Our government has decided that it is okay for a doctor or hospital to charge an uninsured customer 10X what an insurance company would pay for a service. Thus, an American who doesn’t want to pay 10X the fair price and risk bankruptcy has no choice but to sign up for health insurance. He/she/ze/they cannot pay the $25,000 that an insurance company would pay for a serious issue and defer the purchase of a new car. Instead, he/she/ze/they must deal with a bill for $200,000 and aggressive bill collectors and lawyers from the hospital.

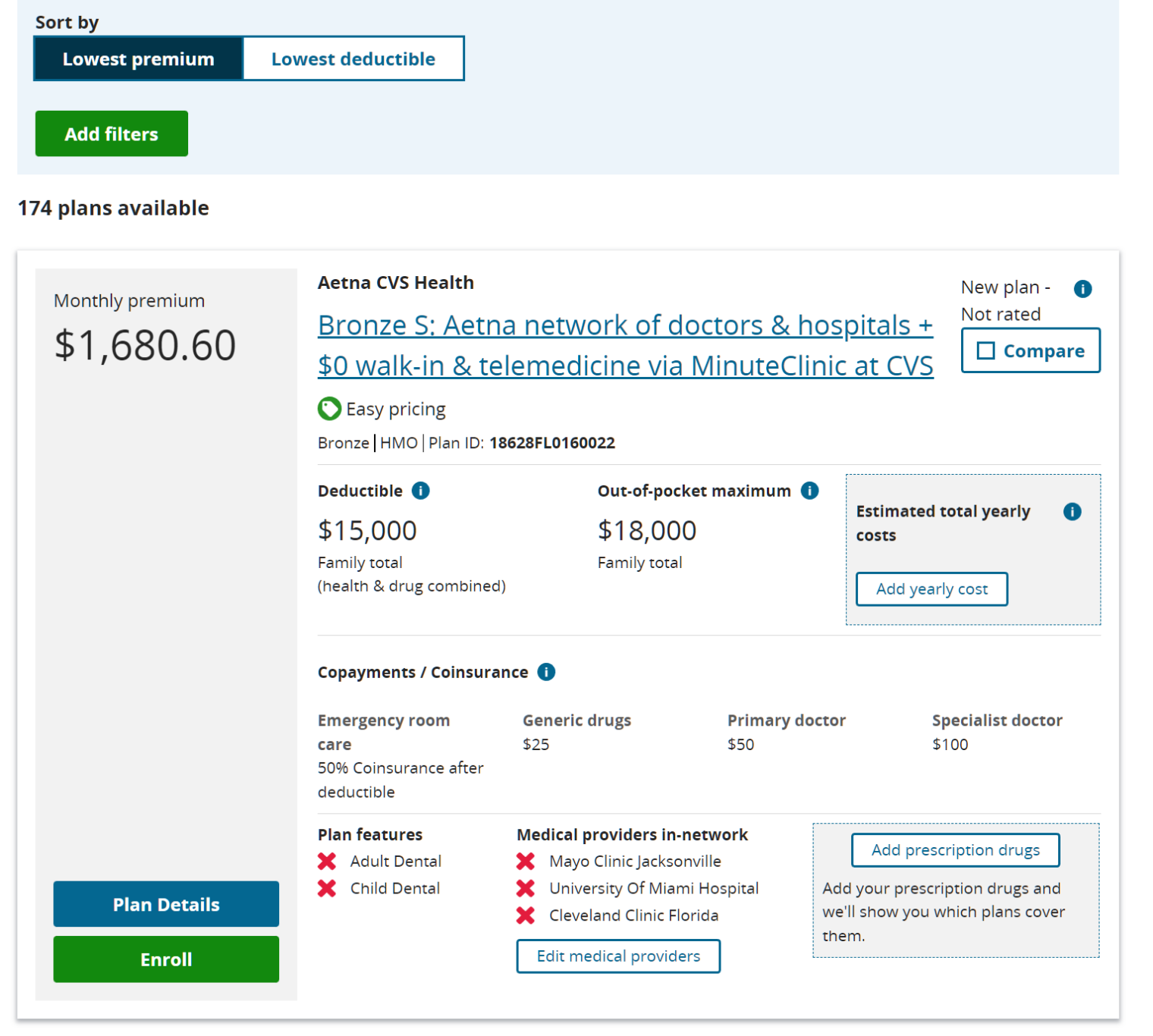

I recently decided to see if it would make sense to get a policy from healthcare.gov for our family. There are three big providers in eastern Florida: Mayo Clinic, Cleveland Clinic, and University of Miami. The site has a way to enter these providers and see if they’re in the network for the plan. Here are some of the quotes:

The consumer is supposed to evaluate 174 alternatives, build a spreadsheet and run a Monte Carlo experiment to figure out which is likely to result in minimum spending? You’d be a fool to have insurance that didn’t cover these three networks, as we discovered to our chagrin last year with Humana. Healthcare.gov offers to help you register to vote, but it doesn’t offer to limit results to insurance policies that will pay these essential providers.

