Six months ago, the New York Times’s in-house Nobel-winning economist wrote “Wonking Out: I’m Still on Team Transitory” (9/10/2021):

if we finally get this pandemic under control, the inflation of 2021 will soon fade from memory.

Professor Krugman was correct about Joe Biden getting the pandemic until control. When the Science-rejecting Donald Trump was in the White House 350,000 Americans died with/from COVID-19 in 2020. Due to President Biden’s leadership and the vaccines that He developed, we’re on track to suffer only roughly a third of a million deaths in 2022.

Professor Krugman also seems to have been correct in predicting “the inflation of 2021 will soon fade from memory”, but maybe that is because the inflation of 2022 has been so much more dramatic?

The Nobel laurate is back this week with “How High Inflation Will Come Down”. He starts by doing what my former hedge fund manager friend says nearly all analysts do, i.e., extrapolating from recent events:

Rising prices will get worse before they get better.

Something new for an American journalist or politician… He blames Russia:

Russia’s invasion of Ukraine has caused the prices of oil, wheat and other commodities to soar.

This time it is different:

Forty years ago, as many economists will tell you, inflation was “entrenched” in the economy. That is, businesses, workers and consumers were making decisions based on the belief that high inflation would continue for many years to come.

Things are very different now. Back then almost everyone expected persistent high inflation; now few people do. Bond markets expect inflation eventually to return to prepandemic levels. While consumers expect high inflation over the next year, their longer-term expectations remain “anchored” at fairly moderate levels. Professional forecasters expect inflation to moderate next year.

If the professional forecasters are good at their jobs, why aren’t they absurdly rich via trading on their own previous forecasts and, thus, retired from forecasting?

Nobel-grade thinking… Prices will go down as soon as prices go down:

A lot of recent inflation will subside when oil and food prices stop rising, when the prices of used cars, which rose 41 percent (!) over the past year during the shortage of new cars, come down, and so on. The big surge in rents also appears to be largely behind us, although the slowdown won’t show up in official numbers for a while. So it probably won’t be necessary to put the economy through an ’80s-style wringer to get inflation down.

Professor Krugman agrees with what Chauncey Gardiner pointed out, i.e., that there will be growth in the spring:

The inflation of 2021-22 looks very different, and much easier to solve, from the inflation of 1979-80.

What if it takes a few springs for inflation to subside?

Related:

