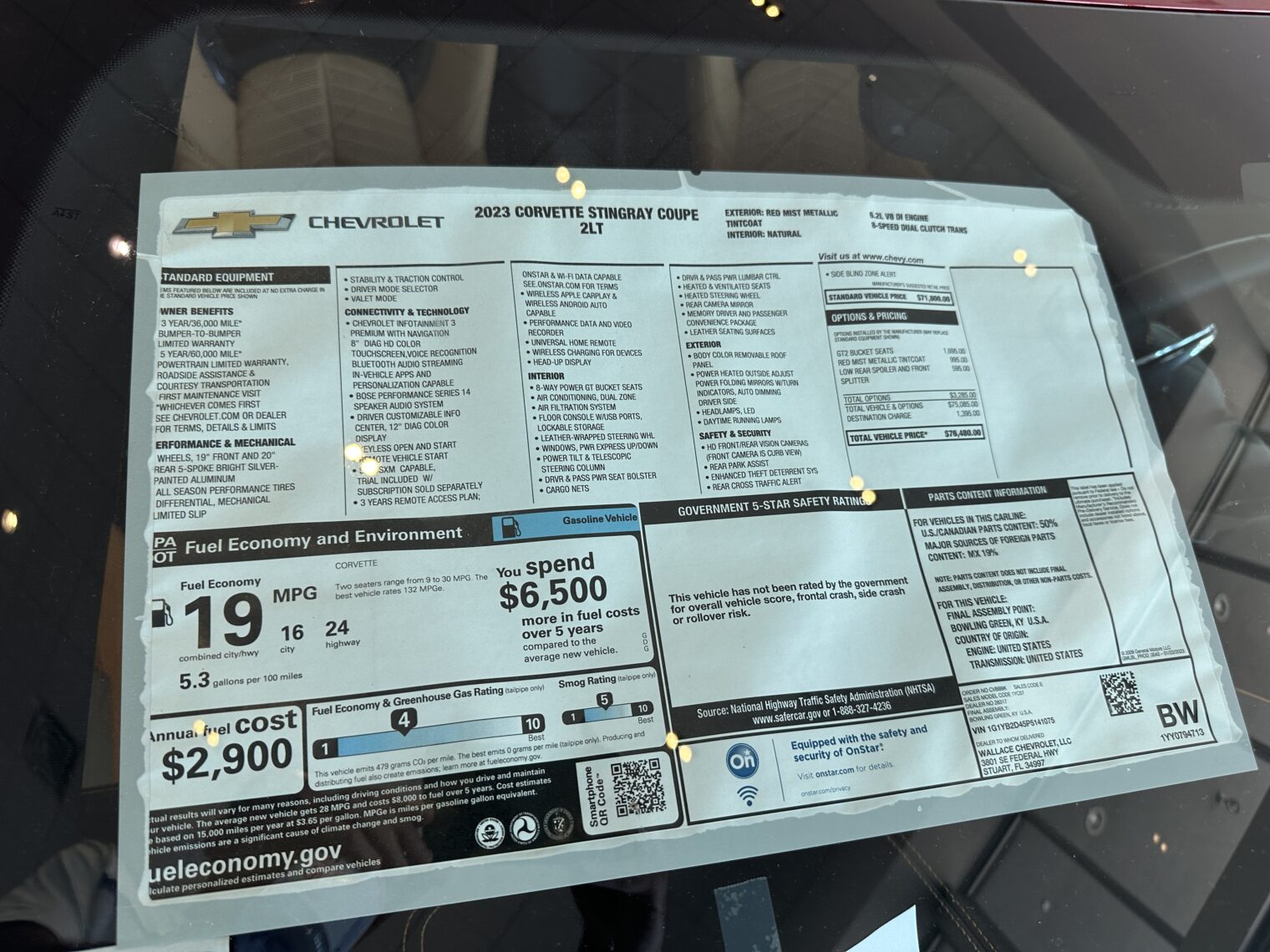

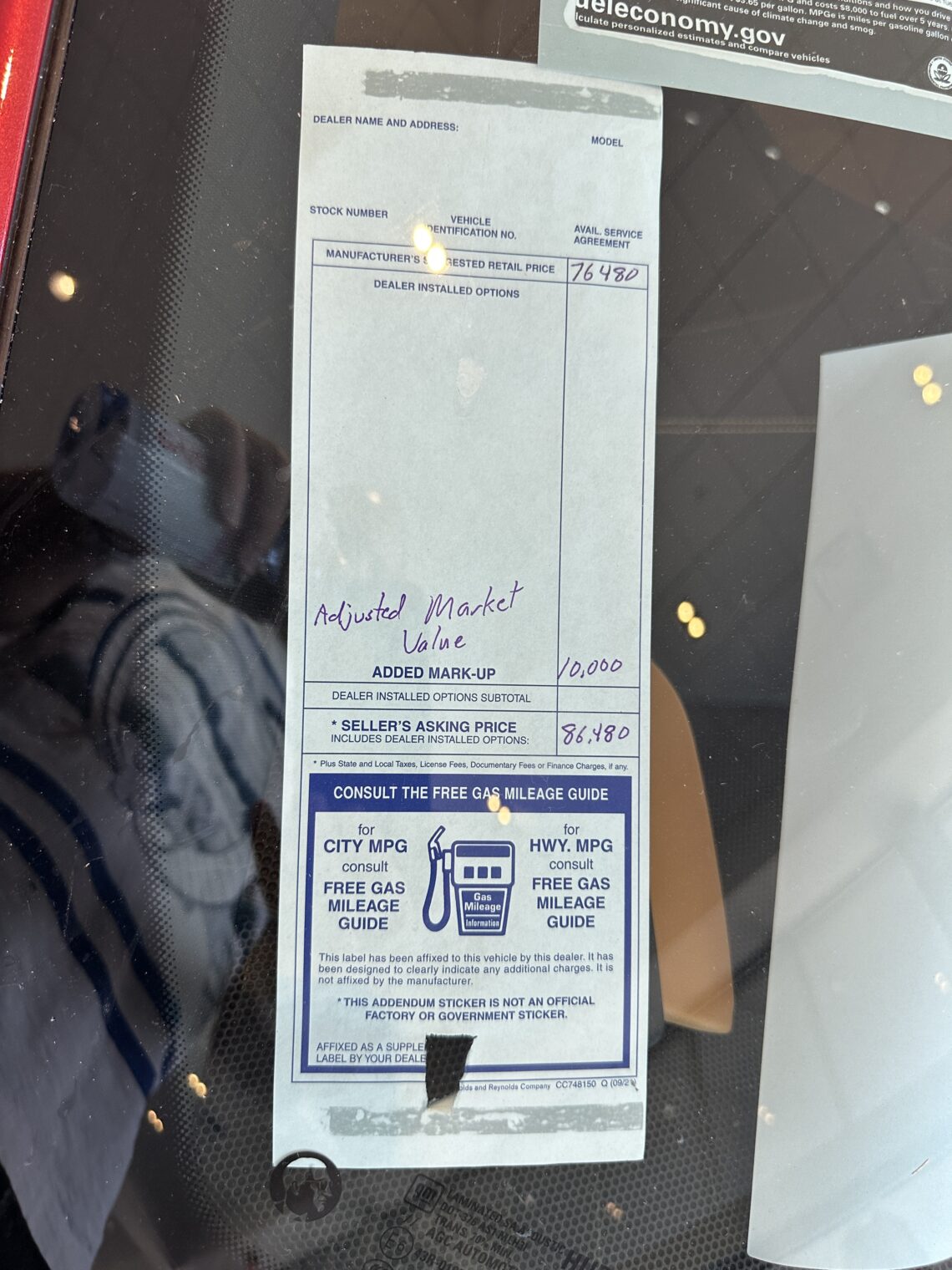

At a Chevrolet dealer in Stuart, Florida on September 15, I learned that not-in-demand cars are selling at MSRP sticker price, leaving the dealer with $4000 more in profit than in the old days when the cars sold at invoice. In-demand cars continue to carry an additional markup. For example, an electric Chevy is $10,000 over sticker, as is a regular Corvette. A Z06 Corvette is $75,000 over sticker on those rare occasions when the dealer can get one.

Can you save some $$ by buying used? A three-year-old 2020 Corvette 3LT (the premium trim) is available for $95,800, which I’m sure is more than its original sticker price.

