Chatting with some pilots and aircraft owners this evening, one mentioned that he’d ordered an $18,245 Garmin 750Xi. This has some computing power, some flash memory storage, a touchscreen display (926×834 pixels), a GPS receiver, and two radios that can operate on a range of VHF frequencies. In other words, all of the same things that you get when you buy a $200 Android phone (except that the phone has higher resolution and the radios operate on higher frequencies).

What’s more painful than paying $18,245 (plus installation!) for this basket of capabilities? The retailer quoted him 9 months for delivery.

You’d think that if there are people willing to pay $18,245 for what is mostly a 10-year-old box of electronics that Garmin would cheerfully deliver a container load of them tomorrow. There are huge development and FAA certification costs for most things in aviation, so every additional sale should be great from a marginal profits perspective. The crypto miners aren’t buying the same chips that go into an airplane GPS. I am doubtful that any TSMC 5nm parts are in there. Why can’t Garmin harvest the fruits of its certification labor?

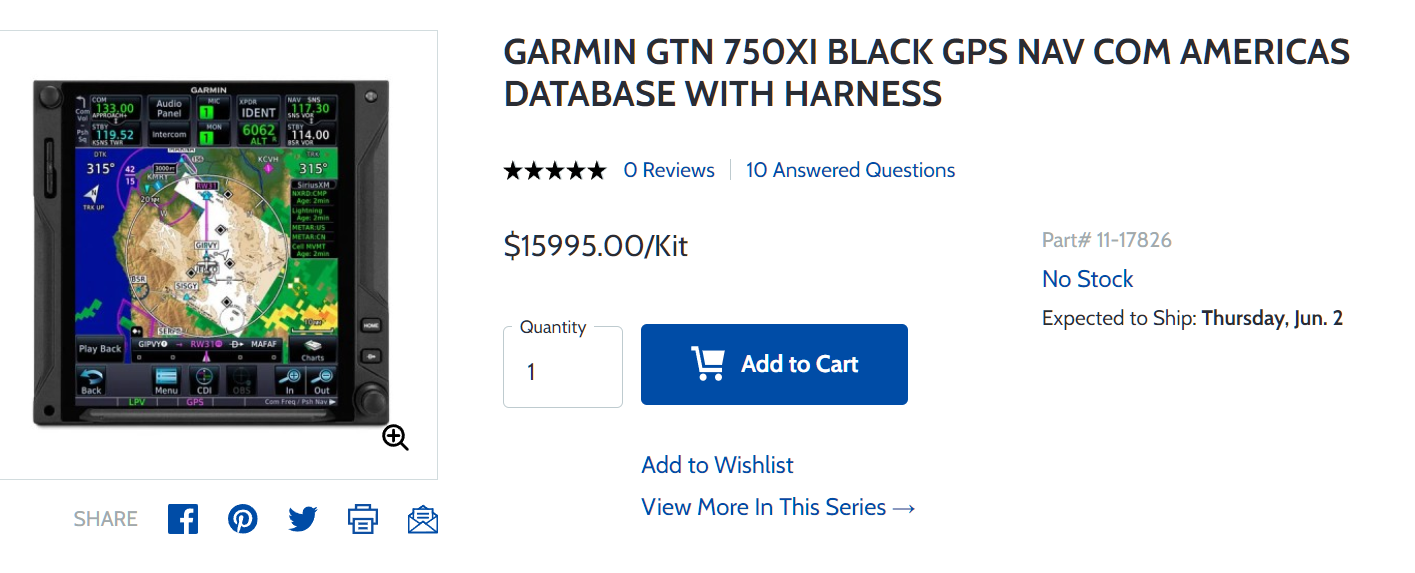

The lack of supply was confirmed by checking Aircraft Spruce, which sells a slightly different package for experimental aircraft: “no stock” and with an expectation of shipping June 2.

It can’t be that there was a huge surge of demand for these items. There weren’t suddenly a lot more airplanes built in which to put them.

Related:

- “Global Supply Chain Issues Reach Aviation” (Fall 2021): Legacy Aviation Service’s RJ Gomez said a big Garmin retrofit provides a good example. The shop quoted a $200,000 upgrade, and he said the customer was pleased with the quote except for one major problem—Legacy couldn’t get the units delivered for between four and seven months.

- Is inflation already at 15-30 percent if we hold delivery time constant? (i.e., how much would we have to pay to get a Garmin 750Xi delivered next week? $30,000?)

FAA is absolutely the worst thing which befell aviation. No crash or mid-air collision even comes close.

One of the narratives for the chip crisis in the car industry was that foundries like TSMC prioritize higher margin chips (AMD Epyc, graphics card chips), so the low end has to wait. I presume that Garmin is using some old Pentium design or similar.

