Let’s see if I got the Sam Bankman-Fried (SBF) trial right… All of the co-conspirators who enabled the fraud at FTX agreed to testify against SBF in exchange for reduced punishment. They all then testified that everything was SBF’s fault and they were helpless puppets (somehow incapable of quitting FTX or exposing the fraud before it got bigger). Now SBF has been found guilty and will be sentenced to up to 110 years in prison in March 2024.

CNN:

Over the four weeks of his trial, Bankman-Fried watched a parade of people he once considered his closest confidantes testify against him. They included friends from math camp and MIT who became his co-founders; and, critically, his ex-girlfriend and trusted business adviser, 28-year-old Caroline Ellison.

The most damning evidence against Bankman-Fried came from Ellison, who testified for the prosecution over three days.

As both the CEO of Alameda and Bankman-Fried’s romantic partner for two years, Ellison was uniquely positioned to comment on what was happening within the tight inner circle of Alameda and FTX executives, many of whom lived together in a $30 million luxury apartment in the Bahamas.

Ellison’s at times emotional testimony offered a narrative of events in which virtually every decision at both Alameda and FTX came down to Bankman-Fried, who founded and was the majority owner of both firms. A common refrain from Ellison, when asked who directed her to carry out various actions, criminal or otherwise, was a variation on the words “Sam did.”

From reading early reports on the meltdown, I got the impression that it was Ms. Ellison’s investment losses that had created the necessity for the fraud. Did that turn out to be false?

What happens to all of the co-conspirators, without whom SBF couldn’t have stolen a dime? Back in December, the New York Post predicted that Caroline Ellison might get off with probation.

This TechCrunch article is titled “Ex-SDNY prosecutor says Caroline Ellison, Gary Wang and Nishad Singh probably won’t get jail time”:

‘I’ve had cooperating witnesses who did get jail time, but it’s the exception not the rule.’

When Wang testified, prosecutors asked at the end of their examination how many years he was hoping to be sentenced. “Ideally hoping for no time,” he replied, which prompted some quiet laughter in the courtroom.

If this plays out as predicted, do we think it is fair? One altruist goes to prison for 100 years while co-conspirators who stole at least $millions for themselves are free to move on to the next scam? If SBF’s guilt had been challenging to establish, maybe this would make sense in some practical way, but it didn’t seem like a tough case for prosecutors to make.

Related:

- “SBF’s mom told him to ‘avoid’ disclosing millions in FTX donations to her pro-Dem PAC: suit” (New York Post, Sept 22, 2023): Bankman-Fried has been accused by federal prosecutors of funneling $100 million in political donations through “straw donors” including Nishad Singh, the former head of engineering at FTX and sister company Alameda Research, and Ryan Salame, another former top executive at the company.

Now that the scandal of the day is wrapped up & the fed is back to dove mode, it’s time to make up a new currency called Spun coin & load up on Spun coin.

Based on my experience with the federal criminal justice system, admittedly a couple of decades out of date, is that SBF will get 20 years and the others will each get a few years, my guess 5 — though i didn’t follow the trial since it seemed a slam dunk for the Government & a lot will depend on what their real roles were in the fraud and how much their testimony was worth in the conviction. Wouldn’t make a lot of sense, to me anyway, for the coconspirators to get no jail time since then the message is it is ok to participate in a massive financial fraud, the coconspirators seem to have been active participants in the fraud not dupes, so long as when you get caught you squeal on others.

My prediction is that the co-conspirators won’t get any real jail time. The ring leader will probably get 8-10 years and be free in 4-5.

I do not have a problem with that because I substantially agree with judge Posner who offered a convincing argument (before he went bonkers in his later years) in favor of no jail time for white color criminals. Instead, a commensurate fine/restitution is a better deterrent.

https://chicagounbound.uchicago.edu/cgi/viewcontent.cgi?referer=&httpsredir=1&article=2842&context=journal_articles

Separately, I wonder why it takes so much time for the judge to figure out the appropriate punishment for SBF. One would imagine that pondering for a month is quite sufficient even for a slow thinker, but waiting 4 months to find out how long your jail time is going to be seems rather cruel.