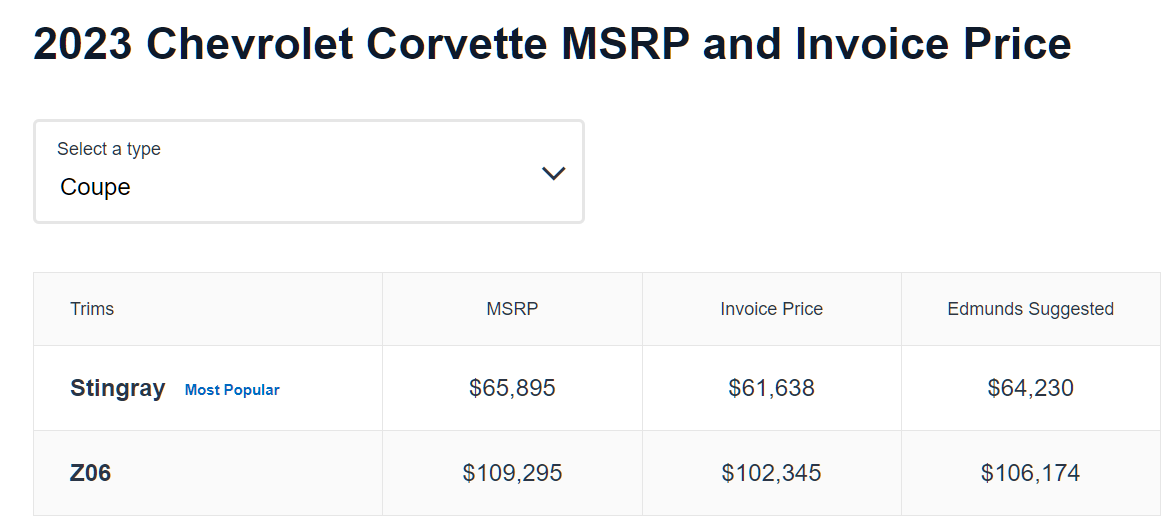

Let’s look at the Z06 Corvette. Here’s what Edmunds says about the simplest model:

According to the official prices, GM thought that the dealer would get about $7,000 in profit from selling this car. In the post-coronapanic world, however, the dealer will get $82,000 for taking an order (the difference between MRSP+$75,000 and invoice).

I’m wondering if this is why the car shortage has continued for so long. Ordinarily, if something goes up in price the producers get paid a lot more and begin working hard to increase production. If gasoline becomes more expensive, for example, gas stations don’t become insanely rich while oil producers keep getting the same old price. The gas station gets its usual small markup and the extra money for petroleum products goes to the oil company, precisely the signal that the market is supposed to give to producers in Econ 101. The legacy automakers, however, never got any financial signal that cars were in demand. Nearly all of extra money paid by consumers went to dealers, who responded by buying new beach houses, new business jets, new jet-powered helicopters for their kids, new yachts, European vacations, etc. The boost in auto prices, thus, spurred production of business jets more than production of cars.

I wrote about this back in 2022: Why aren’t cars (and pinball machines) auctioned as they come out of the factory?. The dealer agreement that I found did not prevent the manufacturer from abandoning a fixed retail/invoice price structure and instead simply auctioning cars to dealers or at least establishing a new market-based price every week. Nothing in the agreement required a manufacturer to keep the price to the dealer fixed for 6-12 months, as has been conventional for legacy automakers even during coronapanic.

Tesla, of course, has been a notable exception. The company has made frequent price adjustments throughout this period of lockdown-induced economic disruption. Thus, Tesla has had a financial incentive to maximize production, e.g., paying chip suppliers extra money if necessary to keep the lines going.

Let’s also consider the recent strike by the United Auto Workers, of whom roughly 146,000 work for the Detroit Three. They want a 40 percent pay increase to compensate for the inflation that the government says does not exist. Could the legacy car companies easily afford to pay this if they hadn’t been selling cars for far less than they were worth for nearly three years?

I think that the Detroit 3 have U.S. revenue of about $300 billion per year, combined. Let’s say that they could have gotten 10 percent more money by selling cars for what they were worth instead of selling them for whatever invoice price they’d established. That would have worked out to approximately $90 billion in additional revenue over three years. In other words, they could have given each UAW member a $600,000 coronapanic bonus and still had money left over to give to shareholders.

Should all of the executives at the Detroit 3 be fired? Every day they produced assets owned by shareholders, i.e., the cars coming off the assembly lines. Every day they sold those shareholder-owned assets for far less than they were worth. They enriched the dealers to whom they owed no fiduciary duty. They starved their own production facilities of the extra cash that could have been used to motivate suppliers, workers, etc. to maximize production and ease the supply shortage that has cost consumers so dearly (and helped to generate ugly inflation numbers). They failed to capture the cash that the UAW is now on strike to obtain.

