Inflation is at 8.6 percent: “Consumer prices jumped 8.6 percent in May compared to last year as inflation holds grip on U.S. economy” (NBC).

If we dig into the article a little, however, we find that current inflation, month-to-month, is actually at 13 percent per year (up 1 percent from month to month).

Another example… “U.S. inflation hit a new 40-year high last month of 8.6 percent“ (Politico):

America’s rampant inflation is imposing severe pressures on families, forcing them to pay much more for food, gas and rent.

The costs of gas, food and other necessities jumped in May, raising inflation to a new four-decade high and giving American households no respite from rising costs.

Consumer prices surged 8.6 percent last month from 12 months earlier, faster than April’s year-over-year surge of 8.3 percent, the Labor Department said Friday.

On a month-to-month basis, prices jumped 1 percent from April to May, a steep rise from the 0.3 percent increase from March to April. Much higher gas prices were to blame for most of that increase.

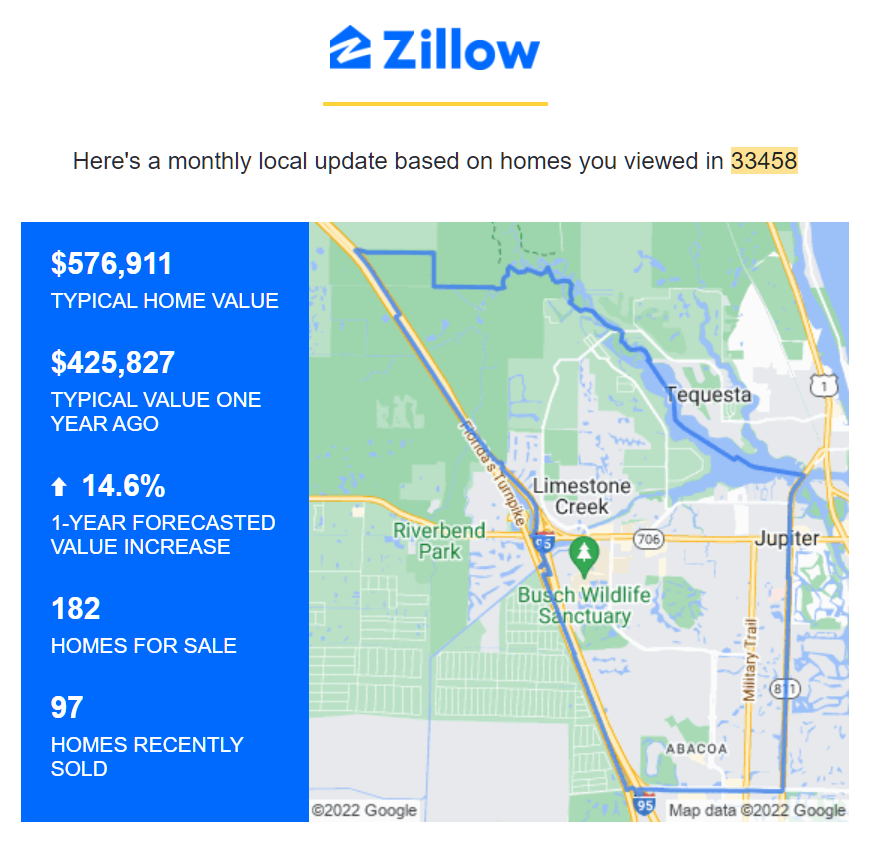

What does Zillow expect for inflation in house prices in our ZIP code (the non-waterfront parts of Jupiter, Florida)? (note that real estate inflation is explicitly excluded from official government CPI) A 14.6 percent boost.

The next wave of coworkers is cashing in its last 3 weeks of housing appreciation & moving to the Fl*rida coast, but closer to Gainesville. They’re not new yorker enough to move to south Fl*rida.

