I met a real estate developer in Sarasota who said that his specialty of buying “Class B-/C+” apartment buildings on behalf of investors and lightly fixing them up no longer made sense. “A year ago, I was paying $60,000 to $70,000 per door and now it is $130,000 or more,” he said. “I can build something new for about the same price.” (These are buildings with at least 40 units.)

Why didn’t he buy the fanciest buildings? “You don’t want to buy in the ghetto, but these buildings are like a Toyota Camry,” he responded. “Even if the economy turns down, there will always be a market for a Camry.”

If used apartment buildings are about the same cost as building new, doesn’t that suggest that the real estate market is near a peak? I say “Yes” because (a) new is better, and (b) there is still a lot of land in the U.S. The developer, who surely knows more than I do, says “No.” He expects 3-5 more years of 20 percent annual inflation in SW Florida until prices reach parity with California. “People are moving here every day from California and also from Miami,” he said. “They want to get away from taxes in California and from the crazy congestion in Miami.”

Readers: Is there anything special that happens to the real estate market when used buildings being to cost as much or more than new buildings? Am I right in thinking that the curve will flatten? (after only the first 2 years of 14 days!)

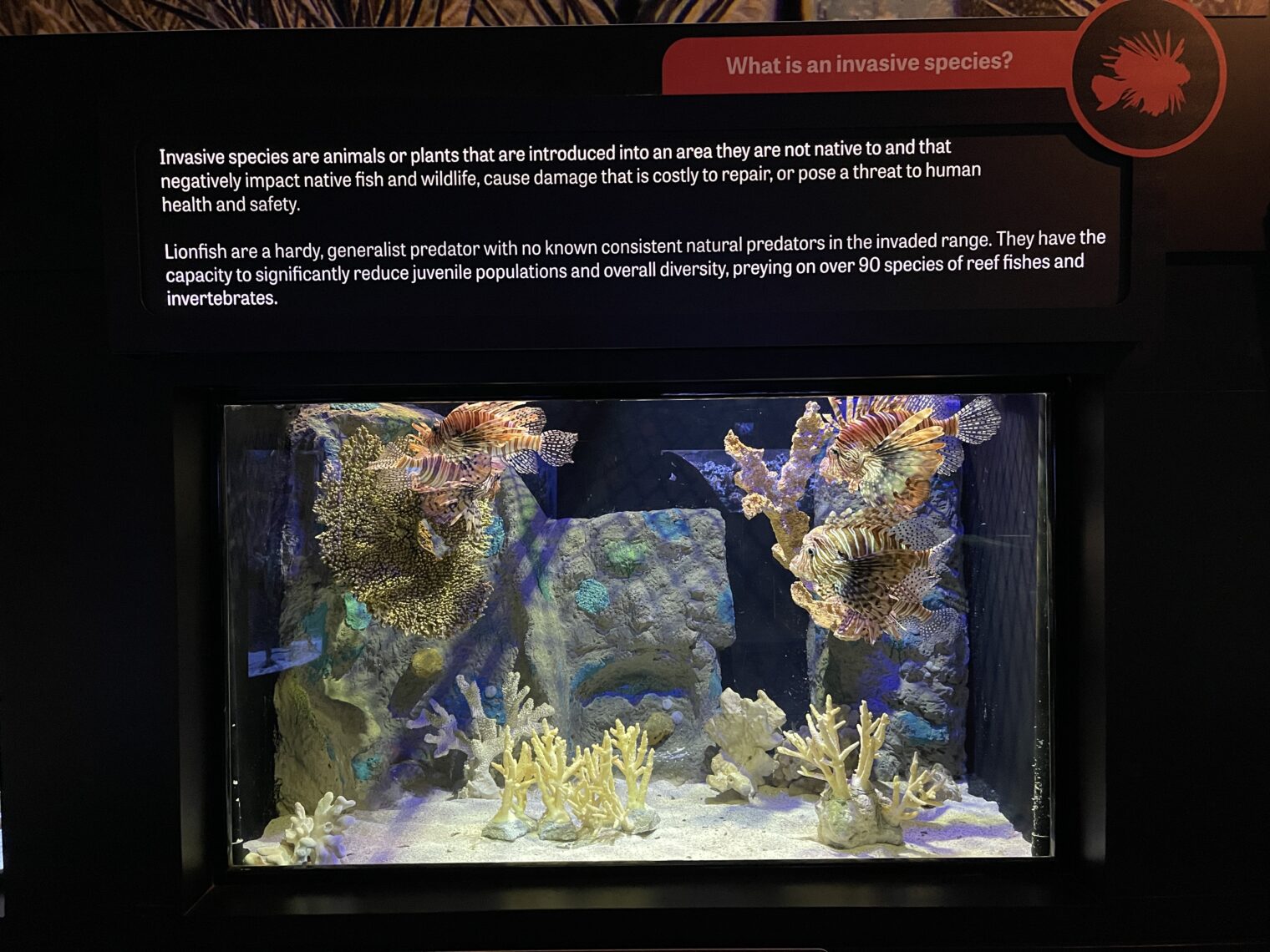

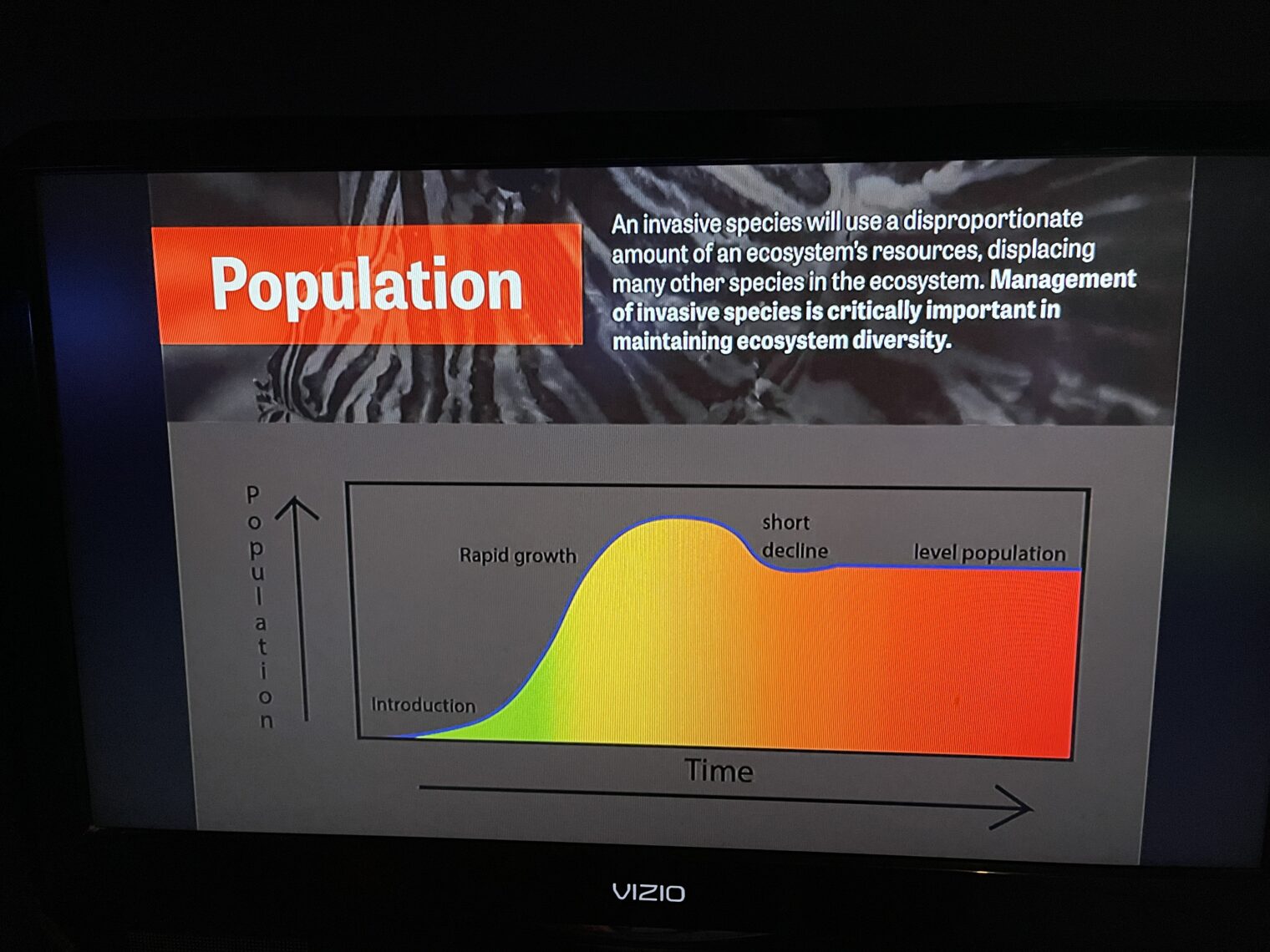

The Mote Marine Laboratory & Aquarium reminded us that invasives will displace a native population.

It depends on where the old buildings are located. Usually they are in the best locations. You mention that there’s enough space in the U.S., but do you get the same views, parks, forests, distance to city center, etc.?

