is much more important to me than the US inflation rate overall. Houses and steaks are cheap in Omaha, but this doesn’t do me much good, living in California.

As anonymous noted, the official inflation is a government lie. To get a better idea of the change in price, I looked up the price of gold in 1962: $35.23/ounce. That means that in 1962 the house cost about 453.87 ounces of gold. If we multiply that by the price of gold today, we get a little over $800,000. So, a house in that town actually costs significantly less on average now than it did then.

Of course, that’s on average. Maybe that particular house was much nicer than average. Wasn’t air conditioning still not universal in 1962, especially in colder climates?

The median house today isn’t new. A new-construction single-family home today in Bowie would probably cost at least $800,000 (though I am not sure it would be directly comparable since standards for insulation, etc. are higher and it would probably be bigger).

When searching for embedded computing modules, not surprisingly there are no embedded computing modules in stock, but more surprisingly the prices for back orders are being held unnaturally low. Maybe they’re trying to capture business with non existent inventory by offering low prices. To actually buy any computer now, you’d have to pay 10x last year’s price.

It would be interesting if someone tracked annual world computing power. The world computing power today is probably lower than it was 2 years ago, for the 1st time in over 2000 years.

My parents paid $3700 for a 3 bedroom house in the early 1950s. My siblings and I sold it in 2018 for $759,000. My Dad was a commercial fisherman and never knew how much money he would make..but he did ok.

I don’t see how he could have done it in today’s economy. This was in the port of Los Angeles area.

In 1967, my father earned $5000 annually a draftsman for a large MA government defense contractor, and purchased his first home for his growing family for $15,400, thirty miles north of Boston. Built in 1900, a 3-story, 2-family, wood frame, 3000 sf, detached 2-car garage, unfinished stone-foundation basement, no A/C, on 0.6 acre, on a cul de sac in a nice quiet neighborhood. Very good school system (at the time), plenty of jobs, and a not unreasonable (at the time) commute to Route 128 tech companies. The rent for the first floor apartment paid the mortgage for thirty years. My Mom sold the place in 1997 for $135K. Zillow lists it today at $550K and the pictures look great!

Ten years ago, I was back in MA, and went by this house, my childhood home. The guy that bought it from my mother in 1997 still owned it and gave me a tour.

Philip’s sister here. Had our parents bought a $15K bungalow/fixer-upper in 1962 in the northwestern Maryland suburbs or even Fairfax/Arlington counties VA to the south of DC, instead of being worth $500K today, it would have appreciated well above $1.2M, probably. So location, location, location in real estate remains a big driver. Our parents sold this Bowie starter home when they desired better public schools for their young children, and then paid $36K for a 4 BR 1.5 BA Cape Cod in Bethesda, MD, in 1966. The buyer in 2012 when our parents moved to a CCRC (where our widowed mother still lives) paid $800K, essentially for the land value as the modest scale of the home was no longer in vogue. Razed our family homestead to the ground, and built a McMansion with at least 3 BA. According to immediate neighbors, the buyers were so “house poor” for over 5 years that they had no furnishings, and did no landscaping (most of the mature trees were collateral damage for the larger footprint house). In Bowie, Maryland, our parents enjoyed a lot of the neighbors, including a number of U of Maryland professors who became their lifelong friends.

In 2017, I put a mid-range 4-ton central AC in my FL residence for $4700 (+$700 for the 10-year extended parts & labor warranty).

In 2020, I added a 3-head ductless “mini-split” system to the home to be able to spot cool two second floor bedrooms and a 300 sf media room, all with a southern exposure – $7200 (plus $700 for 10-year parts & labor warranty). Works great, and saves me about $30/mo on electric costs. At that rate, it’ll pay for itself in just 22 years!

Four months ago, I installed a 2-ton central AC in my rental condo at $6200 (incl. 10-year parts & labor warranty).

In the past 48 months, I’ve spent nearly $20K on AC equipment!

It’s likely because of usury and interest.

Lol