When the lion kingdom sees the BLS graph, it only sees 10 years where inflation just happened in Calif* instead of the national city average, followed by the last 3 years when the Calif* city average became the national city average. The 1979 rise no longer shows up compared to today. The graph is steeper in the last 3 years than at any other point & every other steep climb led to a recession.

We have all kinds of people in this country who haven’t been doing their proper duty recently, which is to be shock absorbers. They’re shocked now!

I didn’t listen to NPR Marketplace today to hear one of their ladies tell me how we’re having a “soft landing” for the economy. As a pilot, I’m sure you’re aware that a “soft landing” as experienced from First Class on an A380 has nothing to do with how violent that “soft landing” is to the tires, struts and the rest of the landing gear. But whatcha gonna do? These are well-engineered aircraft and will last a long time, as long as the shock absorbers don’t collapse.

https://redstate.com/bonchie/2022/06/10/things-get-weird-during-joe-bidens-lie-filled-inflation-speech-in-los-angeles-n577164

It’s something you have to laugh at or you’d cry: I remember listening to an NPR interview with (former) President of Harvard Larry Summers when he tried to warn people that “too much stimulus” was like leaving the taps on in the bathtub so it overfilled and drained onto the floor, and then trickled down to rain on everything underneath it. He had his 15 seconds of commentary and then station cut away to a couple of chicks who decided not to even consider his warning but instead called for More Cowbell!

You start to think that we should defund NPR, but that’s unthinkable.

Yes, it is a complete surprise! Of course we can blame Putin instead of the money supply:

https://fred.stlouisfed.org/series/M2SL

And I have to say that I’m completely shocked, because the Financial Post in Canada is reporting that: “Republicans have blamed Biden’s $1.9 trillion pandemic-relief package for triggering the biggest consumer-price surge in four decades.”

Oy! What the f**k! I could have heard that from Larry Summers (well-known Republican) on National Public Radio a year or so ago!

https://financialpost.com/pmn/business-pmn/janet-yellen-rejects-idea-corporate-greed-is-to-blame-for-inflation

Don’t these people listen to the radio?

Fun fact: the calculation for the “consumer price index” (CPI, aka “inflation) specifically excludes food, housing, and energy … because those prices are deemed “too volatile”. But other than those essentials, inflation is only 8.6%.

The headline CPI number includes food and energy. It’s also reported separately without food and energy as “Core CPI” which is up 0.6% for the month and 6.0% year-over-year:

https://www.bls.gov/news.release/cpi.nr0.htm

Would any reader have any book they can recommend on understanding Inflation and how an investment portfolio should look in an inflationary time?

Book in unnecessary. Putin is forcing the Federal Reserve to print Federal Reserve Notes to “fight Putin”. To hedge the inflation, buy a house as they will go up 15% annually basically forever regardless of median salary and it’s a can’t lose investment. Disclaimer, this is for entertainment purposes and not investment advice.

Paul: Yes, it is scary. The historian Stephen Kotkin (who is fiercely pro-Ukraine!) said in a recent interview that it costs something like $40 billion to keep Ukraine afloat for two months. This does not count only weapons but also money for the huge current unemployment etc.

I wonder how much Europe is printing for the refugee crisis, which won’t help either.

It is still far less than the COVID-19 crony money in the past two years (so far!).

Europe can afford the $40 billion. They will just have to tighten their belt a bit and buy more Renault with the 1L engines and less BMW M-series and Mercedes AMG.

How would $40 billion for Ukraine cause inflation in the US fast? Ukraine just refocuses to fight another world power, in this case Russia, something that US has been doing for the past 30+ years. Did US support mujahedin in Afghanistan had affect on US inflation? I doubt it. Probably it cut pork by outsourcing regular US military backdoor deals to cheaper one Afghan (and now Ukrainian).

But absolutely, Europe should do it, it should stop spending on crappy nature-wreaking EVs and support Ukraine instead. Per my experience once Europeans discover cheap reliable Japanese gas cars they never look back.

The projection was $40 billion every two months or less. We’ll see if it continues.