I was in an Uber the other day here in Palm Beach County. It was a Kia Sorento, a small SUV that supposedly costs $30,885 new. The driver had recently purchased it, a 2019 model, for $28,000. It had 125,000 on the odometer when he agreed to pay $28,000.

Plainly a new Sorento, uninspiring as it seemed to me, is worth a lot more than $30,885 retail. Thus, it amazes me that Kia will keep selling these to dealers for the invoice price. Why not auction each vehicle as it is about to go into production (for buyers who want to choose colors and options) or as it comes out of the factory? That would enable the manufacturer to capture most of the profits that dealers are currently getting and it would even work better in a downturn. Instead of having to work overtime with incentive programs and rebates, the manufacturers would just naturally get less for each car in a recession.

A friend found a Toyota dealer agreement on sec.gov. It says “To buy and resell the Toyota Products identified in the Toyota Product Addendum hereto which may be periodically revised by IMPORTER” is a right granted to the dealer, but nothing about whether every 2022 Camry must be sold at the same price.

When information was being distributed on paper and auctions could be conducted only in person, maybe the fixed invoice/retail pricing system made sense. But why does it make sense now given that the cost of running an auction is a few dollars per item at most?

Nearly every house that is sold is subject to an auction, effectively, right? If it makes sense for houses, why not for cars? Art and decorative objects are auctioned by Sotheby’s. If it makes sense for a Barye at $1,260, why not for a car at $20,000+?

The same logic can be applied to almost anything that costs more than $100. The limited edition version of the Godzilla pinball machine was instantly sold out at $10,500. Stern left a huge amount of profit on the table (some people turned around and re-sold their machines for $15,000 or more) and plenty of potential buyers who would have been happy to pay more were disappointed. Why did it ever make sense to have a list price for this item? Same question for the $9,000 “premium” version of the game, which has a multi-month waiting list.

