A recent Wall Street Journal interview with a guy who made $billions in Argentine bonds… “Paul Singer, the Man Who Saw the Economic Crises Coming”. First, let’s check his track record as a prophet:

“Men and nations behave wisely,” the Israeli statesman Abba Eban observed, “when they have exhausted all other resources.”

In an interview for these pages in 2011, he warned about the broad discretion the then-new Dodd-Frank law gave government officials to deal with what they deem systemic risks. The “atmosphere of unpredictability” doesn’t “make the system any safer,” he said. “This is nuts to be identifying systemically important institutions.”

A dozen years later, he still thinks it’s nuts: “As we’ve seen with SVB and Signature, virtually any institution can be deemed systemically important overnight and seized, with the government then completely empowered to determine what happens to various classes of creditors.”

The result is to destroy market discipline and encourage bankers to behave recklessly. He recounts a conversation on the trading desk at his firm following the recent weekend of bank bailouts. “If they hadn’t guaranteed all the deposits,” a colleague said, “things would’ve gotten very ugly in the markets on Monday.”

Mr. Singer replied: “That is entirely true. Things would’ve been ugly. But is that what regulation is supposed to be? Wrapping all market movements in security blankets?”

What about the most significant economic phenomenon of the moment?

Mr. Singer saw inflation coming at the start of the Covid pandemic. “We think it is very unlikely that central bankers will move to normalize monetary policy after the current emergency is over,” he wrote in an April 2020 letter to investors. “They did not normalize last time”—meaning after the 2008 crisis—“and the world has moved demonstrably closer to a tipping point after which money printing, prices and the growth of debt are in an upward spiral that the monetary authorities realize cannot be broken except at the cost of a deep recession and credit collapse.”

Mindful of the history of the 1970s, when inflation retreated several times only to come roaring back, Mr. Singer figures short-term declines will convince policy makers that they’ve slain the beast. They’ll “probably go back to their playbook,” resuming the policy of easy money.

The guy’s remedy is one that will never fly with the American voter:

How do we chart a course back toward sound money and long-term prosperity? “The optimistic scenario,” Mr. Singer replies, “would entail pro-growth reforms across the board, including tax reductions, entitlement reforms, regulatory streamlining, encouraging energy development including hydrocarbons . . . cutting federal spending, selling the asset holdings on central bank balance sheets.”

(see quote from Abba Eban, above)

Let’s assume that Congress and the Fed are never going to change. How does an individual investor protect him/her/zir/theirself from the doom that Singer predicts? That’s where it gets tough! The guy is bearish on nearly all assets, especially crypto. His $55 billion Elliott Management fund can do things that none of us can do, e.g., buy a big stake in Salesforce and get the company to fire 10 percent of its employees to boost profits (and therefore stock value).

A friend who has done some co-investing with Paul Singer’s fund points out that “talk is cheap” and he won’t accept Singer as a prophet without evidence that he made huge money in inflation swaps after that April 2020 newsletter to his clients. Wikipedia points out that Singer was predicting doom in 2014:

In short, if this smart and experienced fund manager is right, U.S. and European assets will be eroded by inflation for the next few years and returns to investors will be minimal.

In a November 2014 investment letter, Elliott described optimism about U.S. growth as unwarranted. “Nobody can predict how long governments can get away with fake growth, fake money, fake jobs, fake financial stability, fake inflation numbers and fake income growth,” Elliott wrote. “When confidence is lost, that loss can be severe, sudden and simultaneous across a number of markets and sectors.”

Anyone who acted on that advice would have done quite poorly until 2022!

