“When Wall Street Rolls Out the Red Carpet for You, Who Pays?” (Wall Street Journal, March 8):

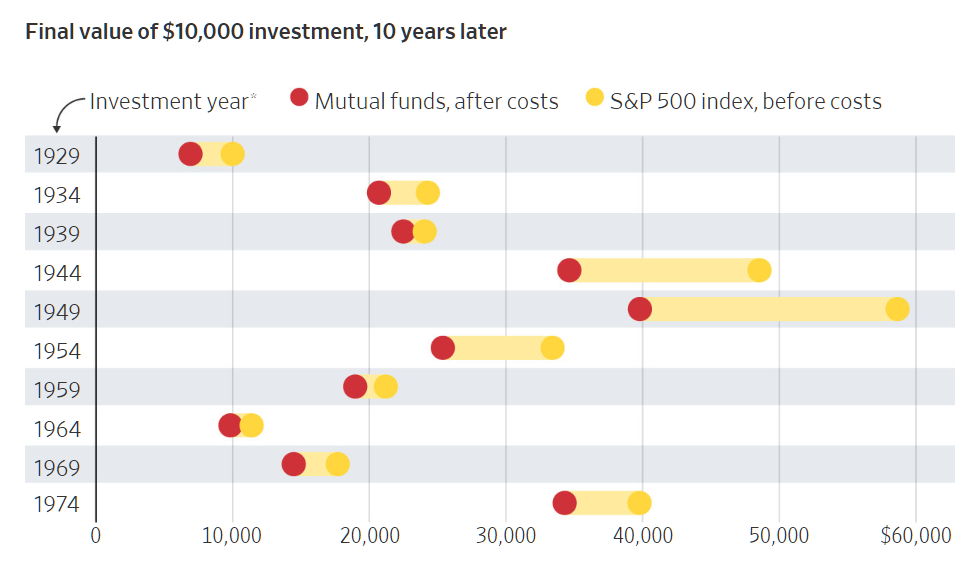

Edward McQuarrie, an emeritus business professor at Santa Clara University who studies long-run asset returns, recently analyzed how mutual-fund investors have fared since the 1920s. His goal was to measure their returns not in theory, but in real life.

He found that a $10,000 investment in 1926 in the index that became the S&P 500 would have grown to just under $198,000, 30 years later, with all dividends reinvested. But you couldn’t have invested directly in that index; it was only a hypothetical measure, without commissions or other costs.

In the real world, where mutual funds charged sales loads of up to 8.5% plus annual expenses, a $10,000 investment in 1926 would have grown to less than $99,000 over three decades. In the real world, costs ate up half the wealth you could have achieved in theory.

Over the next 30-year period, through 1986, fund investors captured only 71% of the cumulative wealth that the S&P 500 hypothetically generated.

(None of these results account for the toll of taxes and inflation.)

That last sentence is brutal. Unless you live in a tax-free environment, e.g., as an EU citizen resident in Italy, It might be better to follow Hunter Biden’s example and enjoy whatever money falls to hand rather than trying to invest!

How about the alternative investments that savvy college endowments buy into?

A recent study found that, on average, for every dollar of return they generated from 1995 through 2016, hedge funds harvested 64 cents in management and performance fees. Lately, at some leading hedge funds, expenses have even risen—to as much as 5% to 7% annually.

Of course, this analysis is presented by the same newspaper that reported on the high effectiveness of lockdowns, mask orders, and school closures as means of preventing COVID-19…

How about the alternative investments that savvy college endowments buy into? They do worse!

Anyone who has worked in the financial markets knows that the best strategy is to keep a distance from those who want to help you manage your money. It is very difficult for someone who is not a professional to spot the fees he is paying. Mutual fund management fees are deducted from the fund’s assets rather than being paid by the shareholder. So imagine how different things would be if your investment in a fund was 100K, the fund charged 1%, and at the end of the year you had to hand over 1K. Hedge funds are a real scam since any “excess return” will typically be captured by the manager. University endowments, labor unions, etc. like the relationship with the hedge funds because the endowment employees have something do do, monitor the investments, go to conferences, etc. The whole enterprise produces no value except for the manager who typically becomes wealthy.

Those commissions add up but how do the results compare to someone who obeyed the news & sold off during the crashes or the average individual stock picker?

My 10-year, non-callable Fidelity brokered CDs are paying a guaranteed, risk-free 5.5%, no expenses.

wow, how did you get that? I couldn’t get anything near that at Fidelity over the past 10 years, I think

That doesn’t sound right. What’s the issuing bank?

bankrate.com shows that a variety of banks are offering CDs at 5-5.15% right now. Right underneath they show Bank of America at a competitive 0.03% and Chase at 0.01%.

Today, Fidelity shows 5 yr CDs at 5.15% and 10 yr at 4.5%. 50+ bps higher a couple months ago.

Frontline did a story a long while ago about fees eating up retirement funds…

https://www.youtube.com/watch?v=lkOQNPIsO-Q

In Europe or at least in Germany you only get tax deductions if you invest in private pension fund. It’s sort of like saving into an annuity – so you get a pension for the rest of your life and cannot cash it out in a lump sum. At least in the USA you can save in a 401k, get company match, and then cash out the lump sum and spend it as you like or buy an annuity instead. Basically the government’s incentive is to want you to retire without going into poverty, but they don’t want anyone getting too rich and accumulating wealth. It’s nearly impossible to be wealthy in Germany.