Ivan

The reason that sentencing in federal actions takes a long time is because there is an administrative process that has to occur before the judge can determine the sentence. This is called the “pre-sentencing report” and it doesn’t start getting written until after the conviction occurs.

The pre-sentencing report consists of interviews of the defendant, people close the crime, background checks, etc. Smart defendants hire advisors to help them put their best foot forward to argue for lower sentence. In addition a time period is required to allow the defendant to solicit character reference letters. [Read the ones submitted on behalf of Elizabeth Holmes if you need a laugh].

This process takes months. Since SBF will get credit for time served during this period, and since he is facing significant incarceration time it doesn’t seem all that cruel in this case.

Also a note to those that say he will be sentenced to X and then serve only half of X…it doesn’t work that way for federal crimes. For federal crimes until very recently it was required that people serve 90% of their sentence. This has been recently changed, but it is still a requirement that people serve over 80% of their sentence. This is unlike state systems where good behavior time can effectively halve a sentence.

Thanks, Richard.

Still, one would want to know how much time one is going to serve, sooner rather than later, even knowing that the wait time will be “credited”.

See also: https://www.forbes.com/sites/digital-assets/2023/10/30/ftx-customers-should-recoup-most-of-their-losses-unless-irs-bigfoots-them

“A Forbes tally of customer claims and visible FTX assets (see table below) estimates that nearly $13 billion of the $15 billion in claims is accounted for.”

The special rules for Alameda on FTX were immoral, but it’s unclear to me whether they mainly had a liquidity issue based on a bank run combined with a temporary decline in value of assets held, or genuinely had billions in realized losses.

For example, from a quick look at the case exhibits, it seems a large percentage of realized losses came during the bank run as they were forced to sell assets rapidly to meet cash needs.

Obviously this was not how customers of FTX expected their funds to be used, and the existing management team should have been exited. However, shutting down the business and reducing its equity value to zero, then spending hundreds of millions of dollars on bankruptcy lawyers and administrators, was probably not in the interest of claimants looking to be made whole.

Other large crypto exchanges with less of a US nexus have had similar issues in the past. They changed their practices, issued IOUs and eventually made full restitution to stakeholders, and continue to operate today.

Which outcome would have been better for users of FTX?

I am completely amazed anyone entrusted their money to these two. In the Bahamas, no less. It’s surreal.

The real crime here is that the national news has never actually come out and said that cryptocurrency is the modern equivalent of tulip bulbs.

We need more education in schools on what a Ponzi scheme is, or we’ll see more of them.

No, at least tulip bulbs have at some redeeming aesthetic value.

Philip, more migrant refugees are coming to Florida, following you example.

https://www.instagram.com/reel/CzKZBPmvzPV/

Any comments?

I have a post scheduled for next week. The media isn’t reporting that he skips out on 7% income tax (newly imposed by Washington State in 2022) and 20% estate tax. Even if these taxes did not influence Mr. Bezos’s thinking, that’s a lot less revenue than planned for the Washington State Democrats.

Tis sad day for WA democracy. Olympia is working tirelessly on new taxes, why Bezos could not wait for at least income tax enacted to make his move? Such a weakling, rushing away to keep mere 7% …

NonAnon: great to see Bezos saying no to the woke, socialist mob! Let the takers find someone else to take from…maybe Obama and his hateful, sad-sack wife (who’s on the record for hating the U.S.) will give WA some of their several hundred million $ fortune. After all, they “didn’t really earn it” unlike Bezos.

I predict that 40 years from now, SBF will be talking about his swollen prostate during Dodgers games. That’s what happened to Michael Milken.

Not quite the Sorosian fate he planned.

I agree. There will be some revisionists writing about how it was all a big misunderstanding (The “Big Short” guy is already onboard) and a later democrat president will commute his sentence after ~8-10 years because of his “altruism”. Maybe he will have a second act as a “Frank William Abagnale Jr.”-style consultant to the government and industry as a champion of crypto regulation.