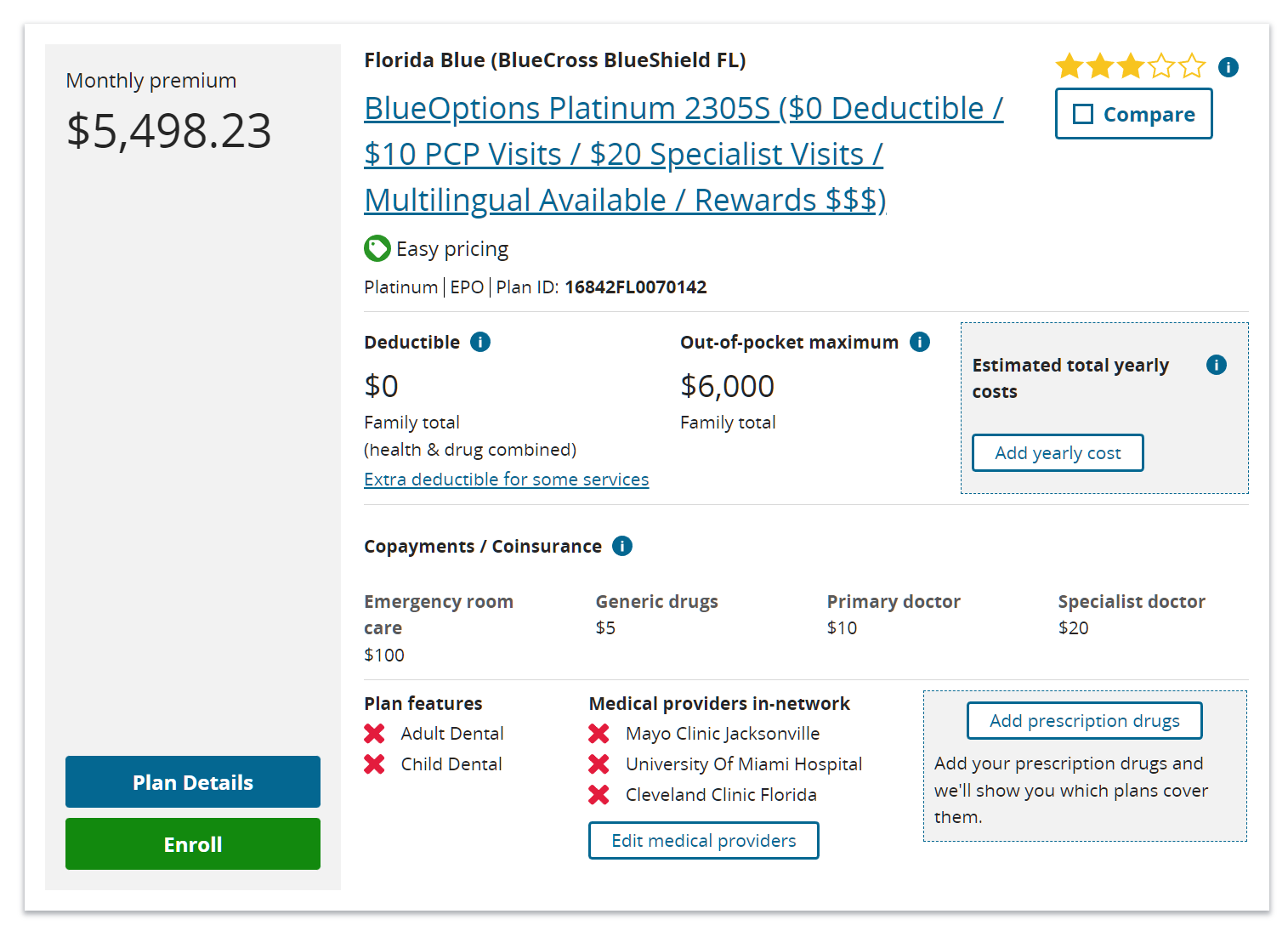

I thought that Blue Cross had deals with everyone and yet this $66,000+/year policy ($72,000 including the out-of-pocket maximum) is presented as not covering any of the places that you’d want to go if you needed a specialized specialist:

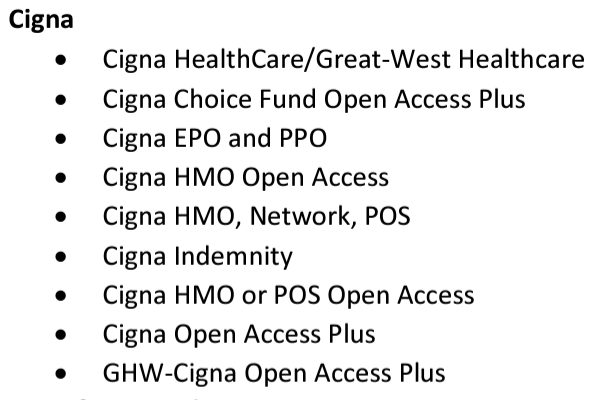

Perhaps we could work it from the other side? Here’s what Mayo Jacksonville says they’ll take:

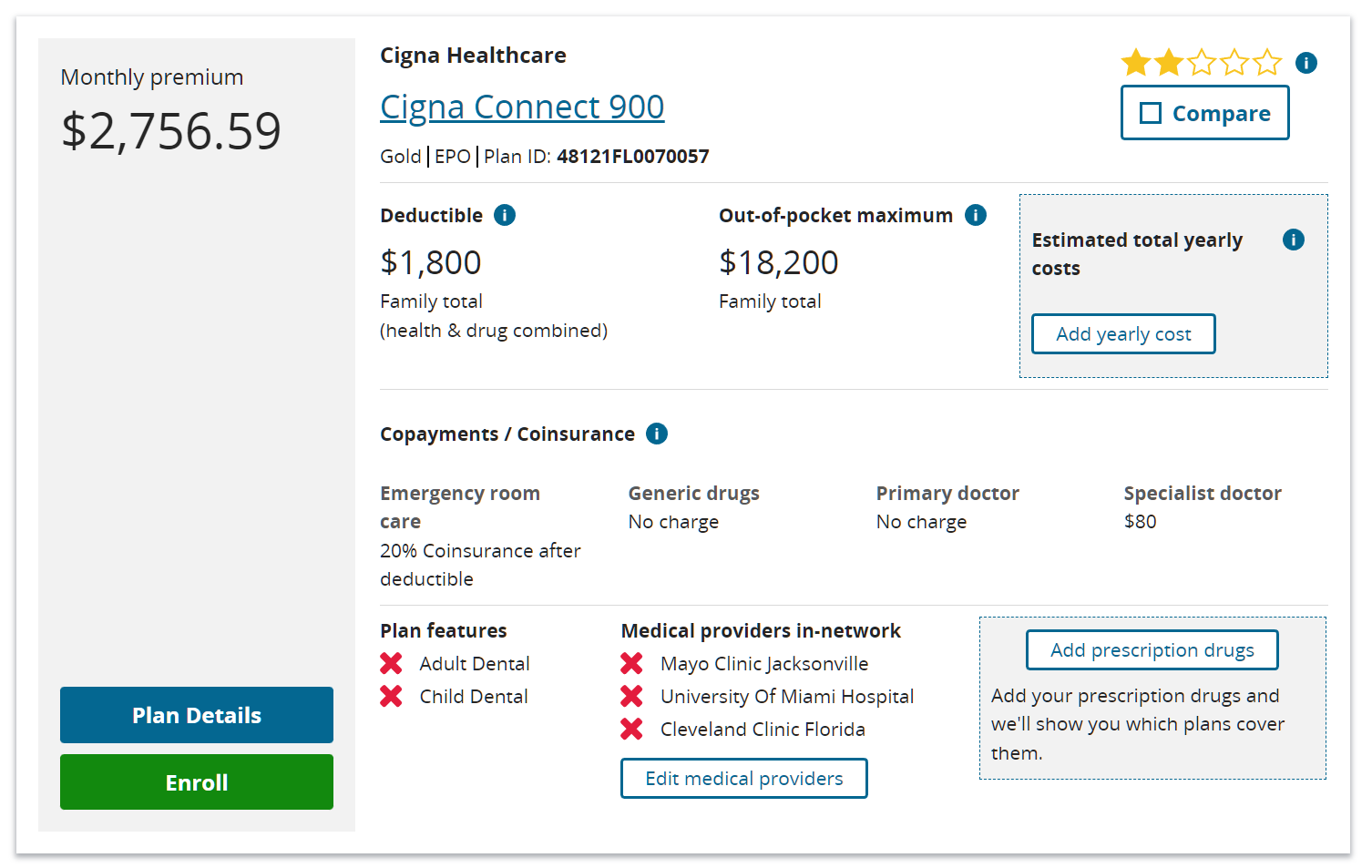

The consumer is supposed to recognize, therefore, that Mayo takes “Aetna” and “Blue Cross Blue Shield” but not the versions of “Aetna” and “Blue Cross” that are sold on healthcare.gov? How many people are this sophisticated? Mayo Jacksonville takes “Cigna EPO”, but, according to healthcare.gov, not “Cigna Connect 900 EPO”:

As Obama said, if you like your doctor you can keep your doctor so long as your doctor doesn’t work at any of the good clinics or hospitals in the nation’s third largest state. I scrolled through all of the 174 plans and never found one that covered more than University of Miami (and that was rare).

Maybe this is peculiar to Florida? Friends in Maskachusetts who had been paying $30,000 per year to Blue Cross (in pre-Biden dollars) switched to MassHealth (Medicaid; there was an income test, but no asset test on the MA signup web site) and found that their choice of doctors was much wider. That seems to be the case in Florida as well. Mayo Clinic is happy to accept Medicaid. Cleveland Clinic says they take Medicaid. University of Miami takes Medicaid. In other words, Americans have voted to set up a system in which a person who works and pays $72,000 per year for health insurance has inferior access to health care compared to what someone who has never worked enjoys.

There is Betteridge’s law; “Any headline that ends in a question mark can be answered by the word no.”

I think a close corollary; For any act of congress, assume the outcome will be the opposite of the statement.

See, the Affordable Care Act or more recently the Inflation Reduction Act.

Check out those Emergency Room coinsurance rates and in particular, in addition to all the other mental gymnastics and analysis, make sure to contemplate the cost for an ER ambulance ride and whether your local ambulance ride would be in or out of network. The charges can easily reach into the thousands of dollars for a 1/2 hour trip to the ER. The Washington Post ran an article about a year ago featuring people in San Francisco who were astonished to get the bill after an out-of-network ambulance ride to the hospital named after Mark Zuckerberg.

https://www.commonwealthfund.org/blog/2021/protecting-consumers-surprise-ambulance-bills

