… it is the folks who don’t want to borrow another $31 trillion who are guilty of destabilization.

October: “U.S. National Debt Tops $31 Trillion for First Time” (nytimes)

This month: “Speaker Drama Raises New Fears on Debt Limit” (nytimes)…

Representative Kevin McCarthy of California finally secured the House speakership in a dramatic vote ending around 12:30 a.m. Saturday, but the dysfunction in his party and the deal he struck to win over holdout Republicans also raised the risks of persistent political gridlock that could destabilize the American financial system.

Economists, Wall Street analysts and political observers are warning that the concessions he made to fiscal conservatives could make it very difficult for Mr. McCarthy to muster the votes to raise the debt limit — or even put such a measure to a vote. That could prevent Congress from doing the basic tasks of keeping the government open, paying the country’s bills and avoiding default on America’s trillions of dollars in debt.

The only way to stabilize our economy and currency is to borrow and spend more!

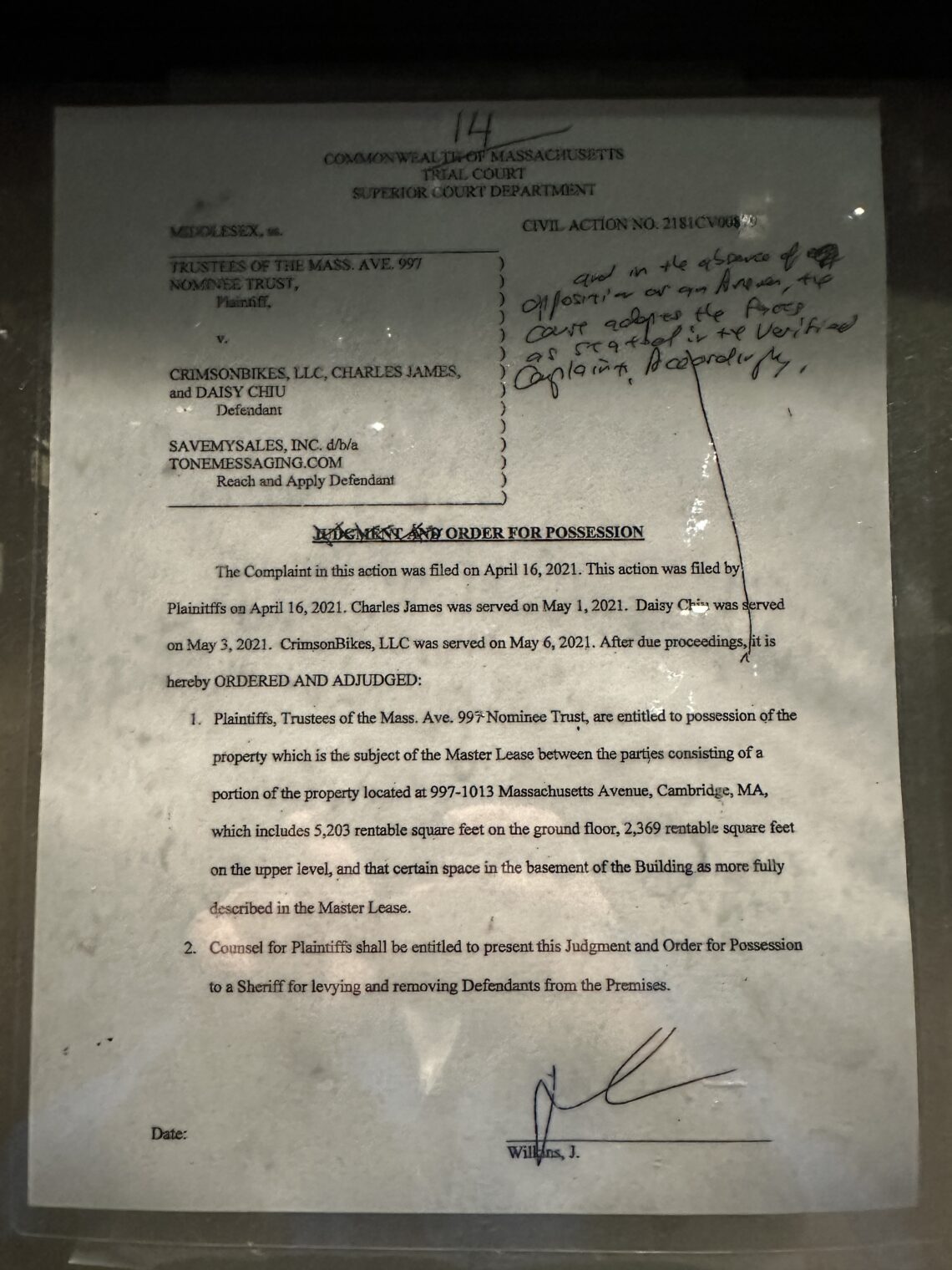

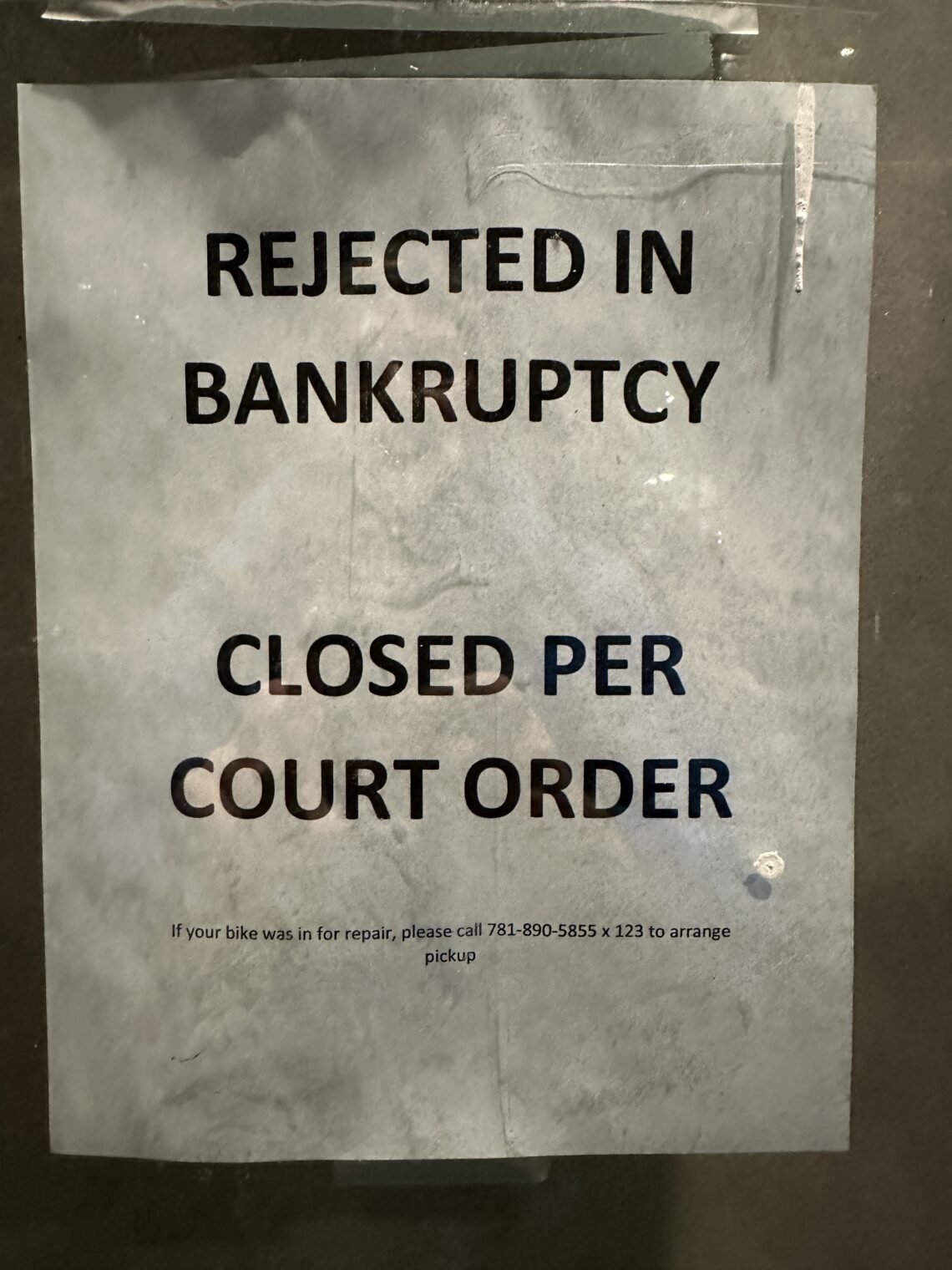

Speaking of the economy, here are a few photos from my old neighborhood in Cambridge, Maskachusetts. The marijuana stores are thriving while the bicycle shop went bankrupt:

According to the NYT, a party that is not ruled by a tiny central committee and does not march in lockstep is “dysfunctional”.

That’s why the current inflation fight is doomed to fail. If they can’t get it back into just asset prices, they’re going to have to exclude wages.