Related:

Car manufacturers cannot sell their products directly to consumers, most states have franchise laws that prohibit it.

Imagine Apple making its iPhones in Michigan, using American unionized labor, and selling them using “dealers” as intermediaries. Samsung would love that.

Great news for Tesla.

Anon: My proposal that car makers auction their cars to dealers (who already buy used cars at auction, conventionally) is unrelated to the idea of Ford or GM selling direct to consumers. The 2022 post asks why manufacturers are selling below the wholesale market value, not why they are selling below the retail market value (these two should be reasonably close).

Oil companies also sell through dealers, as noted above. They don’t, however, sell gasoline to gas stations for far below the wholesale market value.

This is a very good point. My solution to price gouging by dealers is not to buy anything from them.

Good thing the US automakers don’t rely on my neighborhood for sales. They’d all starve to death. Everyone buys imports, except for the occasionally Escalade.

The local daycare has several large vans from GM. The paint is peeling off in large sheets and the tops are rusting badly. The vehicles are about 5 years old. Is GM unable to figure out how to get paint to stick to a car?

And yet, GM has the largest market share in the US. I don’t get it.

GC: I don’t think it is “price gouging” for dealers to sell cars at their market value. The car manufacturers, by selling $60,000 cars to dealers for $35-40,000, created this situation.

Related: Porsche prices have jumped up almost 30% since covid, at least here in Canadastan. Pre-covid a loaded 911 was $170’ish, today its pushing $220?!

Here a loaded Z06 is only $180 MSRP, so maybe a Z06 is actually a bargain even with “dealer adjustment”?

I found this from 7 months ago:

https://www.reddit.com/r/Porsche/comments/112y8mp/dealer_is_asking_100k_over_retail_is_this_normal/

Porsches were, apparently, $50,000 to $100,000 over MSRP. Here’s one from January with a $250,000 markup: https://www.carscoops.com/2023/01/california-porsche-dealership-asking-a-250k-markup-on-a-911-sport-classic/

https://www.corvetteblogger.com/2023/07/20/hall-of-shame-these-dealers-are-charging-the-highest-markups-for-the-c8-corvette-z06/ gives some example Z06 markups from earlier this summer.

Philg

That is an interesting observation. Are there regulations that prevent the car makers from selling “hot” cars at higher prices? If that is not the case, then car makers are very incompetent indeed. Hard to believe that they are that incompetent. I bet there is another explanation. Probably involving some other government regulation (all great US rackets involve the government). I know very little about the specifics of the government influence in the US car industry. For example, I did not know about the “chicken tax” until a few weeks ago when I read about it in a WSJ article. However, when you make an observation that does not correspond with experience you can assume that there is an “invisible force” at play.

As noted in my 2022 post, the sample Toyota dealer agreement on the SEC web site does not require particular prices, a fixed invoice price, a no-auction sale, etc. I think the manufacturers actually were this incompetent!

> Should all of the executives at the Detroit 3 be fired?

Why? Have they done anything criminal or caused profit loss to be fired? They are business wo/men looking after their pockets, shareholders’ interest, and yes, the sticking UAW jobs. And who should replace them if they are fired? Someone from UAW who has no clue on how to run a business (other than strike) so the Detroit 3 crashes to the ground and we end up closing all US car factories?

And those striking UAW, who are complaining about their wages and benefits not keeping up with inflation, shouldn’t they be taking their cause to their legislative leaders?

You’re skeptical that selling an asset worth about $190,000 wholesale (a Z06 Corvette with an option or two) for $110,000 “caused profit loss”? What would be a good example of profit loss if not this behavior?

Yes, you are correct that the explanation is executive incompetence (recall that the big 3 in the U.S. are really just operating pension/healthcare funds for the unionized employees and retirees), so not an industry that attracts competent managers. And, yes you are correct that the dealers have been realizing almost all of the price increases since coronapanic (their gross profit per vehicle went from ~$2k…steady for past 20 years…to over $6k and is only now fading back down.

Astonishingly, U.S. auto production is still way below where it was pre-coronapanic (see: https://fred.stlouisfed.org/series/DAUPSA), which again highlights incompetence. Yes, there were severe supply-chain constraints from coronapanic, but most other industries are well past that now.

Maybe the top execs spend so long banking their salaries and bonuses that they don’t have time to manage the business?