https://www.usatoday.com/story/news/health/2022/12/13/ambulance-surprise-medical-bills/10866349002/

If the situation has changed significantly since those articles were written, someone please let me know.

My 85-y/o father is on a Medicare Advantage plan. He recently fell in a Walgreens parking lot and skinned his forearm pretty bad and had a lump and swelling above his eyebrow. The responding EMTs bandaged him up and wanted to send him in the ambulance to a nearby hospital. Worrying over the (unknown) out-of-pocket cost, my dad refused to go, and called me to come pick him up (from four miles away). I took him to a nearby Urgent Care facility where, for a $10 copay, they re-bandaged him up and sent him on his way. He healed up well.

If it makes you feel better, there are people at just the right income level that instead of getting on Medicaid, they get that 5498.23/month plan instead, and the taxpayer subsidy covers almost all of it.

I had private insurance at something like 220/month and then when the ACA was forced on me, the same plan was something like 600/month. It was an obvious screw job from day one, but the long-term goal is to expand Medicare to all. I guess that would indeed be better.

Medicare enrolls10,000 new users every day, each drawing an average of $14,000 in annual expenditure. We should start a betting pool: How long before the program goes tits up?

US definitely isn’t a good place to retire, unless you’re an immigrant who has come to pay into the debt pyramid.

Try any other place in the world. There are no good places to retire, there are only good places to die slowly.

Japanese actually figured that out long time ago… hence their concept of 生き甲斐 (ikigai).

hilip — Have you written DeSantis and asked him to strengthen the Obamacare offering in his state?

Maybe roll out a public option simple enough to not confuse MIT PhDs?

Btw, have you tried putting in a zip code in CA, NY, or MA to see how the results compare?

* Also, you should be on a high-deductible plan. That platinum plan is designed for hypochondriacs or lonely elderly who like talking to doctors.

I don’t think DeSantis would listen to me, but I don’t think the governor can dictate what these insurance and provider oligopolies do.

I didn’t try out the system in other states. I’m not sure that would work because healthcare.gov tries to verify who you are and where you live before it presents any options.

