A friend’s sister recently died of cancer at age 62 (despite Joe Biden’s pledge to eliminate cancer). He had previously been sued by the mother of the people who used to be his children. As is conventional in Maskachusetts, she was able to obtain a court order that her child support profits be guaranteed in the event of his death via life insurance. The successful plaintiff learned of her kids’ aunt’s death via the kids and reached out to her former defendant… to ask for confirmation that his life insurance that would benefit her was up to date.

Speaking of Maskachusetts and cash… (source):

Matt Gorzkowicz, Healey’s budget chief, said officials believe most of the unexpected revenue was generated by the state’s new surtax on annual income exceeding $1 million — the so-called millionaire’s tax — and collections from capital gains, all money that state officials largely can’t use to balance the budget as a whole.

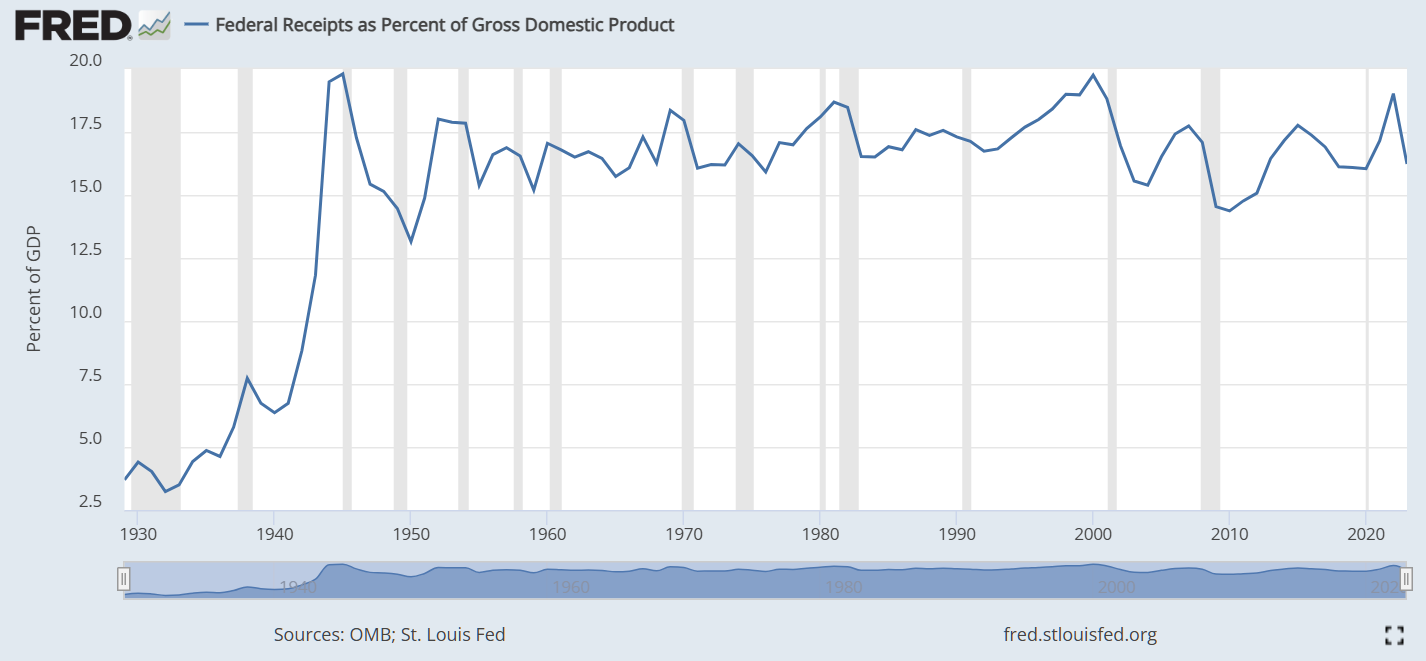

This is the first year that MA is living its principles of taking from the rich to give to the poor. Previously the state constitution required a flat rate tax (I guess that also enables taking from the rich and giving to the poor because the rich paid a lot and didn’t receive much in the way of services). I wonder if those who are subject to the 9% rate (previously they paid 5%) will eventually wander up to New Hampshire or down to Tennessee, Florida, or Texas, thus restoring revenue to its previous percentage of state GDP. This has been the pattern with federal tax rates over the decades, i.e., a roughly constant percentage of GDP extracted despite wildly varying rates:

(Note that the Federal government went on a “wartime footing” in the 1940s, with taxation ramping up from 5 percent of GDP to 20 percent and then has stayed on this wartime footing ever since!)

