On recent trips to the San Francisco Bay Area and Boston, friends who are Democrats spoke gleefully about the prospect of Donald Trump being reduced to poverty via lawsuits. While this might be straightforward in California or Maskachusetts, stripping a Floridian of all of his/her/zir/their wealth is more challenging.

Florida law shields insurance policies and annuity contracts from creditors. Statute 222.13, for example:

Whenever any person residing in the state shall die leaving insurance on his or her life, the said insurance shall inure exclusively to the benefit of the person for whose use and benefit such insurance is designated in the policy, and the proceeds thereof shall be exempt from the claims of creditors of the insured unless the insurance policy or a valid assignment thereof provides otherwise. Notwithstanding the foregoing, whenever the insurance, by designation or otherwise, is payable to the insured or to the insured’s estate or to his or her executors, administrators, or assigns, the insurance proceeds shall become a part of the insured’s estate for all purposes and shall be administered by the personal representative of the estate of the insured in accordance with the probate laws of the state in like manner as other assets of the insured’s estate.

That would seem to protect only the family of an insured after his/her/zir/their death. But then there is 222.14:

Exemption of cash surrender value of life insurance policies and annuity contracts from legal process.—The cash surrender values of life insurance policies issued upon the lives of citizens or residents of the state and the proceeds of annuity contracts issued to citizens or residents of the state, upon whatever form, shall not in any case be liable to attachment, garnishment or legal process in favor of any creditor of the person whose life is so insured or of any creditor of the person who is the beneficiary of such annuity contract, unless the insurance policy or annuity contract was effected for the benefit of such creditor.

Donald Trump could take an unlimited percentage of his wealth and stuff it into a whole life policy and then Florida state law might protect him from, for example, Democrats in New York.

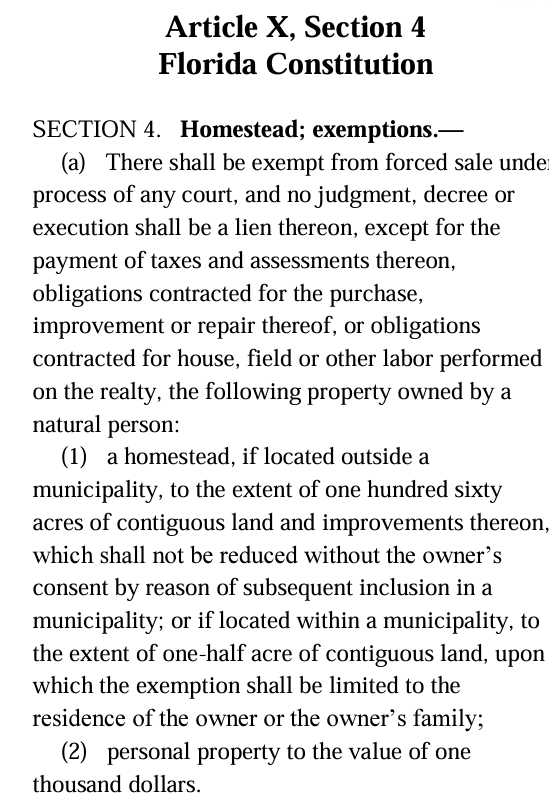

How about 20-acre Mar-a-Lago, worth either $18 million or “hundreds of millions” depending on when you tuned into CNN. It looks like the house and central 1/2 acre of land (maybe this isn’t even the entire house?) can be protected from creditors as long as it it Donald Trump’s primary residence. This is based on the Florida Constitution:

Separately, for those who want to remember the good old Trump days… the U.S. Mint’s Donald Trump medal:

It looks as though they’ve captured the godlike powers that Democrats ascribe to Mr. Trump, e.g., immortality. Age might tarnish this medal, but never the Donald himself!

The US Congress and the US Mint are farces.

Authorized by H.R.3325 in a 406-21 vote: https://clerk.house.gov/Votes/2021161

Inscriptions are “HONORING THE SERVICE AND SACRIFICE OF THOSE WHO PROTECTED THE U.S. CAPITOL” and “ACT OF CONGRESS 2021.”

https://catalog.usmint.gov/united-states-capitol-police-and-those-who-protected-the-us-capitol-on-january-6-2021-bronze-medal-MASTER_MDJ6.html