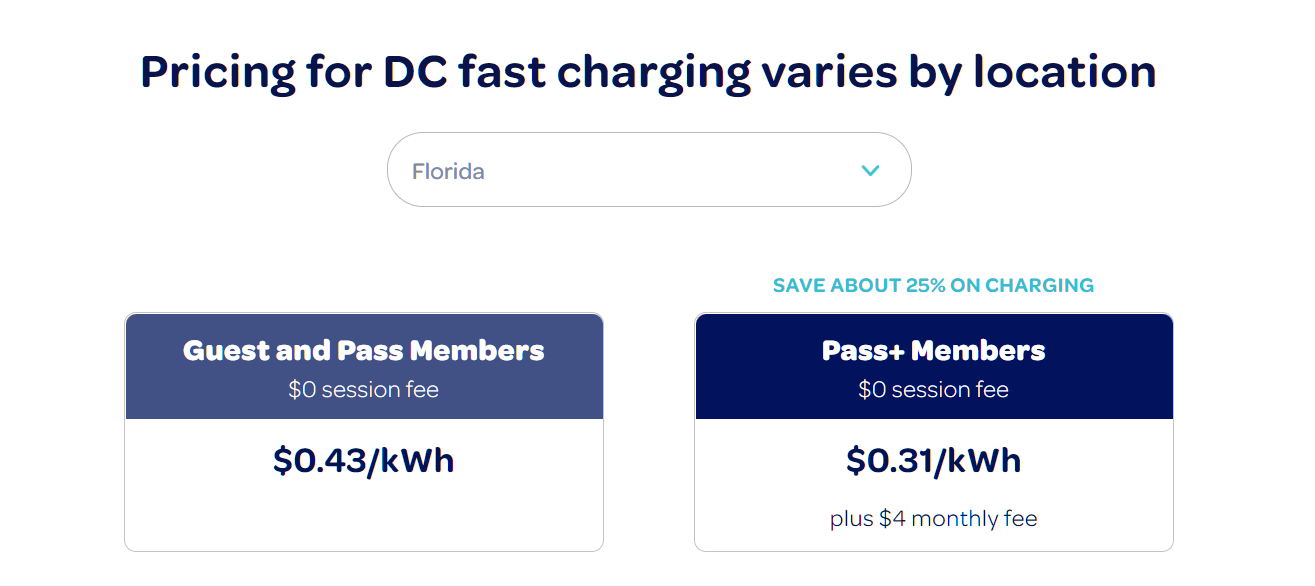

Electrify America charges 43 cents/kWh in Florida:

That’s 4X the average price to a commercial customer in the state (EIA.gov; which shows that Electrify America’s price is 5X the “industrial” rate, which might be more appropriate for a large and busy charging station). (Let’s ignore the membership price of 3X because you can get a fair price at a gas station without joining any clubs.)

Retail gasoline is about 10 percent over cost (source), i.e., 1.1X.

The gas station needs to dig a tank, maintain pumps, insure against environmental calamity, fire, etc. The electric charging station just needs a few parking spots, some wires, and some high-power/high-voltage components.

For people who live in apartments and/or do most of their charging on trips, do these huge charging station markups eliminate the purported fuel cost savings for high-cost electric cars? (we almost never see a Tesla used as an Uber, right?)

I honestly have never seen as high a price for fast charging or even level 2. Strikes me as a rip-off and I would never pay it. Likewise I would not pay $4 a month for a slightly lower price gouge–I agree with you on that score.

Most BVA users charge overnight at home and you’re blessed with with pretty decent electricity prices in Florida. So the cost savings for someone who has a long daily commute and can charge at home could be pretty compelling. I do note you ask about economics for apartment/condo dwellers. It is increasingly the case that complexes are offering level 2 charging on the premises, and one can often work with management or condo association to fit chargers. This also applies increasingly to workplaces.

Level two chargers on the https://www.chargepoint.com/ network in my experience typically either charge very similar to domestic end user rates. And where I live a decent number of them are free sponsored by towns, shopping centers etc. . There is a mix of free charging in publicly accessible locations, and per the Chargepoint access map, on private premises often condos/apartments/workplaces. I personally make a game of charging for free as much as possible, and I’m pretty good at it. Between that and no routine service/oil changes or brake jobs needed on the EV, there are significant running cost savings which at least in part offset the presently high-ish cost of entry.