Also, modern buildings are often built in an inferior manner.

[I love the invasive species pictures, please keep them coming!]

“about” is the cue here. Costs of building new ballooned with raw material and labor costs and there is not much premium to charge renters for age of an apartment building. Would be strange if price of existing units did not catch up to the price of new units when demand is strong.

Meanwhile, the media says no-one is leaving Calif* & we’re not hiring anyone outside Calif* even though we’re completely remote. Every software company is also a real estate company for the investors.

Pretty sure the cost of building is staying way ahead of the cost of buying. This real estate boom is because of money supply rather than demand. Home equity is paying for the $2.2 trillion CARES act. Anyone remember that one?

The trend in my city is converting old commercial space into new residential housing. With covid, zoom calls, and working from home there is 30-40% vacancy in office towers. Several projects are under way converting 30 story class-B buildings into $700+/ft condos.

Isn’t what you describe just a price signal that the housing stock is too constrained or small? Presumably old stock is bid up because the cash flow prospects support it. It sounds like a great time to be building a new building because it’s going to be worth more than you spent building it on day 1, right?

#RealWorldDivorce Here’s one for the record books:

Russia’s 2nd richest man faces $7 billion divorce claim in London, despite already being divorced in Russia 7 years ago (where he was originally married in 1983).

https://www.zerohedge.com/markets/russias-second-richest-man-faces-7-billion-claim-divorce-court

That’s a great intro!

“Jeff Bezos, Bill Gates, pretty much every prominent hedge fund managers in the past 5 years, and now Vladimir Potanin, Russia’s second-richest man, confirm that the best investment someone – presumably a woman, but in these gender fluid times anything goes – can make in this bizarro world is a stinking rich (soon to be ex) husband.”

——————-

Fighting about where to fight (“venue”) is covered in http://www.realworlddivorce.com/Relocation !

The UK is definitely one of the world’s best locations for family court entrepreneurs. After a year of marriage, a plaintiff can collect half of the target’s premarital assets. Prenuptial agreements are generally not enforced. The real question is why so many people in the UK bother to work. The potential profits from sexual relationships, including 15-minute ones (child support is unlimited in the UK), are far larger than from wage labor.

“Potanina made London her permanent home in 2017.”

I wonder if the male part could make Saudi Arabia his permanent home and sue for divorce there.

Natalia is stepping up economic sanctions on Putin’s inner circle in lieu of week Putin’s puppet Biden impotency.

China has managed to beat us yet again at our own games. Real estate giant Evergrande is rated as going bankrupt:

https://www.nytimes.com/2021/12/09/business/china-evergrande-default.html

“The firm, Fitch Ratings, said in its statement that it had placed the Chinese property developer in its “restricted default” category. The designation means Evergrande had formally defaulted but had not yet entered into any kind of bankruptcy filing, liquidation or other process that would stop its operations.”

