A friend owns a company that makes equipment for factories. His theory is that the central planners who’ve been printing money overestimated the elasticity of supply and therefore created much more inflation than they expected. In his experience, the number of Americans willing, interested, and capable of building anything in a factory is essentially fixed. Once existing factories and teams maxed out, increased government spending just created inflation rather than more production.

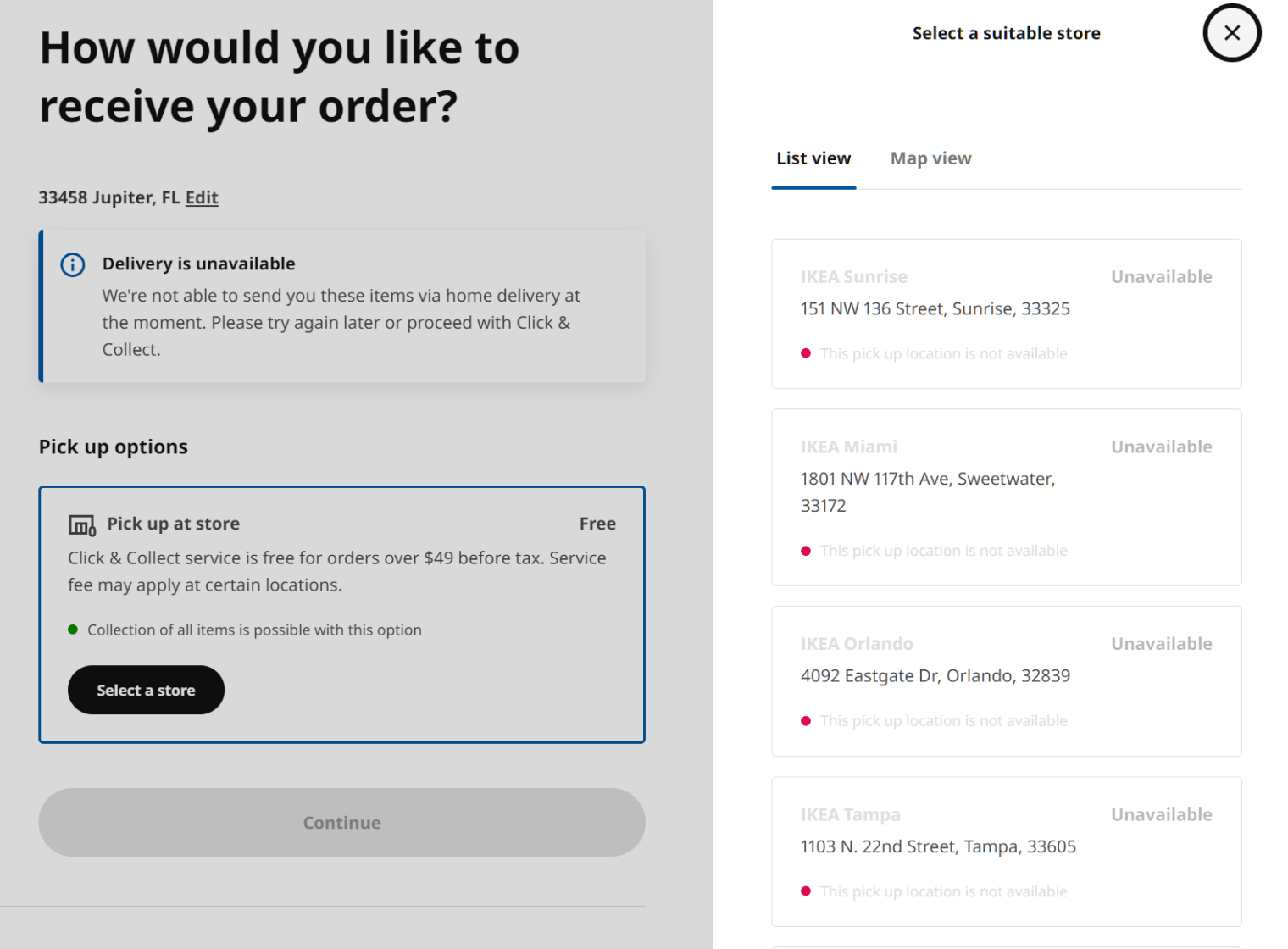

For the apparatchiks who set up the money-printing presses, factories are abstract concepts, never experienced in person. They come up with theories about why certain complex items aren’t available, e.g., automobiles or GPUs, but don’t grapple with the reality than even the simplest-to-build items are back-ordered by months or years. I just checked at ikea.com, for example, and none of the things that we wanted to buy in August 2021, e.g., dining chairs, are back in stock:

(I check every month or so and the situation has never improved. We’ve learned to live with what we have!)

Could the inelastic nature of worldwide manufacturing have been expected? I think so! Look at the Great Toiler Paper Famine of spring 2020. A tiny increase in demand led to empty supermarket shelves, not increased production.

Readers: What do you think of this theory? The Modern Monetary Theory that is the de facto mainstream economic philosophy in the U.S. assumes that inflation occurs as soon as supply runs out, but doesn’t predict when the supply wall is hit.

Related:

- Netflix: American Factory (in which a Chinese auto glass manufacturer tries to get workers in Dayton, Ohio to make high quality glass while Senator Sherrod Brown and other politicians try to get the workers to unionize)

His theory is that the central planners who’ve been printing money overestimated the elasticity of supply

You can’t overestimate something that you never tried to estimate in the first place.

The central planners locked everyone in their homes and then noted that aggregate demand had fallen.

So they turned into NPCs chanting in unison “Demand shortfall! Keynes! Must stimulate! Build Back Better!”

That is in line with my theory that the so-called “elites” are, in fact, inbred idiots lacking any capacity for reflection and long-term planning.