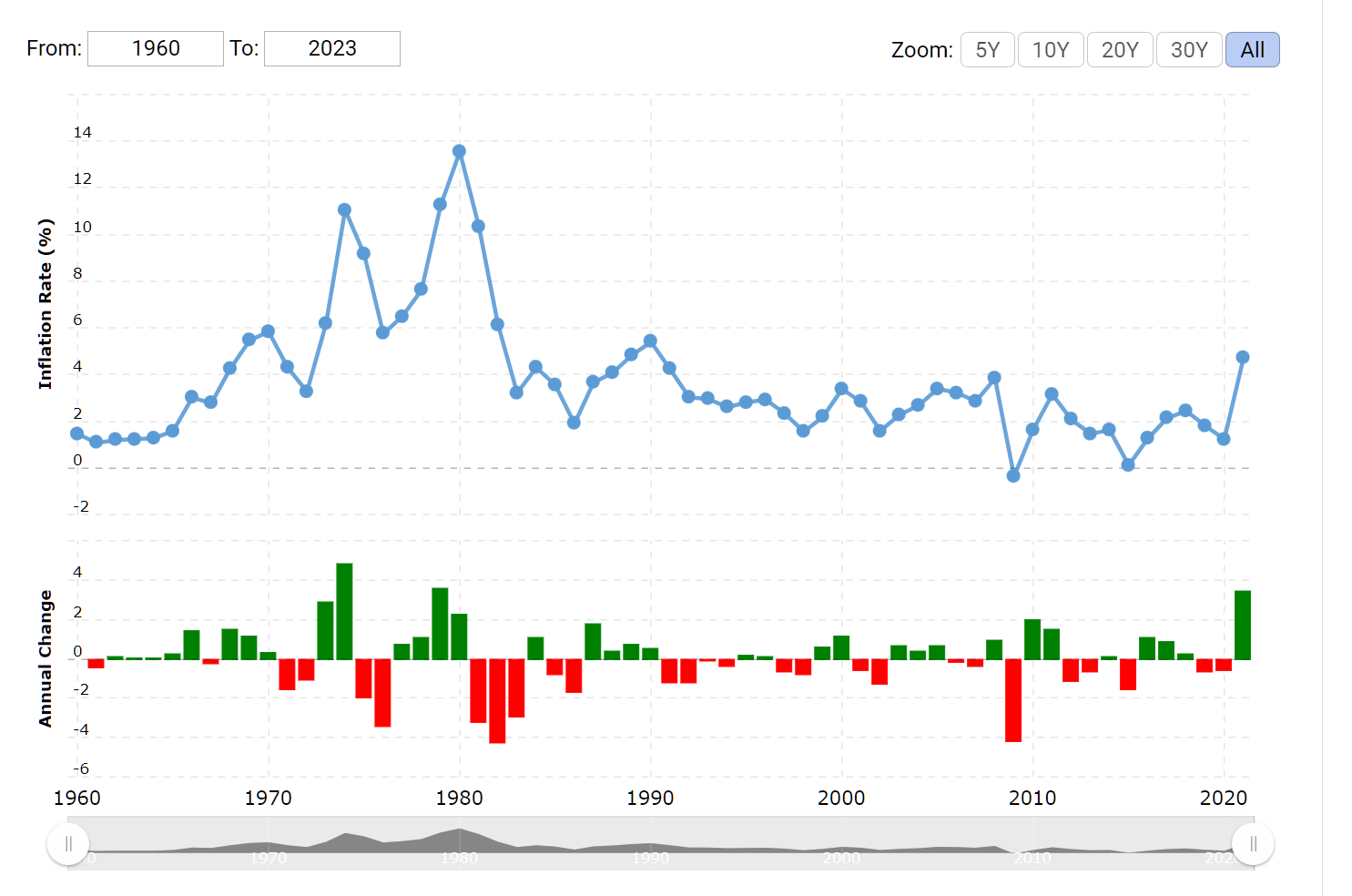

Maybe the take-away should be that Americans today aren’t smarter than Americans were in the 1960s and 1970s. Inflation jumped dramatically in 1966 as Lyndon Johnson and Congress spent like alimony plaintiffs on (1) the Great Society programs of Medicare, Medicaid, etc., and (2) the Vietnam War. The inflation rate did not come down to the pre-1966 level until 1998. Maybe we could argue that inflation was finally whipped by 1992 (chart):

If we’re expecting at least 26 years of elevated inflation, what do we do? For a person who doesn’t already have a house, one reasonable response is for him/her/zir/them to try to get a 100 percent mortgage at today’s 6.5-7 percent 30-year rates. Put some stocks in as collateral as necessary to hit the 100 percent number. If Paul Singer is right that the D.C. technocrats won’t be able to resist inflation-as-usual policies, inflation will render the real cost of borrowing almost $0. If Paul Singer is wrong, there is no prepayment penalty so just refinance if rates fall dramatically.

