A senator introduced a bill for consideration by the Maskachusetts State Senate that would impose a 6.25% sales tax on new and used aircraft, currently tax-exempt in MA so as to compete with neighboring NH, ME, CT, and RI. (CT makes aircraft exempt for rich people buying machines that weigh over 6,000 lbs.; peasants buying little Cessnas, Cirruses, and Pipers must pay.) It doesn’t surprise me that a state senator would be excited to collect $5+ million in tax on a new Gulfstream G800, but of course the obvious response for the Gulfstream G800 buyer is to base the aircraft in nearby NH, thereby moving jobs out of MA. The pilots and mechanic will live in New Hampshire and the plane will zip down to Hanscom Field (KBED) or Nantucket (KACK) to pick up the rich MA resident or executives at a company based in MA and then proceed to whatever the desired destination might be. The $5+ million in tax is never collected and Massachusetts misses out on payroll and income taxes for the crew, real estate taxes for the hangar, construction jobs for building the hangar, etc.

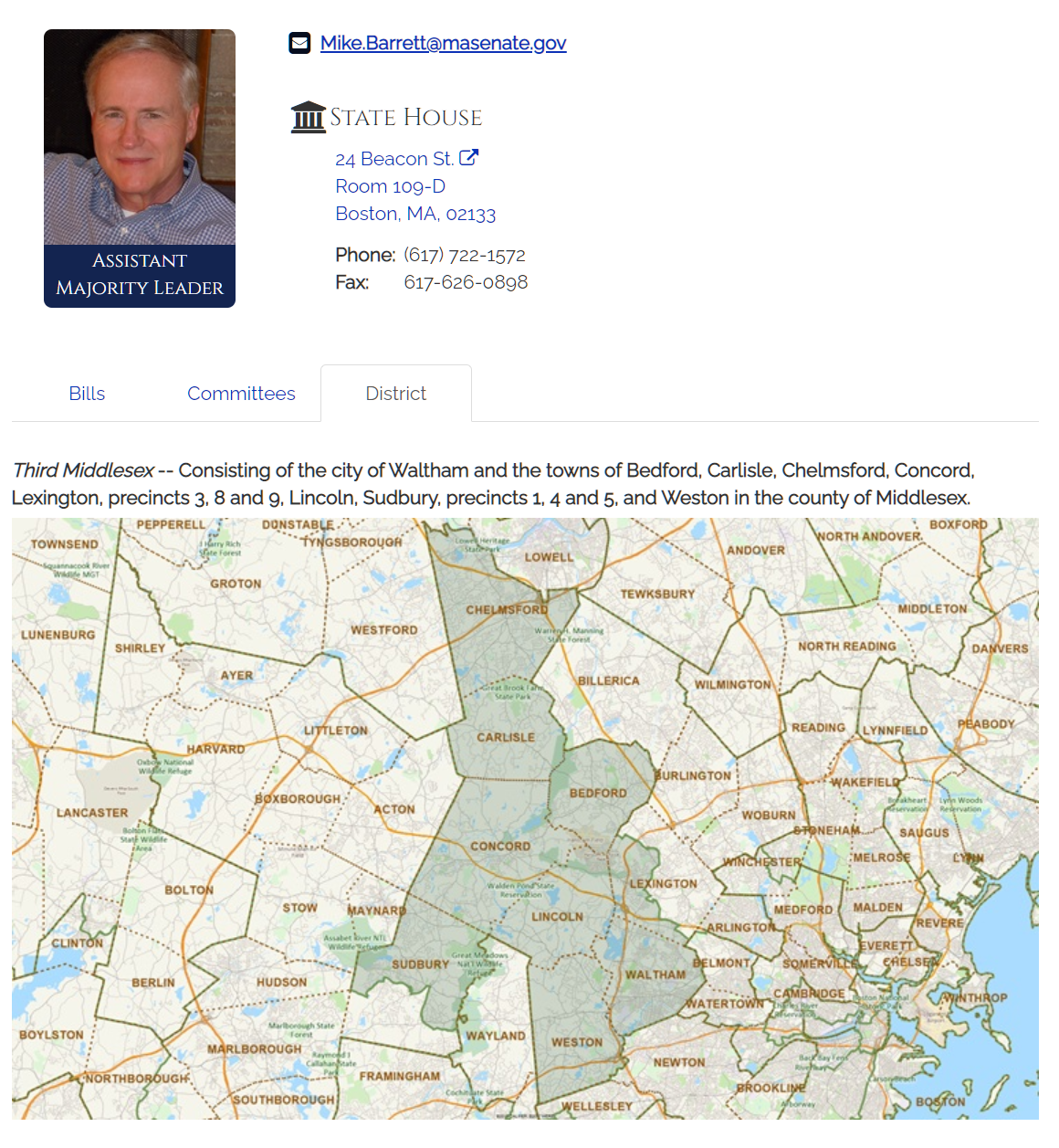

What is surprising? The senator sponsoring this bill is Mike Barrett, whose district includes Hanscom Field, the busiest general aviation airport in New England, and all of the towns surrounding Hanscom (i.e., where pilots, mechanics, and other airport workers are likely to live). In other words, Mx. Barrett has launched a direct attack on the economic prosperity of his/her/zir/their own district.

You can see Hanscom Field at the intersection of Lexington, Lincoln, Concord, and Bedford, below.

It would make sense to me if a senator from a district that didn’t include a busy general aviation airport had sponsored such a bill, but in what other state could a politician be secure enough to directly attack the jobs of his/her/zir/their own constituents?

Speaking of state taxes, I was chatting with a friend of a friend who escaped what he considered to be the disorder and crime of Los Angeles for a new home outside of California. I remarked that I was shocked that he had chosen to live in a state that imposed a state income tax. Why not move to Florida, Texas, Tennessee, South Dakota, or one of other states without an income tax? The successful entrepreneur looked at me with pity. “All of my money is in LLCs and trusts,” he explained. “I don’t have any income subject to state income tax except for my direct salary. Everything that I spend comes from loans from one of my trusts. I borrow money from myself.”

All of my money is in LLCs and trusts,” he explained. “I don’t have any income subject to state income tax except for my direct salary. Everything that I spend comes from loans from one of my trusts. I borrow money from myself.” This little revelation is one of the things that has always made me wonder about the very, very wealthy who voluntarily live in high-tax geography’s like NYC, San Francisco, etc… Is their wealth setup in such a way that they can effectively dodge taxes? I have of course assumed that was so even if the mechanism wasn’t obvious to me. What high-tax states and cities seem to do is tax the merely well-off who have a high-income but it is an obvious and directly reported income, e.g. those making six figures from a W-2 reported job. Is anybody who’s wealth is in the 7-figure and greater range range actually paying income or even normal capital gains taxes on that wealth?

Wonder if 1 loophole is donating to a charitable trust & then taking a loan from the trust. Elon Musk donated $5 billion of his last stonk sale to charity in order to avoid capital gains tax, which could have been Jared Isaaaacman’s charitable trust.

> Is anybody who’s wealth is in the 7-figure and greater range range actually paying income or even normal capital gains taxes on that wealth?

My wealth has seven digits. My income has six. I am one of those suckers who pays income and capital gains taxes because I don’t know how to avoid them.

Any pointers are appreciated!