They suspect that their station in life is not due to their own merits but rather solely because of their relationships with other “elite”. Thus they are mortally afraid of being shunned or of expressing any opinion which would have even a slight chance of alienating their peers. The lock-step nature of their narratives is not a sign of conspiracy but the sign of pervasive fear.

And, yes, I’ve seen a Silicon Valley billionaire covering in fear and nervously looking around when I complimented him on hiring a beautiful woman. He fired her, too.

Always wondered why China doesn’t force TSMC to give up its trade secrets so someone else can make GPUs, as a matter of strategic necessity. The trade secrets would have to stay in China though.

It’s obviously no longer a pandemic issue but a repeat of the RAM shortages of 40 years ago. Monopolies want a fair price. It’s a good time to downgrade to the standard C library & tensorflow lite while abandoning CUDA & boost.

TSMC is in Taiwan, not China. And, if China Hong Konged Taiwan, they would be cutoff from all the supporting IP that goes into chip making. They’d be stuck at whatever generation of chips they’re currently making. That’s if there is no plan in place to scuttle the fabs in the event of Chinese invasion.

TSMC is building a plant in the US, as I’m sure the US government will entice many other companies to do in the wake of the awakening as to the magnitude of critical supply chains on the US economy.

Here’s an interesting article on all the complex pieces that go into making chips–it’s much more than trade secrets from one factory:

https://www.forbes.com/sites/georgecalhoun/2021/10/23/semiconductors-more-us-leverage-more-bad-news-for-beijing-part-3/?sh=15d22081224e

Every time something goes bad, it’s the governments fault? If we stipulate that the government printed too much money and offered too much stimulus this time, are we better or worse off than the 2007 financial crisis, or if we’d gotten it wrong on the other end? In other words, is it better to over stimulate vs under? If the US got it so wrong, what countries got it right–isn’t inflation happening around the world? And, why didn’t the miraculous free market and the omnipotent job creators find a way to prevail? Maybe because they created the problems in the first place, with their just-in-time, zero slack manufacturing practices. Not enough people to work in factories–what happened to your steadfast faith in market clearing wages? If Amazon can con people into working in their delivery labor camps, surely other employers can too.