I have always thought the whole scheme was a way of laundering campaign contributions by Venture Capital firms and creating a pretext for the urgency of government regulation of cryptocurrencies. (Follow the money)

Matching ethical foundation but way too smart to replicate Soros’s black-market style thuggish operations. And Soros did not compete with treasury in money printing business, as a wise guy he knows the hierarchy.

Maybe Joe Biden will pardon his biggest donor on his last day in office! Bill Clinton did that for Marc Rich https://en.wikipedia.org/wiki/Marc_Rich

On the question of justice, there’s a good case to be made that Ellison should spend time in jail.

However, I suspect very few people are troubled with “the person at the top got all the punishment”

This is far, far better than the case where a bunch of underlings go to jail and the person at the top manages to get away, so we should consider this “good enough”

Btw, I’m not expecting that Ellison will use her charm and good judgement to parlay this experience into a great second act. Maybe in a few years she’ll be on a Big Brother special with Elizabeth Holmes and Amy Cooper.

What’s an example of “the person at the top managed to get away”?

If you do some searching for the people who were convicted after the Enron fraud, you’ll find that quite a few were imprisoned, not just one headliner. (The person at the top, Ken Lay, did managed to escape imprisonment, but he did so by dying of a heart attack.) https://www.nbcnews.com/id/wbna13088326

We had a president who convinced the criminals under him not to talk, then he pardoned them. Does that count?

David: you’re talking about Bill Clinton? He pardoned 140 loyal Democrats on his last day in office, but is it fair to say that these people were working together “under” Mr. Clinton? https://en.wikipedia.org/wiki/Bill_Clinton_pardon_controversy

Did Bill pardon people who were in jail because they refused to cooperate in an investigation again Bill?

If you’re claiming Bill and Trump both belong in jail for doing this, don’t look to me to defend Bill.

I wasn’t aware of any remarkable pardons by Donald Trump. Maybe you can be specific about the pardons and how they benefitted Mr. Trump.

Amy Cooper doesn’t deserve to be lumped in with those two.

https://www.thefp.com/p/the-real-story-of-the-central-park

David, not sure whether if you were following events during Bil Clinton times, but even left wing politico says that Trump was right (about Bill Clinton gang). It looks like that everyone who worked for or with Trump and their dogs are testifying against Trump now.

“When you have your staff taking the Fifth Amendment, taking the Fifth so they are not prosecuted, when you have the man that set up the illegal server taking the Fifth, I think it is disgraceful.” — Donald Trump

https://www.politico.com/blogs/2016-presidential-debate-fact-check/2016/09/trump-gets-it-right-about-clinton-staff-taking-the-fifth-228728

I have to concur with David on the main point though. Way too often, in cases that are not made public, CEOs and such get a pass and executors in the middle get the blame, often on purpose fed to zealous prosecutors by the same top guys who put the executors on the task. Scooter Libby case comes in mind and I know non-public cases.

It’s called The Prisoner’s Dilemma for a reason. She threw her ex-boyfriend under the bus to save her own skin, just as Madoff’s own sons did to their father. Unedifying, but everyone knows there is no such thing as honor among thieves.

As for a good case of a person at the top getting away, there is the former CEO of eBay Devin Wenig facing no legal consequences for the campaign of terror he unleashed against critic couple the Steiners, when the underlings went to prison:

https://en.wikipedia.org/wiki/EBay_stalking_scandal

Inner City Press live-tweeted the trial. If I read the tweets correctly, SBF testified that he should be found innocent because although he knew he was committing fraud, his lawyer told him it was okay.

What you won’t hear about is the Democrat funding for the 2020 election (second or third after George Soros) to the tune of about $100 million: https://www.huffpost.com/entry/sam-bankman-fried-donations-allegations_n_64db5809e4b030f54dc71b85 , the FTX-Ukraine connection and the funding by FTX and SBF affiliates of pro-Covid-vaccine narratives under the guise of Covid research (SBF’s brother Gabe was involved and funded by FTX). That part won’t receive public scrutiny of any significance.