And of course, many virtuous rich people, who tell us in public that we should use energy saving light bulbs and use public transport, are buying private jets in order to escape government tyranny:

https://www.reuters.com/business/aerospace-defense/booming-private-jet-market-stretches-rich-buyers-climate-clouds-gather-2021-10-21/

I suspect just the software that runs the thing cost about $15-20 mln to develop. Then hardware (I suspect it’s not available to do total wipeout on FPGA market and the thing does use FPGA to support multiple communication interfaces in the airplane). Hardware development and testing of this thing probably run another 3-5 mln. Certification addes another $2-3 mln. Then one once to make profit on very limited aviation market puls support warranty. Hence crazy cost.

Anon: Why can’t Garmin outbid a car company? The GTN 750Xi costs almost as much as a car, but it doesn’t have any expensive materials or mechanical components. So Garmin should be able to pay way more than Ford for a chip and still make a good profit. If Ford can still make cars, why can’t Garmin make these boxes?

Phil if we follow you logic than aviation division if Garmin should be super profitable and propel whole company forward. Which I doubt is the case…..

philg: Epyc 3 processors can also cost up to $10,000 and were hard to get for individuals. I agree that one should think that Garmin could offer a 5000% premium for their (probably) obsolete-but-certified chips and still make a huge profit. But what does it cost to switch a production line from Epyc to Pentium III? Is 5000% enough for TSMC?

Aviation is a surprisingly large part of Garmin and yields a gross margin of 73% with an operating margin of 26%. See https://www.businesswire.com/news/home/20210428005224/en/Garmin-announces-first-quarter-results

I would have expected aviation to be a rounding error, but it is bigger than automotive and more than half the size of fitness.

It is 8%! And declining…. I bet biggest margin is database subscriptions.

If the things are as described in this post what stops aviators to glue on $30 cevlar holder for $200 Android phablet and use it instead of Garmin avionics while keeping old avionics to satisfy the rules?

What’s worse than paying $18,245 for $200 of electronics? The answer is simple! It is worse to pay high subscription fees to Jeppesen which just takes tax payer funded navigational data then reformats it and charges millions of dollars for it!

Aren’t there a bunch of analog interfaces that are included in the price? For example, doesn’t the system need to be able to interface to various types of autopilots, Nav instruments, Comm panels, etc? I don’t think it’s too analogous to a $200 Android phone.

The Android phone has a USB port and what it does with the radio is much more sophisticated that the analog AM modulation/demodulation that the Garmin’s radio does! (see https://en.wikipedia.org/wiki/Airband )

So, you’re right in that more wires come out of the GTN 750Xi, but the overall machine is much less sophisticated I think. Consider that the Android phone has Bluetooth, NFC, and WiFi, for example.

Phil’s I doubt you want to use those wireless interfaces in airplane. I defiantly won’t. Doing instrument approach at night only to find out that wifi got dropped as it happens with even iPhone.

As you probably know making reliable things is not trivial business. And definitely does not come cheap unless it scales nicely.

I’m no aviation person so I know noting about the cost or the market for Airplanes, leave alone private planes, but here is my thinking and I would like to see if my logic holds.

Such sensitive parts are expansive because this is a niche market with limited customers, limited needs and a very difficult field for companies to step in. The FAA regulation alone is enough to keep companies out of this business thus there is no Chinese counter part in play. As far as I know, the FAA regulations is far more strict then FDA regulations even when it is a fact that far, far more people die from food and drugs vs public and private planes. So Garmin sees this and capitalizes on the opportunity, not to mention, how many units does it sell a year to keep the price down and profitable?

Question: what’s the cost of this unit in other countries outside the US, such as Canada, South America, Europe, Africa or Asia?

Aviation is a surprisingly large part of Garmin and yields a gross margin of 73% with an operating margin of 26%. See https://www.businesswire.com/news/home/20210428005224/en/Garmin-announces-first-quarter-results

The GTN 750Xi is a niche product, but that does not mean the components inside are niche or exotic.

Phil, only 26% margin then according to you it should be 100% or at least 42% as an Apple does.

Alex22: I think that the gross margin number (73%) is the one that tells you how much room Garmin has to pay higher prices for components and still make a marginal cost on each additional GTN 750Xi sold.

The number you’re focused on (“operating margin”) is not related to building already-designed and already-certified avionics boxes. It is reduced by, for example, R&D costs for all of Garmin’s next generation of products (and certifying their existing autopilots, for example, on more airframes). It also reflects costs that are fixed, e.g., liability insurance premiums.

See https://www.investopedia.com/ask/answers/010815/what-difference-between-gross-profit-margin-and-operating-profit-margin.asp

(To answer your question, why isn’t Garmin’s gross margin of 73% instead 100%? That would make them a crypto coin issuer! I’m not sure what else can be sold for hundreds of millions of dollars without even $1 of costs for components or labor. If Garmin paid even 1 penny for the sheet metal that surrounds the GTN 750Xi it would no longer be possible for the company to achieve a 100% gross margin.)