It is absolutely ridiculous that the same politicians who spent $31 trillion are now the ones who are threatening to not raise the debt ceiling. They are the ones who got us into this mess in the first place and yet they are the ones who are now threatening to make it even worse. It is a perfect example of the dysfunction of our political system.

The American people are largely to blame for this situation. We demand lower taxes and higher spending, while simultaneously complaining about budget deficits. This contradictory stance has only encouraged politicians to keep spending beyond their means, knowing that the people will never hold them accountable. It is an example of the broken state of our government and the flawed system of democracy that allows these sorts of things to happen. It is inevitable that this situation will lead to a debt default, as the politicians who borrowed $31 trillion will never be able to find enough money to pay it all back. The only way out of this mess is for the government to either dramatically raise taxes or drastically cut spending, neither of which are politically feasible. Thus, a debt default appears to be the only logical outcome.

Ryan: I agree that the fundamental problem is that we aren’t as rich as we imagine ourselves to be and believe that we deserve to be. This is the root of a lot of politics, e.g., borrowing and spending like crazy, running unlimited means-tested welfare programs for citizens and recent migrants to the U.S., etc. I’m going to do a separate blog post on this, but I recently discovered that a family of four earning $210,000+/year can get taxpayer-subsidized housing in Boston: https://www.boston.gov/departments/housing/housing-and-urban-development-income-limits