I’m really very happy with the overall economics of my Tesla M3, which I purchased with $10k in aggregate rebates in 2018. Tesla Supercharger rates are also roughly equal to what I pay at home, $0.23 or so per kwH, I use them only rarely on long trips, and charge only infrequently at home for that matter. I prefer free to home rates–which would still beat gas by about a factor of 2.

If one doesn’t have access to charging either at one’s apartment/Condo complex, or employer, or perhaps a Chargepoint in the neighborhood, it’s probably too early in the BEV technology adoption cycle for you.

Oh, and before you go there, taxi/rideshare/trucking and other commercial applications are not yet supported by BEV infrastructure for a variety of reasons, primarily charge time, which impact the economics of the business not directly through the pure cost. Yes, charge time can be a minor inconvenience for users such as myself on occasional long trips, however day-to-day the domestic use case it’s a non issue. In fact one saves time, because one never has to stop for gas, or worse, make a detour or special trip.

A few things:

Demand for gas stations is clearly on the decline. You don’t have to look very far to find defunct gas stations in any urban area. In my town, one is now a vegetable stand, one sells stone countertops, and a bunch are liquor stores or mechanic shops. For most gas stations, the capital cost of the real estate has been amortized over decades.

Electric charging stations are far less efficient at serving customers per unit time. While it may not take much infrastructure to charge cars, far fewer cars can be charged than at a gas pump overall.

Most gas station owners claim to make most of their profits from running the auxiliary convenience store attached to the station rather than from selling gasoline per se.

At least in Calif*, the cost of the land for the charger is like a billion dollars + 2% property tax. It’s surprising how many people pay to use a supercharger instead of charging at home. The supercharger is always packed, despite this being a bedroom community.

Why is the markup on electricity for charging cars higher than the markup for gasoline?

I can think of a couple of reasons:

First, utility demand charges for level 3 chargers can be high. E.g. in some locations, Tesla has paid 14¢/Kw just for demand charges, in addition to any usage charge.

Residential users generally don’t pay demand charges, although that may be starting to change.

Second, in Econ 101 I learned that the relationship between cost and price is a bit tenuous, especially in the short run.

“in Econ 101 I learned that the relationship between cost and price is a bit tenuous”

and, in the original post

“Retail gasoline is about 10 percent over cost”

If you reference Phil’s source, you will see that the 10% is the gross markup applied by convenience store sellers on the wholesale gas sold to them by the branded oil companies and non-branded distributors. I’d argue this is a very misleading statistic, because it ignores the economics of the bulk the gasoline supply chain. In a matter on months light sweet crude–the input product for gasoline–has spiked in price, doubling in on global markets, due to geopolitical factors which I would warrant are largely unrelated to the costs to mine, refine, store and transport. It is typical in comparable circumstances over history for the big oil companies to make windfall profits, perhaps related for the tendancy for retail prices to ratchet . . . go up in sympathy the price of crude, and tend to stick when the price of crude declines. The convenience stores and other gas station retailers may not be coining it, but someone sure is.

Also, it occurs to me I formed my impression of the favorable economics of electric cars prior the recent spike in gas prices, so I’d argue the case is even more compelling now.

“the relationship between cost and price is a bit tenuous”

Well, in short term, yes. Also true for luxury goods where perception is what is being sold rather than the material part of it.

For the mass market / commodity goods the relationship is quite strong longer term because higher margins attract investment (and thus increase supply thus lowering margins). This results in different industries and producers converging on roughly similar margins (thus giving rise to normal profits). Note that some industries do consistently enjoy supernormal profits mostly due to the non-market interventions artificially restricting supply (regulation, licensing, IP laws, etc).

It takes 30m-1hr to supercharge a car, Google tells me. So 10x how long it takes to fill up with gasoline. Clearly, cost of an entitled (that is, made compliant with zoning) and legal (compliant with enviro, biz regulations) parking spot will explain markups in some markets. What are real estate costs like in your part or Florida?

Ryan: That’s a great point and I thought about it a little bit, but disregarded it because it looks like the charging companies are getting free real estate either from shopping mall owners or government. See https://www.tesla.com/host-a-supercharger (should the page be retitled “How to do the shareholders of a $trillion company some favors”?)

Why are you spending your time looking for root cause for a doubtful hypothesis based on misleading cherry picked data?