William Bernstein’s book, Deep Risk, examines the four horsemen of economic collapse: inflation, deflation, confiscation, devastation. For inflation, he recommends global equities, commodities producers, gold, and TIPS. Seems as good an approach as anything else.

The printing press is basically human progress. The more new stuff gets invented, the more the government can spend, whether it’s through taxation or offsetting price declines in 1 area with price increases in another area. For the government to run out of fake money would require progress to have stopped or to have not kept up with the pace of government expansion.

We live during times when everything is a “crisis” and absolutely no one and nothing can fail-and-crash. The fear of causing a “panic” is so ramped up as such, our government is fixated on doing whatever it takes to plug a leaking hole on the ship, but who cares if the ship is heading straight toward an iceberg.

What’s truly sad, is that the public has gotten so used to government hand-outs and bail-outs. There is no longer a sense of accountability or responsibility left anymore.

Lion writes: “ For the government to run out of fake money would require progress to have stopped or to have not kept up with the pace of government expansion.”

A More likely event is that the dollar loses its reserve currency status. China is working actively to bring this about. With the help of the Biden regime’s feckless policies, The Chinese are getting the cooperation of the Saudi’s and Brazil.

I think it is far fetched that serious countries would prefer their currencies to be controlled by Beijing rather than Washington. How many readers are exchanging their USD for RMB?

There is a long proud history of people predicting inflation every year because of monetary policy, but now with inflation being driven by supply chain problems and energy price spikes, they can conveniently ignore all the years they were wrong and claim they saw it first.

The press that covers them should know better, but that’s asking for too much.

@David, you are right.

However, the irony here is that federal reserves and policymakers, *knew* their monetary policies cannot be sustained, and yet their historically low-level interest rates, printed money faster than you can cut trees down, and told the public not to worry about tomorrow.

When the ship captain is drunk, everyone’s prediction becomes right at some point in time. Unfortunately, the press will not print a page about the out-of-control ship captained by a drunken captain that we are sailing on, but that’s asking for too much.

David: Are you saying that monetary policy has never caused inflation? How do you explain the inflation that took off in 1966 and wasn’t fully tamed until the 1990s? (chart above) How do you explain Argentina (pick almost any year!)? Brazil from mid-1980s to mid-1990s? Lots of countries in Central and South America that eventually had to give up on having a currency at all (they switched to using dollars)? And, of course, Zimbabwe!

Philip — I was referring to my adult life in the US — so the last 15 years or so.

Most notably, the Fed became very aggressive with monetary policy during the great recession (around 2008), and there was no shortage of people claiming the US was going to turn into Zimbabwe, but as your graph shows, there’s no record of excess inflation during that period or for years following it.

I suspect many of the people who predicted inflation back then had predicted inflation again, but I’ve never heard anyone asked the question “You predicted inflation 15 years ago and it never came, and you’re predicting it again now. What’s different?”

In the current case, we saw a large number of contributing factors:

– Supply chain problems like the chip shortage that’s import for car manufacturing. This is why used car prices spiked and new cards were sometimes going for 10k over list: https://www.usatoday.com/story/money/cars/2022/02/13/used-cars-cost-more/6778705001/

– Energy shortages caused by wars

– Pork prices spiking because of swine flu

– China shutting down for months to fight covid

– Spikes in corn prices making milk and other farm products more expensive: https://www.macrotrends.net/2532/corn-prices-historical-chart-data

But in general, if you’re seeing worldwide inflation rates around 10% across different countries with different currencies, it’s hard to pin that on monetary policy.

I’m not denying that printing 1000x your currency will also drive inflation.