Every time something goes bad in Soviet Union or any other command style economic, including those ruled by government mandates and infusions – government (policy) is at fault – absolutely.

If you’re suggesting the US is now a communist style command government, what is an example of a successful major economic power that doesn’t have a command economy?

2021 was a bloodbath of a year cor the paper business. Mill closures due to everything crom wildfires to washouts to floods, safety related shutdowns, politics related shutdowns, unprofitable mills dezpite robust demand (how???) and inadequate supply, the everpresent and mysterious “supply chain disruptions” (how does one’s supply chain get disrupted when one IS the supply chain unless it is for machinery or process chemicals that come from elsewhere??)

Result: I cannot buy common #10 window and #9 regular envelopes. Every last envelope in this country earmarked for a large account has been spoken for.

It is a disaster for me. I can’t pay enough for envelopes to survive. And it all hit at once in a cascade, like a blackout sweeping across an entire industry. We don’t have a Plan B for something like this. It’s like telling doctors that the country is permanently out of oxygen bandages and IV supplies.

https://www.globalpapermoney.com/closures-and-cutbacks-in-2021-cms-13020

Inre: “Inflation Rages” – and sure, you can say: “Oh, I can go to ULine and buy 5 boxes of 500 blank #10 windows for $120.00 plus shipping! That’s just 4.8 cents each plus shipping! What’s wrong with you, Alex?”

The problem is that last year at this time, they were ~1.8 cents each, wholesale, shipping included, in any quantity over 10,000 and I could pick and choose from 5 suppliers all within 100 miles of my location.

Total destruction.

Sorry for the typos above: smartphone post. I am not, as yet, an accurate thumbster because I try my best to avoid text messaging.

Sorry for the multiple posts, but I’m trying to find a way to laugh at all this. From this post, the replies, and my tale of woe, what have we learned?

We not only lack a labor force educated and elastic enough to increase factory output when needed, we also cannot get the advanced microchips to build crypto farms to mine our highly volatile virtual currency, we have just-in-timed our way out of inventory management that buffers against supply chain disruptions, we are de facto following an economic theory that cannot predict when supply walls will be hit, our genius billionaires in Silicon Valley are afraid of hiring good-looking women lest someone draw a big target on their backs, and finally, we can’t get the IKEA chairs for our dining rooms to sit down and write a letter about it and stick it in a #9 or #10 envelope, put a stamp on it and mail it at anywhere near what it cost a year ago.

And gasoline in my area is now $3.60 per gallon, up nearly $0.25/gallon in about one month.

Top of the World! At least the Los Angeles Rams won the Superbowl after a goal-line defensive holding that never happened!

And Vladimir Putin is about to blast the holy living s*** out of Ukraine unless we Give Him Things. Lots of Things.

Carry on!

“Result: I cannot buy common #10 window and #9 regular envelopes. Every last envelope in this country earmarked for a large account has been spoken for.”

I can’t know how large the volume of your needs are, however #10 window and #9 regular are available in stock for overnight delivery from Amazon for what, to my unpracticed eye, seem like pretty decent prices (around a nickel each).

https://amzn.to/3LOZ2my

https://amzn.to/3H2oFfU

(and larger volumes/better prices in stock online.)

I appreciate I can’t know in detail the economics of whatever direct mail business you are in, but your point isn’t about the specifics. It is presumably a more general statement about supply chains and inflation. The sanity check I did in my head is to compare a penny more or less per envelope with e.g. bulk mail rates, and then I also have a sense for what things cost, and take some signal about supply chains from product being available from multiple manufacturers through multiple distribution channels for immediate shipment (in the case of Amazon no added cost and overnight, with cost built in to the selling price), and it’s really hard to see the varacity of your claim. Which is not to blindly dispute it, just to say more justification is needed?

Also: Is the nature of your business really critically dependent on snail mail?

