“Rising Home Prices Are Mostly from Rising Rents” (Kevin Erdmann) was sent to me by a retired bond fund manager. He starts by noting that the Case-Shiller real estate index, when adjusted for CPI (“real”), shows dramatic apparently irrational price swings. We go in and out of housing bubbles based on sentiment.

The problem with that theory is that rent inflation has definitely risen faster than general inflation for the past 40 years or so. So, instead of adjusting for inflation based on a reasonable theory that has stopped reflecting reality, why not adjust home prices with rent inflation instead of general inflation? When you do, it turns out that prices have become more volatile, but the deceptively compelling long-term flat pattern that suddenly jumps to a higher range isn’t so clear any more. Persistently high rent inflation is driving the rise in the “real” Case-Shiller index.

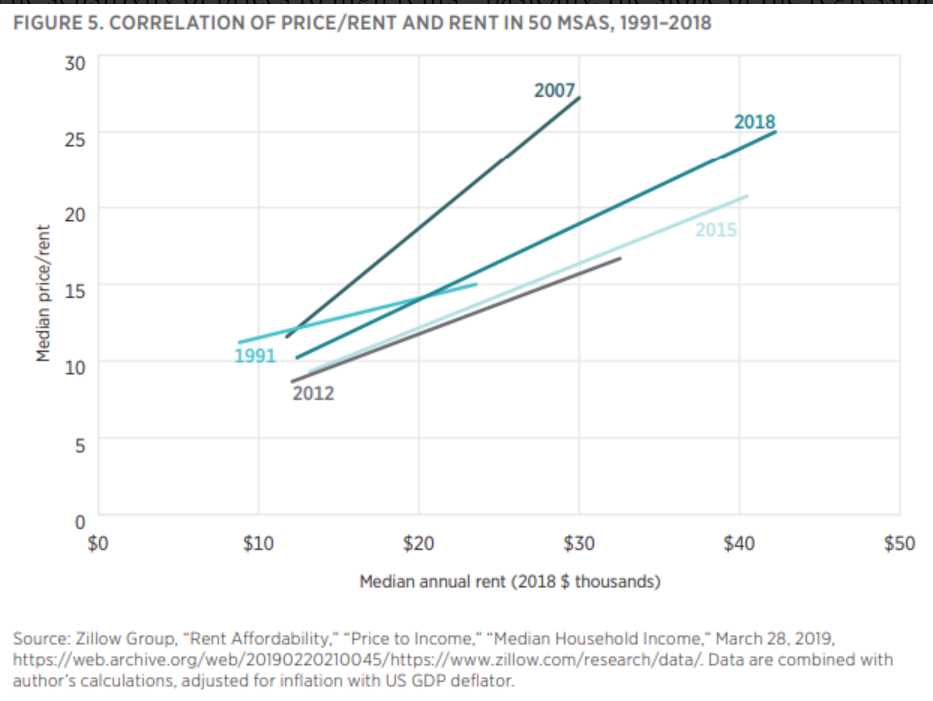

When the adjust-by-rent system is applied to individual cities, the purchase price of housing looks even flatter. Here the author generates smooth curves fit to data points from 50 metro areas. 2007 does look like irrational exuberance, but primarily in the higher-cost cities (even in 2007, in cities where rent was low, the buy/rent ratio was about the same as in 1991, 2012, 2015, and 2018).

Thanks to the miracle of population growth and the inability of Americans to come up with a cheaper way of building housing…

In Figure 8, we can see that prices are now rising in every city like they were in Los Angeles before. Low rates of building, with constrained lending, means that residents with low incomes are suffering from our policy choices now everywhere.

[Blaming “policy choices” is where I part company with this author, who talks about “systematic, persistent lack of housing production” as though that could be changed with the wave of a central planner’s wand. As I noted in City rebuilding costs from the Halifax explosion, even when land is free and there are no zoning restrictions, the basic cost of building an apartment now exceeds what a couple with two median incomes can afford (maybe the answer is that Americans need to live in throuples?). A simpler explanation is that we’re simply not wealthy enough, on average, to afford the things that we believe we deserve, including high quality housing for 333+ million people. We’re a medium-skill country, trending toward low-skill via our immigration system, demanding all of the stuff that properly belongs to a high-skill country.]

