People in Maskachusetts say that they’re “progressive”. Very few earn more than $1 million per year. Why, then, did more than 1.1 million people vote “no” on a constitutional amendment that would allow the state to ding the rich (more than $1 million/year in income) at a 9% rate instead of the 5% flat rate that prevails for the peasantry?

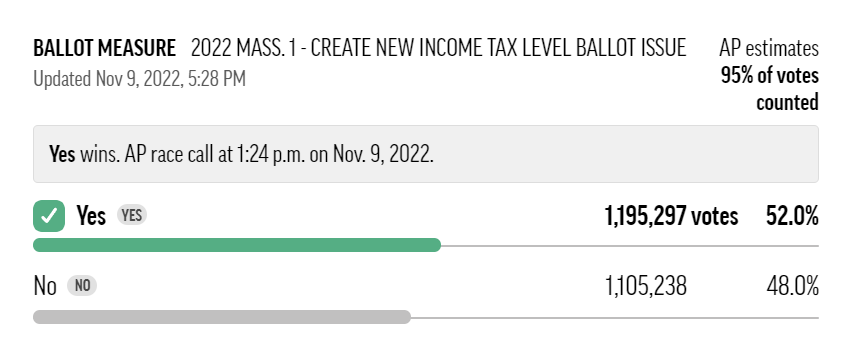

“Massachusetts passes Ballot Question 1 (Millionaire’s tax), AP says” (MassLive):

We are informed that it is only Republicans and married white women who are so stupid that they vote against their own interests. There are hardly any Republicans in Maskachusetts and a lot of the married white women have taken advantage of the state’s no-fault divorce system to head for a profitable exit. This ballot measure should have passed by at least a 30-point margin, not a 4-point margin.

How can we explain the race being close? How could so many peasants be against rich people getting closer to paying their fair share? (which actually should be at least 13.3% because that’s what rich people in California pay for state income tax)

It can’t be because people were concerned that inflation would lift them from the old 5% bracket into the new 9% one. The text of the ballot question explains that there will be annual inflation adjustments.

Separately, this was a great outcome for the luxury real estate industry in Florida! Rich bastards will need to pull up stakes in MA before the end of December 2022 if they object to paying their fair share. (See Relocation to Florida for a family with school-age children )

Finally, the tax bump won’t be great for alimony defendants. “New Guidance on the Intersection of Alimony and Child Support” (Burns Levinson law firm, August 2022), quotes the law: “the amount of alimony should be determined with reference to the recipient spouse’s need for support to allow the spouse to maintain the lifestyle enjoyed prior to the termination of the parties’ marriage.” Alimony is now tax-free to the plaintiff and not deductible for the defendant. since most couples spend close to 100 percent of their income, the only way for a divorce plaintiff to enjoy the marital lifestyle is to collect close to 100 percent of the defendant’s income). So in setting the order, the judge has to make some assumptions about what tax rate the defendant will pay in order to figure out what the after-tax income is and make sure not to order the defendant to pay more than 100 percent of income. A high-income defendant in Massachusetts will have less after-tax income, but the court order to pay based on the old tax scheme can’t be changed without the defendant starting a “modification” lawsuit that could take years and cost $millions in fees to resolve.

Related:

- Colorado FF, a proposition to hit those earning more than $300,000 per year with a stealth higher tax rate by reducing the deductions they can claim (it passed because lots of folks earning less than $300,000 per year voted for it!)

- Effect on children’s wealth when parents move to Florida (kids end up about 40% richer if a parent moves south and clings to life for 30 additional years)

“a constitutional amendment that would allow the state to ding the rich (more than $1 million/year in income) at a 9% rate instead of the 5% flat rate”

In FL, a constitutional amendment needs 60% of the vote to pass. That’s why FL’s Amendment 3 giving an additional homestead property tax exemption for teachers, police officers, correctional officers, firefighters, active-duty military members, and child welfare workers did not pass (58.7% in favor of Amendment 3, shy of the 60% required to pass).

Nonetheless, an Amendment 3 is guaranteed to pass in the near future as more and more Floridian’s work for the preferential government categories to benefit.

The real puzzler here is why US taxes are so focused on income, and not on assets. Homeowner’s get taxed on the value of the one asset that is widely held (via property tax), but owners of stocks pay no tax unless they sell their asset.

Thus, the tax system favors those with assets, while penalizing those who have to work for a living. It’s almost like the rich wrote the tax code.

It’s true. California and Massachusetts should certainly live their principles and impose a wealth tax on top of these existing taxes. Is 0.5% per year too much to pay to help the vulnerable?

There are some people in the Commonwealth who are becoming tired of the tax and spend policies. A million dollars ain’t what it used to be when the gateway to the “middle class” is $150,000+ a year and at least twice or three times that in net worth. Even the peasants aspire to to be able to retire comfortably with something left to leave for their children that the government(s) won’t take.

However, it’s a very slowly-growing phenomenon and it’s fragile.

Geoff Diehl got 34.7% of the vote for Governor despite the actual, registered voter breakdown in MA being something like 1:9. So there were quite a few “crossovers” and people who are looking ahead to the future thinking: “Yeah, you know, one day I’d like to start a business with my kids and friends, and earn a million dollars a year and not have it all vacuumed away to pay for licenses for illegal immigrants, layabouts, health care, and a ‘government by telephone wait line’ system that keeps expanding and works like s**t anyway.”

Not to mention Constitutional Rights Revocation by Executive Order and the Establishment system of not having anyone in the Legislature vote for anything controversial that might get them unelected. This is still the Kennedy Family’s Back Yard but the neighbors are beginning to gather at the fences and push inward. I’ll really believe it when some genius in the Legislature has the guts to propose building a new nuclear power plant here instead of relying on Pure Grease to ease the pain.

I am curious why you see “Geoff Diehl got 34.7%” as a sign of something. The current MA governor is a Republican. He was also competitive when he lost in 2010.

@An Anon: > “The current MA governor is a Republican.”

Hahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahaha. That’s the funniest thing I’ve read in months. MA elects Republican RINO governors so nobody in the Legislature has to vote for anything ‘dangerous’ and whatever hapless schmuck is in the Governor’s office has to do their dirty work for them.

It’s like being King of the Dipshits in Sixteen Candles. Romney wasn’t any better. He was an even bigger King of the Dipshits. Deval Patrick was the best Governor that Massachusetts has had recently – at least he was nominally a member of his own tribe.

@An Anon: In other words, Geoff Diehl is too much of an actual Republican to be elected Governor in the Commonwealth at this point, but he gave it his best shot and a lot of people (somewhat surprisingly) still support him, despite the loss – which we expected. I never thought he would win.

In American politics, 35% rounds to 0. There is no reason for the “historic first” governor to consider the interests or preferences of that group.

Maybe they thought the rate was too low and are holding out for a higher one.

That’s a good point. Certainly the threshold is too low. I guess the next election can include a question that will refine the rates. 0% for the income under 50,000 Bidies per year. 4% from 50-300k/year (a small break to encourage the masses to vote for it). Then scale up to 13% at $1 million.

It could be rational if not indexed for #BidenInflation. By the time the Big Guy takes his last lick of ice cream in six years someone on food stamps might be pulling down $1 million.

I should have read closer:

“The text of the ballot question explains that there will be annual inflation adjustments.”

However, due to hedonistic adjustment creativity lived BidenInflation > official government BidenInflation.

So still rational to be leery, even for minimum wage workers given our possible Weimar future.