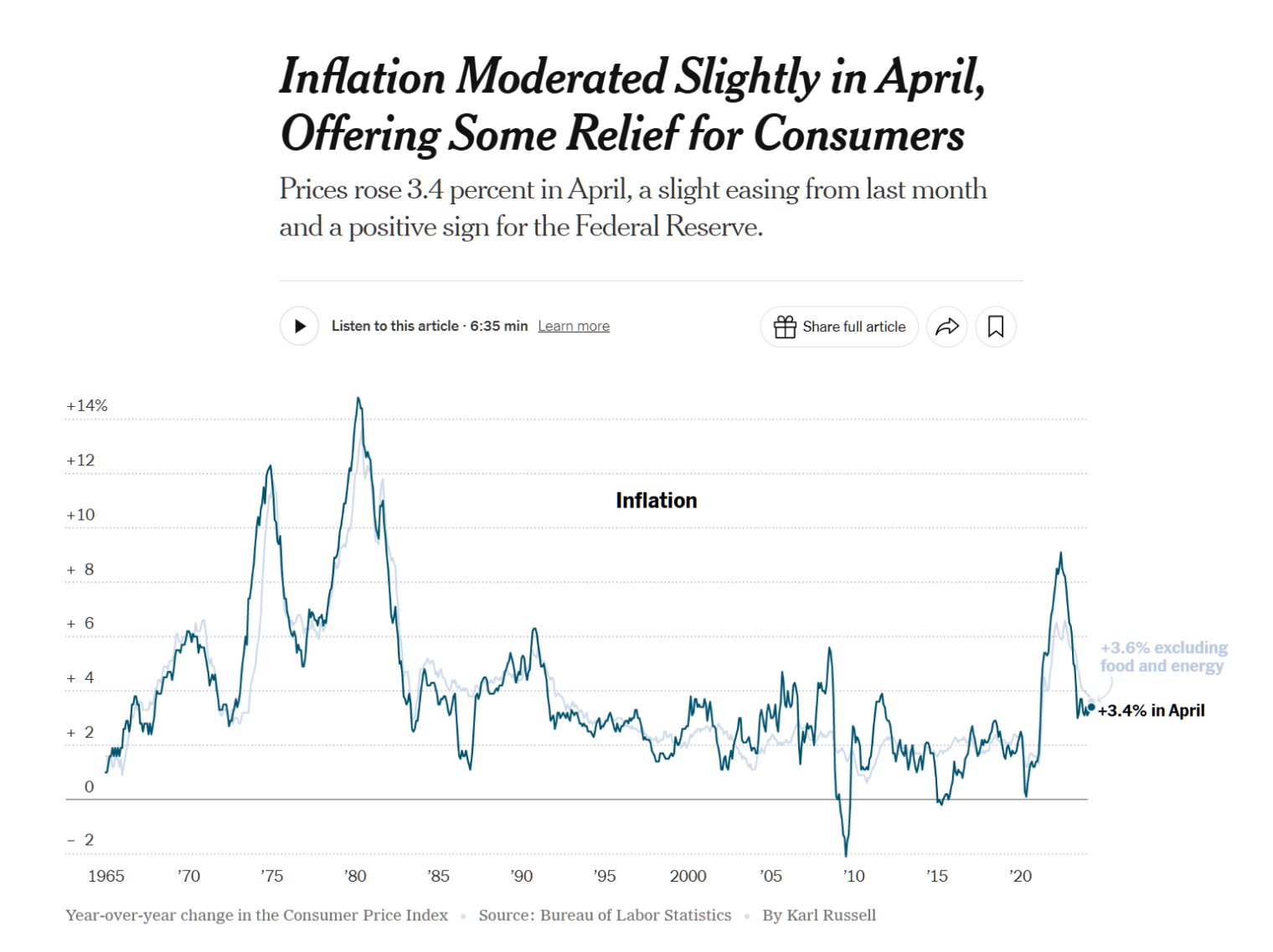

“Inflation Moderated Slightly in April, Offering Some Relief for Consumers” (NYT, May 15):

The Consumer Price Index climbed 3.4 percent in April from a year earlier, down from 3.5 percent in March, the Labor Department said on Wednesday. The “core” index — which strips out volatile food and fuel prices in order to give a sense of the underlying trend — rose 3.6 percent last month, down from 3.8 percent a month earlier. It was the lowest annual increase in core inflation since early 2021.

The report followed three straight months of uncomfortably rapid price increases that rattled investors and worried policymakers at the Federal Reserve. Economists cautioned that one month of encouraging data was far from enough to put those worries to rest. But they said that the data should ease concerns, at least for now, that inflation is re-accelerating.

If you couldn’t afford stuff previously, therefore, you’ll be “relieved” to learn that prices are yet higher.

