…. because he has experience with running a government at a structural deficit, something that states are theoretically not allowed to do.

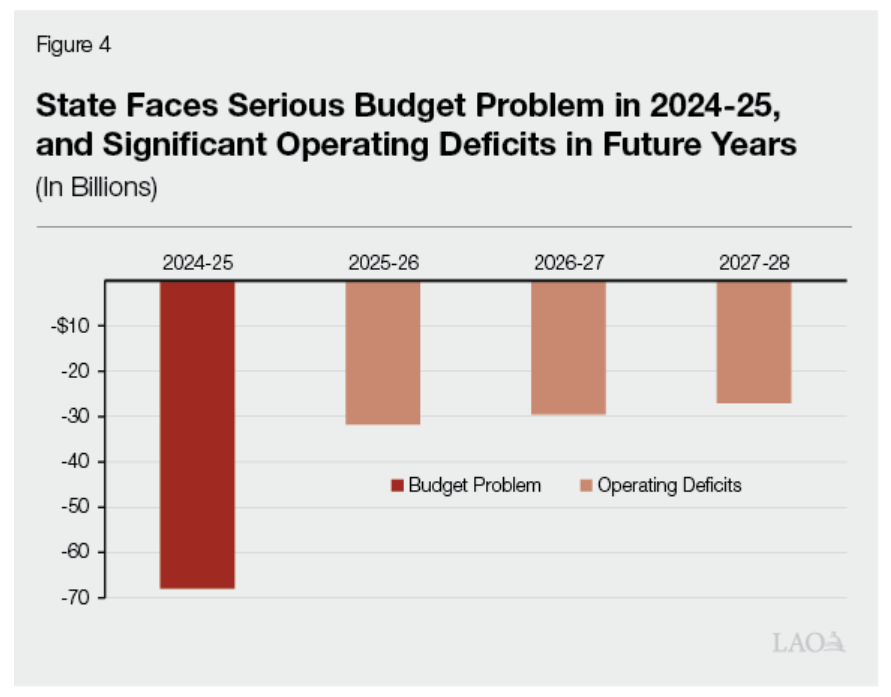

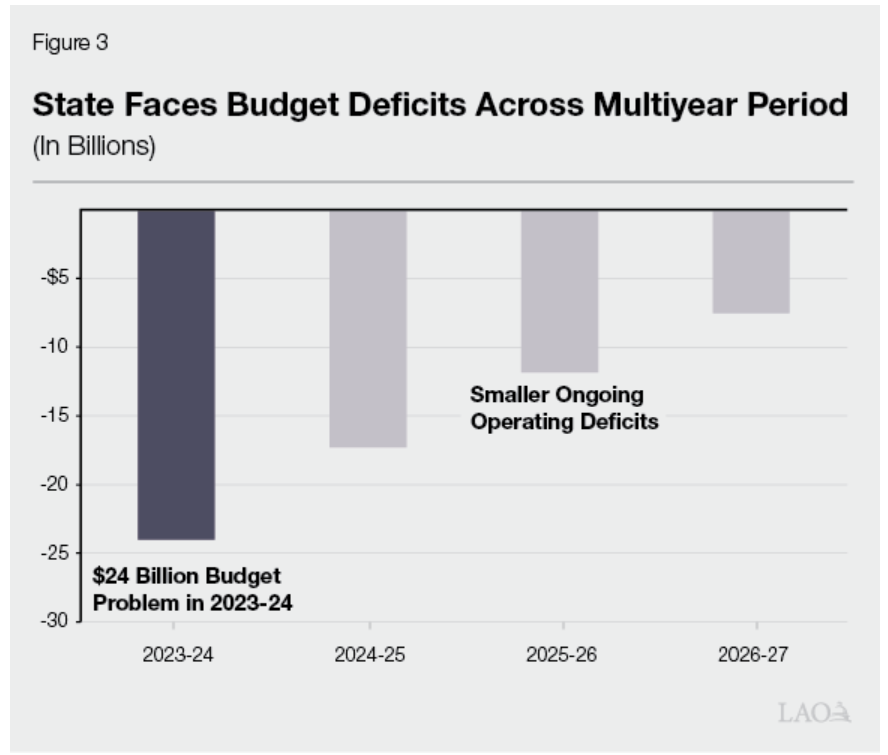

California has been in the news lately for its forecast $68 billion budget deficit, about 30 percent of total spending by the state government and about $7,000 per significant taxpayer (in just one year) if we assume that only about 10 million Californians are earning enough to live an unsubsidized life. The report that is the basis for these media stories has a more interesting figure, though:

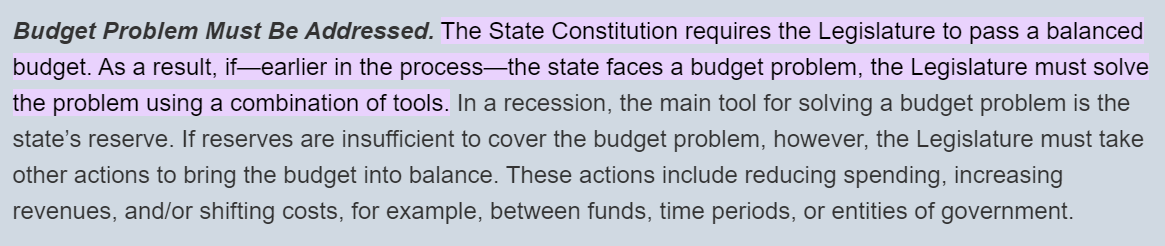

Like the federal government, the California state government is set up to spend more than it collects in tax revenue. California can’t print money the way that the Feds do. I’m wondering what their theory is for how they can run deficits indefinitely. Do they believe that the U.S. is in a huge slump right now and better economic times are around the corner once another 10 or 20 million undocumented cross the border? And that migrant-fueled economic boom will increase tax revenue to move the state back into surplus? In the previous version of this report, the analysts said that the budget had to be balanced every year (but reserves can still be spent to allow a deficit?):

What’s the near-term solution that the legislature’s analysts propose? Cutting spending on education! I can’t see a proposed long-term solution in these documents, though.

Oh yes, let’s also look at how good the best and brightest humans are at economic prophecy. The previous year’s report forecast a deficit for 2024-5… of about $17 billion.

Related:

“I’m wondering what their theory is for how they can run deficits indefinitely. ”

Simple. They’ll continue borrowing (munies) as long as there are willing lenders:

https://www.bloomberg.com/news/articles/2023-12-08/bond-buyers-unfazed-by-california-s-alarming-68-billion-deficit

Thanks, Ivan, but doesn’t their constitution prohibits them from issuing bonds to cover general deficit spending? I know that their cities, universities, etc. can still borrow for various purposes, but the state itself can’t just $68 billion in bonds to cover a $68 billion deficit, I don’t think.

Google, or rather the local Pravda, tells me that:

“This [balanced budget requirement], alas, is a myth. There is no balanced budget requirement, and these are not the only choices to keep the state running.

Defying the conventional wisdom, the Constitution requires only that the governor introduce a balanced budget. The Legislature does not have to pass a balanced budget, the governor need not withhold his signature if the budget isn’t balanced and the state is not obligated to maintain a balanced budget.”

https://www.latimes.com/archives/la-xpm-2003-may-13-oe-silva13-story.html

Ivan: Thanks for that. I guess we can file this under the “everything that we’re told is a lie” rubric. Based on a quick Google search, though, it does look like the state’s “general obligation” bonds are mostly tied to capital spending. https://www.ppic.org/wp-content/uploads/content/pubs/jtf/JTF_BondFinancingJTF.pdf says that Prop 13 requires voter approval for state-issued general obligation bonds.

https://wisevoter.com/state-rankings/debt-by-state/ claims that California has $520 billion in debt, but doesn’t break it down. It hints that pension obligations are on top of this. California may have an addition $1.5 trillion in unfunded pension liability (https://www.thecentersquare.com/california/article_b77e67bc-e842-11ec-ba2b-83e39b9717cd.html ). I’m not sure how the latter can be calculated without a letter from God saying how long each current government worker is going to live and how many more years the current retirees have before dying. Today’s 20-year-old government worker could die in 2085, for example, or live to 2120 if medical technology improves so that most people can live as long as the current longevity champions.

They’re now managing to continue hitting deficits despite double digit sales tax, capital gains tax, & gas tax. Another year, another last tax increase we’ll ever need.