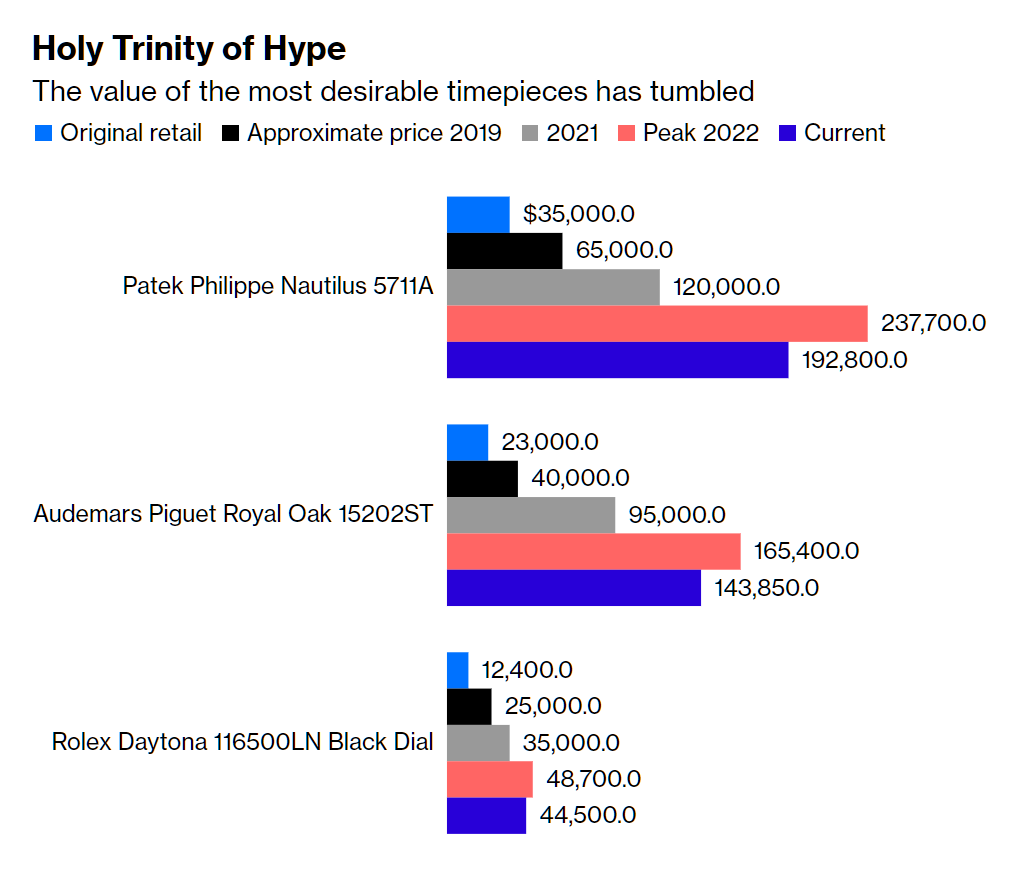

Let’s look at watches. A used in-production Rolex is worth $44,500, but Rolex sells it to dealers for the retail price of $12,400 minus the wholesale-retail discount. If we assume that a new Rolex Daytona is worth at least as much as a used Rolex Daytona, Rolex is giving up roughly $30,000 of profit on every sale. From Bloomberg, the jewelry store that PPP built:

If the answer is “consumers expect fixed prices and to consider a purchase for a few months before making a final decision,” coronapanic can be the excuse for a switch to an economically rational system in which everything reasonably valuable is auctioned, if not to the final consumer then at least to the retailer (who can adjust his/her/zir/their price accordingly).

They already are auctioned via heckling with the dealer, especially if the customer is an expert witness. Wonder how often customers would hit buy now if they were auctioned.

Traditional car companies think of their customer as “dealers” and the product they sell “zip codes”.

Maybe a better question is why the dealers don’t auction cars, but I think they more or less have been?

If you offered me a Rolex for 12,000 dollars that supposedly sells for 44,000 dollars retail, I would be wary of such a deal. The first problem is that the realistic value of the watch is its melt value–probably a few bucks. The second problem is that the 12,000 and 44,000 dollar figures are derived from a tremendously complicated and lengthy (decades-long) marketing process which might as well be witchcraft to me.

But an auction is not witchcraft. An auction is a sawdust floor a few miles from the slaughterhouse. On the auction floor, you will find that your Rolex (or many other goods) will fall mighty close to its melt value.

You do basically the same thing when you sell a used car FSBO with a big sign on it at the end of the driveway. You will not get the same amount of money for a used 2008 Subaru Outback with 187,000+ miles, a cracked exhaust manifold, and in need of a new front bumper clip. You’ll get BO of wildly varying amounts depending on where and when you sell it.

In MA, for instance, where there are tons of Subaru owners of various demographic and gender identity groups, someone looking for a second or third car for the winter (it DOES have a new timing belt, water pump, and the heated leather Limited interior) may make a juicy offer because they have garage space and four or five months to put wrenches on the car and fix it.

Up here in MA, that ’08 Subaru is still valuable even when broken to people who might have a college kid who needs a car, etc. Other places, zilch.

Oh, and did I mention that it also has a sunroof and the factory 17″ “windmill” spoke wheels? Lol 😉 Great fixer-upper.

This doesn’t answer your question, but related –

I bought a Kia Telluride last year. At the time none of the 3 dealers within an hour of me would sell for less than MSRP +$6000, and none would let me spec out a car to order from the factory. Apparently people for happily paying it, even sight-unseen, and 2 hrs away in Atlanta they were getting +$10,000.

It took me about an hour of web search to find a list of dealers and salesmen names who would go MSRP. One of them happened to be about 1.5 hrs away. I called him and placed an order over the phone to build to my specs. It took about 4 months to get but I wasn’t in any hurry. Worked out well.

I test-drove a Telluride last year and the dealer told me “$5000 over MSRP, non-negotiable, and we don’t care if you want it or not because we’ll sell it to someone at our terms within 24 hours”. Glad you found one priced a little more sanely.