Even more confidence-inspiring… an 81-year-old who never took an economics class is tackling what non-NYT readers might perceive as a problem:

“I know many families are struggling, and that even though we’ve made progress we have a lot more to do,” Mr. Biden said in a statement released by the White House. He called bringing down inflation his “top economic priority.”

If you don’t like higher prices, it’s “progress” when prices are higher every month. Maybe it doesn’t matter that the president hasn’t taken economics because he/she/ze/they is advised by expert economists? Let’s look at the chair of Joe Biden’s Council of Economic Advisors:

Bernstein stated he grew up in a “musical family” and aspired to be a professional musician as a young person. Bernstein graduated with a bachelor’s degree in music from the Manhattan School of Music where he studied double bass with Orin O’Brien. Throughout the ’80s, Bernstein was a mainstay on the jazz scene in NYC.

He also earned a Master of Social Work from Hunter College as well as a DSW in social welfare from Columbia University’s school of social work

(He’s so old that he could get to class at Columbia without pushing through a thicket of tents and Palestinian flags!)

The NYT deceptively charts CPI since 1965 without noting that the definition has changed dramatically over this period. The reader is left with the impression that things were far worse during the Jimmy Carter “malaise years”:

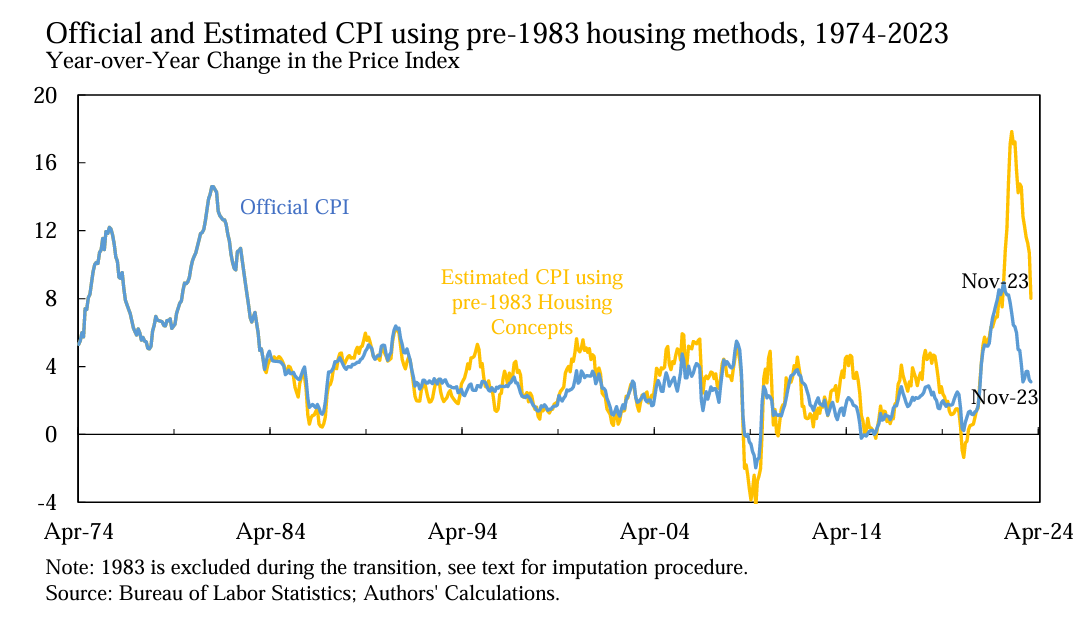

Larry Summers and friends, though, show us what the chart would look if you simply undid the big change from 1983 to use a fictitious rent measure rather than actual housing costs. In fact, Bidenflation is roughly comparable in intensity to the inflation that Americans suffered as a consequence of the Kennedy/Johnson expansions of the welfare state and the Kennedy/Johnson decisions to enter the Vietnam War (Carter gets blamed for this, but the seeds were sown in the 1960s).

Mostly I find the above fascinating as an example of journalism that purports to be neutral and skeptical yet in fact is primarily propaganda about the great job that our rulers are doing.

ShadowStats.com compares economic data calculated using the govt’s current and past methodologies (eg: inflation pre 1980). They have “alternate data” for Inflation, Money Supply, GDP, Unemployment and the Dollar.

https://www.shadowstats.com/alternate_data

If Carter’s stagflation is JFK’s fault, can we blame President Trump for today’s inflation? After all, wasn’t it during Trump’s 4-year tenure that the national debt skyrocketed by a whopping 40%?