I am no real estate expert or analyst, particularly among the wealthier cohort of new arrivals in Florida, but I will say a couple of words regarding desirability and property values of new vs. old properties:

As the first @Anonymous in this thread points out: “It depends on where the old buildings are located. Usually they are in the best locations.”

This is important, and in a place like the one where you live, it’s an unavoidable consideration. The places sitting on the best land with the best views and in the plum locations could remain very valuable as rehab properties for a long time, particularly if the municipality has strong zoning laws and a group of people who don’t want to see their neighborhoods cluttered up with new construction.

On “new” vs. “rehab.” I once lived in the tallest all-rental apartment building in the world, in Chicago. It went condo and all the units were rehabbed to the new specifications and in photographs and on paper they were beautiful. However, the building itself was a product of 1960’s engineering and because it was 1) Very tall and 2) Presented a great deal of surface area to the winds it had a habit of bending and swaying in the breeze. You used to be able to watch the water in the toilet bowl slosh back and forth in high, gusty Chicago winds. Also: the building had an integrated chilling/heating system that served the entire building from a central location deep in the sub-basement. The windows were all old, 1970s vintage at the latest, and even with the best updates they could do, they were leaky and drafty.

So after the rehab, you got a great-looking condo. with all the amenities in a fantastic location with great view BUT the building creaked like an old rusty hinge in the wind and you could feel it move.

The ONLY benefit of the old construction was that the sound insulation and isolation properties were *superb*. The walls were thick and solid. You could NOT hear your next door neighbors romping around with a pop-up electronica party, or any other kind of romping they might be doing. You couldn’t hear the people upstairs marching across their floors like elephants. Too many new construction buildings lack that kind of acoustic solidity.

So it was a mixed bag. You got some things over here, gave them up over there. If you could live with the few days a month when the building was creaking through the night and could put up with the slightly drafty windows, you loved your new condo. Caveat Emptor!

https://www.pptcondos.org/

If I was forced to be a betting man, I would say, however, that my general theory of the continued stratification of the U.S. into a third-world-esque country would tend to indicate that there is still significant upside pricing room in the real estate market, for several years at least, in good locations like the one you’re talking about. Particularly if the economy goes to hell, people are going to want to park their money someplace NICE.

BTW: On the “all-building” cooling/heating system: One year I lived there, the chiller in the sub-basement *failed* during the first week of July, IIRC, knocking out the air conditioning in all 900+ units of the building. The only chiller with enough capacity to service the building was a *spare unit* from one of the Twin Towers in New York City, which had to be flown out to Chicago on a 747 cargo plane and then trucked WIDE LOAD in a convoy from the airport.

A huge hole was dug next to the building and one of the walls of the sub-basement was basically cracked open so that the old chiller could be cut into big pieces and extracted and the new chiller could be lowered in there and installed.

I knew the property manager at the time and he aged a few years in a week, which was how long it took for the small army of structural engineers, civil engineers, HVAC engineers and workers to accomplish the heart transplant. Luckily, the summer weather was very mild in Chicago that week with daytime temperatures no higher than 75 degrees and night time temperatures in the low 60’s, so none of the elderly renters in the building had too much trouble with heatstroke. He still had an on-call, on-site paramedic crew and a few people wanted to stay in hotels while the noisy work was completed, particularly on the lower floors. Fun days!

Wow! I live in army barracks converted to condos. Heat / air-conditioning comes from one vent per room retro-fitted to the ceiling. Doesn’t make for even heat.

I was under the impression that real estate functions, in practice, as a monopoly. While the desirable places to live do change over time, at any given time, either you suck up the price increase for living in a desirable place, or you like somewhere crummy, or you live somewhere nice but you are stuck with a big commute. So actual land availability means nothing in practice — who wants to live in a nice place and commute two hours each way for work or to go to the art gallery? there is a reason why rural folks are ‘deplorable’, and it is because of their deplorable indifference to moving in condos in town so they can keep up with the cultural life of the intelligentsia. They might live somewhere nice, affordable, and have short commutes for work, but they are far from the art gallery, so…

If remote work persists it might have a reasonable impact on this whole story, but it is too early to tell.