The past 15 years haven’t actually been different if you believe that Fed book that I reviewed in a couple of previous posts. There was massive inflation, but it was in asset prices, such as for houses, which had been removed from official CPI. The other factor that kept CPI low was Chinese manufacturing capacity coming online, but that’s stabilized now to the point that it may be cheaper to make at least some items over here. (See https://philip.greenspun.com/blog/2020/02/21/netflix-american-factory/ for how cheap natural gas and lack of VAT made it seem like a good idea to make automotive glass in the U.S.)

If the issue was the currency being debased, you wouldn’t see the problem focused in certain sectors like housing. It would be broad-based.

In the case of housing, it’s easy to see how a decrease in interest rates drives housing prices up — people are focused on their monthly payment, and not the price of the home, so anything that reduces the monthly payment drives home prices up.

A long-term decrease in mortgage rates drives a long-term increase in housing prices:

https://fred.stlouisfed.org/series/MORTGAGE30US

And there appears to be some momentum built into housing price expectations combined with homebuyers not being that smart. When Shiller looked at housing prices pre-great recessions, after several years of rapid increased in home prices, the market consensus among buyers (if I remember correctly) was that home prices would continue increasing by ~ 30%/year for the next few years.

This is why people entered the market with the idea “This $600k LA home is going to be worth $1M within 2 years, so I need to buy now”.

I find it hard to fault the Fed for this stupidity.

The Fed has a mandate to manage inflation and unemployment. It’s too much to add: Please pop bubbles when investors are behaving foolishly.

David is perfectly right in his comments, especially about the 2008 inflation mongers. Equating the RBZ and the Feds shows profound misunderstanding and unwillingness to understand of how the US Central bank functions and what its raisin d’etre is.

I am sure that David is right about many things, but he is definitely working from an incomplete data set. He wrongly believes that inflation is a worldwide phenomenon. Paul Singer says it is due to European and US central bank and government actions. We do see high inflation in Europe and the US, but not in “the world”. China is a big part of the world, for example, and they have a 1% inflation rate. China is missing the core western idea that it is easy to get richer without working and studying harder.

Speaking of Europe, I can’t figure out what keeps inflation under control in the Eurozone. An individual government has a strong incentive to borrow and spend and, perhaps, ultimately default on what was borrowed. Spending beyond what is collected in taxes will make the voters happy and ensure a government’s reelection. Any pain in the form of inflation generated by this fiscal profligacy will be primarily inflicted on people in other countries (since no individual country is a majority of the Eurozone). Why wouldn’t every European country have a huge budget deficit? (I know that they’re not supposed to run huge deficits, but an “emergency” can always be declared. Find a virus or a war or an economic slowdown or something else that justifies a temporary permanent deficit.)

Except that, the 2008 crisis was NOT the making of the federal reserve, it was due to policymakers encouraging everyone and anyone to buy a home and making it super easy to get a loan. Have we forgotten about “jumbo loans”? And let’s not forgot about the second mortgage on your existing home. What about approving low-income owners for a loan?

Banks were giving out loans very much to anyone who asks for one. Even worse, they would stricter a loan to circumvent around any red flags the borrower may have.

None of this was the doing of the federal reserve.

George: The Fed wasn’t involved in the pre-2008 lending of money to people who had no income and therefore who were never going to pay back their loans? https://www.federalreservehistory.org/essays/community-reinvestment-act talks about a law that Jimmy Carter signed that pushed the Fed to push the banks that they regulated to make loans that they wouldn’t otherwise have made (for fear of never being repaid). You could blame the Democrats who controlled Congress in 1977 and Jimmy Carter, I guess, but the law was vague and it was the Fed that was responsible for the implementation. (The premise of the law was interesting. Bureaucrats and politicians in Washington, D.C. imagined that banks were leaving profit on the table by refusing to lend to certain people who were, in fact, good credit risks? When has prejudice ever been more powerful than greed?)

David is right in pointing out that inflation is a complex phenomenon that cannot be blamed exclusively or even primarily on Central bank monetary policy. We cannot say, “oh the evil feds printed a pile of money like in Zimbabwe, that’s why the price of bread is so high”.

One can split inflation causes into monetary and non-monetary.