Bruin: I do think it is unfair to blame Bidenflation on Joe Biden. I would pin the blame on Congress and the Fed going back to 2009 with a combination of deficit spending and “quantitative easing”. I covered that in https://philip.greenspun.com/blog/2023/03/25/a-book-about-the-federal-reserve-and-inflation/

Congress with Trump’s signature threw gasoline on the fire in 2020, obviously, but the fire was started circa 2009 in my view.

The proper way to look at inflation today vs years past is to take into account the cost of buying or renting a home. The delta of buying or renting vs individual or family income has sky rocketed [1], [2]. In effect, someone who used to be considered a middle class and is able to buy a home and start a family is now gone.

[1] https://www.visualcapitalist.com/median-house-prices-vs-income-us/

[2] https://www.corelogic.com/intelligence/us-rent-affordability-drops-lowest-level-decades/

Calif* set a new record median housing price of $900k, but Powell says the trend is in the right direction. Keep voting for economic stimulus packages.

I’m not a great believer in “specialty schooling.” The inventors of the airplane were bicycle makers. It is perfectly possible for me to imagine some smart guy with just a high school education who designs, builds, and flies a helicopter, all without engineering training or any FAA license. You can be a great economist with a degree in history.

I’m not a fan of the current administration; however, I think focusing on inflation is not very productive. We should instead focus on the deflationary PISA scores of the US. That is the root of many of this country’s problems. You cannot have a great republic with uneducated people. Different administrations just follow the same “panem et circenses” policies that make people happy but are the causes of deficits and inflation.

US budget deficits by administration, any differences?

https://www.presidency.ucsb.edu/statistics/data/federal-budget-receipts-and-outlays

Prima facie, Daniel Kahneman’s background does not appear to be very different from Bernstein’s. He was the recipient of the 2002 Nobel Prize in Economics.

https://en.wikipedia.org/wiki/Daniel_Kahneman

Anon: Kahneman’s background (research psychology) is dramatically different from Bernstein’s (a “doctor of social work”).

Even if Dr. Bernstein were working toward a Kahneman-style Nobel Prize (like Obama!), that would be a contribution in https://en.wikipedia.org/wiki/Microeconomics and inflation is typically attributed to decisions made in https://en.wikipedia.org/wiki/Macroeconomics

That said, a microeconomics background could be useful for answering questions that have macro consequences, e.g., “if you have open borders and a welfare state promising four generations of a comfortable work-free lifestyle, will millions of people from all over Planet Earth choose to walk across your open border?”

> He was the recipient of the 2002 Nobel Prize in Economics.

There actually is no Nobel prize in economics (only in Physics, Chemistry, Physiology or Medicine, Literature, and Peace). Practitioners of “the dismal science” were jealous of this, so they made up their own award with a confusingly similar name: the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel”, aka the “Nobel Memorial Prize in Economic Sciences”. It’s awarded by Sweden’s central bank, not the Nobel Foundation.

https://en.wikipedia.org/wiki/Nobel_Memorial_Prize_in_Economic_Sciences#Controversies_and_criticisms

I think neither had any formal training in economics (correct me if I’m wrong). It could be that indeed psychology provides a better understanding of economics.

Anon: As noted in my reply above, Dr. Bernstein has a degree in social work. He has no training in the numbers-/statistics-heavy field of research psychology. Kahneman does show that a research psychology background can be helpful in the field of microeconomics. There is no example of a research psychologist doing important work in macroeconomics (which is what those pulling the strings of our economy are trying to do) and, in any case, Dr. Berstein was never a research psychologist.

You are right. And let me be clear: I’m not comparing Kahneman with Bernstein. By the way, “Thinking, Fast and Slow” is one of the best books I’ve read in the past few years (I did not care for the other one). I just wanted to make the point that it is technically possible to be a great economist without formal training in economics. There is even room for people with degrees in electrical engineering, like you.

https://en.wikipedia.org/wiki/Herbert_A._Simon

Also, Dr. Krugman kind of shows that really anyone can be an economist.

Professor Krugman actually is something of a macroeconomist (his PhD thesis was about exchange rates). It is too bad that Joe Biden did not appoint him to direct the U.S. economy. Imagine how well we’d be doing with a truly qualified thinker at the controls!

Here’s Krugman in his Scrooge role:

https://www.nytimes.com/2021/04/15/opinion/andrew-yang-automation.html

“Yang’s claim to fame is his argument that we’re facing social and economic crises because rapid automation is destroying good jobs and that the solution is universal basic income — a monthly check of $1,000 to every American adult. Many people find that argument persuasive, and one can imagine a world in which both Yang’s diagnosis and his prescription would be right. .. Is his universal basic income proposal a good idea? No, it isn’t. It’s both too expensive to be sustainable without a very large tax increase and inadequate for Americans who really need help.”

In other words, Krugman is a model of fiscal restraint compared to Congress and Joe Biden!