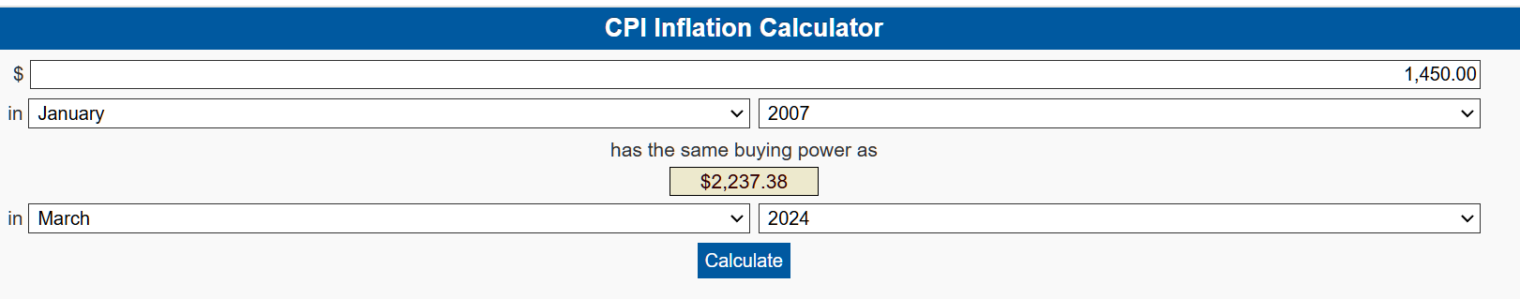

Friends who live in what Zillow says is a $2.5 million house in the Boston suburbs are in the process of negotiating the purchase of a $4 million to-be-built house here in Jupiter. They’ll pay the millionaire tax on their way out partly because they bought their house in 2007 for $1.45 million. Adjusted for official inflation and expected realtor commission, it is actually worth about the same as what they paid (which means they’ve lost money when you factor in maintenance and pre-sale repair expenses and they’ve lost huge $$ if you compare to the S&P 500), but they’ll have a fictitious capital gain that is larger than the $500,000 married couple exclusion for a primary residence:

Massachusetts is still getting money from them, even more than before, but the bureaucrats aren’t privy to their escape plans. I.e., the state government is on a sugar high, at least with respect to them, and the inevitable crash will come in 2025 when the new house is finished and the Pack Rats are loaded up.

Circling back to the original topic… it’s important to remember that a human in his/her/zir/their 60s is like a 9-year-old dog and that cancer can strike either kind of animal at any time. Get that estate plan tuned up and, unless you love progressive political schemes more than your own children, have a way to move out of Massachusetts (16 percent state estate tax) as soon as the first cancer diagnosis is received!

Related:

“Adjusted for official inflation and expected realtor commission, it is actually worth about the same as what they paid (which means they’ve lost money when you factor in maintenance and pre-sale repair expenses and they’ve lost huge $$ if you compare to the S&P 500)”

But they also received 18 years of a roof overhead. If, instead of buying the $1.45 MM house in 2007 and invested that $1.45 MM in the S&P, then they would have had to have rented for 18 years. I guess it’s no matter, it looks like renting + the S&P investment might still turn out more profitable.

DP: property tax, maintenance, landscaping, insurance, etc. likely exceed the cost of any conventional apartment, but they had 4,000 square feet plus a walk-out finished basement (maybe 6,000 square feet of finished space) so I guess you could argue that they got a somewhat cheaper deal per square foot on a running basis (i.e., it would have been cheaper/ft if they’d gotten the house for free).

Successful couple with children. Wonder if having prime real estate was worth it. Does not look like their home improvement investments improved their family life. What caused this divorce? Marital infidelity?

perplexed: the people moving out of Maskachusetts aren’t divorced and are different people from my friend whose sister died. What caused his wife to sue him? Her belief that she could enjoy the same spending power and standard of living without keeping him around. He had some access to her email and text messages (the defendant was more tech-savvy than the plaintiff!) and found that her female friends were encouraging her as soon as she put the idea forward. He wasn’t cheating on her, but she was tired of him. Kids were around 3 and 6 at the time she decided to cash out. As it happens, her lawyer and her friends overpromised regarding the financial merits of the divorced lifestyle. She did manage to get almost all of the money that he was earning, but wasn’t able to invade a family trust that she felt entitled to after a few years of having sex with the guy.

I think this is a common story. The family court plaintiff has typically never previously filed a lawsuit and therefore doesn’t realize that plaintiff-side lawyers tend to paint a best-case scenario. She did a lot of damage to her own finances (not least because of the legal fees paid by both sides!) and a huge amount of damage to her kids’ financial future. The man that she sued went on to re-partner with another female and now has additional children. So the kids’ opportunity to inherit wealth is at least cut in half and maybe a lot more (he could die and leave most of his money to his new partner, for example). She had her hooks into a pretty good financial asset and her litigation mostly resulted in control of that asset passing into the hands of another female and her children.

It’s the opposite of what you might think would be a rational evolutionary strategy for an animal who cares about her offspring.

they do not teach critical thinking skills in public (or most of “elite” private schools). The plaintiff is a product of broken educational system and forgotten morals. On the long run the defendant probably is better off, I can imagine shopping sprees the plaintiff used to go on.

Someone I knew, married businessman with a lovely wife and children who inherited his business and also worked and manged it actively and whose mother was too successful businesswoman, hired an architect to remodel his house. His wife had an affair with the architect and left him! He was pretty distraught for a couple of years and even turned to religion but then he got over it. In five years, he sold his business for about 1000% premium and moved to Florida, few years before coronavirus struck. He was lucky! He used to be not a very nice guy, the divorce made him more likable.

but the bureaucrats aren’t privy to their escape plans…… until they read this blog post!