Friends who bought private jets and luxury waterfront property with their crypto profits were discussing the FTX meltdown and Sam Bankman-Fried‘s return to financial Earth.

One cited the Sequoia Capital investment memo regarding the vegan MIT graduate founder:

The FTX competitive advantage? Ethical behavior. SBF is a Peter Singer–inspired utilitarian in a sea of Robert Nozick–inspired libertarians. He’s an ethical maximalist in an industry that’s overwhelmingly populated with ethical minimalists. I’m a Nozick man myself, but I know who I’d rather trust my money with: SBF, hands-down. And if he does end up saving the world as a side effect of being my banker, all the better.

This is a purportedly hard-nosed Silicon Valley venture capital firm. Another chat participant cited a mixture of truth and fiction:

A comment from one of the participants:

Makes Madoff look like an amateur. He Played everyone. And I mean everyone. Absolutely insane. He was clearly insolvent in June and knew it. Then the real fraud began.

Good old fashioned segregation of funds issue.

Some tweets these guys liked:

Related:

- “Andreessen Horowitz Went All In on Crypto at the Worst Possible Time” (WSJ, October 26, 2022): “a 50-year-old partner named Chris Dixon who was one of the earliest evangelists for how the blockchain technology powering cryptocurrencies could change business. His unit was one of the most-active crypto investors last year, and in May announced a $4.5 billion crypto fund, the largest ever for such investments.”

It’s possible that I don’t understand crypto, but my understanding is that most (all) cryptocurrencies have a finite supply. There’s no such thing a reserve ratio (unless, as it’s said, the TOS allows borrowing of client funds) which means that any crypto scheme that looks like a bank or an exchange will have to make it’s money through fees, because it’s impossible to generate leverage. So you know anyone making billions on crypto is either benefitting from appreciation of long-held crypto assets, or stealing.

This was fascinating in part because it was so entirely unnecessary.

SBF started with a hedge fund (Alameda) before building FTX. Alameda initially ran very simple arbs circumventing Asian countries’ capital controls. Basically money laundering, no math degree required.

They later expanded into making directional bets with no risk management, overseen by two people with about a year of entry-level experience between them.

The exchange meanwhile became a large, real business: $1B rev from fees, $250M net income in 2 years. That is what everyone invested in.

It was a real and profitable business, and if he’d shut down his hedge fund when he started taking large-scale outside investment in FTX (last year) then he would still be a deca-billionaire today.

Instead he let the incompetent traders at Alameda make $10b of illiquid bets, then bailed them out with customer funds when the market inevitably turned south.

https://mobile.twitter.com/marcfriedrich7/status/1591193646585774080 the ‘nerds winning like zuckerberg’ narrative has really provided great cover for people who can’t even competently deceive.

Seems obvious that FTX profitability numbers were made up. FT says: “the company’s biggest asset as of Thursday was $2.2bn worth of a cryptocurrency called Serum. Serum’s total market value was $88mn on Saturday”.

But what FTX has really started is a chain reaction/contagion effect where Crypto.com is undergoing a bank run, not to mention smaller players like BlockFi, forcing them to suspend withdrawals. Pretty soon Binance itself might be in trouble. The whole crypto house of cards is coming down, or at least undergoing a huge stress test that will make Celsius failure seem like a walk in the park. And unlike the fiat Lehman failure, there’s no Fed to step in and bail everyone out.

“Pretty soon Binance itself might be in trouble”

Binance may well regret not bailing FTX out and covering the whole thing up, no matter how obvious & brazen the theft was.

I like the Peter Singer/Robert Nozick comment. I would line up behind Robert Nozick because you know where he is coming from — rather than Peter Singer who spends his life fabricating convoluted arguments trying to work out some demons that none of us could possibly understand — just like this character, hang on to your wallets people when you are in the presence of a holy man. Note Singer’s assurance at the beginning of the manifestation of the virus that it emanated from the “wet markets” of Wuhan — which according to him should be banned — certainly because it would save the animals not because of his deep knowledge as of March 2020 as to where the virus emanated from. https://www.project-syndicate.org/commentary/wet-markets-breeding-ground-for-new-coronavirus-by-peter-singer-and-paola-cavalieri-2020-03. Who really cares about a deadly virus when the lives of pangolins are at stake?

Kind of like Charlie Munger’s comment, maybe paraphrasing, which would you prefer, your daughter telling you she is engaged to a manager at Chevron or a literature professor at Swarthmore?

I suffered through a long interview of SBF on the virtues of effective altruism. Seemed like a very noble and generous man, or a con man. I guess now we know.

sounds like Elizabeth Holmes, who lectured ad nauseum about altruism and her burning desire to cure diseases, etc.. SBF grew up on Stanford U campus to academic parents; Holmes spent a few years on that campus, too. The world isn’t small enough!

When a banker or a trader starts speaking about altruism, run for the closest exit.

Isn’t crypto that money substitute that only exists in the imagination of computers? Oh wait that is no different than most measures of wealth, except faith in Jesus, children, and livestock.