CB liberal monetary policy *may* translates into more liberal lending by commercial banks which *may* cause broad increase in inflation by increasing aggregate purchasing power relative to the stock of useful goods and services. After the GFC, bank lending, for many reasons, continued to be anemic despite extremely liberal CB monetary policy. That anemic lending partially explains why inflation was subdued post-GFC.

Non-monetary inflation/deflation cause examples:

legislation distorting economic forces, e.g. federally guaranteed mortages, student loans);

ACA and generally broken health care structure;

temporary shortages of labor and raw materials (aka supply chain disruption);

technological innovation (deflation);

demographic shifts;

etc.

Non-monetary inflation affects some sectors but not the others: college tuition, healthcare, electronics, used cars, and raw materials.

Where I disagree with David is bundling countries, other than those with more or less similar economic structure, together. China is a special case and we have no clue whether their inflation is truly 1%. Paul Samuelson’s perception of the Soviet economy is a cautionary tale in this regard.

@Philip, my point is, the federal reserve is NOT the one enacting lending policies, it is the policymakers, thus why I don’t blame the federal reserve.

We have the same story for student loans. Policymakers made it easy for students to get a loan, even a dumb, dumb person (like Toucan Sam would say) that doesn’t qualify for higher education can get into one and pile up loans to the point they will never pay it back to the rest of their lives.

Policymakers need to draw a line and acknowledge that they cannot put everyone in the country into one basket and expect to save everyone.

@David, @Ivan, as little as 40 years ago, when the interest rate was at 10% and more, a middle-class family of 4, with a single household income, could afford to buy a single-family home. Today, even with 2 incomes, it’s nearly impossible.

Since we’re all at the betting window of the inflation track, what pony do you like?

Our listed securities were up 10% the prior year (yay!) and off 10% this last year (boo). I no like. And that’s just in Bidies. In real, it’s off quite a bit more. So that’s not what I would call “hedged”. What I would call that is “facked”. Gold tells the bitter truth. Glad I got in around $1200, but wouldn’t be buying now. (There is no long-term correlation between gold and the price of the dollar since FDR stole the gold. As much as we would like to hope/believe so.)

Played commodities back in the ’80’s, ’til the pros sent me home with a spankin’ and a ‘don’t you come round here no more’.

Had to park some cash back in the oughts. This was when credit cards had 0% cash advances. I managed to float about $250K LOC unsecured, to build a spec house. Charged all the lumber, sheetrock, roofing & siding, etc. Got the cert of occupancy the day the brokers got frog-marched out of Lehman Bros. Or was it Bear Stearns? So long ago… At the closing of the takeout loan the broker remarked that there was no way he could write that loan today.

Today Everbank is just another bank but back then it had a retail product in currencies, currency baskets. I took a flyer in some of them that made sense. British Pound (oil)+Norway Kr (oil)+S.African Rand (gold)+Brazil (country of the future and always will be). Others, not so much. Icelandic Krona (cod)? Mexican peso (tacos)? The Irish pound (rain) was very hot back then…had to be something bent in there. Made out well enough prior to that 2008 thing, but today about the closest I can see to it is actual currency from a country less insane than ours. Japanese Yen (Japanese people) comes to mind. But the wily Nipponese know what they’ve got and make it tough for you to get your grubby gaijin paws on it.

I was wingeing to my investment guy about why can’t we be in some of that European coal company action, which just went monstah when the Krauts realized that between the Russkies and the windmills they were gonna freeze. And got

the short and sharp (and deserved) lecture on chasing the market.

Real estate owned is working out pretty well as I was able to bump the rent from 1750 to 2300, but now it’s furnished, different market, different business model. And tomorrow I have to go fix a toilet handle. But it feels kinda hedgy so I like. The trouble is the increment; I don’t have the down payment on another quarter million laying around. And if I did…prices seem kinda high.

BitThing? That’s the punchline — what’s the joke?

Like it or not, we’re all at the races. I think I like Mambo Dancer ln the seventh. Looks well meant for a claimer.

P.S, The Finance Lady sez we have to do a Roth thing and take a loss on these Muni’s and buy bonds. Or maybe it’s the other way around. Investment Guy calls it “rebalancing”. I play along, but I no like. Whaddya gonna do?