I showed both a cheap plan and an expensive plan in the original post to demonstrate that, regardless of deductible or monthly cost, none of the Obamacare plans deliver to the working/paying what Medicaid does to the non-working.

But… if a dictator ordered providers on the Medicare/Medicaid gravy train to sell services to the uninsured at 1-1.2X what Medicare pays I would have an infinite deductible policy, i.e., no policy. The only reason that I want health insurance for our family is that, without it, we will be bilked at 5-10X the normal prices. The insurance part of the insurance is of no interest to us (I assume that the carriers will make money in the long run so I know that therefore the premium will likely average out to be at least a bit more than the total cost of the services consumed).

You can circumvent healthcare.com by pricing and buying health plans directly from the insurer. I believe they are required to be the same plan and same price as the on-exchange plans. It’s a bit more work but you can do out-of-state comparison shopping without verifying identity.

The devil of course is in the details. A lot of providers won’t participate in the ACA plans, even though they are affiliated with hospital systems that allegedly DO participate in the plan.

Steve: Thanks. I don’t think I could do the comparison that David suggests in CA or NY because I don’t know where the elite doctors work in those states. I guess in Maskachusetts I would look to see if the healthcare.gov plans cover Mass General, Brigham, and Children’s Hospital (but actually I think they would have to because Massachusetts is so overwhelmingly dominated by these institutions; there is a lot more competition in Florida).

One last comment: the reason healthcare.com makes comparison shopping hard, is that the government doesn’t want anyone to accidentally see the unsubsidized price of the plans. So they try to collect zip code and income data before they will show the prices. You can debate whether the underlying intent is nefarious, or to simply to ensure applicants understand that subsidized plans are inexpensive.

Since the subsidies are calculated based on income and the cost of a benchmark silver plan, there are almost always bronze plans available for a fairly minimal amount of money. This is the carrot to get people into the system: Make $45k? Bronze plan $100/month Silver $300/month, Gold $500/month. Or thereabouts.

Philip — The issue is that marketplace plans are focused on the cost-sensitive, so the insurance companies put together low-priced networks that exclude some of the most expensive providers (as you’re seeing).

It’s like buying a super-saver airline ticket. Good enough, but no frills. It’s the right product for most people buying insurance on the exchange.

In California, you can see the difference when you check the “insurances we accept” page of some of the high-priced places. I seem to remember Stanford saying they took Blue Cross XXX plan, but not Blue Cross Exchange plans. (This was years ago, so things might be different).

If you want a rich network, you might be better off going to the insurance company directly. You can expect to pay more, but be more likely to get the network you want. They’ll likely put you in the same network many of their corporate customers use.

In your case, if your concerns are: (1) wide network, (2) benefit of pre-negotiated prices, and (3) tail-risk insurance, you’ll want a high-deductible plan. This will also give you the tax benefit of having an Health Savings Account.

If you want a rich network, you might be better off going to the insurance company directly.

David, what you just described is illegal under the ACA. The entire point of the law is that private individual insurance is community rated with the exchange plans; i.e., the same price and the same narrow network.

If you want a wide network there are four options: 1) wait until Medicare eligibility 2) Drive income to poverty level 3) Join a government union 4) Join a large corporate buyer

Steve — I don’t think that’s right.

I live in California, and I can go to the Blue Shield of CA site and buy an individual plan called the “Bronze 7500 Trio HMO” that’s accepted at Stanford, while none of the other coveredca.com plans are.

https://stanfordhealthcare.org/for-patients-visitors/health-insurance-plans/covered-ca.html

This plan is not available on coveredca.com, our exchange.

Interesting. I see that “Blue California” is available on coveredca, but I can’t research details without creating a login. I also see that “Blue Shield Trio HMO” does NOT allow you to select a Stanford PCP, nor a Stanford specialist, without preapproval from your assigned medical group. But it does allow you to use Stanford with preapproval.

Perhaps California created additional regs on top of the ACA? I don’t know; here in New Hampshire the ACA exchange plans and the “private” individual plans are the same.

I knew if I waited long enough this would become a Bernie blog!

Nope. Bernie is an old idiot, and nothing will help him, too late to learn any economics.

The Florida Blue plan has a 3-star rating despite costing twice as much as the 2-star Cigna plan. That sounds about right.

The problem is that Medicaid and Medicare both have the implicit bargaining power of the federal government behind them, which requires most providers to participate to receive federal money.