/df: I wrote about this in 2003! https://philip.greenspun.com/blog/2003/04/27/harry-potter-and-the-100-millionyear-manager/

I noted that it is time-consuming to be rich and, therefore, if you pay managers so much that they become rich their productivity will fall. The three companies at risk of being shut down by the UAW are paying their respective CEOs $20-30 million/year. After taxes, therefore, each of these folks has to figure out how to spend $15 million per year. https://abcnews.go.com/US/wireStory/uaw-justifies-wage-demands-pointing-ceo-pay-raises-103259228

Yes, as I was saying…the management teams “work” for the unions and retirees.

I could be that car makers worry about alienating costumers with higher prices. Many sellers , popular restaurants, big sport games… could take advantage of the market, but refuse to do so. Why should concert organizers allow scalpers to take their profits?

In the case of car makers, I would agree, the most likely explanation is that they are inept (“Occam’s razor”).

Anon: That’s a great point. Why did the greatest musician in the history of humanity (Taylor Swift) not have auction pricing for each ticket to begin with? Restaurants are also an example of how the real world and Econ 101 intersect only occasionally. A restaurant’s big cost is real estate. So you’d think they’d charge by the table-minute while serving food and drinks at a much more modest markup than what’s on current menus. But the restaurant is not giving away 80 percent of its profit to a dealer of some kind, so its behavior is less astonishing than what has happened in the car world and the concert ticket world.

Have you noticed innumeracy of all involved in in the contract negotiations? Asking 40% raise for 80% percent work results in 50% raise. It would not even make up for real inflation in the last 3 years form 2021. Average consumer of course is the ultimate loser but that the reason for Labor Union existence is to sucker consumers, as all expenses are always relegated to consumers.

I think that the premise of this post applies only to limited number of GM/Ford/Chrysler product, such as cult all-American GM car Corvette which is designed to be middle class super-car and has stats similar to more expensive super-cars. At the outset it is not large part of GM revenue, it mostly branding. GM, Ford and Chrysler/Jeep/Dodge strive to be highly competitive in mass sales market with products such as GM’s Chevrolet SUVs and pick-up trucks, where it competes with Japanese and Korean automakers. In this market car shortages are minimal and pricing is very robust, and dealers help push car onto consumers.

I agree.

I had to get a new car lease in August and was somewhat apprehensive about the process but not much since I’d simply bought out the “old” car in case the new terms turned out to be as bad as described here (or as I anticipated).

While the dealership added some new b.s. fees in comparison to 3 years ago, I did manage to negotiate acceptable terms that were about 8% more expensive that the previous lease (I got the same model so it was easy to compare).

In short, I do not see dramatic car price inflation for ordinary cars (an X3, in my case). The only issue was that I had to wait for the car to be manufactured since the inventory was low and, therefore, to prolong my previous lease by two weeks. This circumstance did not have any influence on the negotiation process.

I made another half-hearted attempt to convince myself to get a Tesla, in which case a dealer-intermediary link would have been eliminated, but failed, as I did three years ago, because of my subjective “price/performance” ratio comparison, in combination with exorbitant insurance rates for a Tesla vehicle.

perplexed: The average car dealer profit on all of its activities, which included selling half as many cars compared to 2019, was up by 242 percent as of Q1 2022. https://www.motor1.com/news/589765/dealership-profits-at-record-levels-q1-2022/

(In the old days, the dealer made almost no money by marking up the car, which was why they were so passionate about selling financing, extended warranties, etc.)

See also “82% of consumers are paying above sticker price for a new car” (up from 2.8%)

https://www.cnbc.com/2022/02/17/more-than-80percent-of-consumers-are-paying-above-sticker-price-for-new-car.html

Philip, we are told that Hyndai Elantra is a best seller in 2023: https://www.caranddriver.com/news/g43553191/bestselling-cars-2023/

MSRP prices are from $20,500 to $29,000 https://www.car-buying-strategies.com/dealer-invoice/hyundai-elantra-prices.html

I checked its dealership prices in boom-town Palm Beach area, at first listed dealership: https://www.napletononnorthlake.com/new-inventory/index.htm?search=&saveFacetState=true&make=Hyundai

First listing comes at $22,973 and also button for calling for today price. Maybe you could request a quote and compare it to MSRP for same trim and enlighten us?

Surprisingly Chevy Malibu is listed as a best selling GM car as #23. It tells me that GM can not compete on price in CUV/SUV segment.

https://www.nytimes.com/2023/09/12/podcasts/the-daily/ford-general-motors-strike.html