I’m not sure what we should take away from this as investors. The residential real estate market isn’t as irrational as previously portrayed. House prices, like apartment building prices, track rents. But how do we make money unless we have a crystal ball to forecast future rents? The friend who forwarded this to me said that historically real estate provides lower returns than investing in the stock market (but maybe this isn’t true if you consider leverage and the ability to stick lenders with the downside risk while keeping the upside benefit) and real estate ownership carries idiosyncratic risks, such as litigation risk (the owners of a hotel were hit for $26 million because a jury found that a clerk employed by the owners allowed a pervert to check in next to a sports journalist and film her naked (and that she suffered $55 million in damages from this, more than if she had been killed)).

As taxpayers one take-away is that we’re going to be paying the rent for a high percentage of our brothers, sisters, and binary-resisters who either don’t want to work or whose skills don’t yield a sufficient income for housing that we consider suitable for a resident of the U.S.

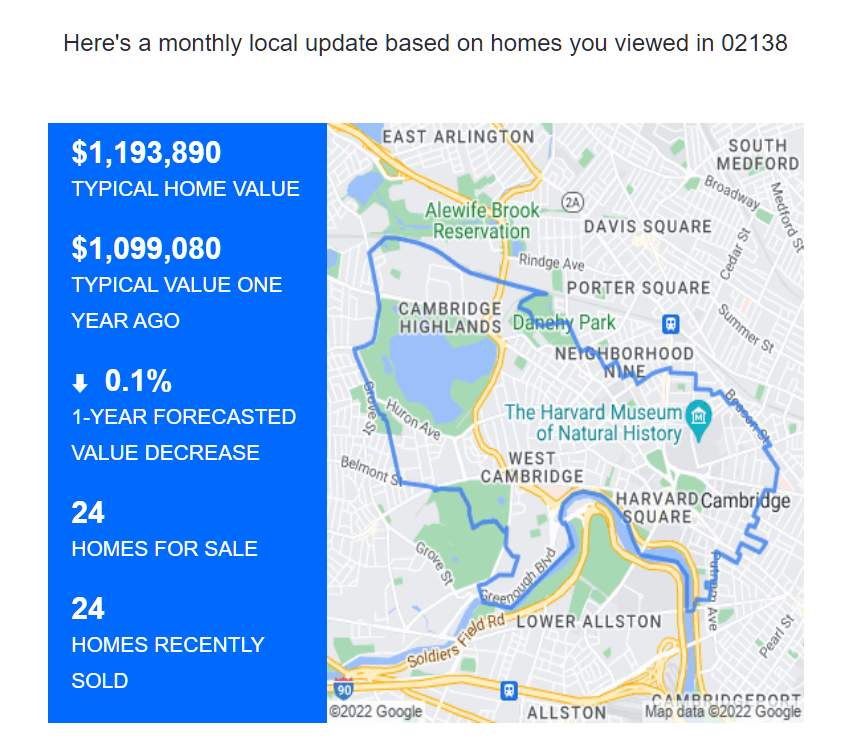

Speaking of real estate investing, you can’t go wrong by doing the opposite of whatever I suggest. My theory was that Cambridge, Maskachusetts real estate would go up in value once the Followers of Science abandoned their fears, masks, school closures, lockdowns, and vaccine papers checks. When everyone was back at his/her/zir/their desk in the office towers of Kendall Square or the academic buildings of Harvard Square, real estate in Cambridge would catch up to real estate in South Florida. The brilliant minds of the AI software within Zillow disagree, forecasting a down round for Harvard Square:

Related? “Report: Migrant ‘Invasion’ Is Spiking Rents, Inflation”

https://archive.ph/wip/QYavn