The leftovers are mostly soaked up by private corporate and government health plans that have fortune 500 and union bargaining power backing them.

The full-paying ACA folks simply aren’t a very big cohort and most health systems would prefer to exclude them. That’s true for both the on-exchange subsidized plans, and the identical off-exchange unsubsidized plans.

This isn’t a Bernie argument per se (as someone above suggested), but when you have two exceptionally large cohorts (government dependents, and fortune 500) with massive collective negotiating leverage, and then a small cohort that is left behind, the outcome is rather dystopian.

Steve: I think 97% of the problem could be fixed with a one-sentence decree from the all-powerful Feds. “An institution that gets federal money cannot charge an uninsured patient more than 1.2X the Medicare rate for the same service.” It is painful to pay $20k for a medical intervention, of course, but a lot of people manage to scrape up $20k for a car or a home improvement. The same intervention at $100k or $200k is unaffordable even for the moderately rich.

“Our government has decided that it is okay for a doctor or hospital to charge an uninsured customer 10X what an insurance company would pay for a service.”

The real problem is not that – anyone selling anything should be able to set his price at whatever.

The real problem is that medical providers can charge you that “whatever” without telling you what the price is BEFORE you agree to their services. And that is plain fraud – which the government approves.

Add to that the tax implications (when you pay yourself it’s after-tax dollars, when employer pays, it’s before taxes) and the required insurance to mid-size and large businesses, and you have the situation when you are forced to have health insurance. I’m sure insurer lobbyists had nothing to do with that bullshit.

Oh, and you cannot buy insurance which matches your needs – it’s so heavily regulated that no matter what you want you’re getting essentially the same bullshit collection of “services” – most of which you’d never need and you know you will never need them. Because medical insurance in US is not insurance at all – it’s a socialist redistribution program designed to extract as much money for the medical industry as possible by reducing financial consequences to people who just cannot be bothered to have a healthy lifestyle.

There’s another issue with the medical “insurance” which makes it completely unlike anything resembling any actual insurance – the so-called “insurance” only covers on-going losses as long as you have coverage, and the insurer can drop you at will. This is plain fraud – you have insurance, you get ill – and will need maintenance and have higher risks for the rest of your life – and the insurer simply drops you as soon as they can. Instead of requiring the medical insurance to be the real insurance – to cover everything for the rest of your life resulting from your illness diagnosed while you had your coverage – the congress morons opted out for prohibiting actuaries from making pricing decisions based on your health (and because the regulations do not permit exclusions on services based on pre-existing conditions, insurers are strongly incentivized against offering customized insurance to already ill).

The lack of ability to customize essentially creates oligopsony for doctors and hospitals and oligopoly for patients. And that means that the hospitals find it much easier to form corrupt relationship with insurers – so that they are able to exploit patients pretty much to the extent of patients’ ability to pay. The whole system is totally corrupt and exploitative. The idiots in con-gress totally destroyed market pricing mechanism with their supposedly well-intentioned bills “protecting” people – so now the corporate medicine is able to post arbitrary prices in virtual dollars having no relationship whatsoever with the actual money the services cost. Which is pretty much exactly what Soviet system of prices looked like.

So… the price you see for “cash” service is in virtual dollars. If you ask, you can easily discover that the real price is 10x less. And always ask BEFORE you sign anything. (Well, that doesn’t work so well if you’re desperate or unconscious… but COVID made it pretty clear that the medical establishment in US is not burdened with anything resembling ethics or morals.)

A: In a market economy I would agree with you that a business should able to charge what it wants. But health care has already been so distorted by government that nothing like a market is available to operate for the uninsured who actually pay their bills (the smart ones say “I’m undocumented and homeless” and let the government pay, even if they aren’t on Medicaid). We have Medicare and Medicaid and government-regulated and subsidized insurance and then the government paying for the “free” or “charity” care that is dispensed to those who haven’t qualified for Medicaid (e.g., because they recently walked across the border).

I was recently looking for health care because I retired a few years early. I had people calling me constantly offering plans for $200. I assumed these would be terrible and so stayed with my Cobra which was a lot more but I already know I like it. But I’m so confused by what is going on with these really cheap plans.

I am so distrustful of these people that I’m even thinking of going back to work.

My government job offers a decent Aetna HMO, $0 premium for the employee on the individual plan. $400/mo employee premium for the family plan.

I’m sure you have looked at this, but do you or can you belong to an affinity group (alumni group, professional group, etc.) that offers some plans? The system is a shitshow for everybody but especially for bare-naked individuals with some money.