Yes, 90% of my business is snail mail. I am a direct mailer. At the volumes I do, one cent is difference per envelope inserted is enough to send a customer elsewhere. Amazon is no bargain, they’re not even close to what in-trade prices are. 1 penny per envelope represents an almost 50% increase. I buy 100,000 envelopes at a time, and I’m a *small* direct mail business, competing with businesses ten times my size who buy envelopes by the *millions* and store them in their own climate controlled warehouses adjacent to their mailing equipment.

We have called just about everyone on the East Coast of this country. Even the shipping cost from the west coast would eliminate my profit margin: that is how competitive my business is.

@J: I appreciate your help and even your incredulity that people attempt to make a living in the direct mail business any longer, because believe me – sometimes I find it incredulous myself! Lol. If this drought goes on for much longer, though, it will begin to affect even people who have stockpiled envelopes, so they will also be forced to raise their prices for mailings, and unless they have their own converting shops (some do! they buy paper in huge truckloaded rolls and convert their own envelopes) and equilibrium will be reached again at a higher price point for everything. In an emergency, a couple of weeks from now I estimate, I may have to use Amazon or someone similar. We are working the phones and preparing for that scenario should it occur.

It affects everything I do: postcard stock has gone up. Sheetfed paper has gone up. Every aspect of production cost for me, including electricity to run my machines and the fuel to deliver our jobs has gone up.

Our mailings are quite successful – so it’s likely our customers will absorb some price shock – but the question is how much, and will they cut their volumes in response? That affects a mailing in more than just the commodity prices: it also affects postage. For example, if you are saturation mailing into an entire set of zipcodes with all the addresses included, your presorted postage drops significantly. If you try to snip out zipcodes and areas within zipcodes called carrier routes to lower the volume and make the mailing smaller, it changes the sort classifications and the prices go up on the *postage* side.

We’re hoping some of the “temporary” mill capacity will come back online and the supply situation will steadily improve, but it’s anyone’s guess as to how quickly that will happen – if it does at all.

@Alex, wishing you success in navigating through this business difficulty. It sucks, but I’m hoping you can figure a way throught.

@Nick: Thank you. Here’s hoping that some of these temporary mill closures / slowdowns are indeed temporary. In the direct mail business, pennies matter particularly for repeat bulk mail and direct mail clients who have a choice. Higher prices have a measurable, fast and serious impact on business because it is comparatively expensive and of course, people pay in advance most of the time – for the postage at the very least (the USPS extends credit to absolutely nobody, period the end.)

@Alex Thanks for the reply in rather more detail than expected. I accept everything you say, and wish you success in business. Even so, a penny increase on a 100,000 mailing campaign translates to $1000, which doesn’t sound like that much compared to what the overall budget must be. As you yourself say you’re in a commodity business unfortunately with very little pricing power. As noted everywhere there is inflation now, and supply chain issues, it must hit all your competitors (except those that hedged by buying future envelopes/paper). It is honestly hard to see, from what you said, that the paper industry is in *particular* disarray.

@J: Well, to explain more deeply would require giving you my exact prices to my clients, which I do not want to do in a public forum because – as you pointed out – my pricing power is already weak enough vis-a-vis my competitors. But I can tell you with a lot of assurance that in the envelope situation is serious, it has effected every mailing house I know of on the East Coast, everyone is wondering where the end/turnaround will come, and that at least three wholesale suppliers of paper in my area have been driven out of business by it in the past six months. I can also tell you that on some of my jobs, my profit margin disappears completely and I am “under water” if I absorb a cost of just 1.5 cents extra per envelope – and most of my jobs require two envelopes for mailing.

That may not seem like “widespread disarray” to you, but to me, it is a very serious problem. COVID-19 was bad enough – causing approximately 40% of my customers to cut back and/or cease their mailings entirely. Now I am coping with the inability to call my supplier and have 50,000 or 100,000 envelopes delivered – with no time horizon given for that to change.

Surely the MMT proponents have great computer models, just like the heroes of the subprime mortgage crisis of 2008. From a time when the NYT still occasionally appeared to make sense:

https://www.nytimes.com/2008/11/05/business/05risk.html