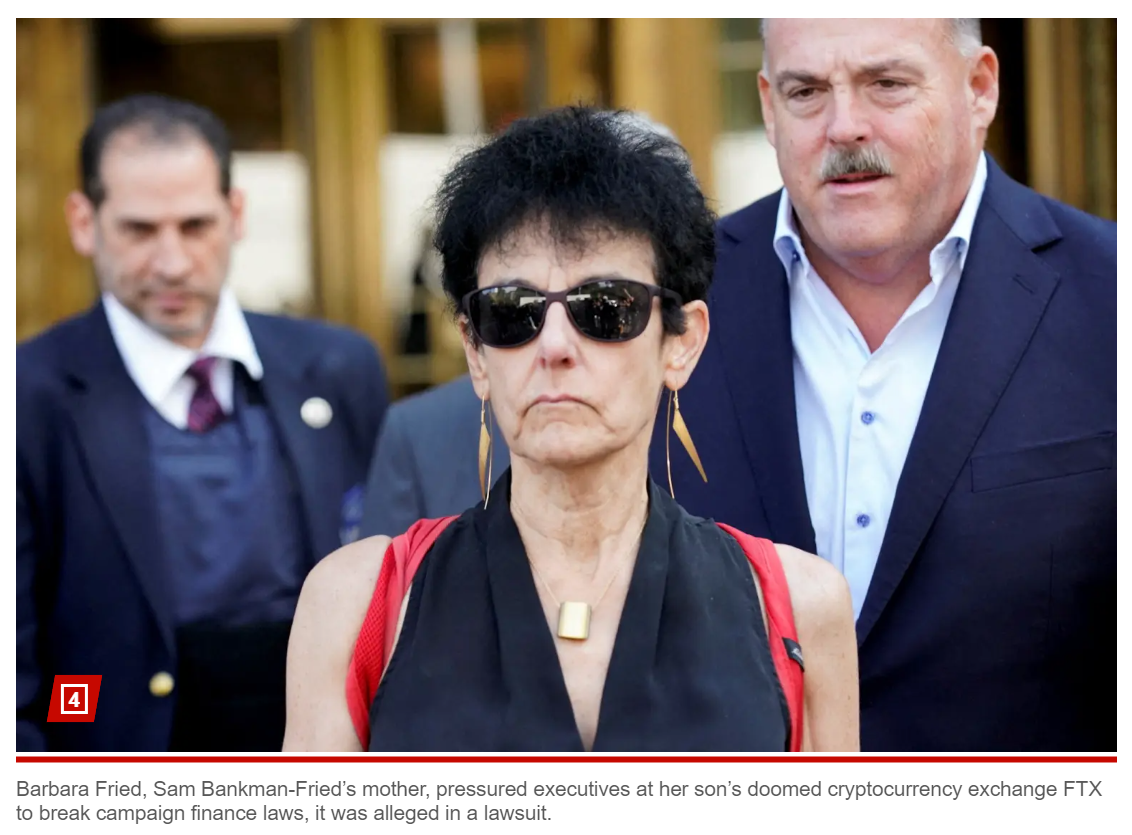

How does Barbara Fried explain all this, as an expert of corporate and legal ethics? It’s amazing how academics are the kings of hypocrisy.

The couple ivolvment in their son business is a fascinating read as a study in hypocrisy:

https://www.theverge.com/2023/9/19/23880783/bankman-fried-ftx-lawsuit-clawbackEmbedded therein is the original complaint FTX v. B/F.

Also:

https://nypost.com/2023/09/22/sbfs-mom-pressured-son-to-break-campaign-finance-law/

How’d this rich kid have such an ugly girlfriend?

Because he didn’t care, as shown by his notes on the subject. From Lewis’s book (https://www.fastcompany.com/90961832/10-big-revelations-michael-lewis-sbf-book-going-infinite):

“In a lot of ways I don’t really have a soul,” he wrote. “There’s a pretty decent argument that my empathy is fake, my feelings are fake, my facial reactions are fake. I don’t feel happiness. What’s the point in dating someone who you physically can’t make happy?”

Df, ultimate success of Ayn Rand’s Ellsworth Toohey’s selfless man. This is how must be feel to have Mr. and Ms Toohey as parents. Ayn Rand probably got inspiration for last name Toohey from Yiddish tuches.