Crypto suffers from two fundamental problems (that’s why I decided not to waste my time making a cryptocurrency 30 years ago…)

The first is that there is no natural limit to the number of cryptocurrencies. Anyone and his dog (let call him Doge) can make a clone, and it is not inherently worse than any other “currency”.

The second is that all of them violate the conditions of the regression theorem. As such, they can only be transient fads. Good for pyramid scams, but useless as the store of value

For the long-term insurance part of my portfolio I prefer the currency protected by the quantum no-cloning theorem coupled with impossibility of recreating supernova conditions with any concievable terrestrial tech. Right smack in the middle of the island of stability.

It is useless to speak of it. If investors don’t know when the initial deck says returns without risk, they all deserve whatever they get. If they believe in another cult of personality, they all deserve whatever they get. If they make investment judgments based on erections and soggy panties, they all deserve whatever they get. There is no stopping it. The only way would be to randomly shoot one out of every two or three who do such things. No trial. No jury. Just a public lynching.

The great wars are coming. They will cleanse us.

“…and they don’t regret any of it for a second – nor should they…But at the end of the day, Jessie knows the only person’s opinion that matters is their own.”

https://www.tag24.com/lifestyle/tattoos/tattoo-enthusiast-spends-roughly-10k-on-body-modifications-and-vows-to-go-bigger-2664481

> If they make investment judgments based on erections and soggy panties, they all deserve whatever they get.

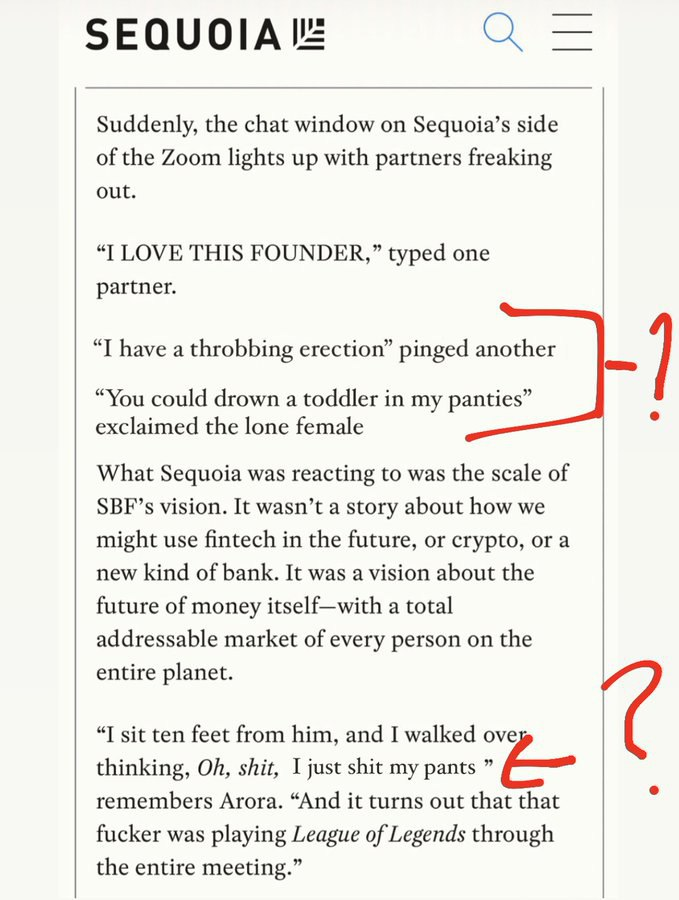

Those sentences are (likely) fake. The “I shit my pants” sentence isn’t even on the same baseline as the previous text.

I’ve read the same source but it doesn’t have these sentences.

@dpawlyk: Thanks for the heads-up. I know that since it is published on the Internet that makes it “automatically true.” Even if they’ve been grafted in there, perhaps they accurately describe some of the sentiment, though.

Vegetarians eat vegetable. Beware of humanitarians! … seems to apply in this context

Elizabeth Holmes and SBF both claimed to be vegans. Holmes had her assistant run out for “green juice” ingredients at WFM, which were then billed to Theranos (part of the $800K in restitution the court is asking Holmes to pay?).

What are the chances that either of them was a strict vegan?

These crypto schemes are all basically Ponzi schemes. The early investors make out with lots of cash while the late arrivers get left holding a bag of worthless crypto coins.

Reminds me of the Internet crash in 2000.

Who is the source behind the colourful story at the top about zoom comments from Sequoia partners talking about wet panties and erections? Can’t find it anywhere?

I can’t rat out my sources! At least one of them is himself a venture capitalist. They may have connections to non-public info.

It just looks like a fabrication. If you search for the now removed note you can read it on different web sites and there’s no profane language.

Hmmm… I think it might have come from https://twitter.com/MorningDewCap/status/1590491225496645633

Let me edit the original post.

In the original note the partners where excited about FTX, but no comments like the one you show above on your page