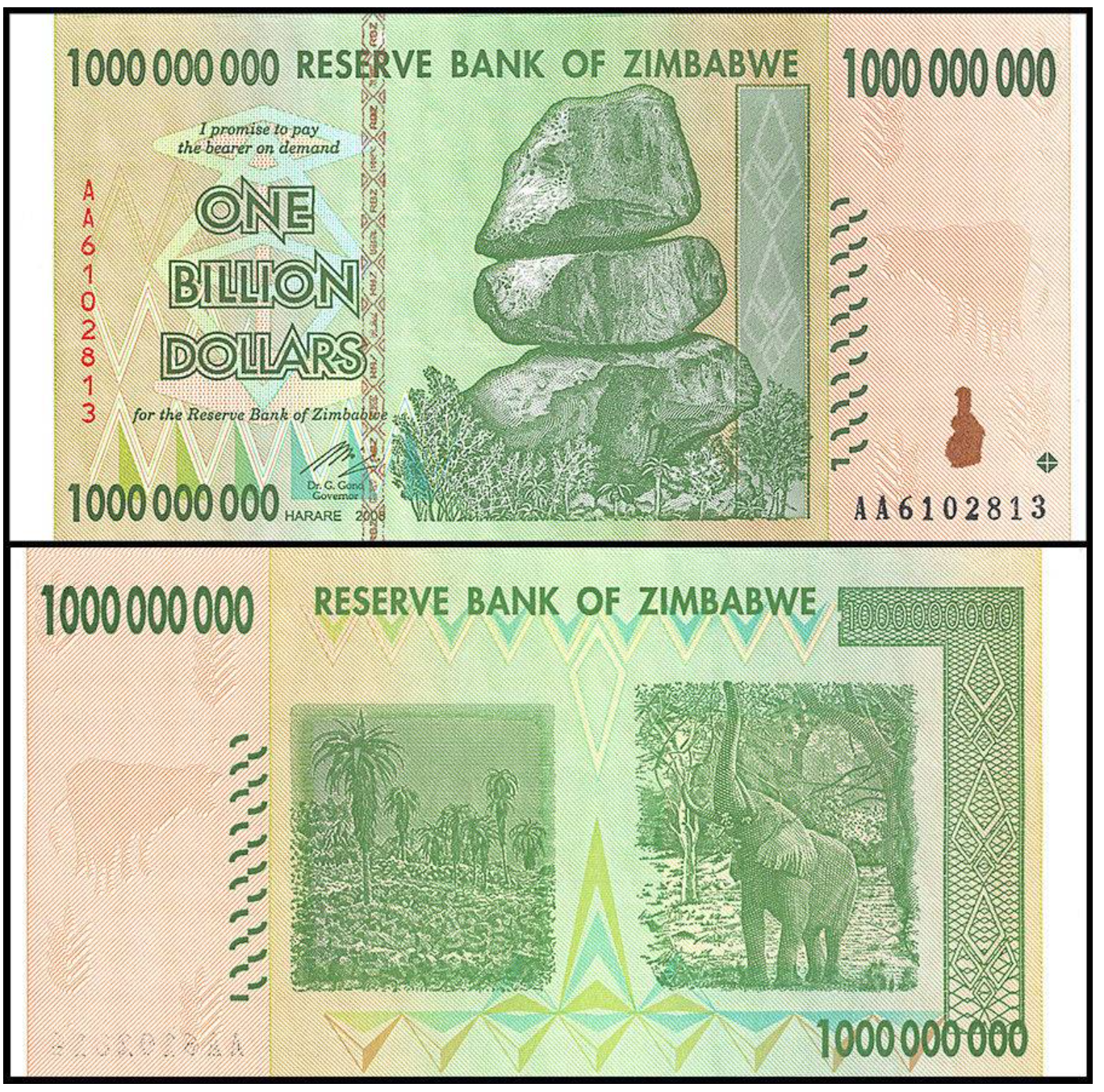

- “Zimbabwe’s trillion-dollar note: from worthless paper to hot investment” (The Guardian, 2016): “When the Zimbabwean dollar first came into existence in 1980 it had a similar value to the US dollar … The central bank of Zimbabwe issued $100,000,000,000,000 notes during the last days of hyperinflation in 2009, and they barely paid for a loaf of bread.”

“Rising prices will get worse before they get better.” – this is not extrapolation from recent events. On my memory staple foodstuff prices has never come down, even in nominal terms of cheaper dollars. Maybe he tried to weasel it to mean “Rate of price increases will slow” That could temporary (transitory) happen during D. J. Trump’s second term in office

If Dr. Krugman really meant that staple products prices will come down it is indeed a bold prediction.

I think it is the other thing as Dr. Krugman had good sense to refuse any actual economic advisory or managing positions in current government.

The majority of economists, including the Nobel one, are usually failed mathematicians who nevertheless have enough math prowess to come up with this or that “model” having little to do with the economic reality they are trying to analyze/predict. Krugman is a typical specimen of that breed, uninteresting as an economist and boring as a run-of-the-mill liberal.

The economic crisis of 2008 amply showed what a fraud the economic profession is. As I recall, Krugman did not have a clue as to what a CDO was when trying to discuss the crisis.

Ivan, there are some successful economists mathematician turned economists. Leonid Kantorovich comes to mind – his optimization techniques have been in common use. Myron Scholes – base for derivative market calculations. Markowitz – his portfolio theory is easy but I would never come up with it, it was a revelation when I read it. Sweden central bank prize named after Alfred Nobel went down the tubes when one of the qualification for it became to be a marxist.

perplexed:

I read all three blokes: Kantorovich, yes, he is a good guy, Marcovitz’s portolio stuff is too simplistic and does not really work in practice (I have some experience in quant fin) but, ok, it gives some insight, Scholes, no.