Is there no asset limit, like Medicaid? Is it possible to buy an “affordable” condo and then rent it out at market rate? Are there any conditions under which they can take it away from you once you buy it?

Ryan: I would doubt that there is an asset limit in Maskachusetts for this because there doesn’t seem to be an effective asset limit for Medicaid (“MassHealth”). A friend who owned a $2 million house and perhaps $10 million in additional assets got his family on MassHealth about 10 years ago. Saved $30,000 per year (in pre-Biden dollars!) and reported that it was much easier to access specialists because every doc was suddenly in-network. He went from $30,000/year to less than $100 per year by filling out some online forms truthfully. They never even asked about assets.

It’s not just Massachusetts; states that expanded Medicaid under Obamacare explicitly aren’t allowed to have asset tests:

https://www.medicaid.gov/medicaid/eligibility/index.html

> The MAGI-based methodology does not allow for income disregards that vary by state or by eligibility group and does not allow for an asset or resource test.

Without the $1.7 billion omnibus spending bill, the debt ceiling would have been hit much later.

Ed: Your typo inadvertently shows the problem with present-day Americans. We can’t tell the difference between billions and trillions and/or think that it doesn’t matter. 🙂

Vote for me and I’ll steal for you!!!

No problem we can export our IOUs to the world. Ad infinitum.

Minting trillion-dollar platinum coins will fix everything.