In the first place, option valuation method similar to the three stooges’ model (BSM) was invented as early as in 1900 by Louis Bachelier and used since by many traders on the floor (some variations thereof).

e.g.

https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.581.884&rep=rep1&type=pdf

https://arxiv.org/pdf/2104.08686.pdf

I do not know if BSM stole the idea or came independently to a similar valuation method but as I recall they did not credit Bachelier. I may be wrong on that. In the second place, I’d claim that LTCM fate completely discredited Scholes et al. as having no clue as to what they were doing.

https://en.wikipedia.org/wiki/Long-Term_Capital_Management

Ivan, maybe you are right on Scholes and BSM but it is hard to argue that derivatives markets did take off until it was publicized. I recall LTCM times because back then I was learning their business for fun – they were somewhat bold and simple but they were destroyed by heavy handled above-the-law government-corporatist individuals in a power play that resulted in big business power grab, emigration of talent from LTCM to Europe and offshore, empowering European financial institutions and weakening American power. Not sure about real Scholes role at LTCM.

If you think about it then it appears whole derivative play is superficial and will never exactly reflect underlying reality. Opposite, valuation may force business specific way. It may even be a Marxist thing – Marx said that in the communist future mathematics will be used to describe economic and social functions, without being a mathematician himself. Marxists of course not able to do that but they can write in their “scientific” papers about it.

It is interesting that most of the NYT comment section (!) no longer believes the Krugman nonsense.

Like the Nobel Peace Prize, the Nobel Econ Prize has always been suspect & Paul Krugman’s guesses about the future are probably on average about as good as everyone else’s. His job for many years has not been the study of economics but to generate propaganda for the Democrat Party & to please the readers of the NYT — so if I were ever to read the NYT I would interpret his predictions that way. I would not expect him to provide an objective view of the world — so it is not exactly surprising that the quotations above buttress Democrat Party propaganda.

inflation can come down if people can be persuaded ( through inflation ) to live in apartments near work and drive a lot less. If the upstairs neighbor likes playing Jurassic Park through a 200W sub at 3am, that Substitute Good externality isn’t measured on the CPI so the economists’ extrapolation will be reasonable.

Lol Paul. People who wanted to be good liberal citizens and dedicate their lives to corporate/etc work now face 30% annual lease hikes. You suggest more people to follow that to raise rental real estate demand. Even larger price hikes for staple because shoplifting is now legalized in most of the places with jobs right now. Large store chains do not lie that it does not affect their bottom line much, it affect bottom lines of their non-shoplifting customers.

The lion kingdom expects the new money to wind its way back to exclusively asset inflation. The bottom 99% buy crap which is part of the CPI. The top 1% are a separate economy which only buys assets. All the output of the bottom 99% eventually goes to the top 1%.

Krugman has been left behind by the acolytes of MMT (which should be properly called ZMT with Z standing for “Zimbabwean”). He apparently is not radical enough on pressing the “print” button.

PS Nobel Econ Prize is not actually a Nobel Prize, and it’s not just suspicious, it’s right in the same “embarrassing to receive” bucket as Nobel Peace Prize (which routinely goes to likes of Kissinger, Arafat and Obama).

Krugman also predicted in 1998 that the internet’s impact on the economy will be no greater than the fax machine’s.

https://www.bloombergquint.com/onweb/paul-krugman-got-something-very-right-about-the-internet-the-fax-machine-and-the-economy says that Krugman was right! The economic impact might even have been negative (everyone on Facebook instead of working).

Also, without widespread consumer Internet, governors in the States of Righteousness wouldn’t have been able to do 1-2 years of lockdowns, school closures, etc. The U.S. would have been forced onto the Swedish/Florida plan with adults at work, children in school, and the vulnerable elderly hiding during plague peaks.